Maybe the question should be, when or why should you put bank details on an invoice? I’m throwing this question to you because i believe that as a business owner cash flow, not profit, is the most crucial aspect of your business.

But you first need cash flowing into your business to have a positive cash flow. And invoicing is the only way to do that.

Although creating invoices isn’t the most fun work, it is a constant task that needs your complete attention.

The problem is that invoicing involves more than just asking a buddy to send you money via Venmo or another electronic fund transfer channel.

It’s a step that can build or break your company. You must always make sure that an invoice contains pertinent information about you, your client, and the goods supplied or services rendered.

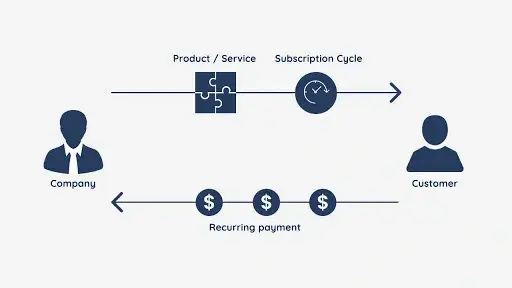

Businesses increasingly use online transactions and electronic invoicing to streamline payment procedures in the digital era.

Yet, this convenience carries the danger of fraud and security lapses. One question that frequently comes up is whether it is secure to include bank information on an invoice.

This article examines whether it is required for your invoices to contain information about your bank account as well as several reasons why you might decide to do so or not.

Is it safe to put bank details on an invoice?

This is a common question among individuals and businesses that send invoices for payment. Generally, it is not recommended to put sensitive details on an invoice.

Including bank information on an invoice might seem convenient, but it also increases the possibility of fraud and identity theft.

What are the risks of including bank details on an invoice?

The main risk of including bank information on an invoice is the possibility of fraud and identity theft. Hackers can intercept invoices, using bank account details to steal money or carry out illicit transactions.

Small businesses are at a higher risk since they might not have strong security measures to thwart cyberattacks.

Another problem is that it’s easy to send bills to several recipients, which increases the risk that the information could get into the wrong hands.

Moreover, emailing invoices frequently makes you vulnerable to hackers and phishing scams.

Thirdly, including bank details on an invoice could also put your clients at risk, as they may be targeted by scammers who pose as your business to obtain their bank information.

How can you protect yourself and your clients?

There are several precautions you can take if you choose to include bank information on an invoice to safeguard both you and your clients from threats like fraud and identity theft:

- Use safe routes for communication: To reduce the danger of interception or hacking, utilize a secure email provider or an encrypted messaging service when sending invoices containing bank

- Check the bank account details: Before adding bank details on an invoice, ensure the information is accurate with your This might prevent fraud and help avoid mistakes like using incorrect account numbers.

- Security measures: Consider establishing and implementing security measures such as two-factor authentication and encryption to safeguard your systems and reduce the possibility of data

- Restrict access: Only clients and the finance department can access the bank account Limit access to such information and only give it to people who need it.

- Look over your accounts: Check your credit card and bank statements often for any strange Once you notice any, get in touch with your bank immediately.

- Keep correct records: Documenting all financial transactions, such as invoices, receipts, and payments, is vital as it would make it easy to notice and handle errors easily.

Adhering to these measures can help protect you and your clients when you want to include bank details in an invoice.

What are the legal implications of including bank details on an invoice?

Depending on the nation and location a business operates, different regions will have different legal implications for having bank information on an invoice.

Companies must generally abide by the required laws to protect and safeguard client financial information, including bank account information.

Data protection laws and regulations are in effect in many countries, requiring businesses to take precautions and safeguard their customers’ financial data.

Failure to abide by these regulations may result in legal repercussions and damage a business’s reputation.

There could be legal repercussions if a business adds bank account details to an invoice in Nigeria. Several guidelines are in place to check how individuals’ personal data is collected and used.

The Nigeria Data Protection Regulation (NDPR), which was established to regulate and supervise how individuals’ personal data is processed and used in Nigeria, is one such body.

Before using an individual’s bank information, businesses are required by the NDPR to get permission from the said person.

Businesses are required to notify the NDPR Commission and affected individuals if any data breach occurs. Along with the NDPR, other laws have been established in Nigeria to protect the privacy of financial data.

The Central Bank of Nigeria (CBN), for instance, introduced guidelines for businesses to follow on how they manage e-banking.

Businesses that violate these guidelines risk the possibility of receiving penalties, paying fines, and having the impacted parties sue them, among other legal repercussions.

When including bank information on an invoice, businesses must ensure they adhere to all applicable rules and regulations.

Businesses in Nigeria should put in place the necessary security measures, such as encryption and secure transmission mechanisms, to safeguard bank information provided on invoices to protect themselves and their clients.

When collecting their clients’ bank information, they must also get their express permission beforehand.

In general, it is important for businesses to be aware of their legal responsibilities for the security of their clients’ financial information and to take the required precautions to safeguard that information.

Is it necessary for businesses to avoid adding bank details on invoices?

Depending on the specifics of their circumstance and the level of risk they are willing to take, businesses may decide to refrain from including bank information on invoices.

Disclosing sensitive financial information on invoices is generally only advised if required. Wire transfers and online payment portals are other payment options that businesses can use.

They do not require including bank information on the invoice. Businesses should take precautions to ensure the security and protection of bank details if they are included.

Ultimately, deciding whether to include bank information on an invoice should be based on a detailed analysis of the advantages and disadvantages.

Businesses should speak with legal and financial specialists to ensure they adhere to all pertinent laws and take the proper precautions to protect their financial information.

In conclusion, if proper safety precautions are not taken, publishing bank information on an invoice may be risky for businesses and their clients.

Businesses should take precautions to protect their financial information since fraud and identity theft present major threats.

However, using a platform like ProInvoice to create invoices is safe and reliable. You can include information like your bank account details without worrying about theft or fraud.