Digital record-keeping has become essential for modern businesses. In today’s regulatory and data-driven environment, relying on paper files or scattered spreadsheets creates unnecessary risk. More importantly, poor record management can delay audits, damage credibility, and even attract penalties.

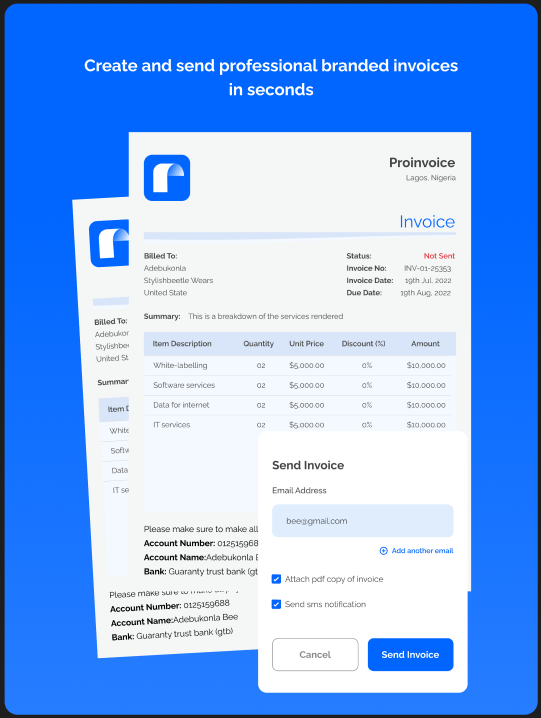

On the other hand, businesses that adopt digital record-keeping enjoy clearer financial visibility, faster audit processes, and improved transparency. With invoicing and financial tools like ProInvoice, companies can store, retrieve, and manage records accurately without stress.

This article explains why digital record-keeping matters, how it supports audits, and how it strengthens business transparency for long-term growth.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

What Is Digital Record-Keeping?

Digital record-keeping refers to storing business and financial records electronically instead of on paper. These records include invoices, receipts, payment histories, tax documents, and financial reports.

Unlike manual systems, digital records:

- Remain searchable

- Stay organized automatically

- Reduce the risk of loss or damage

- Support compliance requirements

As a result, businesses gain control over their financial data while improving accountability.

Why Audits Demand Accurate Digital Records

Audits verify the accuracy of your financial information. Therefore, missing or inconsistent records raise red flags.

Faster Audit Preparation

Auditors request documents such as invoices, receipts, and transaction histories. With digital record-keeping, businesses retrieve these files instantly.

According to Investopedia, organized digital records significantly reduce audit time and errors.

Using ProInvoice, businesses can generate invoice histories and transaction summaries in seconds.

Reduced Risk of Compliance Penalties

Manual record-keeping increases the likelihood of missing data. However, digital systems automatically log transactions and maintain consistency.

Consequently, businesses reduce the risk of:

- Tax discrepancies

- Incomplete audit trails

- Regulatory fines

Digital Record-Keeping and Business Transparency

Transparency builds trust with customers, partners, and regulators. Therefore, businesses that keep clear records appear more credible and professional.

Clear Financial Visibility

Digital records provide real-time insights into:

- Outstanding invoices

- Paid transactions

- Revenue trends

- Tax obligations

With a free invoice generator, businesses ensure all invoices follow the same format, improving clarity and traceability.

Stronger Stakeholder Confidence

Investors and partners trust businesses with transparent financial systems. In contrast, disorganized records suggest operational weakness.

According to Harvard Business Review, transparency directly improves stakeholder trust and decision-making.

How Digital Record-Keeping Supports Tax Compliance

Tax authorities require accurate documentation. Therefore, digital records simplify tax filing and reduce disputes.

Easy VAT and Tax Tracking

Digital invoicing tools automatically calculate taxes and store VAT details per transaction. As a result, businesses avoid underreporting or overreporting taxes.

Using ProInvoice, businesses can maintain clean tax records that align with regulatory requirements.

Simplified Tax Audits

During tax audits, digital records provide:

- Timestamped transactions

- Consistent invoice numbering

- Accurate totals

This structure shortens audit duration and reduces stress.

Common Problems with Manual Record-Keeping

Despite its risks, many businesses still rely on manual systems. Unfortunately, this approach creates several challenges.

Lost or Damaged Documents

Paper records degrade over time. Additionally, physical storage exposes documents to theft, fire, or water damage.

Human Errors

Manual entry increases calculation mistakes. Over time, these errors compound and distort financial reports.

Poor Scalability

As businesses grow, manual systems fail to keep up. Digital record-keeping, however, scales effortlessly.

How Digital Invoicing Strengthens Record Accuracy

Invoices form the backbone of financial records. Therefore, accurate invoicing improves overall data integrity.

Using free invoice templates ensures:

- Consistent invoice structure

- Clear payment terms

- Reliable numbering systems

As a result, businesses maintain cleaner audit trails.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

The Role of Automation in Digital Records

Automation eliminates repetitive tasks while improving accuracy.

Automated Invoice Storage

Every invoice generated through ProInvoice is stored automatically. Consequently, businesses no longer search through emails or folders.

Automated Payment Tracking

Payment status updates in real time. Therefore, financial records always reflect current information.

Digital Records and Fraud Prevention

Fraud thrives in poorly managed systems. However, digital record-keeping adds accountability.

According to ACFE, transparent record systems significantly reduce fraud risk.

Digital logs create traceability, making unauthorized changes easier to detect.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

Why SMEs Benefit Most from Digital Record-Keeping

Small and medium-sized businesses often operate with limited resources. Therefore, efficiency matters.

Digital record-keeping helps SMEs:

- Reduce administrative workload

- Prepare financial reports faster

- Respond to audits confidently

With tools like ProInvoice, SMEs gain enterprise-level organization without high costs.

Mobile Access Improves Record Availability

Modern businesses operate beyond office walls. Therefore, mobile access matters.

Using the ProInvoice mobile app, business owners can:

- Access records anywhere

- Send invoices instantly

- Review transaction history on the go

This flexibility improves responsiveness during audits and client inquiries.

Best Practices for Digital Record-Keeping

To maximize benefits:

- Store records consistently

- Back up data regularly

- Restrict access based on roles

- Review records periodically

Fortunately, digital invoicing tools enforce many of these practices automatically.

How Long Should Businesses Keep Digital Records?

Retention requirements vary by region. However, most authorities recommend keeping financial records for at least five years.

Digital storage simplifies long-term retention without physical clutter.

The Future of Audits Is Digital

Audits increasingly rely on electronic records. Therefore, businesses without digital systems risk falling behind.

According to PwC, digital audit readiness improves operational resilience.

Adopting digital record-keeping today prepares businesses for tomorrow’s regulatory landscape.

How ProInvoice Simplifies Digital Record-Keeping

ProInvoice helps businesses:

- Store invoices automatically

- Track payments accurately

- Generate financial summaries

- Maintain audit-ready records

Additionally, its free invoice generator helps startups begin digital record-keeping without cost barriers.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Final Thoughts: Digital Records Build Trust and Resilience

Digital record-keeping is no longer a convenience—it’s a necessity. Businesses that embrace it reduce audit stress, improve transparency, and build lasting trust.

By using smart invoicing tools like ProInvoice, businesses protect their data, strengthen compliance, and position themselves for sustainable growth.