International Invoicing Guide for USA Businesses: International invoicing presents complex challenges for US businesses expanding into global markets, requiring a sophisticated understanding of currency management, tax obligations, and compliance requirements across multiple jurisdictions. As American companies increasingly serve international clients, mastering cross-border invoicing becomes essential for maintaining profitability and avoiding costly regulatory violations.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

The complexity of international invoicing extends far beyond simple currency conversion, encompassing diverse tax systems, varying payment preferences, cultural business practices, and evolving regulatory frameworks. Businesses must navigate foreign exchange risks, comply with international tax treaties, meet local invoicing requirements, and manage collection challenges across different time zones and legal systems.

Successfully managing international invoicing requires systematic approaches that address currency fluctuations, automate tax calculations, ensure compliance with local regulations, and facilitate efficient payment processing. Companies utilizing professional invoicing platforms with international capabilities, such as comprehensive invoice generation systems that support multi-currency operations, often experience smoother international expansion and better client relationships.

Multi-Currency Invoicing Strategies and Best Practices

Currency Selection and Client Preferences

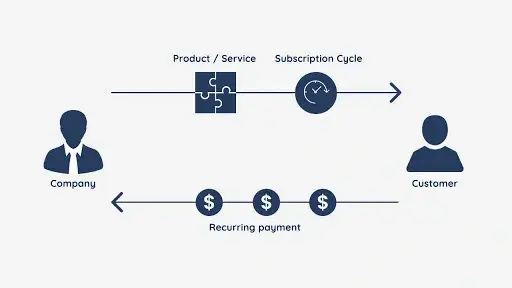

Choosing the appropriate currency for international invoices significantly impacts customer satisfaction, payment speed, and foreign exchange risk exposure. Many businesses default to invoicing in USD to minimize their currency risk, but this approach may create barriers for international clients who prefer transactions in their local currencies.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

Consider offering invoicing in major currencies like EUR, GBP, CAD, and AUD for clients in those regions, as this approach often accelerates payment and demonstrates cultural sensitivity. However, currency diversification increases complexity and requires robust systems for managing exchange rate fluctuations.

Professional invoicing systems that support multiple currencies streamline this process by automatically converting amounts, tracking exchange rates, and maintaining records in both original and reporting currencies for accounting purposes.

Also read: How to Get Emergency Loans Fast in the USA ($100-$10000)

Exchange Rate Management and Risk Mitigation

Foreign exchange rate fluctuations can significantly impact profitability on international transactions, particularly for businesses with extended payment terms. Implementing systematic approaches to currency risk management protects against adverse rate movements while maintaining competitive pricing.

Forward Contracts: Lock in exchange rates for future payments, providing predictable revenue regardless of market fluctuations. This approach works well for businesses with consistent international sales volumes and predictable payment timing.

Currency Hedging Strategies: Utilize financial instruments to offset potential losses from currency movements. While more complex, hedging can protect margins on large international projects or ongoing service agreements.

Dynamic Pricing Models: Adjust pricing regularly based on current exchange rates, ensuring consistent profit margins across currencies. This approach requires sophisticated systems but provides maximum protection against currency volatility.

Payment Terms and Currency Considerations

International payment terms must account for currency conversion delays, cross-border transfer times, and varying banking systems. Standard NET-30 terms may effectively become NET-40 or longer for international transactions due to additional processing requirements.

Consider offering payment incentives for transactions in your preferred currency, such as early payment discounts for USD payments or extended terms for local currency transactions. These strategies can optimize your currency mix while maintaining customer satisfaction.

Clearly specify currency exchange responsibilities in your payment terms, including who bears conversion costs and what exchange rates apply. Using professional invoice templates that clearly display multi-currency information reduces confusion and payment delays.

International Tax Compliance for US Businesses

Understanding Tax Treaty Networks

The United States maintains tax treaties with over 60 countries, providing frameworks for avoiding double taxation and reducing withholding tax rates on international transactions. Understanding applicable treaty benefits can significantly reduce your international tax burden while ensuring compliance.

Tax treaties typically address income tax, withholding taxes, and information exchange requirements. Businesses must determine treaty eligibility, claim appropriate benefits, and maintain documentation supporting treaty positions for potential audits.

Withholding Tax Considerations: Many countries impose withholding taxes on payments to foreign businesses, ranging from 5-30% of invoice amounts. Treaty provisions often reduce these rates, but claiming benefits requires proper documentation and procedures.

