Knowing the top invoicing tools as a small business owner is very key for financial growth. Many business owners and entrepreneurs find the act of managing their finances and carrying out their bookkeeping challenging.

Upholding a good cash flow will help your company grow especially when you are still beginning. Due to technology, small business owners and non-accountants find it easy and economical to manage their little business finances.

The only thing needed by you as a small business owner is a good invoice and billing tool. You might be wondering what is the perfect invoicing tool you can use in your business to help you.

There are some common small business invoicing tools available online to help brands receive payment.

The top invoicing tools for small business owners in 2023 are ProInvoice, Invoice [NG], Waveapps, Zoho Invoice, Freshbooks, Invoicely, Sage One, QuickBooks Online, Xero, and Accounteer.

These invoicing tools will aid you in streamlining your invoicing process and making the collection of payments from clients quick and simple.

Invoicing is very essential though it isn’t really easy to carry out as a freelancer or small business owner.

Still, if you make use of these top invoicing tools coupled with the right actions, you’ll be able to turn your invoicing process into a smooth and automated one and you can even start small and then upgrade later if necessary.

Why Should I Use Top Invoicing Tools As A Small Business Owner?

Making use of top invoicing tools even as a small business owner will make you stand out and look very professional.

You can be customizing your invoice to make it correspond to your brand’s style and theme. Also, you can be accepting card payments through your invoice and this will add up to make you look more professional.

Using good invoicing tools will enable you to send reminders automatically, tackle late payments and even collect a deposit for a job that hasn’t been done. Invoicing tools are indeed a wonderful option for entrepreneurs and growing businesses.

They will also help you track your spending, draft the invoice automatically and monitor your finance reports.

Small business owners can now be aware of cash flows and other financial information, thanks to online invoicing tools.

A lot of other features are also available on these tools for you such as adding your bank details, personal spending, storing invoices and receipts, etc.

Are These Top Invoicing Tools For Small Business Owners Free?

The top invoicing tools for small business owners are usually free and provide these free features to help business owners minimize their spending to the lowest.

You can start creating and sending well-formatted invoices as a small business owner free of charge.

When you open a free account with these online tools, you can begin customizing every single detail to ensure your invoice is reflecting the brand’s style.

