Any entrepreneur looking to make a mark in their niche this year must pay attention to some tried and tested tips for small business owners in 2023 to help position their business goals.

Setting out on the entrepreneurial path as a small business owner is akin to embarking on a grand odyssey. Furthermore, it represents a multifaceted journey of exploration and innovation.

The small business arena is both thrilling and challenging. Additionally, it’s a landscape where dreams are transformed into reality.

It is here, where the will to succeed meets countless opportunities and hurdles. Therefore, this article serves as your intricate map, meticulously crafted to illuminate the path through the ever-evolving terrain of small business ownership.

Whether you are a seasoned entrepreneur with years of experience or a determined newcomer, the following tips for small business owners are the guiding stars that promise enduring growth, financial success, and customer satisfaction.

Top Tips for Small Business Owners

1. Prioritize Customer Satisfaction

Your customers are the lifeblood of your business. Moreover, achieving customer satisfaction goes beyond delivering products or services.

It entails understanding your customers at a profound level, anticipating their needs, and creating delightful experiences. Therefore, solicit feedback and act upon it to improve your offerings and customer service. Furthermore, establishing an emotional connection with your clients can turn them into loyal advocates for your brand.

Such advocates not only become repeat customers but also become the most powerful marketing tool at your disposal. Consequently, they influence their networks and attract new clients to your business.

The depth of your commitment to customer satisfaction ultimately defines your brand. Additionally, it sets you apart from the competition.

The Complete Customer Journey

In addition, keep in mind that delivering a superior product or service is just one aspect of customer satisfaction. Instead, the entire customer journey should be smooth and enjoyable, from the first interaction to the post-purchase experience.

Train your staff to provide impeccable customer service. Furthermore, go the extra mile in addressing inquiries, concerns, and issues.

Investing in a robust customer relationship management (CRM) system can help you keep track of customer preferences and history. As a result, this enables you to personalize their experiences and offer targeted promotions.

By consistently exceeding customer expectations, you’ll not only secure their loyalty but also inspire them to spread the word about your business to their network. Ultimately, this boosts your brand’s reputation and drives growth.

2. Invest in Strategic Marketing

The realm of small business is teeming with potential customers who may not yet know about your products or services. Therefore, to tap into this market, an effective marketing strategy is imperative. In today’s digital age, your online presence plays a pivotal role in attracting and retaining customers. This is one of the many tips for small business owners that no one should play with.

Develop a comprehensive digital marketing plan that targets your ideal customers. Furthermore, utilize search engine optimization (SEO), social media advertising, and email marketing campaigns.

By identifying your target audience and crafting compelling content, you can effectively reach and engage with your prospective customers.

SEO and Search Engine Visibility

Incorporate SEO strategies to enhance your website’s visibility on search engines like Google. This ensures that when potential customers search for products or services related to your business, they find your website among the top search results.

Social Media and Email Marketing

Social media advertising offers an excellent opportunity to connect with your audience through various platforms such as Facebook, Instagram, and Twitter. These platforms enable you to create highly targeted advertisements that reach users based on demographics, interests, and behaviors. Consequently, this allows you to connect with potential customers who are more likely to engage with your business.

Additionally, email marketing campaigns can be a powerful tool for nurturing leads and maintaining relationships with your existing customer base. By regularly sending relevant and valuable content to your email subscribers, you can keep your brand at the forefront of their minds. Moreover, this encourages repeat business.

Ultimately, a well-crafted marketing strategy will not only increase brand awareness but also drive sales and revenue. Therefore, this ensures the continued success of your small business.

3. Embrace Technology for Efficiency

In the digital era, technology can revolutionize your small business operations. Furthermore, it enhances efficiency and frees up your time for strategic planning and growth.

A critical area where technology can make a significant impact is in the realm of financial management. Small business owners often find themselves juggling multiple tasks, from managing employees to servicing customers.

Amid this whirlwind of activity, it’s easy to overlook the importance of accurate financial record-keeping and management. However, maintaining detailed financial records is not just a best practice; it’s a fundamental necessity for the survival and prosperity of your business.

Neglecting this aspect can lead to financial troubles, regulatory issues, and missed growth opportunities.

