Is an invoice the same as a receipt? definitely, no. Invoices and receipts are two essential documents that businesses use in their day-to-day operations.

Although they serve different functions, each of these documents provide crucial information regarding financial transactions.

Effective financial management requires an understanding of the distinctions between invoices and receipts. The similarities and differences between invoices and receipts will be discussed in this article.

Is an Invoice the same as a receipt? – Defining the terms.

What is an Invoice?

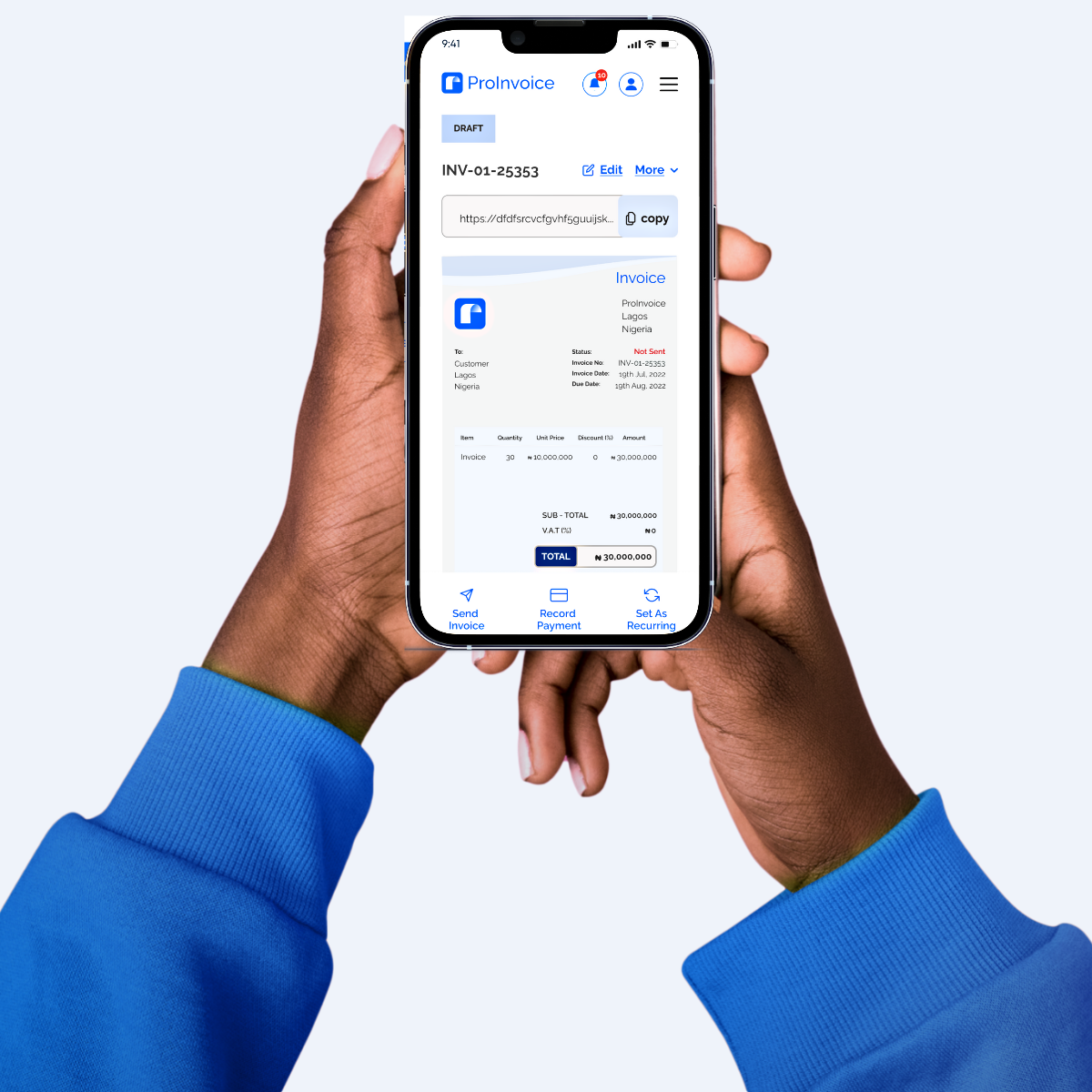

A vendor may send a buyer an invoice to demand payment for products or services that have already been rendered.

