Every business owner understands that getting paid on time is vital to keeping operations running smoothly. Yet, many companies — especially small and growing ones — lose control of their cash flow simply because they don’t effectively monitor unpaid invoices.

Whether you’re a freelancer in Nairobi or a startup founder in Accra, unpaid invoices can quickly pile up, disrupt cash flow, and strain client relationships. The solution? Using a smart invoicing tool like ProInvoice that helps you track, manage, and follow up on unpaid invoices automatically.

Let’s explore how monitoring unpaid invoices can transform your financial management and how ProInvoice makes the process seamless for Kenyan and Ghanaian businesses.

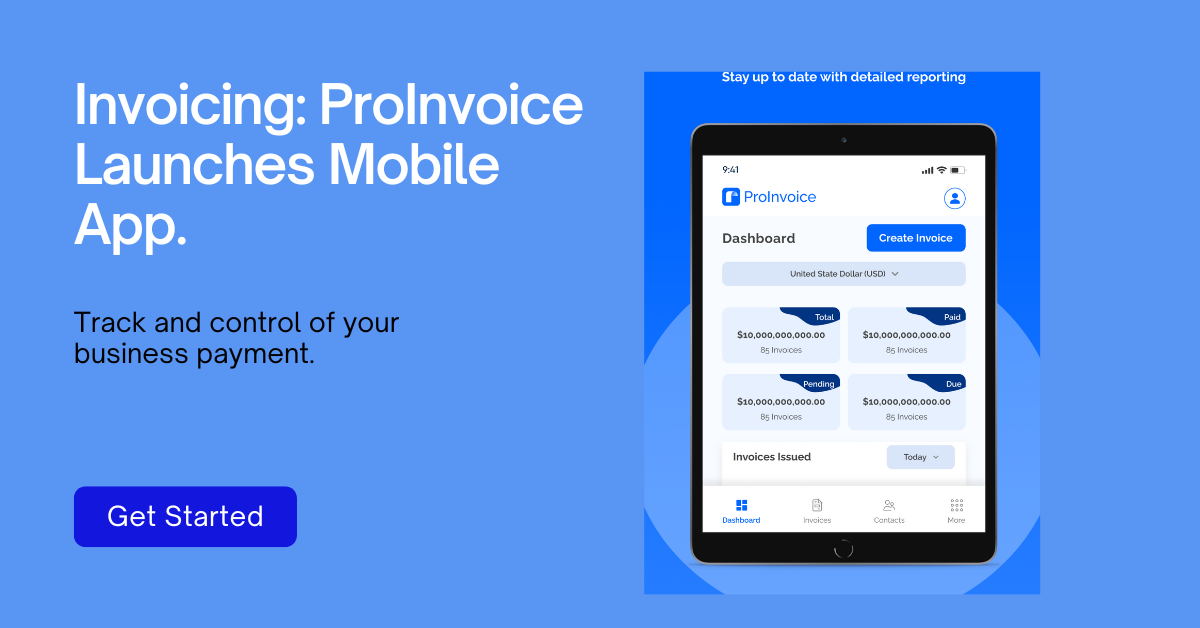

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

What Does It Mean to Monitor Unpaid Invoices?

To monitor unpaid invoices means keeping track of every bill sent to clients that hasn’t yet been paid. It involves identifying:

- Which clients owe money

- How long payments have been pending

- Which invoices are close to their due dates

Instead of checking spreadsheets or going through old emails, a proper invoice management system gives you a dashboard that shows payment statuses in real time. That’s where ProInvoice steps in — providing a smart and automated way to manage all your unpaid invoices in one place.

The Impact of Unpaid Invoices on Businesses in Kenya and Ghana

In both Kenya and Ghana, delayed or unpaid invoices can create serious financial bottlenecks. Many SMEs depend on steady cash inflow to cover expenses like rent, salaries, and inventory. When payments are delayed:

- Cash flow weakens, making it hard to meet obligations.

- Growth plans stall, as businesses lack liquidity for expansion.

- Relationships strain, because constant reminders can create tension with clients.

By using an efficient invoicing solution like ProInvoice, businesses can automatically monitor unpaid invoices, reduce delays, and build stronger client relationships through professionalism and consistency.

Challenges Businesses Face When Tracking Unpaid Invoices

Before automation tools like ProInvoice became popular, most businesses handled invoices manually. Here are some of the biggest problems that approach creates:

1. Manual Errors and Missed Payments

Relying on spreadsheets or manual tracking often leads to oversight. A client might have paid, but you forgot to record it — or worse, you may never follow up because you forgot an invoice was due.

2. Lack of Centralized Tracking

Without a single view of all pending invoices, it’s difficult to see how much is owed or which clients are frequently late.

3. Poor Communication with Clients

Sometimes, clients delay payment simply because they didn’t receive a reminder or the invoice was buried in their inbox.

4. Time-Consuming Follow-Ups

Chasing payments manually takes hours that could be better spent growing your business.

