Agreed that there are many types of invoice which businesses can send to their clients to request for payments for product sold or services rendered, you have done well to dig a bit further to know the kind of invoice that is right for you and your business.

Invoicing, or as it was referred to back in the day, billing for goods or services rendered, has a long, colorful history dating back to ancient Egypt; where Egyptian papyri was used by noble merchants to document their transactions; which was written in the language of the time, the stylish but highly-incomprehensible hieroglyphics.

It was a time when you did not have the luxury of having the different types of invoice as we do today.

However, much later in medieval Europe, a period marked with economic and territorial expansion, and accompanied by State-sanctioned, accelerated urban growth, the art of invoicing evolved considerably.

In those times, the emergence of national identity, and the restructuring of secular and ecclesiastical institutions, inadvertently opened up a new marketplace for businesses to thrive, and in turn expanded the use of one of the major tools of effectively doing business; invoicing.

Invoices were handwritten documentation; exchanged between merchants and their prospective or long-time clientele.

These invoices not only validated transactions but also came in handy to settle the ever-present disputes that were known to come up over things like the cost, size and of course, the quality of goods delivered.

Invoicing has taken many forms since those times, accommodating varying addendum due to the ever changing business landscape around the world, and many forward-thinking companies now use specialized software to generate and manage their invoicing needs.

These aforementioned invoicing systems often include features such as automated billing, payment reminders, and more recently, integration with accounting software.

Invoicing as a business process is a method of validating business transactions, to give credibility to the sales process; and as a result of factors like business type, geographical considerations, recurrence and unique extenuating circumstances, invoices now come in different types, to meet different business concerns.

This is important to note, because as a budding Entrepreneur, surviving amidst the harsh terrain of the 21st century business ecosystem, requires a high level of business professionalism to help you stand out from the crowd.

One such professional outlook is in the knowledge of correctly invoicing a prospective or long time client, when conducting a business deal.

There are several types of invoicing available to today’s entrepreneurs, but here are six of the most common types of invoice.

Common types of Invoice today

1. Standard invoice:

As the name implies, this type of invoicing is standard, accommodating the base-level requirements that any business invoice should have.

This includes important details such as: the seller’s name and contact information, the buyer’s name and contact information, the date of the transaction, a description of the goods or services provided, the quantity of goods or services provided, the price per unit, and the total amount due.

This invoice is usually presented only after a business transaction is complete.

2. Proforma invoice:

This invoice type is preliminary in nature, and is issued before the actual transaction takes place.

It is tendered to provide the prospective buyer with a detailed estimate of the cost of the goods or services they have shown interest in purchasing.

So, here’s how it usually works; a prospective client somehow finds you online or maybe through a referral and shows interest in your advertised goods and wants a large order collated and delivered in the near future.

What he requires after making his request known to you is a Proforma invoice, helping him get a sense of the overall cost, so he can plan towards the consignment or probably compare prices with the cost he got from other similar businesses.

3. Commercial invoice:

If your business requires your goods to make its way across international lines, then the type of invoice you probably need is what is called a, Commercial Invoice.

A Commercial Invoice is an invoice used in international trade, and requires more than the usual invoice details.

Additional details such as the country of origin of the goods, the harmonized system (HS) codes for the goods, and the terms of payment and delivery needs to be imputed in a Commercial Invoice to make the transaction viable.

4. Recurring invoice:

An invoice is said to be recurring, if it is issued on a regular basis, such as monthly or quarterly, for goods or services that are provided on an ongoing basis.

Take for example, you have a deal to supply 1,000 crates of eggs weekly to ShopRite for the unforeseeable future.

The type of invoice you will supply the establishment weekly is a Recurring Invoice; because like the name explains, the aforementioned transaction reoccurs every week without adjustment to the cost or quantity of the goods supplied.

5. Debit memo:

This is a type of invoice that is issued to adjust a previously issued invoice. It increases the amount owed by the buyer to the seller.

A little context here; let’s use the ShopRite analogy. ShopRite asks for 1,000 crates of eggs weekly to a seller/supplier and after a hasty management meeting, realize that they would need about 1,500 crates of eggs after all.

