In South Africa, invoicing isn’t just a formality—it’s a legal necessity and a benchmark for professionalism. Whether you’re delivering goods, offering services, or closing a sale, your invoice should be clear, compliant, and timely. Using tools like ProInvoice ensures that your invoicing is not only easy and efficient but also fully compliant with South African standards.

This article walks you through everything you must include in your invoice, explains the differences between full and abridged versions, and shows how ProInvoice makes it effortless.

Essential Components of a South African Invoice

1. Invoice Title

Your document must clearly display the term “Invoice”, “Tax Invoice”, or “VAT Invoice”. This clarity is crucial for proper classification.

2. Supplier Details (Your Business)

Include your:

- Legal business name

- Physical address

- VAT registration number (if applicable)

3. Recipient Details

- If the recipient is also VAT-registered and the invoice value is significant, include their name, address, and VAT number.

4. Invoice Number & Issue Date

Each invoice must have a unique serial number and a clear date of issue to maintain order and aid in tracking.

5. Description of Goods or Services

Provide a detailed yet concise description of what you’re invoicing for. If applicable, specify if any goods are second-hand.

6. Quantity or Volume

Ideally, list the quantity or volume of goods or services supplied—though this may be omitted in certain abridged invoices.

7. Breakdown of Amounts

Include:

- The price excluding VAT

- VAT amount charged

- Total consideration (price plus VAT)

Full vs. Abridged Invoices in South Africa

| Invoice Type | When It Applies | Required Information |

|---|---|---|

| Full Tax Invoice | Supply value over R5,000 | All details listed above (+ recipient info if needed) |

| Abridged Invoice | Supply value between R50 and R5,000 | Title, supplier info, invoice number, date, description, values & VAT |

| Receipt/Docket | Supply value R50 or less | Till slip or similar as proof (VAT not mandatory) |

ProInvoice automatically selects the correct format based on value and ensures all required elements are included—no guesswork needed.

Why Accurate Invoicing Matters

- Legal Compliance: Only a compliant invoice lets VAT-registered businesses claim input tax deductions.

- Payment Efficiency: Clear invoices reduce payment delays and disputes.

- Audit Readiness: Proper records help you stay prepared for any tax inspection.

- Professional Image: Well-crafted invoices reflect a well-run business.

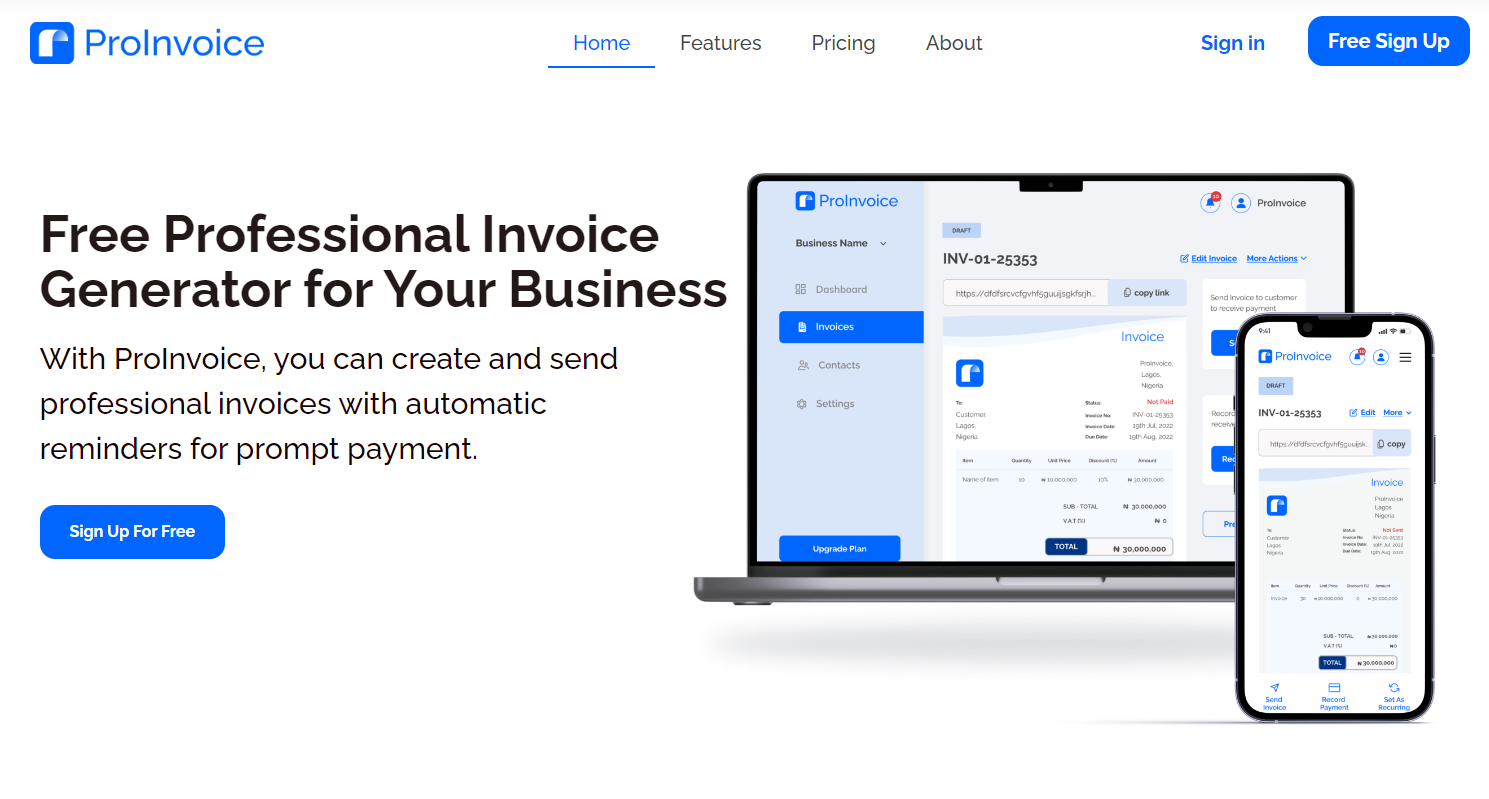

How ProInvoice Simplifies Invoicing

- Prebuilt, compliant templates: Automatically includes all mandatory fields.

- Smart invoice type selection: Full or abridged handled based on the amount.

- Immediate issue and storage: Create, send, and archive in one interface.

- Effortless audit trail: Digital records that are easy to find and manage.

Final Thoughts

Writing an invoice in South Africa should be straightforward—provided it includes all the right information. Whether you need a full tax invoice for large sales or just a receipt for small transactions, accuracy is key.

Simplify the process with ProInvoice—a tool that ensures compliance, professionalism, and peace of mind.

Ready to upgrade your invoicing game? Sign up now for ProInvoice to create compliant, professional invoices with ease.