The Ultimate Guide to Recurring Invoices for Subscription Businesses

Subscription businesses are growing rapidly across Kenya, Ghana, Nigeria, and other African markets. Whether you’re running a SaaS product, gym membership service, digital agency retainer, online learning platform, or any monthly service, recurring revenue offers stability and predictable cash flow.

However, managing repeated monthly or weekly billing manually can drain your time, cause errors, and even lead to missed payments. That’s why recurring invoices for subscription businesses have become one of the most important tools for modern SMEs and freelancers.

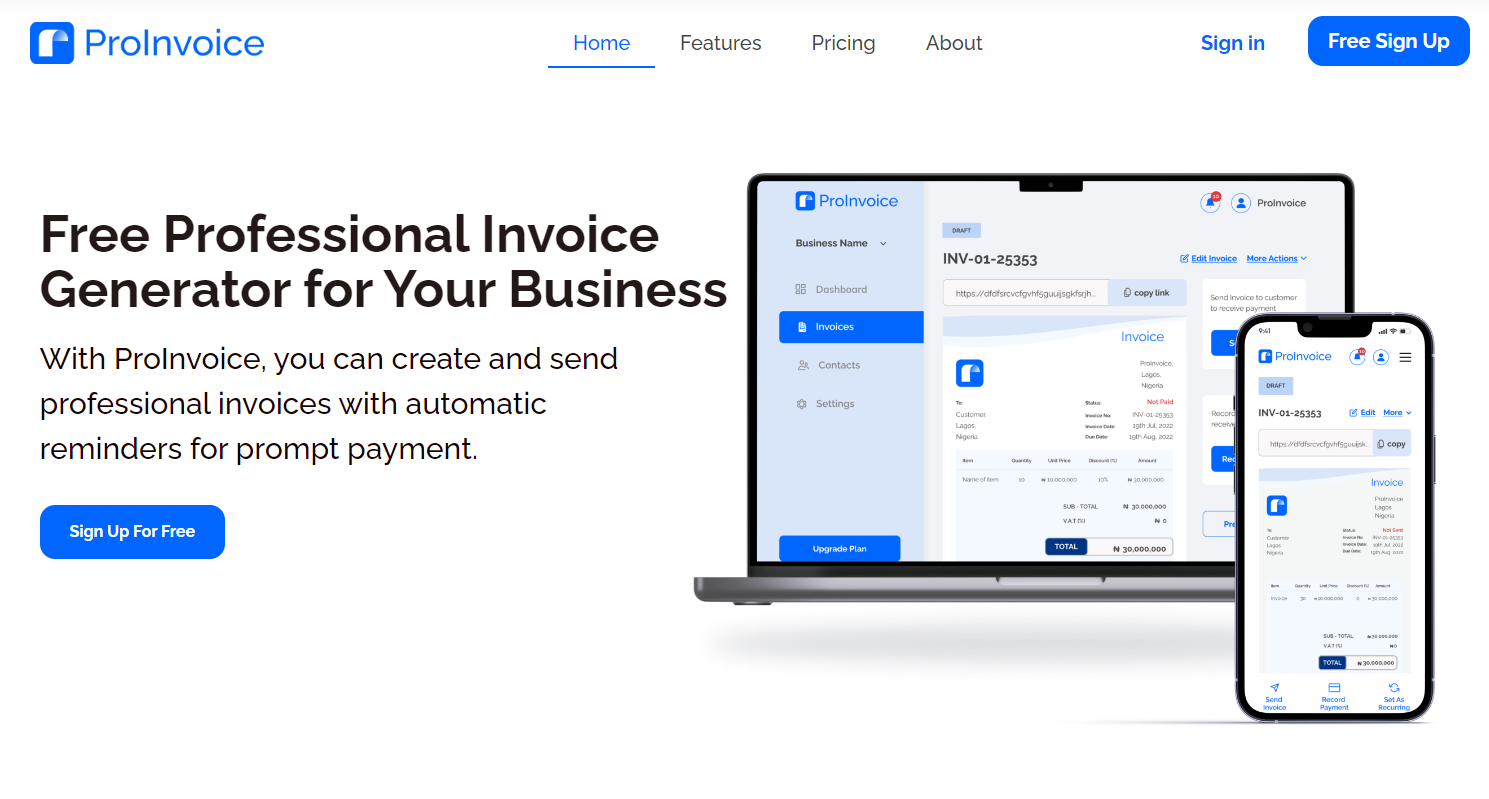

Automated invoicing platforms like ProInvoice make it easy to schedule invoices, automate reminders, track payments, and get paid faster without doing repetitive work. Subscription businesses in Kenya and Ghana, in particular, benefit from this automation because clients expect seamless billing experiences similar to global platforms.

