How to Break the Cycle of Late Invoice Payments: Late payments are one of the most frustrating challenges facing small businesses today. When clients consistently pay after the due date, it creates a domino effect that can cripple your cash flow, strain vendor relationships, and make it difficult to cover operational expenses. According to recent studies, small businesses are owed an average of $84,000 in late payments at any given time, with some waiting 60 days or more to receive payment for completed work.

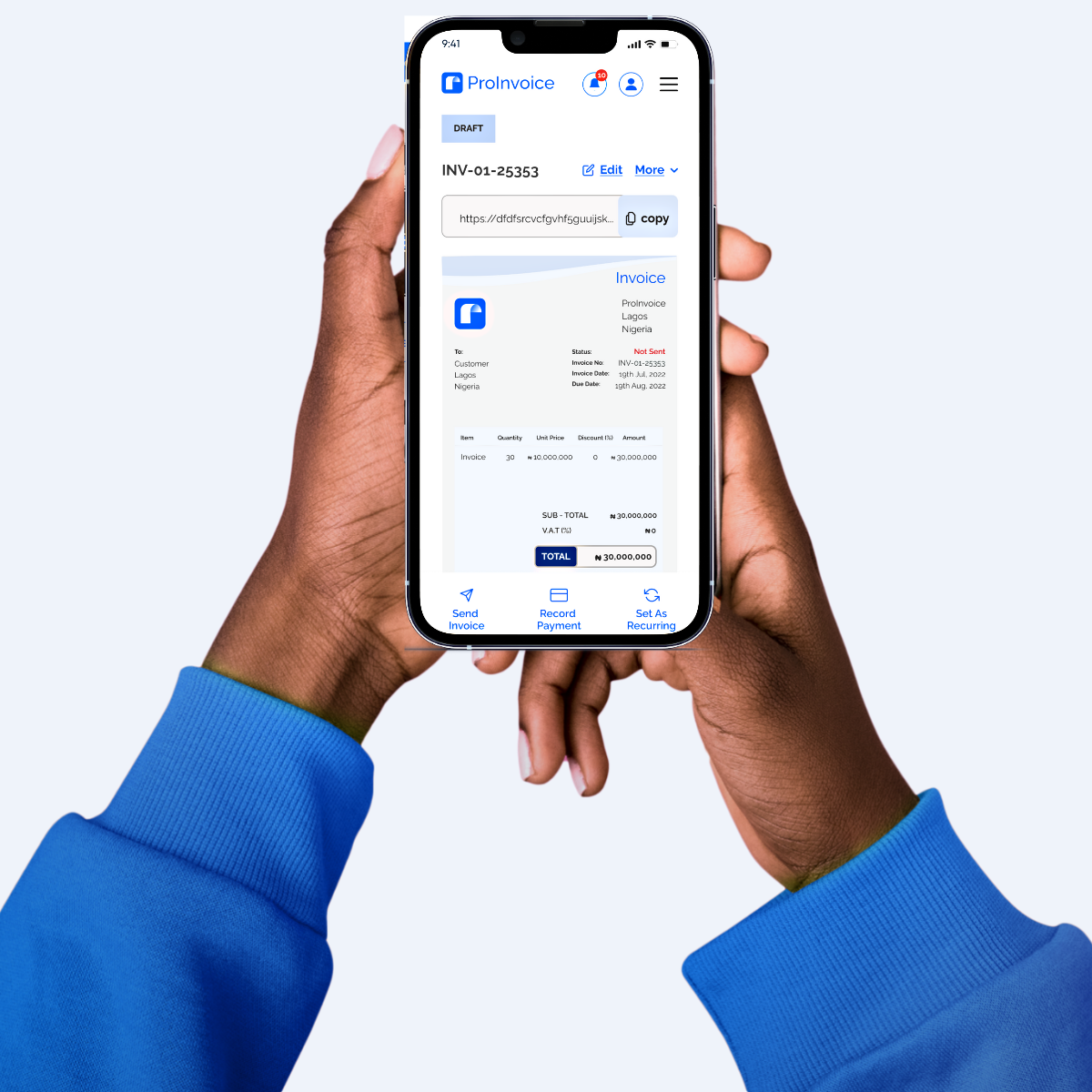

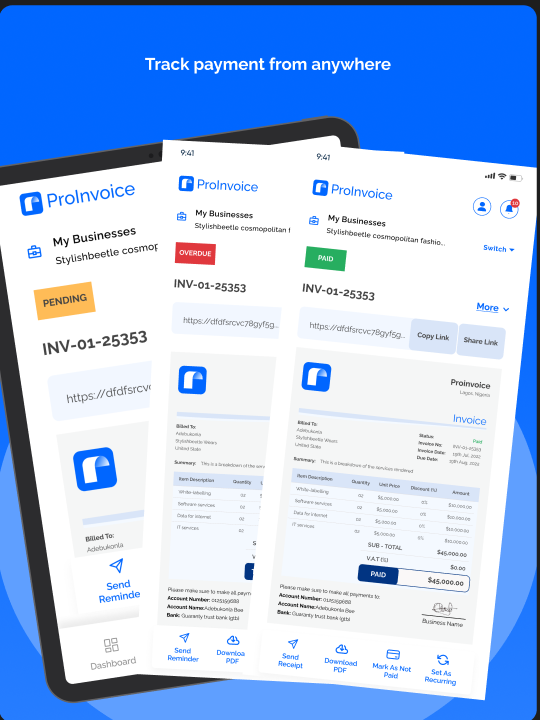

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

The good news is that breaking the cycle of late payments isn’t impossible. With the right strategies, systems, and tools in place, you can transform your payment collection process and ensure steady cash flow for your business.

Understanding Why Clients Pay Late

Before implementing solutions, it’s important to understand why late payments happen in the first place. Common reasons include:

Disorganization and forgetfulness. Many clients simply forget about invoices amid their busy schedules. Without proper reminders or automated systems, your invoice can easily get buried in their inbox.

Unclear payment terms. If your invoice doesn’t clearly state when payment is due, what methods you accept, or what happens in case of late payment, clients may not feel urgency to pay promptly.

Cash flow issues on their end. Sometimes your clients are also waiting on payments from their own customers, creating a chain reaction of delays.

Disputes or dissatisfaction. If a client is unhappy with the work or has questions about the invoice, they may delay payment until the issue is resolved.

Taking advantage of flexibility. Some clients simply pay late because there are no consequences. If you’ve established a pattern of accepting late payments without penalties, they’ll continue the behavior.

Set Clear Payment Terms From the Start

The foundation of getting paid on time begins before you even start the work. Establish clear payment terms in your contracts and communicate them explicitly to every client.

Your payment terms should specify the due date (net 15, net 30, etc.), accepted payment methods, late payment fees, and any early payment discounts you offer. Don’t leave room for ambiguity. For example, instead of saying “payment due upon completion,” specify “payment due within 15 days of invoice date.”

