At some stage in our entrepreneurial journey some of us must have also asked the question, Can anyone write an invoice or it is a task that must left for our accountants.

If that is the case, when would you grow to be able to afford one? Quick answer before we go on. Yes, anyone who wants to request for payment for their product or services can write an invoice.

Invoices are an essential part of any business transaction. Every commercial transaction must have invoices.

These are official documents that describe a sale’s specifics, such as the goods or services offered, the cost, and the terms of payment.

But who is able to create a bill? Is it a job that anybody can do, or are there particular legal and professional qualifications that must be satisfied?

We’ll talk about writing invoices in this article and address some often asked queries concerning who can write them.

Let’s begin by quickly defining an invoice before we get into further detail.

A document known as an invoice is issued to a client or customer as a request for payment for products or services that have been rendered.

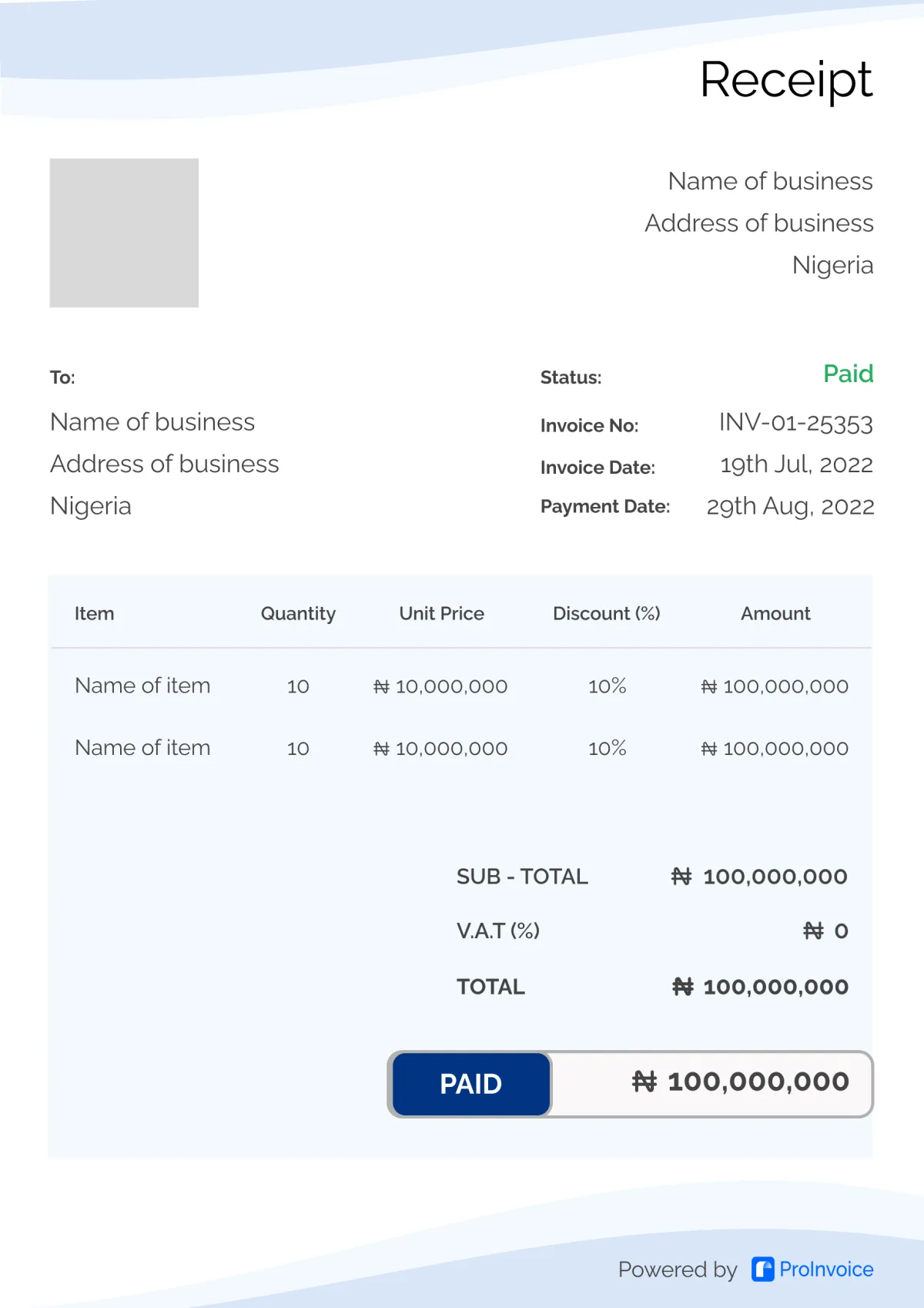

The date of the sale, a description of the goods or services rendered, the amount, and the price are frequently included.

