Nigeria is one of Africa’s largest economies, filled with entrepreneurial opportunities and a rising population of young, energetic business owners. But while the potential is massive, the reality is that doing business in Nigeria comes with serious challenges.

From poor infrastructure to inconsistent government policies, many small and medium-sized businesses (SMEs) struggle to thrive in the Nigerian business environment.

In this article, we break down the key challenges entrepreneurs face in Nigeria — and share practical tips to overcome them.

1. Unstable Power Supply (Electricity)

One of the biggest costs to Nigerian businesses is inconsistent electricity. Most SMEs spend a chunk of their profits on fueling generators daily.

🔌 Impact:

- Increases cost of production

- Reduces working hours

- Affects customer experience (especially for online businesses)

💡 Solution:

- Invest in solar alternatives for small operations

- Batch production and work during hours of power supply

- Explore shared co-working or production spaces with better infrastructure

2. Access to Capital

Getting funding to start or scale a business in Nigeria is still very tough. Banks ask for high collateral, interest rates are harsh, and most startups are not “fund-ready”.

💸 Impact:

- Limits business growth

- Many ideas die before launch

- Most entrepreneurs depend on personal savings

💡 Solution:

- Explore microfinance banks, cooperatives, or government loans like NIRSAL or BOI

- Pitch to angel investors and accelerators (Lagos Angel Network, VC4A, etc.)

- Use invoice management tools like ProInvoice to build credibility and show financial records

3. Inconsistent Government Policies & Regulations

Nigerian entrepreneurs often face sudden policy shifts — from import bans to multiple taxation and license requirements.

🧾 Impact:

- Business planning becomes difficult

- Uncertainty discourages investors

- Small businesses face double taxation from federal and state bodies

💡 Solution:

- Stay updated on regulations via trusted sources (SMEDAN, NAFDAC, CAC, etc.)

- Register your business to access government programs

- Join business networks like LCCI or NASME to stay informed

4. Poor Infrastructure

From bad roads to poor transportation systems, infrastructure affects everything — from logistics to customer delivery.

🚚 Impact:

- Delivery delays

- Damaged goods

- Limited customer reach

💡 Solution:

- Work with reliable logistics partners (e.g., GIG, Kwik, Topship)

- Use social media to build local customer bases and offer pick-up options

- Partner with delivery startups for affordability and reach

5. High Cost of Doing Business

Rent, staffing, raw materials, importation — all expensive. Inflation keeps rising and the naira continues to lose value.

💼 Impact:

- Business owners operate on thin margins

- It’s hard to scale

- Customers are price-sensitive

💡 Solution:

- Go lean: Use virtual staff, shared workspaces, and low-cost tools

- Source locally where possible

- Automate repetitive tasks using affordable software like ProInvoice for invoicing and sales tracking

6. Poor Access to Technology & Digital Tools

While Nigeria has seen growth in tech adoption, many SMEs still don’t use tools that make business easier.

🖥️ Impact:

- Missed opportunities online

- Poor record-keeping

- Unprofessional customer service

💡 Solution:

- Embrace free or affordable tools like WhatsApp Business, Canva, and ProInvoice

- Take online courses on business automation and marketing

- Create a simple e-commerce platform or order form for your products

7. Insecurity

In some regions, insecurity makes it unsafe to operate businesses, especially logistics, farming, or offline retail.

🔐 Impact:

- Delivery risks

- Operational shutdowns

- Loss of inventory

💡 Solution:

- Insure your business and goods

- Use secured logistics services

- Consider digital business models (e.g., dropshipping, online services)

8. Low Purchasing Power

The average Nigerian is struggling financially. That means many customers can’t afford to buy high-ticket products consistently.

🛒 Impact:

- Slow sales

- Difficult to raise prices

- Stiff competition on pricing

💡 Solution:

- Offer flexible payment options or bundles

- Focus on value-based products

- Use WhatsApp and Instagram to stay connected with your customer base

9. Lack of Business Education

Many Nigerian entrepreneurs jump into business without understanding marketing, pricing, branding, or bookkeeping.

📉 Impact:

- Poor financial management

- Burnout and early business death

- No scalability

💡 Solution:

- Take free or paid online business courses

- Join communities and accelerator programs

- Track sales, expenses, and profit using tools like ProInvoice

Final Thoughts

Yes, doing business in Nigeria comes with its fair share of headaches. But every challenge is also an opportunity to innovate and stand out.

With the right mindset, tools, and network, you can not only survive but thrive in Nigeria’s business environment.

