Last week, we got a message from a new user asking if he could send an invoice as a PDF. So, we decided to throw some more light into the question with this article. Read to the end.

The acronym ”PDF” stands for Portable Document Format. Regardless of the software, hardware, or operating systems used by everyone who examines the document, it is a flexible file format made by Adobe that provides individuals with a simple, dependable way to show and exchange information.

Have you ever received a document requesting payment from a supplier or service provider after a purchase or simple home repairs? A “bill” of this nature is an invoice.

More officially, an invoice is a commercial document related to a selling transaction that a service provider issues to a customer.

Depending on the use case, the invoice may also be referred to as a tax invoice, sales receipt, bill, proforma, or purchase order form.

Some are utilized in uncommon circumstances; thus, thoroughly receiving counsel on the type of invoice form is crucial.

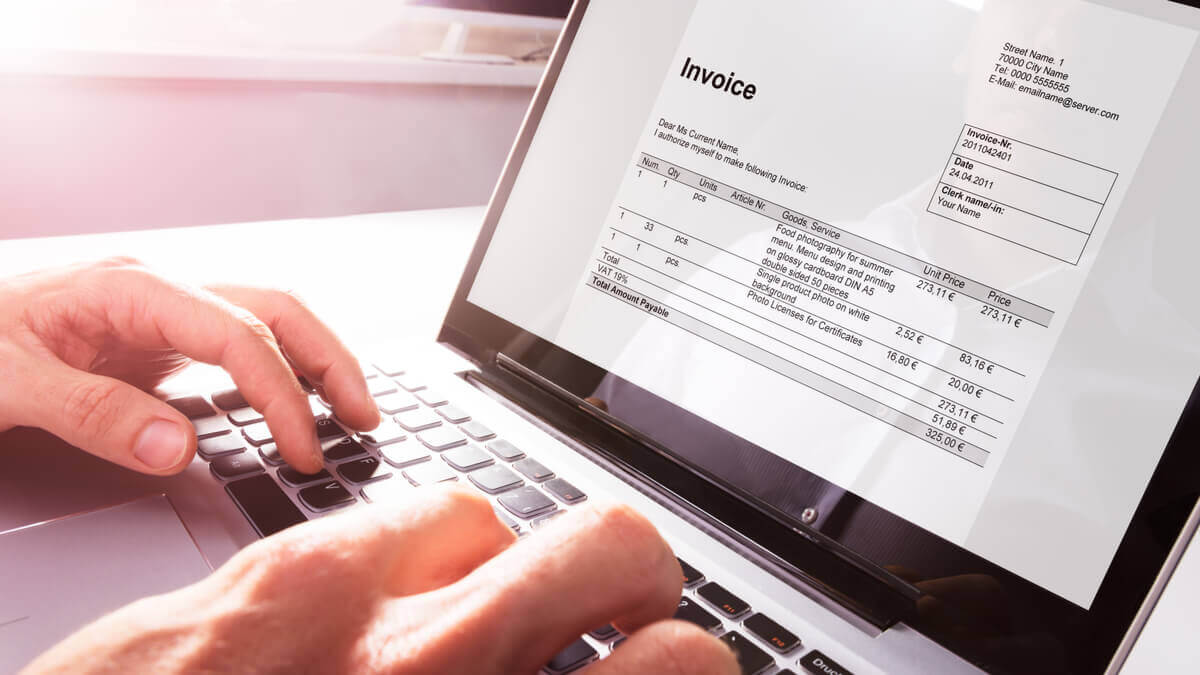

Furthermore, the parties involved in the trade, the goods, their quantities, the date of shipment, the mode of transportation, taxes, discounts, and the agreed-upon costs for any goods or services the seller gave the buyer are typically listed. Below is a typical invoice form:

Various invoice types exist:

Pro forma invoice:

In international trade, a pro forma invoice is a statement of the seller’s promise to the buyer to deliver particular items at particular costs.

The value is frequently declared for customs purposes. The seller does not record a pro forma invoice as an account receivable, and the buyer does not record a pro forma invoice as an account payable as it is not a real invoice.

A pro forma invoice may occasionally be sent to the buyer to ask for upfront payments, either to start production or to secure products.

Credit memo:

Whenever a customer returns an item, the seller typically issues a credit memo for the invoice’s amount or a smaller amount and then refunds the customer’s money.

Alternatively, the purchaser may include the credit notation in an additional invoice.

Commercial invoice:

In international trade, this customs declaration form lists the participants in a shipping transaction, the items being transported, and their value.

It serves as the main customs document and must adhere to certain specifications, including the Harmonized System number and the country of manufacture. Moreover, tariffs are computed using it.

Debit memo:

It is standard procedure to send a debit memo for the outstanding balance and any late fees when a business underpays or fails to pay an invoice in full.

Debit memos work the same way as invoices.

Timesheet:

Information from a timesheet is frequently used in invoices for hourly services issued by companies like law firms and consultants.

Moreover, operated equipment rental firms may produce a timesheet invoice, including timesheet-based and equipment rental rates.

Progress billing

It is a method for securing partial payment on long-term contracts, particularly in the construction sector.

Continuation or Recurring Invoicing

It is the standard when renting out equipment, especially tools. A recurring invoice is created periodically throughout the term of a rental agreement.

EDI invoicing and electronic invoicing

They are not always the same thing. Electronic invoicing broadly includes EDI, XML invoice messages, and other file types like pdf.