Professional Accounting Software Solutions

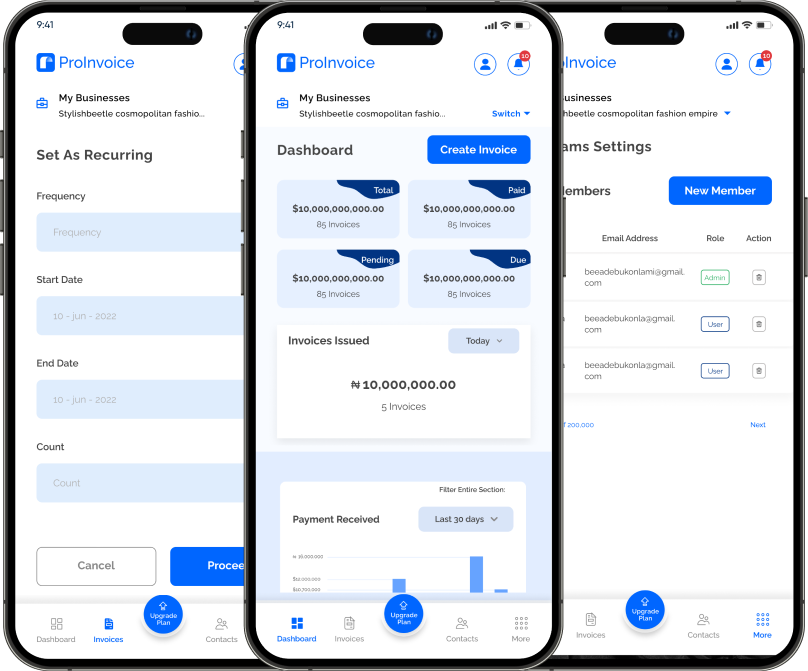

One essential tool for managing your finances effectively is the use of professional accounting and invoicing software, such as ProInvoice. This best invoicing software streamlines the financial management process, making it simpler and more efficient. Additionally, it helps you create and send invoices, keep track of your expenses, and monitor your cash flow.

By automating these financial tasks, you reduce the risk of errors. Moreover, this ensures that your financial records are accurate and up-to-date.

Additionally, invoicing software can help you get paid faster by offering convenient payment options for your customers. As a result, this improves your cash flow.

Furthermore, this software generates financial reports that provide insights into your business’s financial health. Therefore, this enables you to make informed decisions and develop a strategic financial plan. Get started with ProInvoice today to streamline your financial management.

By adopting technology to manage your finances, you free up valuable time and resources to focus on other aspects of your business. For instance, this includes product development, customer service, and marketing.

Ultimately, the efficiency and accuracy provided by technology will empower your small business to thrive.

4. Master Financial Management

Sound financial management is the backbone of any successful small business. It’s not just about tracking money in and out; instead, it’s about understanding the financial health of your business and making informed decisions based on this understanding.

Maintaining meticulous financial records is a fundamental practice for any small business owner. These records provide a detailed history of your business’s financial transactions, including income, expenses, and investments.

With accurate records, you can track your cash flow and understand how your business is performing financially. Furthermore, this allows you to identify areas where you can cut costs or make strategic investments to grow your business.

Budgeting and Financial Planning

Budgeting is another crucial aspect of financial management. A well-structured budget helps you allocate resources efficiently. Moreover, it ensures that you have enough funds to cover operational expenses.

It’s a roadmap for your business, guiding you in making decisions about spending, hiring, and investments. By sticking to a budget, you’ll be better prepared to manage financial ups and downs. Additionally, this maintains financial stability.

However, financial management isn’t just about record-keeping and budgeting. Instead, it also involves monitoring key financial ratios and indicators to assess the health of your business.

Key performance indicators (KPIs) can help you understand how well your business is performing in different areas. For example, this includes sales, marketing, and customer retention.

By regularly analyzing these KPIs, you can identify trends and make data-driven decisions to optimize your business operations.

Consulting with financial experts or hiring a professional accountant can also be a wise investment for small business owners. This is especially important when dealing with complex financial matters.