On contacting the seller about this new development, a debit memo invoice is issued to adjust the previous cost and increase it to the new cost.

6. Credit memo:

It is a type of invoice that is issued to adjust an invoice that has been issued before . It reduces the amount owed by the buyer to the seller.

The ShopRite analogy is still relevant here. They request for 1,000 crates of eggs to be supplied and this time after the hasty management meeting realize that they actually need only 700 crates.

The seller will send a Credit memo invoice to ShopRite, reducing the previously agreed amount invoiced.

Knowing the various types of invoice available is smart, but having a system that ensures that you can create varying invoice types at will without stress, is forward thinking.

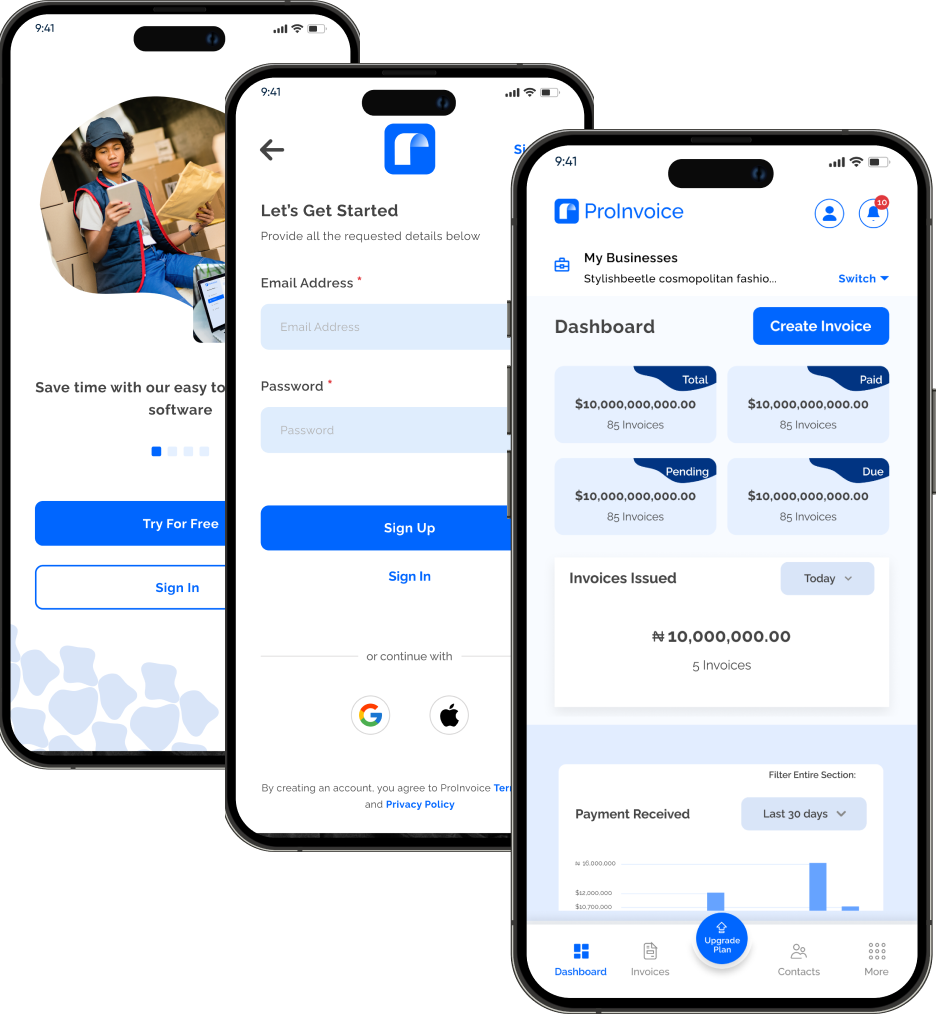

ProInvoice offers a range of professional invoice needs all on one platform.

So, the next time you are caught trying to decipher the details required for a particular invoice type, what that means is that it is time to hand that aspect of your business to a professional invoicing software platform.