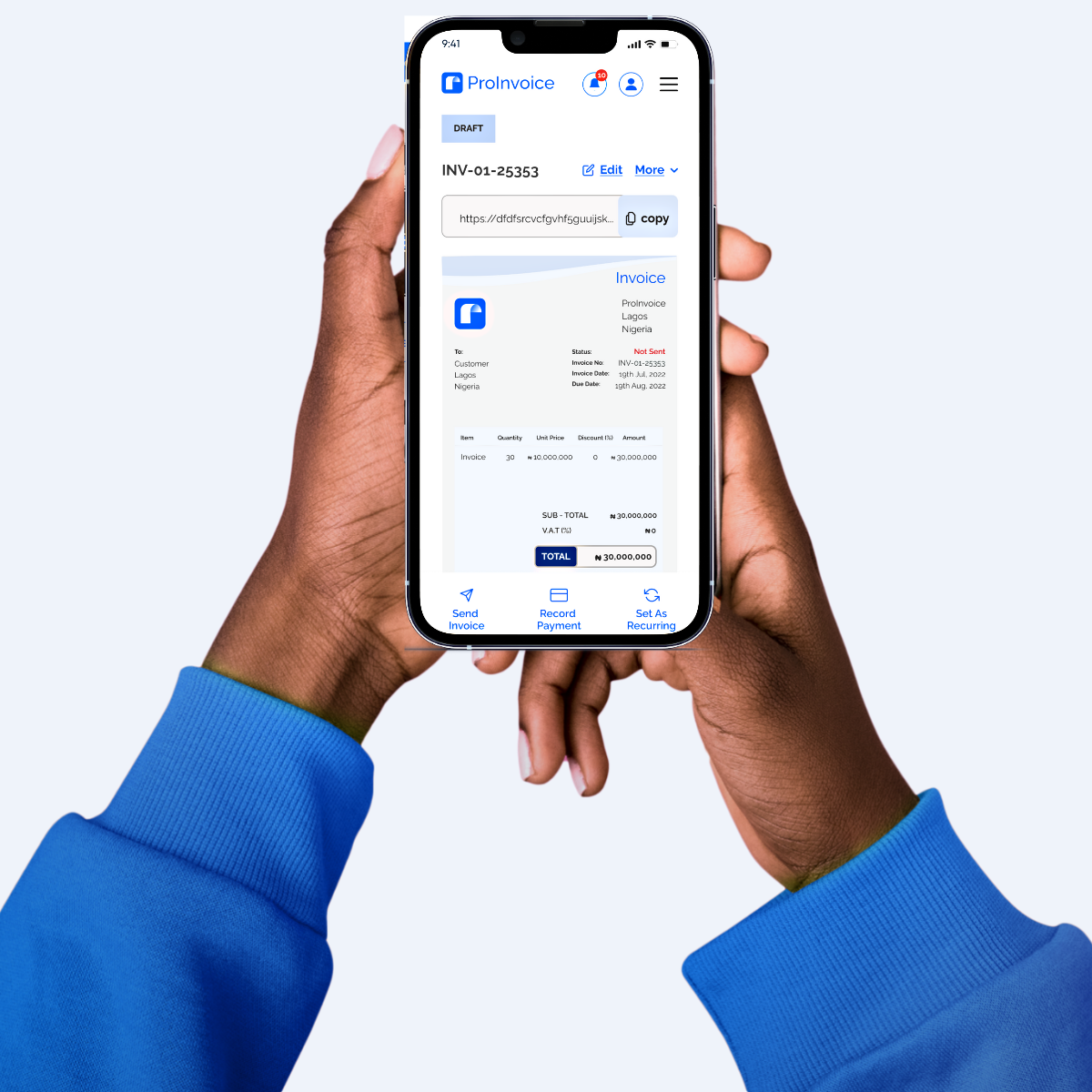

You can even integrate these invoicing tools with other tools you’re using in your business. Some of the invoice software offers free mobile invoicing so you can be accessing your details even on the go.

Therefore, small entrepreneurs who travel all the time can now have mobile access to their invoices.

When you make use of a good invoicing tool as a small business owner, you can begin tracking expenses, designing the template you want, and following up on your finances free of charge.

You don’t have to spend any money when creating and sending your client an invoice.

Is ProInvoice A Top Invoicing Tool For Business Owners?

