Simplify invoicing if you want your business to grow faster and get paid on time. For many small businesses in Kenya and Ghana, delayed payments are not caused by bad clients—but by poor invoicing systems. Fortunately, with the right digital tools and strategies, businesses can eliminate confusion, reduce delays, and improve cash flow significantly.

In this guide, you will learn practical ways to simplify invoicing, avoid common mistakes, and use smart invoicing tools like ProInvoice to get paid faster.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

Why Invoicing Is a Major Challenge for SMEs in Kenya and Ghana

Across Kenya and Ghana, small businesses face similar invoicing problems. Although services and products may differ, the billing challenges remain consistent.

For example:

- Invoices are sent late

- Payment terms are unclear

- Records are scattered

- Follow-ups are forgotten

As a result, cash flow suffers. However, when businesses simplify invoicing, they remove friction from the payment process.

What It Means to Simplify Invoicing

Simplifying invoicing does not mean cutting corners. Instead, it means creating a billing system that is clear, consistent, and automated.

When you simplify invoicing:

- Clients understand what they are paying for

- Payments are easier to process

- Errors reduce significantly

- Follow-ups become automatic

Therefore, businesses that adopt digital invoicing systems get paid faster than those relying on manual methods.

The Cost of Manual Invoicing for Small Businesses

Manual invoicing often seems cheaper, but it costs more in the long run.

Firstly, handwritten or spreadsheet invoices take time to create. Secondly, mistakes occur easily. Thirdly, tracking payments becomes stressful.

In contrast, digital invoicing platforms like ProInvoice automate these processes, saving both time and money.

How Clear Invoices Speed Up Payments

Clear invoices reduce confusion. When clients understand your invoice, they pay faster.

To simplify invoicing effectively, every invoice should include:

- Business name and contact details

- Client information

- Invoice number

- Due date

- Clear description of services

- Total amount payable

Using free invoice templates ensures all invoices follow a professional and consistent structure.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

Why Small Businesses Should Use Digital Invoice Tools

Digital tools eliminate repetitive tasks. Instead of creating invoices from scratch, businesses generate them in minutes.

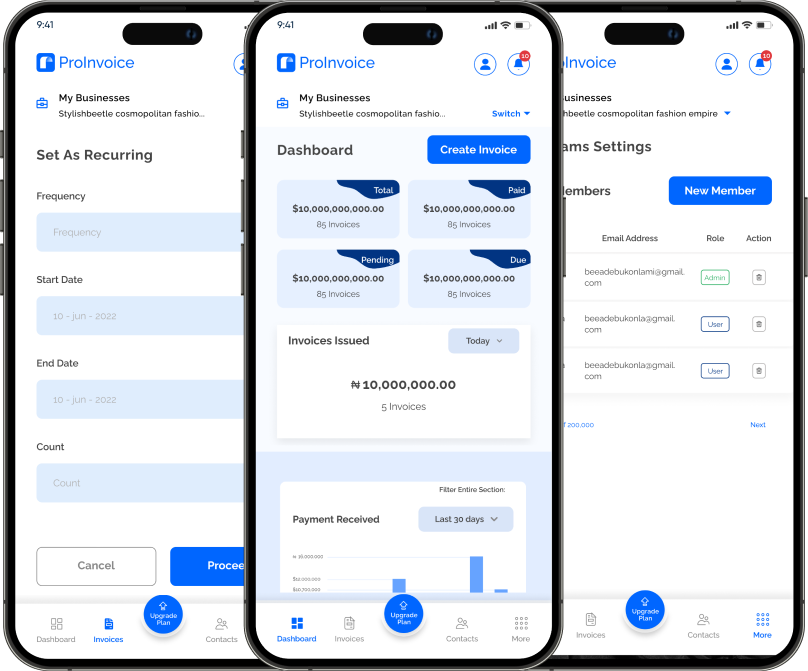

With ProInvoice, SMEs in Kenya and Ghana can:

- Create invoices online

- Send invoices instantly

- Track invoice status

- Store invoice history securely

Consequently, businesses gain better control over their finances.

