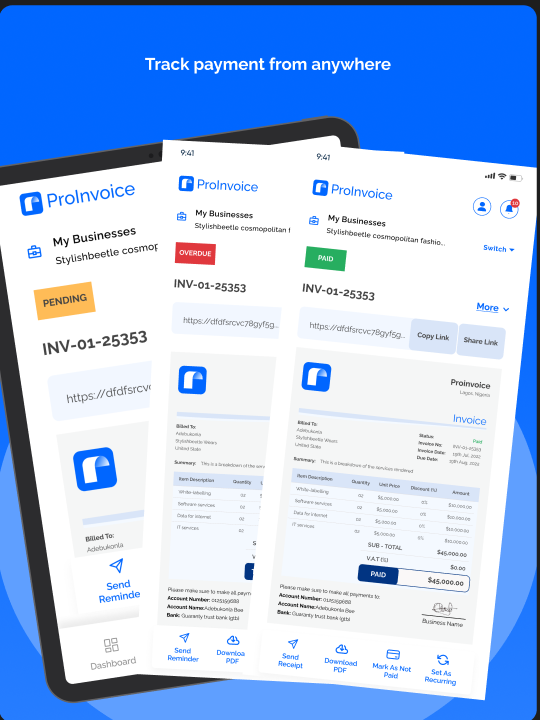

If you want your business in South Africa not just to survive but to thrive, you need more than hustle—you need data. Measuring the right metrics lets you see what’s working, where you’re leaking money, and where to double down. And when your financial metrics are in order, your invoicing needs to match — that’s where ProInvoice comes in, helping you issue clean invoices, track revenue, and stay aligned with your growth goals.

In this article, we explore the most important metrics to track, why they matter, and how using ProInvoice helps you capture, monitor, and act on them.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

What Are Business Growth Metrics and Why They Matter

Metrics are quantifiable measures that help you understand the performance of key parts of your business. They’re sometimes called KPIs (Key Performance Indicators).

Without metrics, decisions are guesses. With them, you see patterns (which customers are profitable, which time periods are weak, what affects cash flow), and you can make changes that move the needle.

In South Africa, with varying market conditions, regulatory burdens, and competition, tracking the right metrics gives you a competitive edge. And the financial side of that edge needs consistent invoicing and tracking—again, here ProInvoice helps you maintain clean financial records tied directly to your metric tracking.

1. Cash Flow (Inflow vs Outflow)

What It Measures

Cash flow tracks how much money enters your business (sales, collections) vs how much leaves (expenses, supplier payments, overheads).

Why It’s Crucial

- Running out of cash is one of the top reasons businesses fail in SA.

- You can be profitable on paper but still collapse if revenue is slow or costs aren’t managed.

How to Track It

- Regular statements (monthly, weekly) showing revenue, collections, and all expenses.

- Forecast upcoming cash requirements (rent, salaries, inventory).

How ProInvoice Helps

- Generate and track invoices swiftly with ProInvoice so you know exactly what money is due or overdue.

- See which clients are slow to pay, enabling follow-ups.

- Match your invoiced revenue against expenses to calculate your net cash flow more reliably.

2. Customer Acquisition Cost (CAC)

What It Measures

How much you spend to acquire a customer: marketing, sales resources, promotions, etc. Divided by the number of new customers in a period.

Why It’s Important

- Helps assess whether your marketing/sales investment is justified.

- If CAC is too high, your profit margins suffer.

How to Track It

- Log all costs related to leads and converting customers.

- Count only truly “new” customers in your period.

How ProInvoice Helps

- Use invoices from ProInvoice to see which customers are new vs repeat.

- Combine that with marketing spend to compute CAC easily.

- Identify customers who cost a lot to acquire but give little revenue, and adjust your strategy.

3. Customer Lifetime Value (CLV) / Repeat Revenue

What It Measures

How much revenue a customer brings over their “lifetime” with your business, minus cost to serve.

Why It’s Key for Growth

- Encourages investment in retention (cheaper than acquiring new customers).

- Helps you decide whether to offer loyalty discounts, subscription models, or repeat purchase incentives.

How to Track It

- Track repeat purchase frequency.

- Track average spend per customer.

- Estimate how long customers stay engaged.

How ProInvoice Helps

- Every time a customer buys or pays you, their record in ProInvoice builds up.

- See which customers are repeat, what they spend, and how often.

- Use that data to forecast CLV and plan retention strategies.

4. Gross and Net Profit Margins

What They Measure

- Gross margin: Revenue minus cost of goods sold (COGS), divided by revenue.

- Net margin: What remains after all expenses including overhead, salaries, taxes.

Why It Matters

- Helps you know if your pricing covers costs.

- Ensures you’re not bleeding money through hidden costs.

How to Track It

- Accurate tracking of costs: materials, labour, overhead, utilities.

- Regular financial statements.

How ProInvoice Helps

- Your invoices with ProInvoice show clearly what you charged.

- Pair that with your expense tracking (outside invoices, supplier bills) to calculate your margins.

- Adjust pricing or reduce costs once you know where margins are thin.

5. Overdue Invoices / Receivables Turnover

What It Measures

How quickly your customers pay. The amount of money tied up in unpaid invoices and for how long.

