Owning a business and being your boss can be exciting, but sometimes overwhelming. As a business owner, one of the things that causes anxiety is keeping a good record of your business finances.

As a business owner, most times you are faced with so many records that you end up wondering what sort of records you need to keep – and how long you need to keep them for.

In this article, we will discuss

- What type of record do you need to keep as a business owner?

- importance of keeping good records

- The Dangers of not keeping an adequate business record

Let’s dive in

Keeping good records for your small business might not seem exciting, but it’s an important activity you need to constantly do if you want to build a successful business. Here are a few reasons why you should keep good records for your business.

- Peace of mind: Nothing beats knowing that your finances are organized and readily accessible. \As a business owner, it reduces stress and allows you to focus on growing your business.

- Help You make Informed decisions: By analyzing your income and expenses, you can make better data-driven decisions about future investments, marketing strategies, and staffing needs

- Financial tracking and budgeting: Keeping records helps you understand your cash flow, identify areas for improvement, and create realistic budgets for future endeavors.

- Proof of business ownership: In cases of legal disputes or loan applications, well-maintained records act as proof of your business’s legitimacy and financial health.

Let’s answer what type of record you need to keep as a business owner.

Types of records you need to keep as a business owner.

Here’s a breakdown of the essential records every small business owner should keep:

1. Income and Sales Records:

- Invoices: Keep copies of all invoices you send to customers, whether physical or digital invoices. This is important because it helps document your income and serves as proof of sales.

- Bank Statements: Your bank statement shows your business’s deposits and withdrawals, providing a clear picture of your business’s cash flow.

- Sales Receipts: Hold onto receipts for any cash sales you make.

2. Expense Records:

- Receipts: Keep receipts for all your business expenses, from office supplies to marketing costs. These are important for tax deductions and tracking your business spending.

- Bank Statements (again!): They not only show income but also show all your outgoing expenses.

- Mileage Logs: If you use your vehicle for business purposes, keep track of the miles driven and the purpose of each trip.

3. Business Formation and Legal Documents:

- Business Registration Documents: Keep copies of your business license, permits, and any other relevant legal documents.

- Contracts and Agreements: Hold onto signed contracts with vendors, suppliers, and clients for future reference.

- Tax Returns: Once you file your tax returns, keep copies for your records.

4. Employee Records (if applicable):

- Payroll Records: Maintain records of employee wages, taxes withheld, and benefits provided.

- Timesheets track employee hours worked, which is crucial for payroll and productivity monitoring.

- Employee Contracts: Keep copies of signed employment contracts with your staff.

- Save money: Proper records help you avoid mistakes on your tax return, which can save you from costly fines and penalties.

- Make smarter choices: By understanding your income and expenses, you can make informed decisions about your business, like where to invest your money or how to cut costs.

- Stay on the right side of the law: It’s required by law to keep accurate business records for a certain amount of time. because failing to do so can lead to trouble with the authorities.

Effect of Bad Record-Keeping

Failing to keep accurate records can have several negative consequences for your business, some of which are

- Poor financial decision-making: Without reliable data, you’re essentially working based on assumptions, making it difficult to make informed decisions about your business’s future.

- Difficulty securing funding: Business investors often require financial statements and other documentation to assess the viability of your business. This means a lack of records can hinder your ability to secure funding for growth or expansion.

- Legal issues: In cases of legal disputes, the absence of proper records can weaken your position and make it difficult to defend yourself.

Conclusion

As stated earlier, as a business owner, managing all these records can be overwhelming, but there are ways to make it easy for you to keep track of these records, especially your income and sales records.

