Building a smart budget is the backbone of financial stability—whether you’re launching a startup or running a freelance venture in South Africa. A clear budget not only ensures you cover expenses but also positions your business for growth. To put your planning into action with excellence, you need tools that keep finances accurate and professional. That’s where ProInvoice makes a difference—helping you align budgeting with invoicing, so every rand is tracked and optimized.

1. Define Your Financial Goals Clearly

Identify short-term (monthly cash flow) and long-term goals (annual revenue, equipment upgrades, or reserves). These goals guide your budget decisions and help prioritize where to spend and where to save. Start with what matters most now, then expand into future planning.

2. Track Your Income Accurately

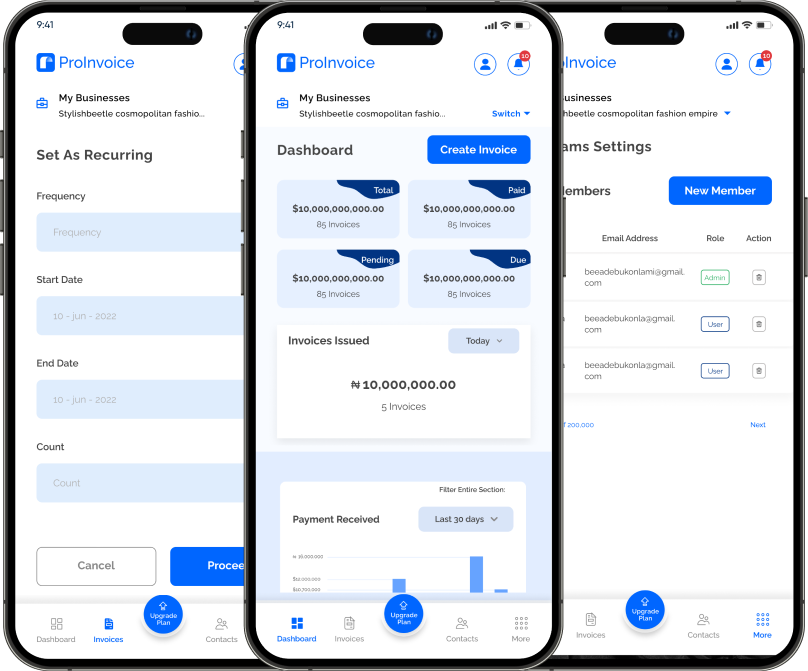

Gather your revenue over the past months—freelance projects, product sales, or service income. If you’ve already used ProInvoice, you can easily access your historical invoice data to see your actual earnings, helping you set realistic income expectations.

3. List and Categorize Your Expenses

Split your costs into:

- Fixed Costs: Rent, Internet, subscriptions

- Variable Costs: Supplies, travel, freelance help

- One-off or Occasional Costs: Marketing bursts, office upgrades

Categorizing ensures you understand where money flows and can adjust strategically.

4. Set Spending Limits for Each Category

Allocate a portion of your budget to each category—prioritize essentials like rent or cost of goods sold, then assign amounts to marketing, development, or savings. Monitor and adjust throughout the month to stay on track.

5. Build in Buffer and Adjust for Cash Flow Gaps

Budgeting isn’t perfect. Always include a small buffer (e.g., 10%) for unexpected costs. If income varies month-to-month, smooth your cash flow by keeping a cash reserve or adjusting spending timing.

Use ProInvoice for accurate, timely invoicing—so your budgeting reflects real data and gaps become easier to manage.

6. Link Invoices Directly to Budget Categories

For every category—like marketing, travel, consulting—track related invoice income or expenses. ProInvoice lets you monitor categories and match income to your budget lines, giving you up-to-date clarity on which parts of your business perform best.

7. Review and Adjust Your Budget Regularly

Your budget is a living tool. At the end of each month, compare your projections to reality:

- Where did you overspend?

- Which revenue categories performed better than expected?

Use those insights to refine next month’s numbers. ProInvoice makes this review smoother by offering easy access to invoice histories and earning trends.

8. Plan for Taxes and Unexpected Contingencies

Add an allocation for taxes (e.g., provisional tax or VAT) and unexpected business interruptions. Treat these as non-negotiable line items so you’re never caught off guard.

9. Set Aside Savings or Business Reinvestment Funds

Healthy businesses regularly reinvest in themselves. It could be equipment upgrades, an emergency fund, or training. Allocate a portion of monthly profit to these areas to build long-term sustainability.

10. Use Budget Insights to Enhance Your Business Strategy

Your budget isn’t just about cutting costs—it’s a strategy tool. Evaluate:

- Which services bring consistent income?

- Where could a small increase in budget lead to more growth?

- When is the right time to invest in new opportunities?

By aligning budgeting with financial visibility—thanks to ProInvoice—you can make smarter, more confident business choices.

