Adapting an invoicing method for getting payment in your business is great, but knowing the best way to invoice clients is most crucial.

In this post, you will be walked through the process of sending an invoice to your clients in a very easy and efficient way…

An invoice is a proof of binding transaction agreement between businesses and their clients/customers.

The details contained in an invoice is self explanatory, revealing to a client the amount of goods or services they acquired, and how much they cost.

This invoice must be prepared as soon as the goods or services [or both] have been delivered or provided to the clients as the case may be.

The clients in turn, goes through the invoice and proceeds with payment in the absence of no clarification.

Invoicing is a good way to get early/punctual payments after you have delivered your goods or services.

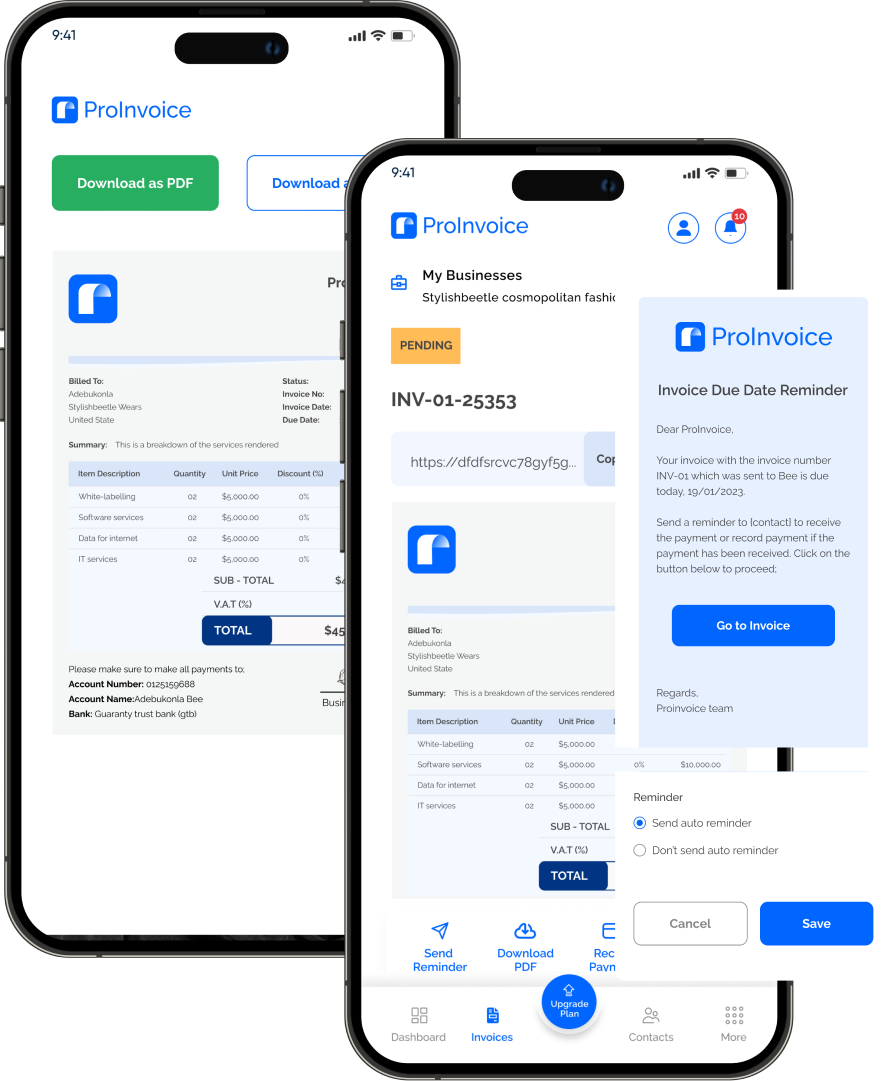

You can also track payments and send auto reminders to clients who are yet to make payments.

Another benefit of invoice is that it allows you to show the due date a payment must be made to avoid late payment penalties.

Other benefits include relationship maintenance with clients, brand transparency, quick dispute resolution [for the proof it provides], helps you stay organised and so on.

Sending invoices to clients requires great attention to details. It requires accurate representation of company’s and client’s information, correct input of numbers, alphabets and so on.

So even though the idea of invoicing is great for businesses, sending it incorrectly can affect your business relationship with your clients.

Having established some of the benefits of sending an invoice correctly; Let’s walk you through the best way to invoice clients.

Step-by-step guide on the best way to invoice clients

Step #1 – Select Your Invoice Method:

There are different methods for administering invoices to your clients and customers. Depending on your type of business, the options include paper invoice method, email invoice method and online invoice method.

- The paper invoice can only be delivered to the client via Delivery process is slow and sometimes may not even get delivered. It is also difficult to track.

- The Email invoice is sent electronically via email. Delivery is sure unlike the paper invoice, and also trackable.

- The Online invoice which can be sent via invoicing platforms or software like This is the most advanced type of all three. It is most efficient, fastest and does not require much technical know-how.

- Delivery is fast, it is trackable, reliable, efficient and strictly online.