An invoice is a formal demand for payment and acts as a transactional record. In B2B (business-to-business) transactions, where the buyer is another firm, invoices are frequently utilized.

The names and contact details of the customer and seller, a description of the products or services rendered, the date of the transaction, the terms of payment, and the total amount owed are all crucial pieces of information that are included in an invoice.

Moreover, invoices may include details like the payment deadline and any related taxes or fees. Because they provide a transparent record of financial transactions and assist in keeping track of income and expenses, invoices are crucial for organizations.

If a payment is not made on time, invoices can be used to start the collections procedure.

What is a Receipt?

After a purchase has been made, a seller must give the buyer a receipt. It comprises information about the transaction and acts as proof of payment.

In B2C (business-to-consumer) transactions, where the buyer is an individual rather than another firm, receipts are often used.

The names and contact details of the buyer and seller, a description of the products or services rendered, the date of the transaction, the payment amount, and any applicable taxes or fees are all significant components of a receipt.

Receipts may also contain other details like a signature or reference number. Receipts are crucial for businesses because they serve as proof that a transaction occurred and because they can be utilized for accounting and tax purposes.

Receipts give customers the ability to return items and may be needed for warranty claims as well.

Is an Invoice the same as a receipt? Let’s look at the differences.

Although invoices and receipts have some similarities, they also differ significantly in a number of important ways.

1 . Timing

The moment they are issued is one of the main distinctions between an invoice and a receipt. Receipts are typically presented following a payment, although invoices are typically issued before to one.

This discrepancy in chronology reflects the two texts’ various objectives. Receipts are issued to prove that payment has been made, while invoices are sent to solicit payment.

2. Potential legal repercussions

The legal ramifications of invoices and receipts are another significant distinction. Invoices are a type of legal document that can be cited as proof in court.

Contrarily, receipts are frequently used as evidence of payment and are not typically regarded as independent legal documents.

Receipts are used to prove that payment has been made, whereas invoices can be used to resolve disagreements and demand payment.

3. Purpose

Invoices and receipts serve different purposes. While receipts serve as proof that a payment has been made, invoices are used to request payment for products or services that have already been delivered.

Since they include a description of the goods or services given as well as the terms of payment, invoices are typically more thorough than receipts.

Receipts are typically easier because they simply need to include the transaction date and the amount paid.

Is an Invoice the same as a receipt? The importance of using the correct document.

It’s crucial to use the right paperwork for financial transactions for a number of reasons.

First, it aids in the maintenance of accurate transaction records by firms, which are necessary for taxation, financial planning, and budgeting.

Businesses may analyze their revenue and expenses, pinpoint possible growth areas or issues, and make wise decisions about their future with the help of accurate record keeping.

Secondly, using the appropriate document can reduce misunderstandings and disagreements between parties.

For instance, if an invoice is used as a receipt, the recipient might not be clear on the details of the transaction, such as whether payment was made or not.

Misunderstandings and even legal issues may result from this. All parties can be clear about their roles and duties by using the correct document, and any disagreements can be settled more quickly.

Ultimately, it’s critical to employ the appropriate documentation to fulfill legal duties. Sometimes certain paperwork are required for certain transactions.

By using the proper documentation, businesses can abide by the law and avoid fines or penalties. For instance, if a consumer receives an invoice rather of a receipt, they can assume that the company is unorganized or unprofessional.

Businesses may show that they are dependable and trustworthy by employing the right documentation, which can enhance their reputation and foster more client loyalty.

Making use of the correct document for financial transactions is essential for accurate record keeping, avoiding confusion and disputes, compliance with legal requirements, and maintaining good relationships with customers or clients.

By understanding the differences between invoices and receipts, businesses can ensure that they are using the correct document for each transaction, and can reap the benefits of accurate record keeping, compliance, and strong relationships with their stakeholders.

Conclusion

Invoices and receipts are two important financial documents used in business.

Invoices are sent to request payment for goods or services provided, while receipts are given to document that payment has been made.

The timing of these documents differs, with invoices being issued before payment and receipts given after payment.

Additionally, invoices can have legal implications and be used as evidence in legal proceedings, while receipts are usually used as proof of payment.

While invoices and receipts may seem similar, they serve different purposes and have different implications.

Understanding the differences between the two documents can help businesses to keep accurate records and avoid issues down the line.

By using the correct document for each transaction, businesses can ensure that they are documenting their financial transactions accurately and in compliance with legal requirements.