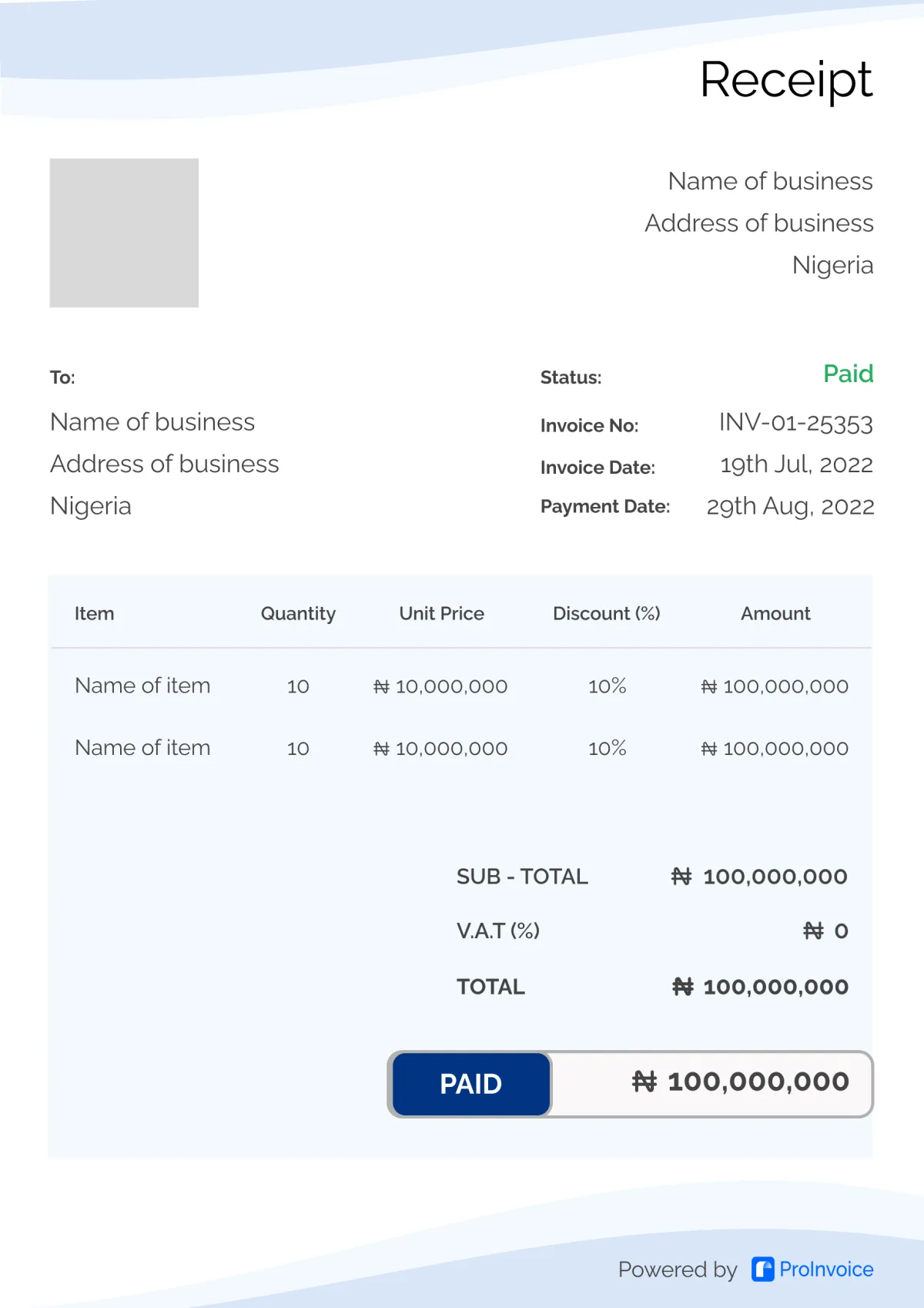

ProInvoice is a great invoicing tool that you can start using for creating and sending well-formatted invoices.

With their free account, you can begin customizing all your invoice details to match your brand style. ProInvoice invoicing and billing tool are great for both small business owners and freelancers.

Their invoices are customizable and you can even set up automatic reminders for payments. You won’t be spending extra time managing your whole invoicing process because of their automated updates and receipts.

You can even integrate the ProInvoice tool with your other business tools to make your work easier. As a small business owner, you can track your finances and be always updated even when a client pays up.

ProInvoice provides a solution to the problems that arise from getting paid.

It caters to the need of freelancers, small business owners, and accountants. You can even brand your business logo with its various templates before generating invoices and bills.

Is Invoicely A Good Invoicing Tool For Small Businesses?

Invoicely is an invoicing tool that is cloud-powered and created for small business owners and freelancers. It is a popular tool that thousands of brands make use of around the world.

Invoicely has every functionality needed for invoicing and billing like creating invoices, scheduling payments, automated reminders, automated workflow, management of brand accounts, and management of clients’ details.

They also offer multi-currency options and the importing and exporting of data. This tool is aimed at helping brands perfect every of their financing area to ensure fast and easy-going operations.

They target small business owners and are even located on many continents. Invoicely provides many well-designed templates which you can customize to suit you.

With them, you’ll no longer experience delayed payments from customers because of their efficient invoice setup.

Is Invoice [NG] A Top Invoicing Tool For Small Business Owners?

Invoice(NG) is an invoicing tool for managing expenses and creating invoices to give to customers. You can also create an estimate and send it to a customer.

The Invoice (NG) tool works for everybody including freelancers, accountants, and brand owners with thousands of employees.

It has in-depth, special templates and more features than other invoicing software. Also, it offers the basics for finances and a great customer experience anyone can ask for.

With this tool, you can begin collaborating and adding members of your team together with contractors to be accessing accounts.

Invoice offers unique accounting solutions and advanced financial features for multiple users. In addition, they provide ample reports, and a lot of integrations, and can be operated on any device that has a good internet connection.

This tool is indeed designed to help small business owners, brands, freelancers, and entrepreneurs.

Quick Read