This guide breaks down everything you need to know about setting up recurring invoices effectively.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

1. What Are Recurring Invoices?

Recurring invoices are invoices automatically generated and sent to clients on a fixed schedule—weekly, monthly, quarterly, or annually.

They help subscription businesses avoid manually creating the same invoice again and again. Instead of repeating the same process each billing cycle, a digital system handles everything.

Using a tool like ProInvoice, you can set up recurring invoices in minutes, ensuring your clients receive accurate and timely billing every cycle.

2. Why Recurring Invoices Matter for Subscription Businesses

Subscription businesses depend on predictable revenue. Recurring invoicing supports this by:

a. Ensuring consistent cash flow

Regular billing leads to steady income, making financial planning easier.

b. Saving time and reducing admin work

Instead of manually drafting invoices each month, automation handles it for you.

c. Minimizing human errors

Mistakes in pricing, dates, or calculations often cause delays. Automation eliminates these errors.

d. Improving client experience

Clients appreciate receiving organized, timely invoices.

e. Supporting fast payment cycles

Automated reminders and seamless payment options increase early payments.

With ProInvoice, all these benefits come built-in.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

3. Who Should Use Recurring Invoices?

Any business that charges clients regularly can benefit. Common examples include:

- Digital marketing agencies

- Software-as-a-service (SaaS) platforms

- Gyms, fitness coaches, and wellness centers

- Cleaning and home maintenance services

- Freelancers working on retainer packages

- Content creators with membership plans

- Tutors and e-learning platforms

- Repair and support subscription services

If your business collects fees monthly or weekly, recurring invoicing is essential.

4. Key Features of a Strong Recurring Invoicing System

To run a subscription business smoothly, your invoicing system should include:

1. Automated invoice scheduling

Set the frequency—monthly, weekly, annually—and the system handles the rest.

2. Pre-filled invoice data

Client info, pricing, tax settings, and descriptions are stored and applied automatically.

3. Automatic payment reminders

This reduces late payments significantly.

4. Multi-currency support

Essential for cross-border clients in Kenya, Ghana, and Nigeria.

5. Secure online payment options

ProInvoice uses Stripe for international payments, helping clients pay instantly.

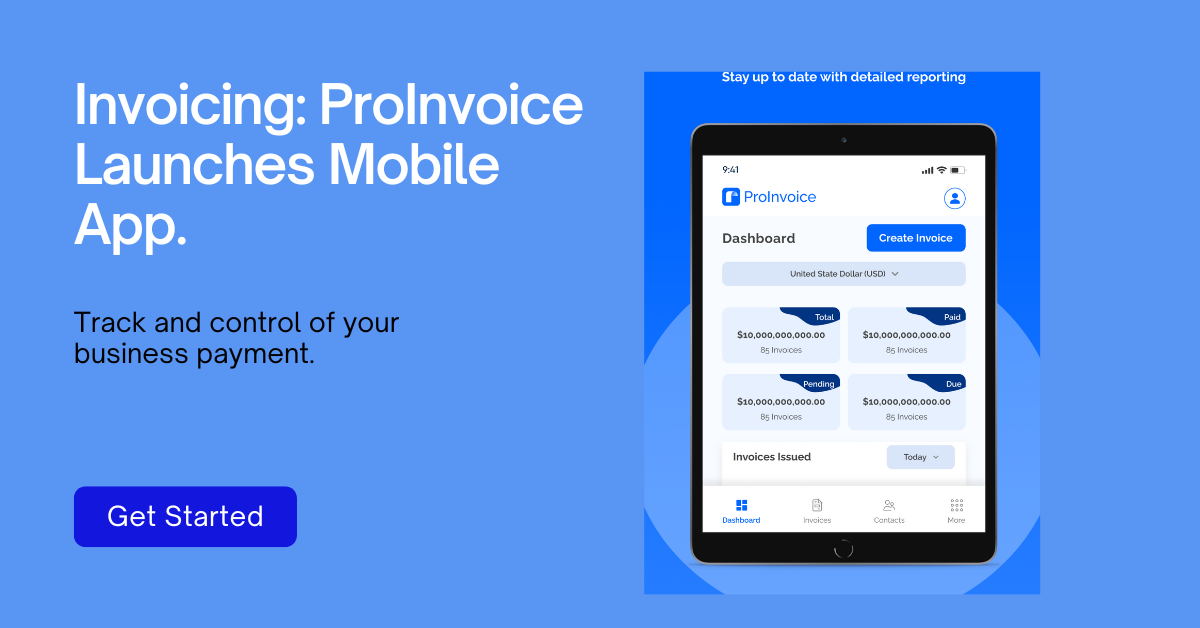

6. Mobile access

With the ProInvoice mobile app, you can manage recurring invoices from your phone.

