Understanding how the Invoicing and payment system works is essential to many aspects of any business transaction.

An invoice has many definitions. An invoice simply refers to a document given to the buyer by the seller to collect payment either for the cost of the products purchased or services rendered to the buyer.

Payment on the other hand is the transfer of money or other valuable items from one person to another in exchange for goods or services.

Payment is also the exchange of money,goods, or services for goods and services in an acceptable amount to both parties and has been agreed upon in advance.

Payment can be made in different ways such as cash, check, credit card, or electronic payment methods such as bank transfers, crypto currency or any other form of online payment.

What is invoicing and payment?

Invoicing and payment are two important components of any business transaction.

Since we already know what an invoice means , let’s go further. Invoicing means to send an invoice for goods or services rendered.

Payment can also be said to be the voluntary transfer of money or other valuable items from one person to another in exchange for goods and services rendered.

In these cases, the seller extends credit to the buyer and issues an invoice with payment terms that specify when payment is due.

These payment terms may include the payment due date, late fees, and interest charges.

Invoicing and payment system

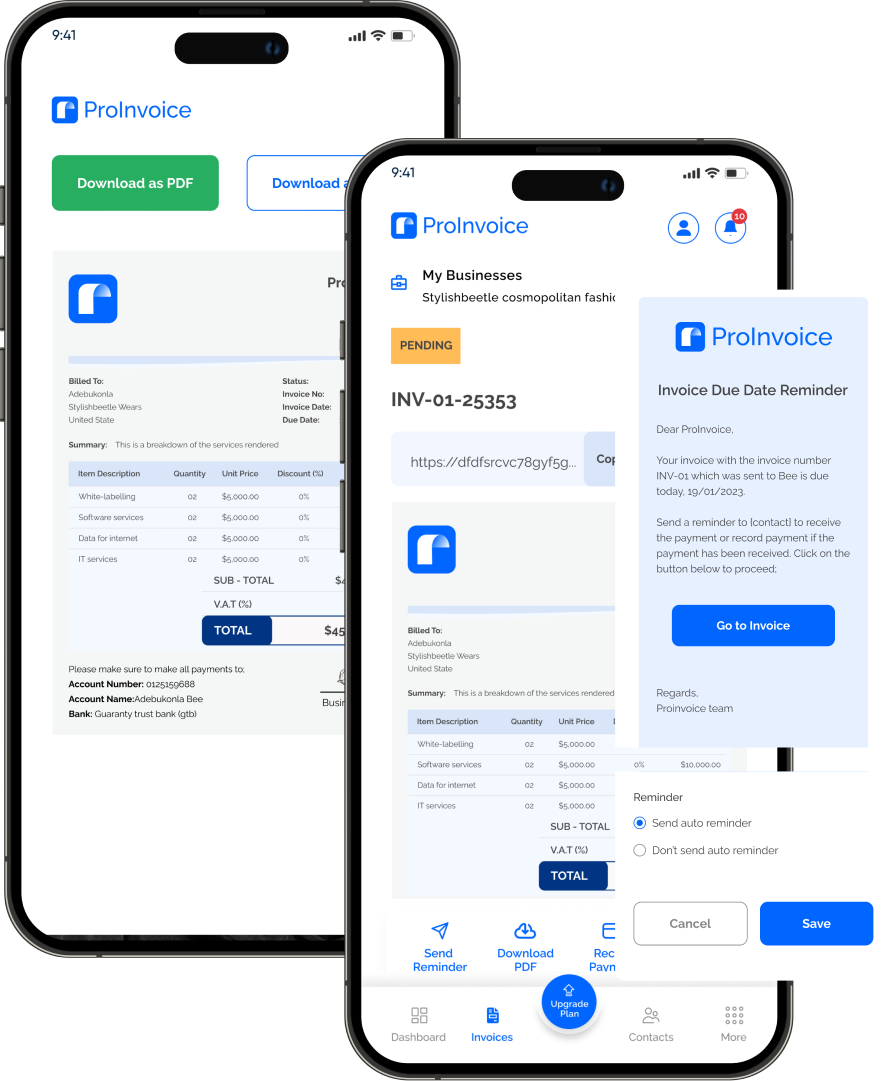

An invoicing and payment system is a software tool or platform that helps businesses create and manage invoices and process payments for example ProInvoice .

These systems can be used to automate various invoicing and payment processes, including invoice generation, payment reminders, and payment processing.

The following features are found in an invoice payment system or software.

- Invoice Creation: The system allows businesses to create professional-looking invoices easily. They are different invoicing systems that you can use so it is advisable to choose the one that suits your business.

- Payment Processes: The system allows businesses to accept payments in various forms, including credit cards, debit cards and other electronic payment methods.

- Payment Reminders: The system also sends automated payment reminders to customers when invoices are overdue, helping them improve collections and reduce the risk of late payments.

- Payment Tracking: The system tracks all payments made, hence allowing businesses or individuals to keep accurate records of their financial transactions.

- Reporting And Analytics: The system provides detailed reporting and analytics on invoicing and payment data, allowing businesses to track performance metrics such as collections rates, average days sales outstanding , and other key indicators.

How To Choose The Right Invoicing And Payment System

Some people have difficulties when it comes to choosing the right invoicing and payment system, because there are many varieties or options available on the market.

When you want to choose the right invoicing and payment system, follow the steps below:

- Considering Your Budget: when choosing an invoice system or platform, always choose the one that suits your budget. Creating a budget helps you to know how much you’ll spend upfront and all the expenses you’ll need for other software related charges. This process helps you to manage and regulate cash flow in your business.

- Choose a system with a good User interface: when choosing an invoice system , choose the ones that the system environment or interface is easy to understand and easy to use. This can help to speed up the process and avoid mistakes.

- Consider A System With Strong Security: Payments data are very sensitive and should be protected at all cost. Hence when choosing an invoicing system, choose the one that uses encryption and provides a secure payment processing system.

- Choose A System With Good Customer Service: good customer service is very essential in every business. Good customers will help you resolve issues quickly and effectively which can also help to improve customer and client relationships.

- Identify Your Business Needs: it is very important that you know what your business needs to grow. Some features that are important are user friendly interface, security , payment processes etc.

Setting Up And Choosing An Invoice System

Setting up an invoice for your business is very important as it helps in regulating your business.

It also helps to save time, reduce errors etc. Here are some steps to follow when setting up an invoice:

- Choose the right system: As mentioned earlier, choose a system that fits your business needs and budget, and has the features you need to manage your invoicing and payment processes effectively.

- Customise your templates: Customising your invoicing templates can help you create professional-looking invoices quickly without any stress. When customising, you Add your company logo, colours, and other branding elements to create a consistent brand identity across all your invoicing documents.

- Choose a system that can generate reports and analytics: this can help you to track your performance and keep you updated. This will also help you to identify areas that need improvement in your business.

- Ensure To Set Up Payment Reminders: setting up payment reminders can help you to keep record on payments to avoid late payments and overdue payments.this will also help to enable a good cash flow in your business.

- Create Payment Policies: it is very necessary that you set up policies in your business. Ensure to set up terms and conditions so as to avoid dispute between your customers. This can also help to create a good relationship with customers.

- Set Up A Good Payment System: always establish a good payment system so that customers can easily make payments. You can add payment methods such as credit cards and other good means of electronic payments. Also ensure you have good security to ensure a safe and secure transaction.

In conclusion, invoicing and payment are crucial for all businesses because they help to maintain healthy cash flow, build trust and good relationships with customers, and they also help to improve overall financial management.

By using different invoice technology and automation to streamline these processes, businesses can save time and money while improving accuracy and efficiency.