Consider requiring deposits or milestone payments for larger projects. This not only protects your cash flow but also ensures the client is committed to the project. A standard approach is requesting 25-50% upfront, with the remainder due upon completion.

For recurring clients, establish a consistent billing schedule so they know exactly when to expect invoices and when payments are due. Consistency builds routine, and routine leads to timely payments.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

Create Professional, Detailed Invoices

Your invoice is more than just a bill—it’s a professional document that reflects your business standards. A well-designed, detailed invoice is more likely to be paid promptly than a hastily thrown together one.

Every invoice should include your business name and contact information, client details, a unique invoice number, invoice date and due date, itemized list of products or services with descriptions and amounts, subtotal and total amount due, payment methods accepted, and payment terms including any late fees.

Using a free invoice generator can help you create professional invoices quickly and consistently. These tools ensure you never miss important details and help establish your business as organized and credible.

Consider including a personal note thanking the client for their business. This small touch humanizes the transaction and can encourage faster payment. You might also include a direct link or QR code for easy payment, removing friction from the payment process.

Send Invoices Immediately

Timing matters when it comes to getting paid. The longer you wait to send an invoice after completing work, the longer you’ll wait to receive payment. Make it a habit to send invoices within 24 hours of project completion or according to your agreed-upon schedule.

When you delay invoicing, several things happen. First, the work becomes less fresh in the client’s mind, making them more likely to question details or forget about it entirely. Second, you’re essentially providing an interest-free loan to your client—money that should be working for your business. Third, you’re sending a message that prompt payment isn’t important to you, which encourages future delays.

Automate your invoicing process whenever possible. Register for an invoicing platform that allows you to set up recurring invoices, schedule invoice delivery, and automate payment reminders. This removes the manual burden and ensures invoices go out consistently and on time.