How to Effectively Monitor Unpaid Invoices

Monitoring unpaid invoices doesn’t have to be stressful. Here’s how to do it efficiently — especially when using ProInvoice:

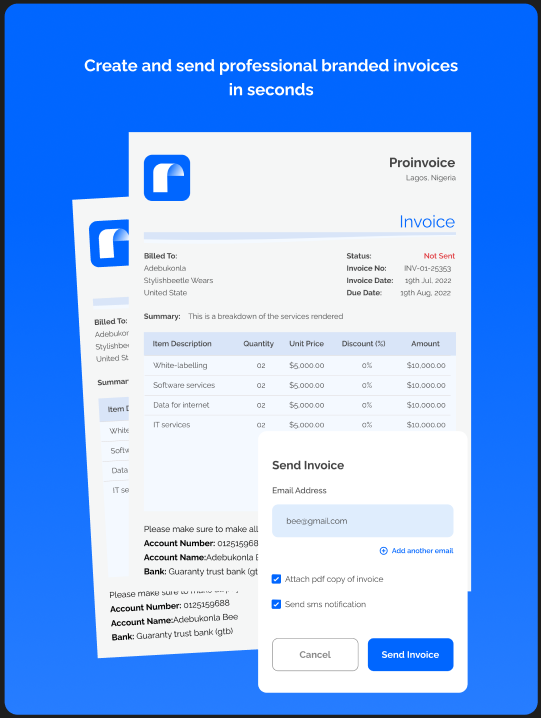

1. Use an Automated Invoicing System

With ProInvoice, you can create and send professional invoices, track their status, and get notified when clients view or pay them. Automation eliminates the guesswork and keeps your records organized.

2. Set Up Payment Reminders

Late payments often happen because clients forget. ProInvoice lets you set automatic reminders that notify clients before or after an invoice is due — saving you from awkward follow-ups.

3. Categorize and Filter Invoices

Filter invoices by paid, unpaid, or overdue so you can focus on what needs attention. This makes it easier to monitor unpaid invoices at a glance and take action quickly.

4. Review Your Dashboard Regularly

Your Invoice Dashboard in ProInvoice provides real-time insights. You’ll always know how much money is outstanding and from whom.

5. Encourage Early or On-Time Payments

You can add clear payment terms and incentives (like small discounts for early payments) to encourage clients to pay promptly.

Benefits of Monitoring Unpaid Invoices with ProInvoice

1. Real-Time Visibility

The moment an invoice is created or viewed, ProInvoice updates your dashboard instantly. You’ll always know which invoices are unpaid and how much revenue is pending.

2. Automatic Notifications

ProInvoice automatically sends reminders to clients about unpaid invoices, ensuring consistent communication without manual effort.

3. Organized Record Keeping

Forget about scattered documents. Every invoice, whether paid or unpaid, is securely stored in your ProInvoice account.

4. Time Savings

Instead of spending hours chasing payments, you can focus on growing your business. ProInvoice automates tracking, follow-ups, and even recurring billing.

5. Mobile Access

With the ProInvoice mobile app, you can monitor unpaid invoices anytime, anywhere — whether you’re in a meeting in Nairobi or working remotely in Kumasi.

Why Kenyan and Ghanaian Businesses Love ProInvoice

ProInvoice is more than just invoicing software — it’s a complete financial tool built for African businesses.

Here’s why it’s a perfect fit for companies in Kenya and Ghana:

Localized Currency Support

ProInvoice supports multiple currencies, including Kenyan Shillings (KES) and Ghanaian Cedis (GHS), making transactions simple for local and regional clients.

Professional Branding

You can customize invoices with your logo, business name, and colors, giving your brand a professional look that builds client trust.

Offline and Online Flexibility

Even with unstable internet connections, you can draft invoices offline and send them when connected — perfect for regions with spotty connectivity.

Automated Insights

ProInvoice provides visual summaries and analytics showing who pays on time, who delays, and how much money is outstanding. This helps you plan your finances better.

Common Mistakes to Avoid When Tracking Unpaid Invoices

Even with great tools, many businesses still make avoidable errors. Here’s what to watch out for:

- Not setting clear payment terms – Always specify your payment due dates and penalties for delays.

- Ignoring reminders – Follow-up reminders are crucial; automation makes it easier to stay consistent.

- Mixing personal and business accounts – Keep business payments separate for clarity and accounting accuracy.

- Failing to review reports – Regularly check your dashboard and reports to stay informed about overdue payments.

By avoiding these mistakes, you’ll reduce payment delays and maintain better financial discipline.

ProInvoice Features That Help You Monitor Unpaid Invoices

When using ProInvoice, you’ll find a suite of tools designed to make tracking unpaid invoices effortless:

- Invoice Status Indicators: Instantly see which invoices are Paid, Pending, or Overdue.

- Automated Follow-Ups: Never forget to send reminders again.

- Client Activity Logs: Know when your client opens or views an invoice.

- Dashboard Overview: Get a quick summary of total outstanding amounts.

- Payment History: Track how long each client typically takes to pay.

These features empower business owners to take control of their finances without extra effort.

How to Get Started with ProInvoice

Getting started is quick and simple:

- Visit ProInvoice.

- Create your free account in minutes.

- Add your clients and start creating invoices.

- Use the Invoice Dashboard to monitor unpaid invoices in real time.

- Download the ProInvoice mobile app for on-the-go access.

In no time, you’ll be running a more organized, efficient, and stress-free invoicing system.

The Future of Invoice Tracking in Kenya and Ghana

The future of business finance in Africa is digital. Companies that adopt automation and intelligent invoice tracking systems gain a major advantage over those still managing paperwork manually.

Tools like ProInvoice are not just about convenience — they represent a smarter, data-driven way to grow. By staying on top of unpaid invoices, businesses can maintain healthy cash flow, reduce losses, and focus on expansion.

Final Thoughts

Monitoring unpaid invoices doesn’t have to be overwhelming. With ProInvoice, businesses in Kenya and Ghana can easily track who owes what, send reminders automatically, and get paid faster — all while maintaining professionalism and accuracy.

Whether you’re a freelancer in Accra, a consultant in Mombasa, or a retail business in Nairobi, ProInvoice gives you the control, visibility, and automation needed to monitor unpaid invoices effectively and keep your cash flow strong.