Sending your first invoice is a significant milestone in your professional journey, marking the initiation of your invoicing experience.

It is a pivotal moment that signifies the start of monetizing your skills and services.

However, before you hit that send button and eagerly await payment for your first invoice, there are several important factors you should be aware of.

Understanding these key aspects will not only help you establish a solid foundation for your financial transactions but also ensure a seamless invoicing process.

In this article, we will explore four essential things to know before sending your first invoice, providing valuable insights and practical tips to optimize your invoicing experience.

4 Essential things to know before sending your first invoice

1. Invoice and receipt are not the same

An Invoice and A receipt may seem like similar things– after all, they are both related to payments – but as a business owner, there are a couple of crucial distinctions that you need to understand.

First, an invoice is a demand for payment (either electronically or physically) the seller sends after the sale of goods/services has been completed but before payment has been made.

As shocking as this may seem, an invoice is, therefore, NOT a proof of purchase- although invoices may be used as proof of having requested goods/services or to show outstanding formal agreements between a buyer and a seller, THEY DO NOT PROVIDE PROOF THAT A SERVICE HAS BEEN PAID FOR.

In fact, unpaid invoices are a significant problem, like many SMEs throughout the UK experiencing issues with late payments.

Conversely, a receipt is proof of transaction provided to customers after they’ve paid for goods or services.

Although receipts include information about the goods/services that were sold, including quantity, price, and discounts, and probably details of the payment method used in the transaction, it is important to note that there’s no specific legal standard for what to include on a receipt.

This therefore indicates that it could be a simple, handwritten note stating the amount that has been paid.

Asides from all the above, guess what? There is something called a “paid invoice.” After an invoice has been paid, it is usually referred to as “settled,” the same way that one would settle a bill.

However, it may simply be referred to as a “paid invoice.” In this sense, a settled invoice occupies a similar role as a receipt, confirming that payment was received for goods and services.

Since most receipts are relatively basic, it’s best to keep both the receipt and the settled invoice.

2. Do you invoice first or get paid first?- Question Answered

From the introduction, it has been established that an invoice is usually sent after a vendor (or supplier) has completed a customer’s order (read more on rules of invoicing here).

The order could be for products, services, or both. Hence, since an invoice is like a payment request, INVOICES COME FIRST.

Any document after payment is either a paid invoice or a receipt

Invoice is sent → Customer receives it as a bill → Payment is made → Receipt

For a business providing a product, an invoice will usually be generated shortly after delivery.

However, in a service-oriented business, the invoice is generated after that service has been provided.

For best practices in service-based industries, it also would be great for the business to follow up with the client first and to ensure the customer is satisfied.

Let’s give an example:

Henry’s Solar Company has been contracted to not only put fittings into a newly built guest house but also to correct some electricity-based building defects.

After the technician finishes the order, he should check with Clifford (the client). If Clifford is thrilled with the job, Henry returns to his home office and consults with his supervisor, who then informs the accounting department that their work has been completed and they should send Clifford an invoice so payments can be made.

On the other hand, suppose the technician did not check in with Clifford for feedback and is unhappy with the work; an invoice would have been received for an unsatisfactory job.

Some time has also been lost here as management must now get involved. Maybe a discount is offered, but that means the invoice must now be modified and reissued, delaying payments to Henry’s Plumbing by a month.

3. Delayed Invoices? You might be doing it wrongly

Depending on the type of services you provide and your relationships with your clients, you can send an invoice immediately, after a few days, or even a month!

Thus, we would explain the best times to send invoices for different situations and when you should adjust your invoicing strategy.

a. Send a monthly invoice

Monthly invoices are ideal when you have clients with multiple visits per month. Sending monthly invoices reduces your paperwork throughout the month and can help you get paid more consistently.

Many home service providers send monthly invoices for recurring jobs, including lawn care, house cleaning, tree care, and pool service businesses. Here are the best ways to send monthly invoices to your clients:

- Schedule a day or week for monthly invoicing.Send each client an invoice right after you’ve finished their last job of the month. Or, use the last week of the month to issue all your client’s invoices simultaneously.