Implement a Strategic Follow-Up System

Even with perfect invoices and clear terms, some clients will need reminders. Rather than viewing follow-ups as awkward or confrontational, treat them as a standard business practice.

Create a systematic follow-up schedule that includes a friendly reminder three to five days before the due date, a polite notice on the due date if payment hasn’t been received, a firmer reminder three days after the due date, and a more direct communication seven to ten days after the due date.

Your initial reminders should be friendly and assume positive intent. Use phrases like “This is a friendly reminder that invoice #123 is due on March 15th. Please let me know if you have any questions or need the invoice resent.”

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

As payments become more overdue, your tone should become firmer while remaining professional. After 30 days, you might say, “Invoice #123 is now 30 days overdue. Please remit payment immediately to avoid late fees and potential suspension of services.”

Automated reminder systems can handle this process for you, sending pre-written emails at specified intervals. This ensures no invoice falls through the cracks and removes the emotional burden of chasing payments.

Offer Multiple Payment Options

One simple reason clients pay late is that you don’t accept their preferred payment method. The more payment options you offer, the easier you make it for clients to pay promptly.

Consider accepting bank transfers, credit and debit cards, digital wallets like PayPal or Venmo, ACH payments, and even checks if appropriate for your industry. While you may incur small processing fees for some methods, getting paid faster is worth the cost.

Modern invoicing solutions often integrate with multiple payment processors, allowing clients to pay directly from the invoice with just a few clicks. This dramatically reduces payment friction and improves collection rates. A mobile invoicing app allows you to manage payments and send invoices from anywhere, ensuring you never miss an opportunity to bill promptly.

Incentivize Early Payment and Penalize Late Payment

Human behavior responds to incentives. Consider offering a small discount (1-2%) for invoices paid within a certain timeframe, such as within 5 or 10 days of invoice date. While this reduces your revenue slightly, the improved cash flow and reduced collection efforts often make it worthwhile.

Conversely, implement late payment fees clearly stated in your terms. A typical structure is 1.5% per month (18% annually) on overdue balances. Make sure these terms are included in your original contract and clearly stated on every invoice.

The key is consistency. If you establish late fees but never enforce them, clients will learn they’re meaningless. However, when clients know there are real consequences for late payment, they’re more likely to prioritize your invoices.

For valued clients who occasionally miss a deadline, you might waive the first late fee as a courtesy while reminding them of the policy. This maintains goodwill while still reinforcing the importance of timely payment.

Build Strong Client Relationships

Interestingly, clients are more likely to pay vendors they have strong relationships with promptly. When you’re just another faceless invoice in their inbox, it’s easy to delay payment. When you’re a trusted partner they value, payment becomes a priority.

Maintain regular communication beyond just invoicing. Check in on how they’re using your products or services, offer additional value through insights or advice, and show genuine interest in their business success. When problems arise, address them proactively before they become reasons to withhold payment.

Strong relationships also make payment conversations easier. Instead of formal collection letters, you can pick up the phone and have a candid conversation about the overdue invoice. Often, you’ll discover there’s a simple explanation and can work together to resolve it quickly.

Know When to Walk Away

Despite your best efforts, some clients will consistently pay late or not at all. At some point, you need to decide whether the relationship is worth maintaining.

Evaluate each chronic late payer objectively. Calculate how much time and stress their late payments cost you, consider whether their business volume justifies the hassle, and assess whether the situation is improving or getting worse. If a client repeatedly pays 60-90 days late despite your efforts, they’re essentially using your business as a free credit line.

For problematic clients, consider implementing stricter terms such as requiring prepayment or deposits, shortening payment terms, or pausing work when accounts become overdue. If the situation doesn’t improve, it may be time to part ways professionally.

Remember that refusing to work with problem clients frees up time and energy to pursue better clients who value your work and pay promptly. Not every client is worth keeping.

Conclusion

Breaking the cycle of late payments requires a combination of clear policies, professional systems, consistent follow-up, and sometimes difficult conversations. The key is treating payment collection as a core business process, not an afterthought.

By implementing the strategies outlined in this article—from setting clear terms and creating professional invoices to automating reminders and offering multiple payment options—you can dramatically improve your collection rates and cash flow. The investment in proper invoicing systems and processes pays for itself many times over through faster payments, reduced stress, and improved financial stability.

Remember that getting paid on time isn’t just about your bottom line—it’s about respecting your own business and the value you provide to clients. When you establish and maintain high payment standards, you attract better clients and build a more sustainable business for the long term.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!