7. Invoice tracking

Real-time updates show which invoices are paid, pending, or overdue.

These features give subscription businesses a reliable foundation for smooth billing.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

5. How to Set Up Recurring Invoices Using ProInvoice

Setting up recurring invoices with ProInvoice is straightforward. Here’s how it works:

Step 1: Create an account

Visit Sign up and register for free.

Step 2: Add your client details

Store their name, email, business info, and billing preferences.

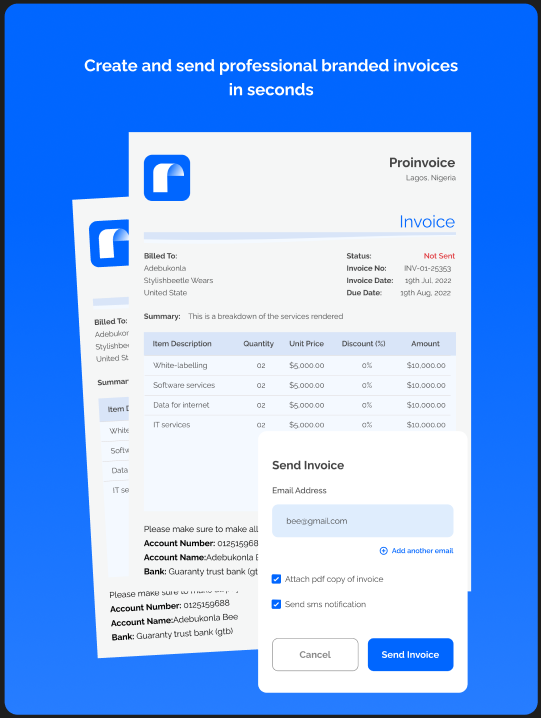

Step 3: Create your invoice

Add descriptions, pricing, VAT settings, and payment terms.

Step 4: Enable recurring billing

Choose:

- Billing frequency

- Start date

- End date (optional)

- Reminder schedule

Step 5: Activate and send

ProInvoice handles each billing cycle automatically.

Step 6: Monitor payments

Use your dashboard to track invoice status and payment activity.

All these tasks can be done via web or through the mobile app.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

6. Benefits of Recurring Invoices for Subscription Businesses

a. Reduces late payments

Clients receive invoices automatically and reminders ensure timely settlements.

b. Improves operational efficiency

You focus on delivering value, not chasing payments.

c. Boosts professionalism

Automated, branded invoices reflect reliability.

d. Increases customer retention

Smooth billing encourages customers to continue their subscriptions.

e. Eliminates repetitive work

No more copy-pasting invoices every month.

f. Supports business growth

As your subscription base grows, automation scales with you.

7. Common Mistakes Businesses Make With Recurring Invoices (and How to Avoid Them)

Mistake 1: Setting unclear payment terms

Solution: Clearly state “Payment due in 7 days” or “NET 14.”

Mistake 2: Forgetting to include VAT or local tax compliance

Solution: Use templates on ProInvoice that support VAT entries.

Mistake 3: Sending invoices late

Solution: Automation ensures invoices go out on time.

Mistake 4: Using inconsistent pricing

Solution: Lock in fixed rates inside your recurring invoice.

Mistake 5: Using manual spreadsheets or Word documents

Solution: Switch to digital invoicing for accuracy and speed.

8. Tips to Maximize the Effectiveness of Your Recurring Invoices

1. Use clear descriptions

Clients should immediately understand what they’re paying for.

2. Set friendly yet firm payment terms

Avoid vague messages like “ASAP.”

3. Use automated reminders

Gentle nudges improve payment speed without spoiling relationships.

4. Provide convenient payment options

Stripe payments on ProInvoice help international and local clients pay quickly.

5. Invoice promptly

Consistency improves your cash flow.

6. Track your analytics

Use the dashboard to understand your payment trends.

7. Keep your client records updated

Old emails cause delays.

9. Why Subscription Businesses in Kenya & Ghana Prefer ProInvoice

Businesses across Kenya and Ghana need invoicing systems built for the local environment. ProInvoice offers:

- Affordable pricing

- Fast sign-up and onboarding

- VAT-ready invoice templates

- Multiple currency support

- Automated reminders

- Secure Stripe-powered online payments

- Mobile access

Whether you’re a freelancer, SME, or subscription-based business, ProInvoice delivers everything you need to automate billing smoothly.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

10. Final Thoughts

Recurring invoices are essential for businesses that depend on subscription income. They help reduce late payments, improve cash flow, automate repetitive tasks, and create a reliable billing system for clients.

With ProInvoice, you can set up recurring invoices in minutes and let automation handle the rest. Sign up today using the Free Invoice Generator or start instantly through the mobile app.

Subscription businesses that embrace automation save time, reduce errors, and get paid faster—every month.