Other file types, such as PDF, were previously excluded from the broader definition of an electronic invoice since they could not achieve the advantages of an electronic message in terms of process.

Yet as data extraction methods advance and environmental issues take the front stage in the economic case for deploying electronic invoicing, different formats are now included in the broader definition.

How True – Can I Send an Invoice as a PDF?

The answer is yes! E-mailing invoices as PDF is the easiest and least expensive way to paperless accounting and is thus often used by smaller companies.

Looking at our definition of a PDF presented above, it might even be a more convenient form of presenting invoices without the issues of format scattering and disorder that comes with the version compatibility or software types of document viewing programs.

Furthermore, saving business invoices on your hard disk is risky, like during hardware failure, where tracking of ever-issued or received invoices is lost.

Nowadays, online invoice editors exist to help create PDF invoices without spending a dime and even autosave your documents to avoid data losses during invoice drafting.

In fact, saving invoices as PDFs is necessary to avoid fraudulent cases that can impact the suppliers.

Benefits of Sending my Invoice as a PDF

Here are the top 6 advantages of incorporating the PDF invoicing format into your company’s operations:

- The document’s format is upheld: One of the challenges with sharing documents generated in Microsoft Word or other word processors is that when you share a file from one computer to the next, the formatting can be significantly different. Your clients or coworkers may be perplexed or think less of you due to this problem. Using the PDF format, you can relax knowing your document will be shown as intended. It is also perfect for sending papers that will be printed.

- Due to the format’s success in achieving its goals, PDF has been widely embraced globally. Moreover, the format is simple to view and distribute. Hence, whether you’re sending a document to someone nearby or halfway over the world, PDF is a secure format.

- Compared to other formats, PDFs typically have smaller file sizes, including the huge advantage of compressing high-quality files to a relatively tiny file size, making it excellent for saving hard drive space, especially if you are working with limited storage resources.

- PDF is compatible with all of the popular operating systems in use today. There is, therefore, almost no concern about the recipient being unable to access the document regardless of whether they are using a PC, a Mac, or even a more modern mobile operating system like iOS or Android.

- Simple incorporation of non-text components (such as graphics, hyperlinks, etc.): PDFs enable you to keep aesthetically beautiful layouts and employ links that will open up in the viewer’s web browser while viewing the documents on a computer or mobile device.

- Information is unlikely to be lost: PDFs are probably here to stay for the long run, despite how swiftly technology advances. Moreover, it would require a fundamental shift in computing for everyone to use a different standard because the format is so widely used and has such a long history.

Step-by-Step Process of Preparing an Invoice in PDF for Sending

1. HEADER CREATION

- Provide your company name: At the top of the page, this essential company information must be written in formal lettering (Arial, Times New Roman, or another suitable font for the header) and centered. The font size should be larger than the size you’ll use for the invoice’s body. If a business name is unavailable, input your first/last name and even the middle initial if desired.

- Give us a way to reach you. In the space provided for your business name, provide your mailing address, business phone number, and business e-mail address. The font size for your contact information should be less than that for your company name. Also, consider entering your contact information on multiple lines to make it seem more readable.

- Consider including your business logo.If you have a logo, place it beside the header to the left/ right of your company name. If your company’s logo includes your business name, you can use that instead of the name. Although it is not compulsory, a corporate logo might give your invoice a more polished appearance.

2. Including Recipient And Invoice Information

- Include the contact details of the recipient. The contact information for the company you are billing should be listed under the heading on the left side of the invoice. Notably, include the person’s name, address, and phone number if you send a personal invoice instead of one to a company. However, if the company or person you are billing does not have an address or phone number, include their e-mail address instead.

- Provide other invoice details, including the invoice number. The invoice details are on the right side of the page, usually next to the recipient’s contact information. In separate lines, the following details are frequently displayed on the right side of the page: Invoice number, date, and due date (if you and the company you are billing have a written agreement regarding when you can expect to be paid). Find out the typical pay-by-term for your industry; in most circumstances, it is between 30 and 45 days if you do not already have an agreement.

- Set forth your terms for payment. Choose your preferred payment method under the invoice details, including cash, cheques, credit cards, etc. If you have a late fee, briefly describe it here if it has not already been stated elsewhere, such as in a contract.

3. Itemizing The Services Rendered

- To itemize the services, create a chart. A table showing the many services you provided for your client or the things they purchased from you and for which you are asking for money is another critical part of an invoice. One row for each distinct service rendered to the client should be represented in your chart’s five columns, with the final row set aside for the total fee you are billing the client for all services:

Date. Include the date the task was completed, or the item was bought.

Services. Here, you can list the service you provided, like copyediting, or the product someone purchased from you, like a piece of your handmade jewelry.

Quantity. Indicate the number of pages you copyedited, the quantity of jewelry you bought, etc.

Rate. Include the price you are charging for the goods or services. For instance, if you bill by the hour, write the fee as $0.00/hr.

Hours. Indicate how many hours were spent providing the service if you bill by the hour.

Subtotal. Write down the total fee you are charging for the work done.

- Determine the total. To compute the total, add any sales tax, shipping costs, or other taxes to the amount owed. Use bold or highlighting to make the total stand out from the other figures.

- Specify more information. Specify your return policy if you are billing a customer who purchases on your behalf. At the bottom of the invoice, you might also want to thank the client for their business and suggest further goods or services. As this is the final thing clients see, strive to be gracious and appreciative of goodwill.

You have now finished creating your unique invoice. Next, using invoicing software, you can send your prepared document directly through e-mail or social media platforms as a PDF.