Why It’s Important

- Unpaid invoices mean cash you can’t use elsewhere.

- High overdue amounts signal risk and weak collections.

How to Track It

- Measure average days from invoice issue to payment received.

- Keep track of the percentage of invoices that go unpaid past due date.

How ProInvoice Helps

- Mark invoices as paid or unpaid, set due dates, and send reminders from ProInvoice.

- Use dashboard or reporting features to see how many invoices are overdue and which clients are slow to pay.

6. Productivity and Operational Efficiency

What It Measures

How effective your business is in turning inputs (labour, hours, resources) into outputs (sales, services delivered).

Why It’s Vital

- Inefficiencies cost money: wasted time, overstaffing, poor workflows.

- Higher productivity can give you more margin or allow you to scale without proportional costs.

How to Track It

- Revenue per employee or per hour worked.

- Time or cost to deliver service or product.

- Compare what tasks take vs what you budgeted.

How ProInvoice Helps

- Invoicing via ProInvoice reveals service turnaround times (invoice date vs delivery).

- Identifies slow clients/processes causing delays.

- Helps you see which services produce more revenue per hour.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

7. Customer Satisfaction, Retention, & Loyalty

What It Measures

How happy your customers are, how often they return, and whether they recommend you to others.

Why It’s Essential

- Retained customers cost less to serve and often spend more.

- Word-of-mouth and referrals are powerful in SA markets.

How to Track It

- Surveys, reviews, NPS (Net Promoter Score).

- Repeat purchase metrics.

- Feedback loops.

How ProInvoice Helps

- ProInvoice invoices become a touchpoint: adding thank-you notes, feedback requests.

- Track repeat customer invoices to see retention.

- Use invoicing data to identify high-value, loyal customers.

8. Growth Metrics: Scale & Expansion Indicators

What It Measures

How fast your business is growing in key areas: revenue growth, new market reach, product or service expansion.

Why It Matters

- Signals whether your business model and operations are scalable.

- Helps attract investment or plan for larger scale operations.

How to Track It

- Year-over-year or month-over-month revenue growth.

- Number of new customers vs churn.

- Geographic or product line expansion.

How ProInvoice Helps

- ProInvoice archives invoiced revenue over time so you can compute growth curves.

- Compare past growth to current to forecast future possible growth paths.

9. Burn Rate (for Startup-Style Ventures)

If you are operating like a startup (even within a small business), tracking how fast you are spending money (burn rate) before revenue catches up is very useful.

What It Measures

How much cash you use per month vs how much you bring in; how long you can sustain operations with current cash.

Why It’s Important

- Ensures you don’t run out of funds unexpectedly.

- Helps in planning funding, cost cuts, or pivots.

How ProInvoice Helps

- Regular invoicing with ProInvoice gives reliable monthly records of cash inflow.

- Pair that with your expense logs for burn rate calculation.

Putting It All Together: Metric Dashboard Strategy

To grow your business, collecting metrics isn’t enough — you need a strategy for using them. Here’s how:

- Pick 5–7 metrics that matter to your business model (for example: cash flow, margin, receivables, retention, growth).

- Monitor them regularly (monthly or even weekly).

- Use a dashboard or system to visualise metrics.

- Tie your actions to metrics: e.g., reduce CAC if it grows too large, or chase overdue invoices aggressively.

- Reassess the metric list annually — some become less relevant, some new ones emerge.

Using ProInvoice as part of this strategy helps because your invoicing side generates clean, accurate data you can plug into metric dashboards.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

Common Mistakes When Tracking Metrics (and How to Avoid Them)

- Tracking too many metrics — spreads effort, dilutes focus. Choose the most impactful ones.

- Using bad or incomplete data — unreliable invoicing or missing expense entries corrupts your numbers.

- Ignoring leading indicators — metrics that signal future issues (like rising overdue invoices) rather than just past performance.

- Neglecting action — collecting metrics without changing anything is useless.

- Failing to revisit metric definitions — what “customer acquisition cost” means might change over time; keep consistency.

With ProInvoice, by having a robust invoicing and payment tracking system, many of these pitfalls are addressed — fewer missing entries, clearer data, better reliability.

How to Start Tracking These Metrics Today

- Begin with setting up your invoicing properly via ProInvoice. Use templates, record every invoice, due dates, payments, client identity.

- Maximize data capture: tag invoices by product, client type, channel of acquisition, etc.

- Build a simple spreadsheet or use a dashboard where you plot your key metrics each month.

- Set short-term targets for improvement (e.g., reduce CAC by 10%, reduce overdue days from 45 to 30).

- Review monthly: celebrate gains, adjust actions where metrics slide.

Final Thoughts

Growing a business is as much about mindset as it is about measurement. The businesses that thrive are those that watch the right metrics, adapt quickly, and ensure their operations — especially financial processes like invoicing — are clean, consistent, and reliable.

With ProInvoice powering your invoicing and revenue tracking, you get accurate data, reduced errors, and less time chasing payments — freeing you to focus on strategy, innovation, and scaling.

If you’re ready to grow your business with confidence, sign up with ProInvoice today and make sure every metric you track is tied to real, clean financial data.