Value Added Tax (VAT) and Sales Tax Requirements

US businesses serving international markets must understand VAT obligations in customer countries, as these requirements vary significantly and can create unexpected compliance burdens. Some countries require foreign businesses to register for VAT once sales exceed specific thresholds.

EU VAT Compliance: The European Union’s complex VAT system requires registration in multiple member states for businesses exceeding country-specific thresholds. Digital services face additional complications under current regulations.

Reverse Charge Mechanisms: Many countries use reverse charge procedures for B2B transactions, shifting VAT responsibility to customers. Understanding these mechanisms helps structure transactions appropriately and avoid unnecessary registrations.

Digital Services Taxes: Emerging digital service taxes in various countries affect US businesses providing online services, software, or digital products to international customers.

Transfer Pricing and Documentation Requirements

Businesses with related entities in multiple countries face transfer pricing requirements that mandate arm’s length pricing for intercompany transactions. These rules affect how services are invoiced between related parties internationally.

Documentation Requirements: Transfer pricing rules require extensive documentation supporting pricing decisions, including economic analyses, comparable transactions, and detailed functional analyses of business operations.

Advance Pricing Agreements: For complex international structures, advance pricing agreements with tax authorities provide certainty about acceptable transfer pricing methods and reduce audit risks.

Global Invoicing Standards and Compliance Requirements

Electronic Invoicing (E-Invoicing) Mandates

Many countries mandate electronic invoicing for B2B transactions, requiring specific formats, digital signatures, and government reporting. These requirements are expanding rapidly, with countries like Mexico, Brazil, and several EU members leading adoption.

XML Standards: Most e-invoicing systems require XML formats with specific data elements and structures. Popular standards include UBL (Universal Business Language) and various national standards like Mexico’s CFDI format.

Digital Signatures and Authentication: E-invoicing often requires digital signatures or certificates to ensure authenticity and prevent tampering. Understanding certificate requirements and management processes is essential for compliance.

Real-Time Reporting: Some jurisdictions require real-time or near-real-time reporting of invoice data to tax authorities, necessitating integrated systems that can transmit data automatically upon invoice creation.

Invoice Content and Format Requirements

Different countries impose specific requirements for invoice content, formatting, and language, making standardization challenging for businesses serving multiple international markets. These requirements often extend beyond simple translation needs.

Mandatory Invoice Elements: Most countries require specific information including seller details, buyer information, tax identification numbers, precise product descriptions, and tax calculations. Missing elements can invalidate invoices for tax purposes.

Language Requirements: Some jurisdictions require invoices in local languages, while others accept English with local language translations. Understanding these requirements prevents payment delays and compliance issues.

Sequential Numbering: Many countries mandate sequential invoice numbering without gaps, requiring sophisticated systems to manage numbering across multiple jurisdictions and currencies.

Payment Processing and Collection Strategies

International Payment Methods and Preferences

Payment preferences vary significantly across countries, with some markets preferring bank transfers, others favoring credit cards, and emerging markets often using alternative payment methods. Understanding local preferences improves collection rates and customer satisfaction.

SEPA Transfers: European customers often prefer SEPA transfers for EUR transactions, providing cost-effective, reliable payment processing within the Eurozone.

Local Payment Methods: Many countries have dominant local payment systems like iDEAL (Netherlands), Boleto (Brazil), or Alipay (China) that facilitate faster, cheaper transactions for local customers.

Digital Wallets: PayPal, Stripe, and regional alternatives provide convenient payment processing for international transactions, though fees and availability vary by country.

Banking and Foreign Exchange Considerations

International payment processing involves multiple banks, correspondent relationships, and currency conversion services, each adding time and costs to collection processes. Understanding these systems helps optimize payment flows and reduce costs.

Correspondent Banking: International wire transfers typically involve correspondent banks that add fees and processing time. Understanding these relationships helps predict total costs and timing for international payments.

Multi-Currency Accounts: Maintaining foreign currency accounts in major currencies can reduce conversion costs and provide natural hedging for ongoing international operations.

Payment Processing Fees: International payment processing involves various fees including wire transfer costs, currency conversion charges, and intermediary bank fees that can significantly impact net receipts.

Technology Solutions for International Invoicing

Automated Currency and Tax Management

Modern invoicing platforms provide automated solutions for currency conversion, tax calculations, and compliance management, reducing manual effort while improving accuracy. These systems integrate real-time exchange rates and maintain updated tax rate databases.