Summary Table: Budget Building Blueprint

| Step | What It Helps You Achieve |

|---|---|

| Set clear financial goals | Guides budgeting focus and motivation |

| Track actual income | Bases your budget on real earnings |

| Categorize expenses | Clarity on where money goes |

| Assign spending limits | Control costs and boost discipline |

| Include a buffer | Prepares for surprises and variability |

| Connect invoices to budget | Real-time tracking of income/expenses |

| Review monthly performance | Learn and adapt your financial strategy |

| Allocate tax & emergency funds | Avoid surprises and stay compliant |

| Save & reinvest | Fuel growth and long-term resilience |

| Leverage insights for strategy | Pivot smartly using financial visibility |

Final Thoughts

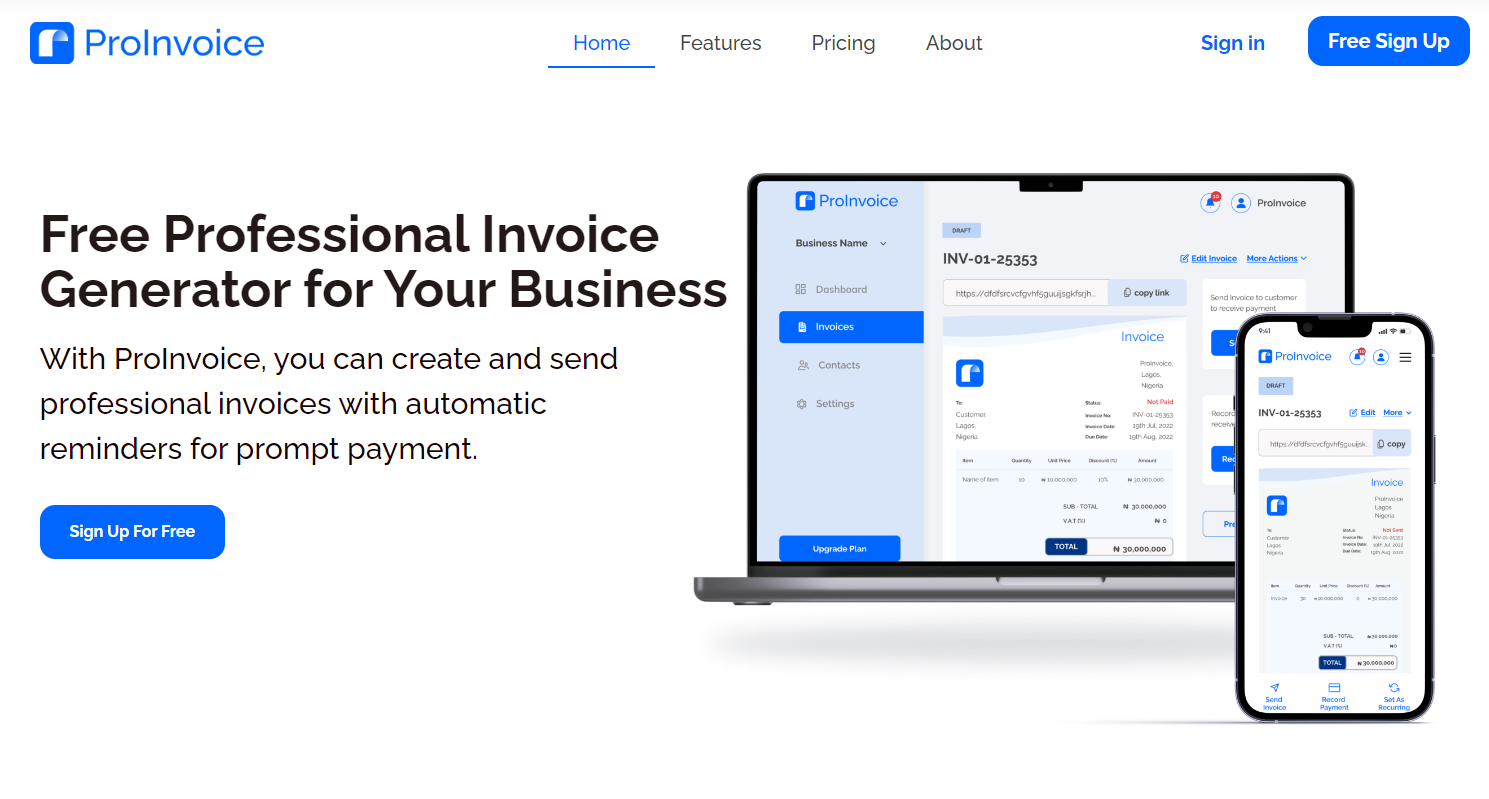

Crafting a budget is more than planning—it’s empowering your business for consistent growth, resilience, and results. And when you pair smart budgeting with ProInvoice, your financial foundation becomes stronger—your invoices are accurate, your cash flow is visible, and your strategy is informed.

Ready to elevate your financial control and get your budget working? Sign up with ProInvoice today and lay the groundwork for a thriving, well-managed business.