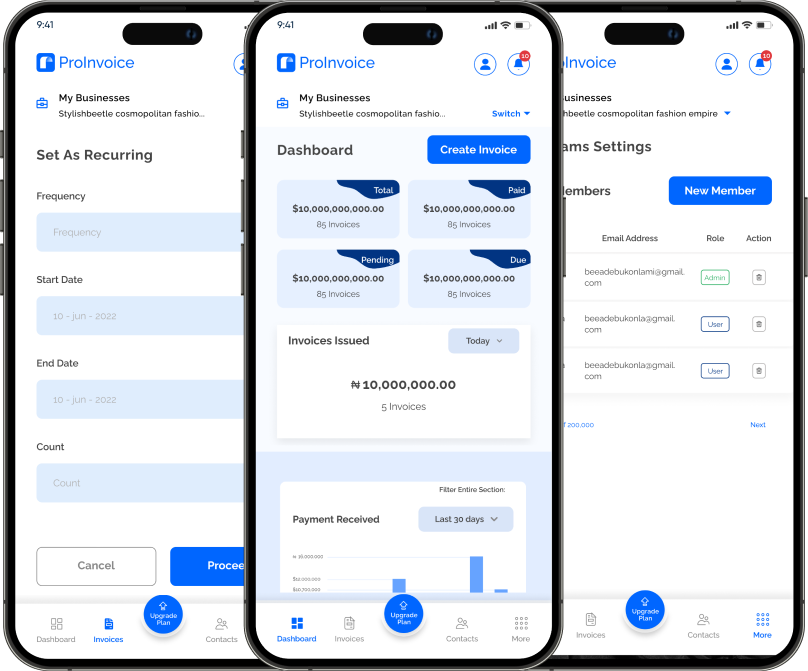

- Convert your completed jobs into invoices at the end of the month using invoicing software. In Jobber, you can generate an invoice with a fixed price for the entire month’s work. Then you can email or text that monthly invoice to your client.

b. Send the invoice within 48 hours of finishing the job

Sending your invoice 48 hours after the job gives you time to ask if the client needs any extra work or rework before you ask them to pay.

When you confirm client satisfaction before sending an invoice, you can avoid disputes, prevent overdue payments, and inspire trust in your business like our Solar guy, Henry.

Invoicing within 48 hours is also good for jobs requiring more extended and complex invoices, such as large-scale landscaping, lawn fertilization, and window cleaning.

Hence, you can use this time to write an accurate, professional invoice if you do not have the time before the job ends. Here is how to go about an invoice to your client within 48 hours of finishing the job:

- Follow up after the job. Follow-up email after you leave the job site to ask if your client is happy with your work. If the client isn’t satisfied, call them to find out what you can do to make it right.

- Email or text your invoice within 48 hours after the client confirms they’re happy with your work. Include a payment due date on your invoice that gives your client 15–30 days to pay.

- Offer online payment options for promptness. Give clients an option to pay online directly from the text or email you used to send the invoice. Mind-blowingly, some invoicing platforms automatically create a link your clients can use to view and pay their invoices. WOW RIGHT?

c. Invoice customers on the spot

Although for most one-off jobs, you can issue an invoice at the job site right after your work.

Invoicing on the spot can get you paid faster and help your business stay profitable.

For example, handyman businesses invoice clients on the spot because their clients are often on-site during the job. Here is how to prepare before invoicing customers on the spot:

- Explain your payment terms before starting the job. Before a client approves your quote, let the client know that you expect payment immediately after you complete your service. Include payment terms on the quote that state your preferred payment methods and any late payment fees.

- Have a professional invoice ready in advance. You can send an invoice faster when you create it before the job is done. To save time, use an invoice template that you can quickly fill in with your job and client details.

- Offer multiple payment methods. Clients will pay you faster when it is easy to make payments. Accept payment by credit card or online to help clients pay you on the spot when they do not have cash or checks on hand.

4. How to Follow up after sending your first Invoice

Often many companies fail to follow up on their invoices long after they should have been paid.

Not following up promptly can be frustrating for the client, even if it is the client’s fault for not paying because the client may have closed the project or is now on a budget for a new fiscal year.

If payment for an invoice is late, do not immediately assume that the invoice is lost. Instead, try the following follow-up methods first:

Send an Email

Send a polite email to the client, and attach the original invoice. Ask for a ‘status update’ when the client has a few minutes to look into it.

Unless payment is urgent (for instance, if the amount is large and you have vendors awaiting their checks), then do not mark it as urgent.

You do not want to affect the possibility of future work.

Try A Phone Call

Phone calls are always friendly because they are so rare these days and add a personal touch. Have the invoice in front of you to reference the number and amount.

The client will appreciate that, as he won’t have to find the invoice himself.