Once you have determined which invoice method to adapt for your business, then you can consider the next steps below

Step #2 – Create and Fill the Invoice with Correct Information:

If you are just starting out with invoice for the first time in your business, then you will need to create an invoice template–that is, after deciding your invoice method as described above.

To create an invoice, there are important information to include:

- Your business name and contact information including your logo,

- Client’s/company’s name and contact information also,

- Invoice ID: which comes unique for every individual invoice

- Invoice creation date

- List of products/services delivered, quantity and cost

- Description of the goods or services

- Total amount and due date

- Taxes and discounts as may be

This template will be available whenever you need to send your clients their invoice. We have a well detailed article on how to create your first invoice. Care to check it out.

Since you are only creating here, the above information can be filled with the correct information when preparing a client’s invoice to be sent out.

Now, go ahead to enter each unique client information that you want to prepare an invoice for. Be careful not to mix up information here.

Any mistake made here like sending the wrong information or sending an invoice to a wrong client can impact business relationships.

Step #3 – Review Your Invoice:

This is very important. It’s the only way you can make sure you are not making any mistake with the information you have imputed.

Many businesses have neglected this simple act which may only take 1–3 minute time. So what else do you check out for again?

Almost all information should be checked. But most importantly, confirm the clients details are correct. This includes name, email, address, phone etc.

Make sure that the list of products/services are in the right quantity and agreed prices. Where you need to make clarifications, include it as a note for the client.

Step #4 – Send Your Invoice:

Now that you have checked and confirmed that everything looks good. Then, you are ready to send the invoice.

The method of invoice depends on how you send them. If you’re using a paper invoice, you will have to mail it to them.

While email invoice allows you to attach your invoice as documents [e.g. PDF] and send through email.

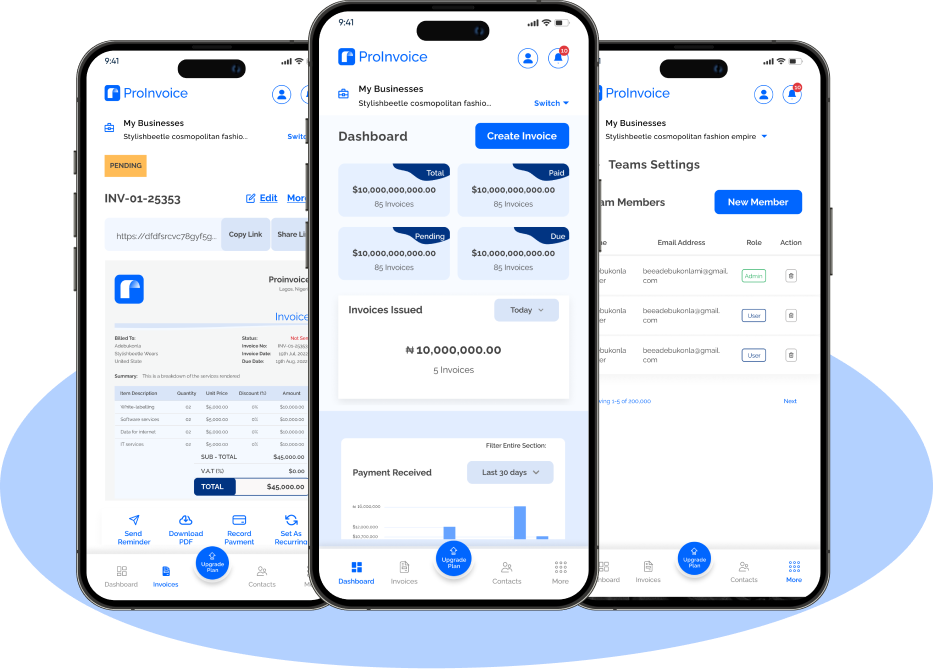

Online invoicing software like ProInvoice enables you to send your invoice directly on the invoice platform.

Step #5 – Confirm Receipt of Your Invoice:

This is one of the major mistakes of invoicing–not confirming receipt from clients.

If we didn’t consider the importance of confirming receipt, this article should have ended after the “send your invoice” point.

But there are more important things you must do after successfully sending an invoice–one of them is confirming if they got it or not.

For the business using paper invoice, email invoice or online invoice, this is very key. Some clients may not know you have forwarded them an invoice, so it is ideal you inform them.

Step #6 – Follow-up On Your Invoice:

Using an online invoicing software like ProInvoice allows you to track statutory and follow-up on your invoice.

The primary purpose of invoice is not just to make sure payment is made, but also to make sure they are made early.

Your Invoice should carry some key dates; date issued, transaction date and due date.

This helps both you and the client to know when payment must be made latest. But when you sense a delay prior to the due date, you may need to Follow-up for reminders.

Step #7 – Record Your Payment Received:

This is also important. Recording your payments on your accounting system once they have been paid helps you to keep track of your business financial flows.

Your record keeping helps know the payments you have received overtime, helping you plan other aspects of your business better.

Conclusion

Take advantage of the benefits an invoice can offer to your business. Remember that attention is a must when sending an invoice to your clients/customers.

With the above steps, we hope you can now send good invoices to your clients that they will appreciate. At ProInvoice, we offer invoicing services to businesses of all kinds.