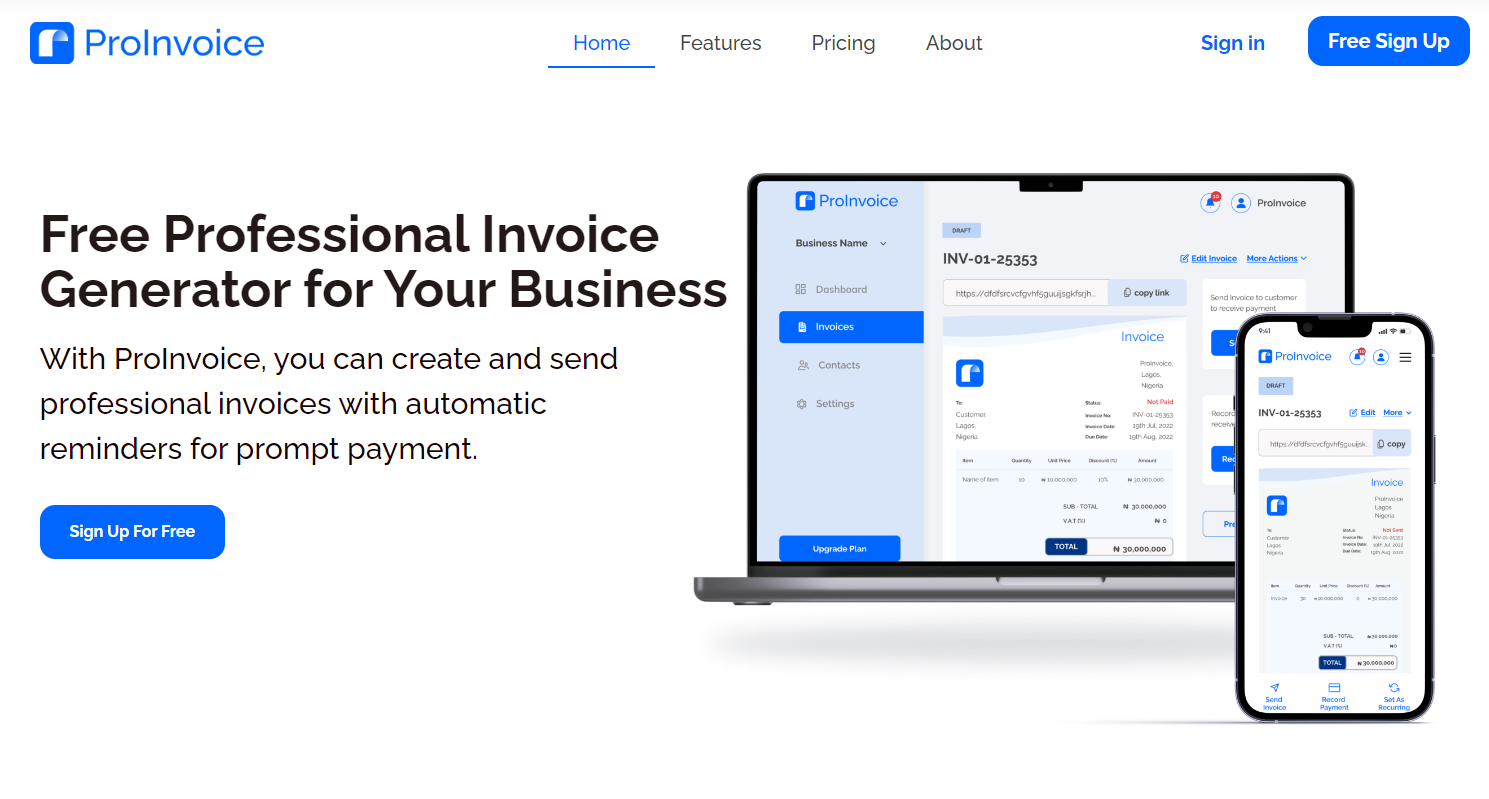

Imagine being able to create and send invoices digitally in a few minutes, and also track invoice status (paid and unpaid), send payment reminders, and accept online payments.

With Proinvoice, you can do all these things, and even more, you can get started for free.

By keeping good records and utilizing tools like ProInvoice.co, you can free yourself from the tedious tasks of record management and focus on what truly matters: growing your amazing small business!