In this article, we would get to talk about the standard practice for selecting an Invoice Generator for Nonprofit Organisation.

Like you already know, invoices are typically used for requesting payment when a service is rendered, or a product is bought.

However, nonprofit organisations can also benefit from using an invoice Generator. Unlike regular invoices for business, charitable organizations use the invoice to indicate the amount a donor donated.

Designing invoices manually is stressful and prone to errors that can cause future accounting issues.

Therefore, it’s best to use an invoice generator for nonprofit organisation to save you time, stress and ensuring you build a database of your top donors.

This article will guide you on what a donation invoice should contain and what essential elements to consider when choosing an invoice generator for nonprofit. Let’s dive in.

What is a Donation invoice?

Nonprofit organizations raise money by requesting donations to fund a project or other activities.

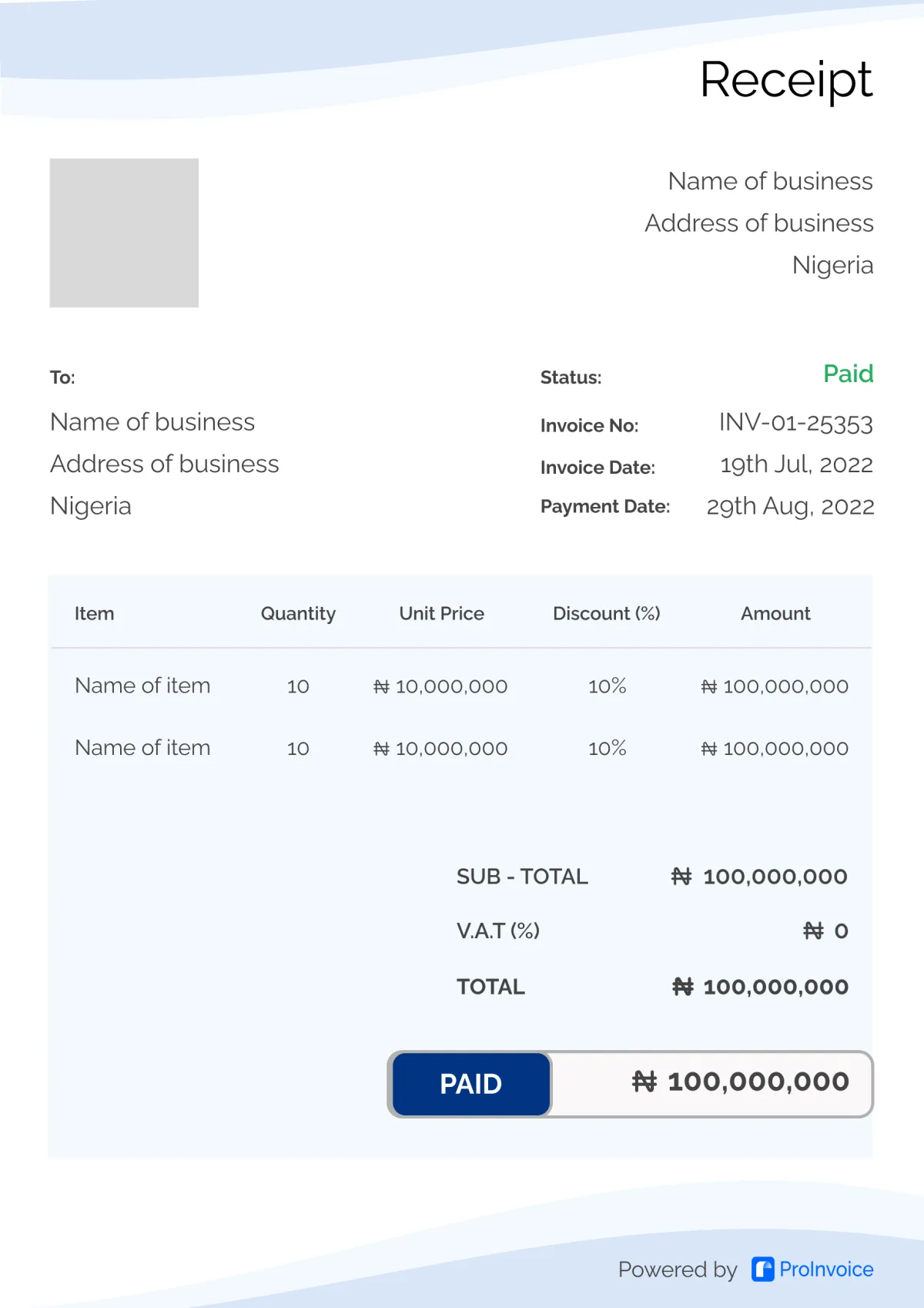

A donation invoice is a document that shows a donation has been received and successfully processed by your nonprofit.