Real-Time Exchange Rates: Automated systems pull current exchange rates from financial data providers, ensuring accurate conversions and consistent pricing across currencies.

Tax Rate Automation: Sophisticated platforms maintain databases of international tax rates, automatically calculating VAT, GST, and other local taxes based on customer locations and transaction types.

Compliance Monitoring: Advanced systems track regulatory changes and update invoicing processes automatically, helping businesses maintain compliance as requirements evolve.

Integration with Financial and Accounting Systems

International invoicing systems must integrate seamlessly with accounting software, ERP systems, and financial reporting platforms to maintain accurate records and support tax compliance. Using comprehensive invoice management solutions that offer strong integration capabilities streamlines these processes significantly.

Multi-Currency Accounting: Integration with accounting systems that support multiple currencies ensures accurate financial reporting and simplifies audit processes.

Automated Reconciliation: Systems that automatically reconcile payments across currencies and accounts reduce manual effort and improve accuracy in financial record-keeping.

Reporting and Analytics: Comprehensive reporting capabilities provide insights into international sales performance, currency exposure, and collection efficiency across different markets.

Risk Management and Legal Considerations

Credit Risk Assessment for International Clients

Assessing credit risk for international customers requires different approaches than domestic evaluations, as traditional credit reporting may be unavailable or unreliable in some markets. Developing systematic risk assessment processes protects against bad debt losses.

International Credit Reporting: Services like Dun & Bradstreet International provide credit information for businesses in many countries, though coverage and reliability vary by market.

Country Risk Analysis: Political and economic stability affects payment risk, requiring ongoing monitoring of country conditions and adjustment of credit policies accordingly.

Trade Credit Insurance: International trade credit insurance protects against customer defaults and political risks, though premiums and coverage vary by country and customer.

Contract Terms and Dispute Resolution

International contracts require careful consideration of governing law, jurisdiction for disputes, and enforcement mechanisms. These provisions significantly impact your ability to collect payments and resolve conflicts.

Choice of Law: Specifying US law (or another favorable jurisdiction) as governing law provides predictability, though enforcement may still require local legal proceedings.

Arbitration Clauses: International arbitration through organizations like the ICC or AAA provides neutral dispute resolution mechanisms that may be more efficient than local court systems.

Force Majeure Provisions: International contracts should address force majeure events including political instability, currency restrictions, and other country-specific risks that could affect payment ability.

Building Scalable International Invoicing Operations

Process Standardization and Documentation

Developing standardized processes for international invoicing ensures consistency, reduces errors, and facilitates training as businesses scale globally. Documentation should address currency selection, tax calculations, compliance requirements, and collection procedures.

Standard Operating Procedures: Detailed procedures covering each aspect of international invoicing help maintain consistency as teams grow and new markets are added.

Quality Control Systems: Regular reviews of international invoices help identify errors, ensure compliance, and continuously improve processes.

Training Programs: Comprehensive training ensures team members understand international requirements and can handle complex situations appropriately.

Continuous Improvement and Adaptation

International invoicing requirements evolve continuously as regulations change, new markets develop, and business needs expand. Building systems for monitoring changes and adapting processes ensures ongoing compliance and efficiency.

Regulatory Monitoring: Systematic tracking of regulatory changes across target markets helps businesses adapt processes proactively rather than reactively.

Performance Analytics: Regular analysis of international invoicing performance identifies improvement opportunities and highlights successful practices that can be expanded.

Technology Upgrades: Staying current with invoicing technology improvements ensures access to new features and capabilities that can improve efficiency and compliance.

Conclusion: Mastering Global Business Operations

Successfully managing international invoicing requires comprehensive understanding of currency management, tax compliance, and global business practices. While complex, mastering these areas enables US businesses to expand globally while maintaining profitability and regulatory compliance.

The key to success lies in building scalable systems that automate routine processes while providing flexibility to handle unique requirements across different markets. Professional invoicing platforms with international capabilities, such as comprehensive invoice generation solutions, provide the foundation for efficient global operations.

Focus on developing systematic approaches to currency management, maintaining current knowledge of international tax requirements, and building relationships with local professionals who can provide market-specific guidance. With proper planning and execution, international invoicing becomes a competitive advantage that facilitates global growth while minimizing risks and compliance burdens.

Remember that international expansion is an ongoing learning process that requires continuous adaptation and improvement. Stay informed about regulatory changes, monitor performance metrics, and be prepared to adjust strategies as your international operations evolve and mature.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.