Long-term Financial Health

In addition to the day-to-day financial management, it’s essential to plan for the long-term financial health of your business. This includes setting aside funds for emergencies, retirement, and growth. Building financial reserves provides a safety net during unexpected financial challenges. Moreover, it allows you to seize opportunities for expansion when they arise.

Financial planning should align with your business goals and vision. Ultimately, a solid financial foundation is the key to the stability and growth of your small business.

5. Develop a Strong Brand Identity

As an entrepreneur, if you miss every other tip, this is one of the most invaluable tips for small business owners you shouldn’t miss.

Your brand identity is more than just a logo or a tagline. Instead, it’s the unique personality and promise of your business.

It’s what sets you apart from competitors and creates a lasting impression in the minds of your customers. A strong brand identity reflects your values, mission, and vision. Furthermore, it resonates with your target audience.

Your brand’s consistency is a cornerstone of its strength. It’s about consistently delivering on your brand promise. Therefore, this ensures that your customers know what to expect from your products or services.

If your brand promises top-notch quality, then every interaction with your business should reflect that commitment. The consistency of your brand identity builds trust and credibility. Moreover, these are essential in creating long-lasting customer relationships.

Understanding Your Market

To develop a strong brand identity, you need a deep understanding of your target audience and market. Market research helps you identify what your customers want, need, and value. With this knowledge, you can craft a brand identity that resonates with your audience.

Your brand identity should be reflected in every aspect of your business. For instance, this includes your website and marketing materials to your customer service and the way you communicate with your audience.

Consistency is key; therefore, it ensures that your brand is recognizable and memorable.

Ultimately, a strong brand identity not only differentiates your business but also connects with your customers on a deeper level. As a result, this fosters trust and loyalty.

6. Monitor and Learn from Competitors

Monitoring your competitors is not about copying their strategies. Instead, it’s about gaining insights to enhance your own.

Although this is coming last, it could easily rank as the most important when talking about tips for small business owners.

Competitor analysis is an essential aspect of staying competitive in the small business arena. By keeping a watchful eye on your competitors, you can learn from their successes and mistakes. Moreover, you can identify industry trends, and discover potential areas for improvement within your own business.

Start by identifying your key competitors. These are the businesses that offer similar products or services to your target audience. Online tools and market research can help you compile a list of competitors. Once you’ve identified them, delve deeper into their operations.

Analyze their strengths, weaknesses, and market positioning. This will provide valuable insights into their strategies and potential opportunities for differentiation.

Marketing Analysis and Customer Base

Pay attention to your competitors’ marketing efforts. Examine their online presence, including their website, social media accounts, and advertising campaigns.

What marketing strategies are they using, and how effective are they in reaching their target audience? Look for gaps or areas where you can offer a unique value proposition to your customers.

Competitor analysis also involves understanding their customer base. Who are their most loyal customers, and why do these customers choose them over others? Are there opportunities to attract similar customers to your business?

Moreover, keep an eye on industry trends. Are there emerging technologies, customer preferences, or market dynamics that are affecting your competitors’ businesses? How are they adapting to these changes, and how can you stay competitive in this evolving landscape?

Implementation and Ongoing Monitoring

Incorporate the insights you gain from competitor analysis into your business strategies. Use this information to refine your marketing campaigns, improve customer experiences, and identify areas for innovation.

Remember that monitoring your competitors is an ongoing process. Regularly reassess their strategies and the state of the market to stay ahead of the competition.

Conclusion

The journey of entrepreneurship for small business owners is both a thrilling adventure and a calculated endeavor. The in-depth tips provided in this guide serve as the navigational stars that illuminate your path. Furthermore, they help you navigate the ever-changing landscape of small business ownership.

These tips for small business owners encompass the importance of prioritizing customer satisfaction, embracing technology, and mastering the intricacies of financial management.

With a strong brand identity and a strategic focus on sustainable growth, you can build a foundation for lasting success. Additionally, investing in your team and adapting to market changes will enable your business to thrive in the face of challenges and opportunities.

Monitoring your competitors and continually learning from their strategies will keep you at the forefront of your industry.

By implementing these tips and consistently working towards your business goals, you’re not just setting sail on the entrepreneurial journey. Instead, you’re embarking on a mission to achieve enduring growth and prosperity as a small business owner.