How a Free Invoice Generator Helps Startups

For startups and freelancers, cost matters. That is why a free invoice generator is a powerful starting point.

A free invoice generator allows businesses to:

- Create professional invoices without upfront cost

- Maintain credibility with clients

- Start invoicing immediately

As businesses grow, they can easily upgrade without losing records.

Simplify Invoicing with Automation

Automation plays a major role in getting paid faster. Instead of manual follow-ups, automated systems handle reminders and tracking.

With automated invoicing:

- Invoices send on time

- Reminders go out automatically

- Payment status updates instantly

Therefore, business owners spend less time chasing payments.

How Invoice Tracking Improves Cash Flow

Invoice tracking shows which invoices are unpaid, paid, or overdue.

When businesses track invoices:

- They follow up on time

- They forecast income better

- They avoid cash shortages

Using ProInvoice, small businesses can monitor invoice status in real time.

Mobile Invoicing Helps You Get Paid Anywhere

Many business owners in Kenya and Ghana work remotely or on the move. Therefore, mobile invoicing is essential.

With the ProInvoice mobile app, users can:

- Create invoices from their phone

- Send invoices immediately after service

- Check payment status anywhere

As a result, businesses bill faster and get paid sooner.

How Faster Invoicing Leads to Faster Payments

Timing matters. The sooner you send an invoice, the sooner you get paid.

Businesses that invoice immediately:

- Appear more professional

- Reduce forgotten payments

- Improve cash flow consistency

Digital invoicing tools ensure invoices are sent without delay.

Why Professional Invoices Build Client Trust

Clients trust businesses that look organized. Professional invoices signal reliability.

When you use structured invoice templates and digital tools, clients:

- Take your business seriously

- Feel confident paying promptly

- Are more likely to return

That is why free invoice templates play an important role in brand perception.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

Simplifying Invoicing Reduces Disputes

Invoice disputes delay payments. However, clear and detailed invoices reduce misunderstandings.

By simplifying invoicing:

- Line items become clear

- Prices are transparent

- Payment expectations are defined

As a result, disputes decrease significantly.

How Consistent Invoicing Improves Business Growth

Consistency builds habits. When clients receive invoices in a familiar format, payments become routine.

Using ProInvoice ensures:

- Every invoice follows the same structure

- Records remain organized

- Growth does not create chaos

Why SMEs in Kenya and Ghana Need Invoice History

Invoice history provides financial clarity.

With proper invoice records, businesses can:

- Analyze revenue trends

- Prepare for audits

- Resolve payment disputes easily

Digital invoicing platforms store invoice history automatically, reducing manual work.

Integrating Payments with Invoicing

Simplifying invoicing also means simplifying payments.

When invoices include clear payment instructions, clients pay faster. Digital platforms also support seamless payment tracking.

This integration improves the overall customer experience.

Common Invoicing Mistakes to Avoid

Even with tools, mistakes can happen.

Avoid:

- Missing due dates

- Vague service descriptions

- Inconsistent pricing

- Delayed invoice delivery

Fortunately, invoicing software minimizes these errors.

How Simplified Invoicing Supports Business Expansion

As businesses grow, invoicing volume increases. Manual systems break under pressure.

However, digital invoicing scales easily. Businesses can handle more clients without extra stress.

That is why simplifying invoicing early supports long-term growth.

Why ProInvoice Is Ideal for Kenya and Ghana Businesses

ProInvoice understands the needs of African SMEs.

It offers:

- Simple setup

- Affordable pricing

- Free tools for startups

- Mobile access

- Secure record storage

As a result, businesses can simplify invoicing without complexity.

Getting Started with ProInvoice

Starting is easy.

Businesses can:

- Create invoices using the free invoice generator

- Customize invoices with templates

- Upgrade when ready

- Use the mobile app for flexibility

No technical skills are required.

Final Thoughts: Simplify Invoicing to Get Paid Faster

Simplify invoicing if you want faster payments, better cash flow, and professional operations. For small businesses in Kenya and Ghana, digital invoicing is no longer optional—it is essential.

With tools like ProInvoice, businesses can invoice smarter, follow up automatically, and get paid on time.