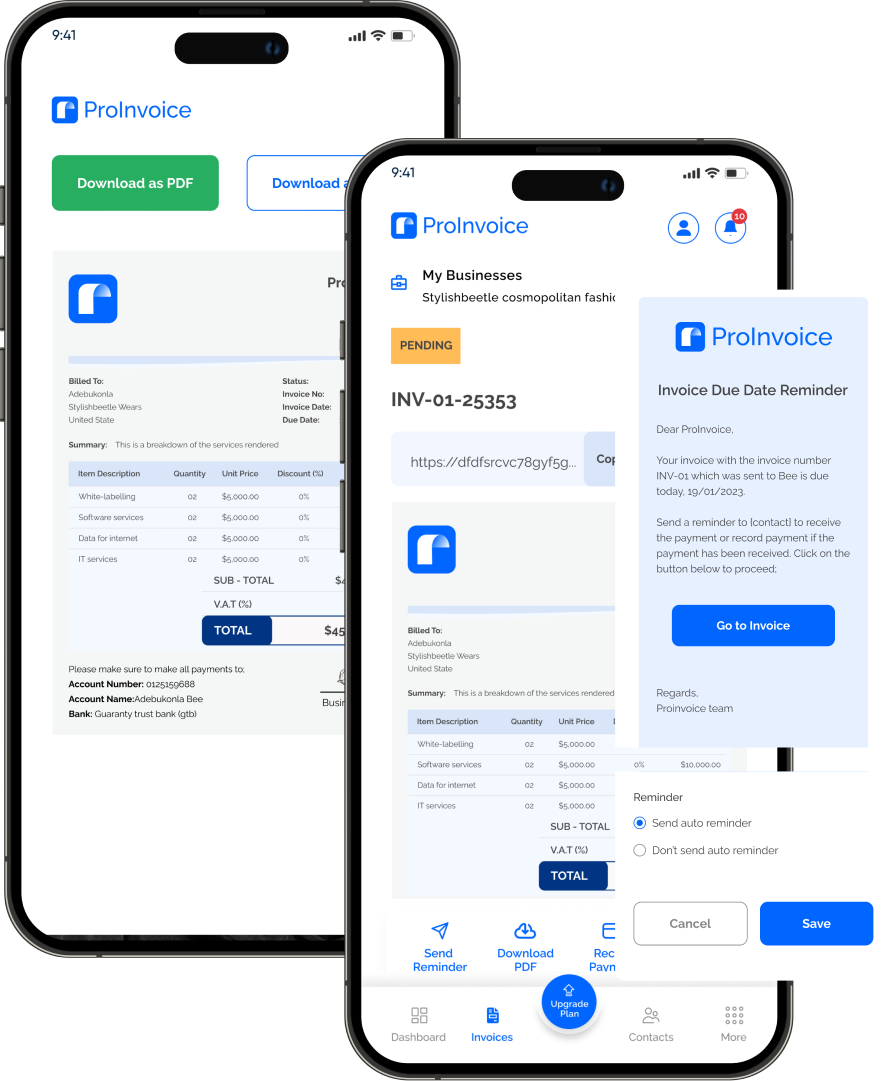

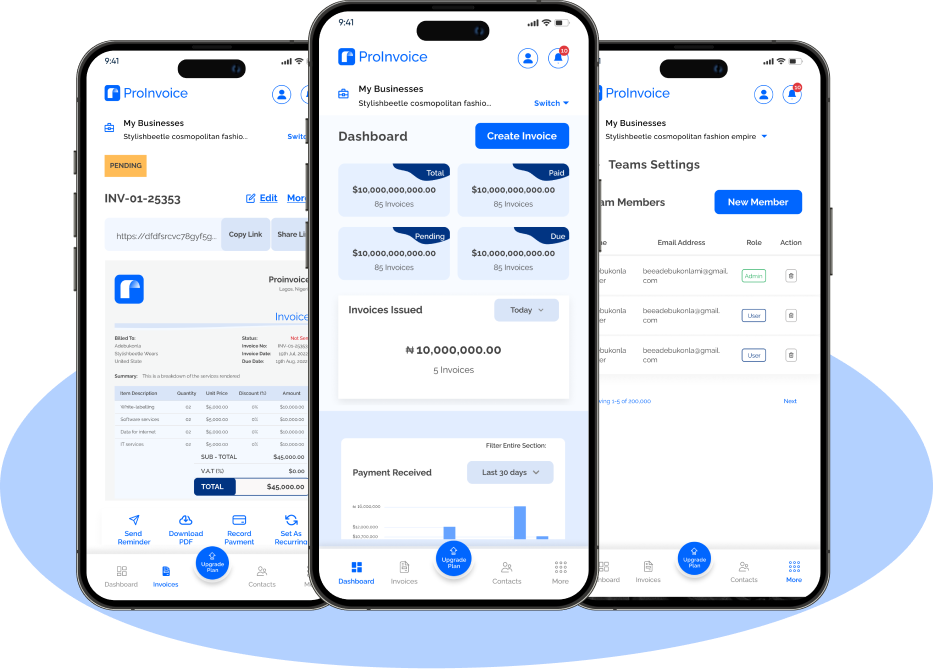

Bonus Tip: Make Your Business More Organized with ProInvoice

From creating professional invoices to tracking sales and payments, ProInvoice helps Nigerian businesses grow with ease.