It’s an important document to have if you want to claim tax deductible for your nonprofits and maintain organized records.

Once the donation is processed, the invoice is generated and sent to the donor, which completes the donation cycle.

What to Include on Your Invoice for a Charitable Donation

A donation invoice is almost similar to a regular invoice for business. However, a donation invoice will not include details like products or services rendered.

This is because the invoice isn’t used to request payment but to confirm that a donation was successfully processed. Here’s a list of elements to include in your invoice for nonprofits;

- Donors name

- The name of your nonprofit and other details

- The date donation was made

- The donation amount

- A signature from your nonprofit that verifies the authenticity of the invoice

Skip the stress of creating invoices manually with docs or Excel sheets. Sign-up on Proinvoice to use our invoice templates to generate professional invoices fast

How to Choose an Invoice Generator for Nonprofit Organisations

Before you go into the nitty-gritty of choosing an invoice generator for nonprofit organisations, it is good we understand what an invoice generator software is.

An invoice generator is software with built-in features allowing you to generate invoices quickly. This software is usually available online, offline, or on mobile devices.

Using an invoice generator limits the chances of omitting important information that might render your invoice invalid or lead to legal issues.

However, there are many invoicing software, each catering to specific business types or needs.

Therefore, it’s essential to understand the crucial element to consider when choosing invoicing software for your nonprofits.

Here are some features the best invoicing software for your nonprofits should have

1. Automated Invoicing

Invoicing requires attention to detail as it’s critical for creating error-free invoices.

When choosing an invoice Generator, it’s essential to check if they have features that allow you to generate invoices automatically.

Launching your automated invoice generator will create the necessary headings and sections in a template form.

But that’s just part of the benefits. Using automated invoicing software, you don’t have to worry about calculating tax manually or summing up the amount donated.

The tool does all calculations immediately after the figures are inputted; all you have to do is click save.

This feature is critical as it helps you save time, avoid errors and deliver professional invoices quickly without the stress of manually designing one.

2. Custom Templates

Sometimes, you might need more time to create one from scratch to send out an invoice fast. Custom templates allow you to customize the invoice to fit your business needs.

For example, using the custom templates on ProInvoice, you can quickly include your nonprofit’s logo, colors, details, fonts, etc.

You will have created a professional invoice that showcases your brand identity and establishes credibility. Confirming that your choice invoice generator has this feature is crucial as it makes your work easier and faster.

3. Payment Integration

Another critical feature to consider when choosing invoicing software for your nonprofits is Payment integration.

Payment integration means you can accept payment from a donor via credit cards, bank accounts, USSD, or payment gateway.

Once you create the invoice and include activating the Payment option, the donor can use your invoice link to pay directly without the back-and-forth conversation about payment.

This feature also helps you track donations as it’s sent directly to the designated account without any interference from a third party.

Using an invoice generator like ProInvoice, you can connect your payment integration through the Paystack gateway. Subsequently, donors can pay you directly via credit card, bank app or USSD methods.

4. Invoice Alerts and Reminders

Sometimes, donors can forget they are getting closer to the donation due date since most donors are business people with busy schedules.

Therefore, you need a feature that allows you to remind them of the contribution due date via email or text.

When choosing an invoice Generator, you must confirm that they support notifications and reminders.

This feature allows you to go about your business without having to write a reminder email every time.

The system takes care of everything, and you can focus on building a nonprofit that delivers a solution to society.

5. Invoice Tracking

Once an invoice is created, there’s a need to have a way to track which donation has been paid or is pending.

This feature helps you keep track of donors’ responses and facilitate effective bookkeeping. When choosing invoicing software, this feature is crucial and shouldn’t be ignored.

It also shows the total amount of pending donations and the total amount of received donations. This dashboard feature is invaluable, especially when you manage your nonprofits alone or with a small team.

Creating professional invoices with the an Invoice Generator for Nonprofit

Invoice helps you establish professionalism, brand identity, and credibility. In the nonprofit space, these features are critical as everything is built around trust.

But, nonprofits often need more workforce and extra support software to automate the process.

An automated invoice Generator is an excellent choice for faster professional invoice creation. Choosing the best invoicing software from a long list of options can be daunting.

However, it would be best to look for key features like automated invoicing, payment integration, alerts, reminders, and custom templates.

These features will ensure that you create professional invoices fast and track them effectively.

ProInvoice software is a great tool that helps businesses, nonprofits, and freelancers to create professional invoices fast.

Once you sign up, you can access a variety of templates, integrate payment options and set up email and mobile alerts fast.

Are you ready to take your invoicing game to the next level? Sign-up for free now to access our unique features.