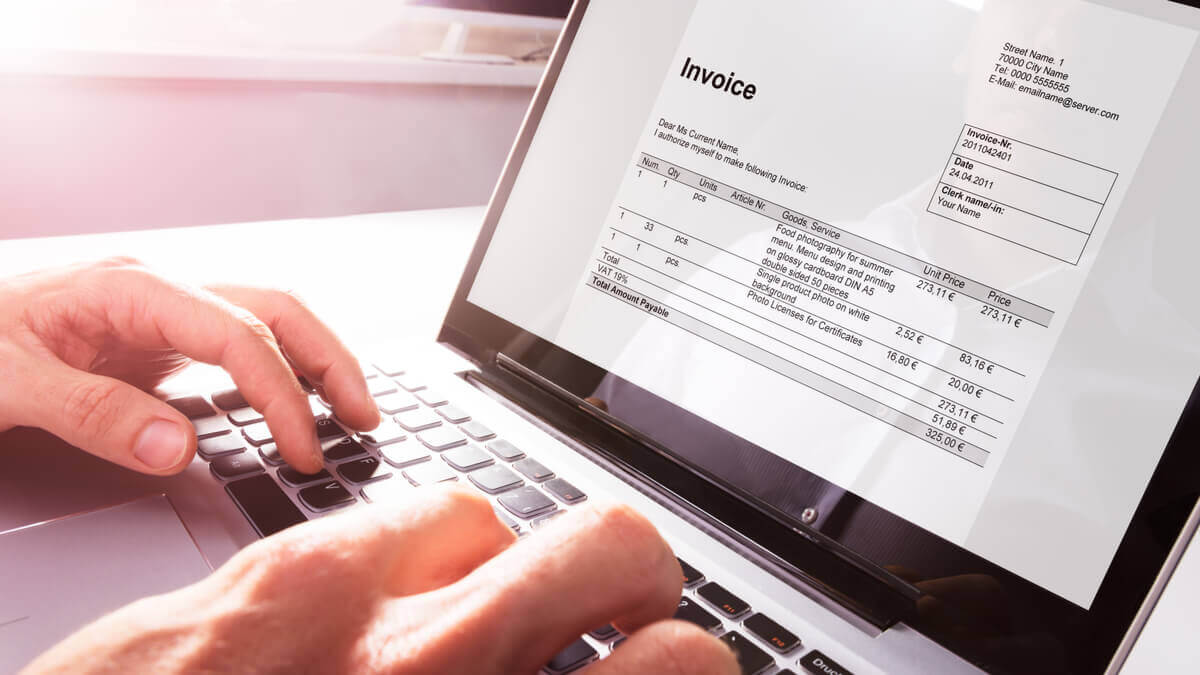

All successful business ventures would need to prepare an invoice at some point in order to keep track of their financial transactions.

This helps to retain a complete record of all sales and purchases. An invoice is a well detailed document that contains the items or services rendered, the price of the transaction, and the payment terms for all customers.

The invoice should clearly state the names and the contact information for both the buyer and seller.

Once the parties involved have been able to agree, an invoice number should be imputed to help track and properly reference the invoice.

The invoice should also clearly specify the quantity and the description of the products or services provided.

This includes the cost of the products and services, payment terms and any additional tax fees or charges.

We know creating an invoice can be a bit challenging hence we’ll go through how invoices are created and the essential components they need to have in this article.

Things to do before you prepare an invoice

Identify The Parties Involved In the Transaction

Before you prepare an invoice, it is very important to identify the parties involved in the transaction.

By precisely identifying the parties involved, you can make sure that the invoice is given to the appropriate person and that there is no misunderstanding over who owes what to whom.

Make sure to include the business name, address, contact information, and email address of both the seller and the buyer on the invoice.

Businesses whether small or big can effortlessly track their income and expenses with the right data at hand, which makes it easier to file their taxes accurately and on time.

Also, by using a structured system to record transactions, firms can more easily spot possible anomalies or mistakes in their financial records and swiftly take corrective action.

Determine The Invoice Format

Choosing an invoice’s format is an essential step in the billing process. Choosing the invoice’s format, content, and organizational structure includes making these decisions.

Depending on the demands of the business and the particulars of the transaction, an invoice can take on a broad variety of formats.

Using a template is one way to create an invoice. Several invoicing software packages provide a selection of templates that can be modified to meet the unique requirements of the company.

Businesses that need to rapidly and simply generate a large number of invoices might consider using templates.

Another choice is to manually produce the invoice using a spreadsheet tool like Microsoft Excel. Although it takes more time, this option provides a greater flexibility to customize the invoice’s look and style.

The invoice format should be modified to the needs, structure and of business.

How to prepare an invoice

An Invoice Number Should Be Provided For Reference Purposes

Every invoice that a company sends out should be given a unique number known as an invoice number. This facilitates keeping track of the invoice and makes it easier to refer to it afterwards.

Aside from assisting the business in keeping track of its financial activities, it also helps the customers in keeping track of their payments.

Detailed Description Of The Product or Services Should Be Provided

Another crucial thing to take to account when preparing an invoice is the specification of the product and services to be rendered.

The description should be itemized to showcase the various products or services and their respective prices.

This should include the quantity, price per unit, and the total cost of purchase. The invoice should highlight the payment terms, additional taxes and due dates.

It is important to ensure that the payment terms and dues dates are clear and concise to avoid payment delays.

Calculate the Total Amount Owed

When preparing an invoice, it is imperative to ensure that all products or services provided are accurately captured and priced.

Businesses can avoid billing errors that may result in payment delays or disputes by doing so.

Invoicing software, which has an automatic feature for calculating the total amount owed, can be useful in calculating the total amount owed.

However, it is critical to manually verify the total to ensure that it is correct. Businesses must not overlook taxes and fees.

Taxes and fees may be applicable depending on the type of business and location. As a result, businesses must include these costs in their invoices to avoid confusion or underbilling.

Furthermore, when calculating the total amount owed, businesses must account for any discounts or promotions that may be applicable.

Including these discounts or promotions in the invoice can be an excellent way to reward customers and keep them loyal.

Proofread And Send Out The Invoice

The last step in preparing an invoice is proofreading it before sending it to the customer.

This step is critical in ensuring that the invoice is error-free and that the customer receives a professional-looking document.

Proofreading an invoice entails thoroughly reviewing it or any errors or omissions that could result in payment misunderstandings or delay.

- Check the accuracy of customer and business information,

- Ensuring that the itemized products or services and their associated costs are correct, and

- ensuring that the total amount owed and payment terms are correct are all part of this process.

Once the invoice has been thoroughly proofread and edited, it is time to send it to the customer. Invoices can be sent via email, mail, or online payment systems.

Businesses should select a method that is most convenient for their customers and ensures timely delivery and payment.

In conclusion, Invoicing allows for the efficient and accurate tracking of financial transactions between a company and its customers.

Creating an invoice typically involves several key steps, including gathering all relevant transaction information and formatting the invoice to meet specific requirements of the business venture.