1. Introduction

In today’s business environment, cash flow and financial stability are crucial. One underrated yet powerful lever is optimized invoicing. Efficient billing habits don’t just affect how quickly clients pay they shape your company’s ability to operate, expand, and thrive. In this article, we explore the significant impact of invoicing on your cash flow and financial well‑being, and demonstrate how ProInvoice can transform your billing process.

2. What Is Cash Flow and Why It Matters

Cash flow is the money moving in and out of your business. Positive cash flow means revenues exceed expenses during a period—which funds salaries, inventory, and growth. Negative cash flow, on the other hand, can stall operations, erode savings, and affect your ability to pay suppliers or service debt.

A strong, steady cash flow builds financial resilience, helps secure loans, and underpins strategic investment.

3. The Link Between Invoicing and Cash Flow

• Speed of Invoicing – The faster you issue an invoice, the sooner you get paid. Delays in sending invoices mean longer gaps in receivables.

• Accuracy and Professionalism – Errors, missing details, or unclear payment terms result in disputes and payment delays.

• Payment Terms and Reminders – Clear, consistent payment terms, combined with timely reminders for overdue invoices, reduce the risk of late or missed payments.

• Tracking & Reporting – Visibility on unpaid, overdue, and recurring billing helps you take early corrective action, maintaining steady cash inflows.

4. Key Billing Practices for Peak Cash Flow

4.1 Use Professional Invoices

Make your invoices stand out by using ProInvoice’s customizable invoice templates or free invoice templates. A sleek, branded invoice signals professionalism and prompts clients to take notice and pay promptly.

4.2 Offer Clear Payment Terms

Define payment deadlines (e.g., “Net 30,” “Due Upon Receipt”) and include them on each invoice. This clarity prevents confusion and ensures expectations are aligned.

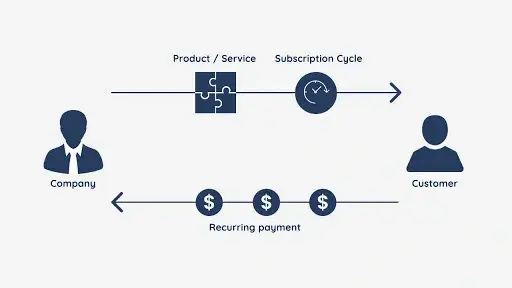

4.3 Automate Recurring Billing & Invoices

Business models relying on subscriptions or retainers (e.g., software services, agencies) are ideal candidates for recurring billing/invoices. Automating this through ProInvoice guarantees that monthly or quarterly invoices are issued punctually supporting predictable cash flow.

4.4 Send Invoices by Email with PDF Attachments

Emailing invoices with a PDF invoice attachment is effortless with ProInvoice. This format is widely accepted, professional, and ensures records are preserved. Plus, it encourages faster client action than postal mail.

4.5 Include Estimates and Quotes

Before running a job or project, provide invoice estimates/quotes. This improves client trust, minimizes disputes, and smooths the path to eventual invoicing accelerating project momentum and billing.

4.6 Send Payment Reminders

Even with clear terms, payments may slip. ProInvoice enables automated payment reminders so you can follow up on unpaid invoices without being the relentless collections voice.

4.7 Track Invoices and View Overdue Reports

Use invoice tracking & status features to monitor which invoices are paid, pending, or overdue. Leverage overdue invoice reports to spotlight problem areas and adjust your strategy.

4.8 Accept Payments Online

Letting clients accept payments online—through credit card, online transfers, or digital wallets removes friction and accelerates payments. ProInvoice offers seamless online payment integration to fuel quicker receivables.

4.9 Enable Mobile Payments

On‑the‑go workers, freelancers, and field personnel benefit from mobile payments. Issuing invoices and receiving payments onsite means fewer delays and fostering quicker cash conversion.

4.10 Issue Receipts

Once paid, send estimates and receipts to close the loop professionally reinforcing trust and providing clients with proof of payment.

5. How These Practices Boost Your Business

5.1 Get Paid Faster

Combining professional invoices, emailed PDFs, optimized payment terms, online payment integration, and reminders means clients pay in days not weeks. Better billing = better cash flow.

5.2 Reduce Administrative Overhead

Manual billing, chasing late payers, and tracking overdue invoices devour time and attention. Automating with ProInvoice frees up hours, enabling you to focus on clients, innovation, and growth.

5.3 Greater Forecasting & Liquidity

When invoices are sent reliably and payments tracked, forecasting becomes accurate. Liquidity remains steady even during slow seasons or growth phases empowering you to invest, stock, or hire with confidence.

5.4 Improve Client Relationships

Transparent estimates, proactive reminders, and swift receipts signal respect. Clients appreciate professionalism and are more likely to continue purchasing and paying promptly.

5.5 Minimize Risk

Late or missing payments can damage your business utility, credit access, and financial reserves. ProInvoice’s tracking, status updates, and overdue reporting reduce that risk helping you stay in control.

6. ROI: Why Invoicing Software Is Worth It

The cost of invoicing software is trivial compared to what delays cost. Consider:

10 invoices monthly × $5 average lifetime value × 30-day delay = $1,500 in deferred revenue

Compare that to ProInvoice’s subscription spend less than 1% of deferred revenue and earn back liquidity almost immediately.

You recoup the cost through faster payments, reduced admin time, and fewer financing fees.

7. ProInvoice Makes It Easy

ProInvoice gives you all the tools to reinforce each step of the billing process:

• Use free and customizable templates to create professional invoices.

• Automate recurring billing/invoices for steady, repeatable revenue.

• Send invoices by email with secure PDF invoice attachments.

• Include payment terms and gentle payment reminders.

• Monitor invoice tracking & status to prevent delinquencies.

• Generate overdue invoice reports for early action.

• Let clients accept payments online via gateway or mobile payments.

• Transition from invoice estimates/quotes to final invoices without duplication.

• Send estimates and receipts to close the billing loop professionally

Each feature tightens your cash flow engine and drives faster, more reliable payments.

8. Monitoring and Continuously Improving

ProInvoice analytics help you analyze which clients pay late, which services turn quickest revenue, and where cash flow bottlenecks happen. Revise payment terms, billing cycles, or reminder frequency accordingly. As your business evolves, so too should your invoicing strategy.

9. Real‑World Scenario: Sam’s Design Studio

Sam owns a design studio charging monthly retainer fees. Before ProInvoice, he created invoices manually—resulting in a 45-day average payment delay. After switching:

• He set up recurring billing/invoices.

• Emails with PDF invoice attachments were sent immediately.

• Online payments and mobile payments were enabled.

• Payment reminders triggered after 7 days past due.

Result: Average payment dropped to 7 days, cash flow smoothed dramatically, Sam reinvested $10k in new tools—and stayed debt‑free.

10. Common Misconceptions About Invoicing

• “Invoice when the job’s done.”

Delaying invoices costs you working capital. ProInvoice lets you bill milestones, deposit-ready drafts, or subscriptions immediately.

• “Reminders are rude.”

Properly phrased, automated reminders signal professionalism they’re expected in business.

• Clients hate emailed invoices.”

The opposite is true email with online payment links makes it faster and easier for clients to pay.

✅ Final Takeaway

Effective invoicing is no longer optional it’s strategic finance. Clear terms, branded invoices, automated reminders, real receipts, and real-time tracking fuel healthier cash flow. With ProInvoice designed around these pillars, you turn billing into your most productive financial tool.