In some situations, an invoice may also include further information like the terms of payment, the payment deadline, and any taxes or levies that may be relevant.

When it comes to who can write an invoice, the answer is that anyone can technically create an invoice.

An invoice, however, must adhere to specific legal and professional standards in order to be legitimate and enforceable.

Can Anyone Write An Invoice? If yes, Who?

Here are some people who may be responsible for writing an invoice: -

Company owners

The majority of the time, business owners generate client invoices. They can either use accounting software, a template, or they can write the invoices by hand.

Whatever method they choose, business owners must make sure their invoices are correct, presentable, and compliant with any applicable laws.

Independent contractors and other self-employed people

Self-employed people and freelancers must also produce invoices in order to bill their clients for the services they render.

Most times they utilize online invoicing software to speed up the procedure, making it simpler to keep track of payments, and help them manage their money.

Service providers and subcontractors

Invoices may also be necessary for contractors and service providers to produce for their clients or consumers.

This is highly common in sectors like construction, where work is frequently performed on a project basis and invoicing is a crucial step in the payment process.

Workers with permission from their employer

Employees’ employers may occasionally give them the go-ahead to generate invoices on the company’s behalf. Employees who manage customer accounts, work in accounting or finance, or both, may experience this.

Legal requirements for invoices

It’s crucial to understand how to write an invoice properly whether you’ve sent out a lot of invoices in the past or are attempting to create your first one.

Writing an invoice involves several distinct elements, and omitting one could make you appear unprofessional.

While anyone can technically create an invoice, there are certain legal requirements that must be met in order for the invoice to be valid and enforceable.

Here are some of the key content and formatting requirements that apply to most invoices:

Content requirements

An invoice should include the following information:

- The word “invoice” or “bill”

- A unique invoice number

- The date of the sale

- The name and contact information of the seller (name of business, address, phone number, email address)

- The name and contact information of the buyer

- A description of the products or services provided, including the quantity and price

- The total amount due

- Any applicable taxes or fees

- The payment terms (such as the due date and any late payment penalties)

Legal Consequences of Non Compliance

There can be substantial repercussions if the legal standards for invoices are broken.

A bill could be deemed unlawful and unenforceable in a court of law if it contains the incorrect information or is not formatted properly, for instance.

Due to this, it could be challenging to get paid for the goods or services that were rendered. Also, failure to comply with the standards for invoicing may result in fines or other legal repercussions.

Importance of accurate and professional invoices

Creating accurate and professional invoices is important for a number of reasons. Here are some of the key benefits:

1. Building trust and credibility

An invoice that is well-designed, accurate, and easy to understand can help to build trust and credibility with customers or clients. This can lead to repeat business and positive word-of-mouth referrals.

2. Securing prompt payment

Clear and precise invoices can also help to guarantee that payments are made on schedule.

It could be more challenging for the customer or client to grasp what is owing and when it is due if an invoice is unclear or contains inaccuracies.

Delays in payment may result, which can be annoying for the vendor.

3. Avoiding legal disputes

By ensuring that invoices are compliant with legal requirements, businesses can also avoid potential legal disputes or penalties.

Invoices that are accurate and complete can help to prevent misunderstandings or disputes over payment amounts or terms.

Conclusion

In conclusion, anyone can technically create or write an invoice, but there are certain legal and professional requirements that must be met in order for the invoice to be valid and enforceable.

Business owners, freelancers, contractors, and employees may all be responsible for creating invoices in different contexts, but it is important to ensure that invoices are accurate, professional, and comply with any relevant legal requirements.

By doing so, businesses can build trust and credibility, ensure timely payment, and avoid potential legal disputes or penalties. Writing an invoice is a good indicator for your company, but it might get tedious after a while.

After a while, you could start to feel as though you’re spending more time completing invoices than you are actually carrying out the work for which you are being paid.

Consider adopting invoicing software in place of producing paper invoices or manual invoices. Accounting software and internet templates can help make invoicing simpler.

Using a template to create an invoice helps you save time and effort. In order to spend less time being an accountant and more time doing the work you enjoy, it’s crucial to have a really straightforward invoicing software like ProInvoice.