Invoices are a vital part of doing business. As a business owner or freelancer, you will undoubtedly come across the term “sample invoice” at some point and need it.

It is easy to get overwhelmed by other aspects of your business operation and forget about one very important one – invoices.

In this article, we will discuss a sample invoice and answer four relevant questions about sample invoices.

What is a sample invoice?

A sample invoice is a document that outlines the details of a transaction between a buyer and a seller. It is used for keeping records and serving as confirmation of the transaction.

It helps you stay organized and documents your finances. There are four relevant areas we would be focusing on with respect to sample invoices.

- Why is a sample invoice important?

- What information should be included in a sample invoice?

- What are some benefits of using a sample invoice for your small business?

- What are the types of sample invoices we have?

Why is a sample invoice important?

A sample invoice is essential for several reasons. It is mainly used as a record of the transaction.

The invoice serves as a thorough and concise record of the transaction; thus, it should be kept by both the buyer and the seller.

The sample invoice can be used as proof to back up the seller’s claim if there is a disagreement regarding the products or services delivered or the amount owed.

Sample invoices are also required for record-keeping needs. Depending on the jurisdiction, businesses must preserve records of all transactions, including invoices, for a specific period of time.

These documents can be consulted when preparing tax returns and responding to tax authorities’ queries. Moreover, a sample invoice can be applied to taxes.

What information should be included in a sample invoice?

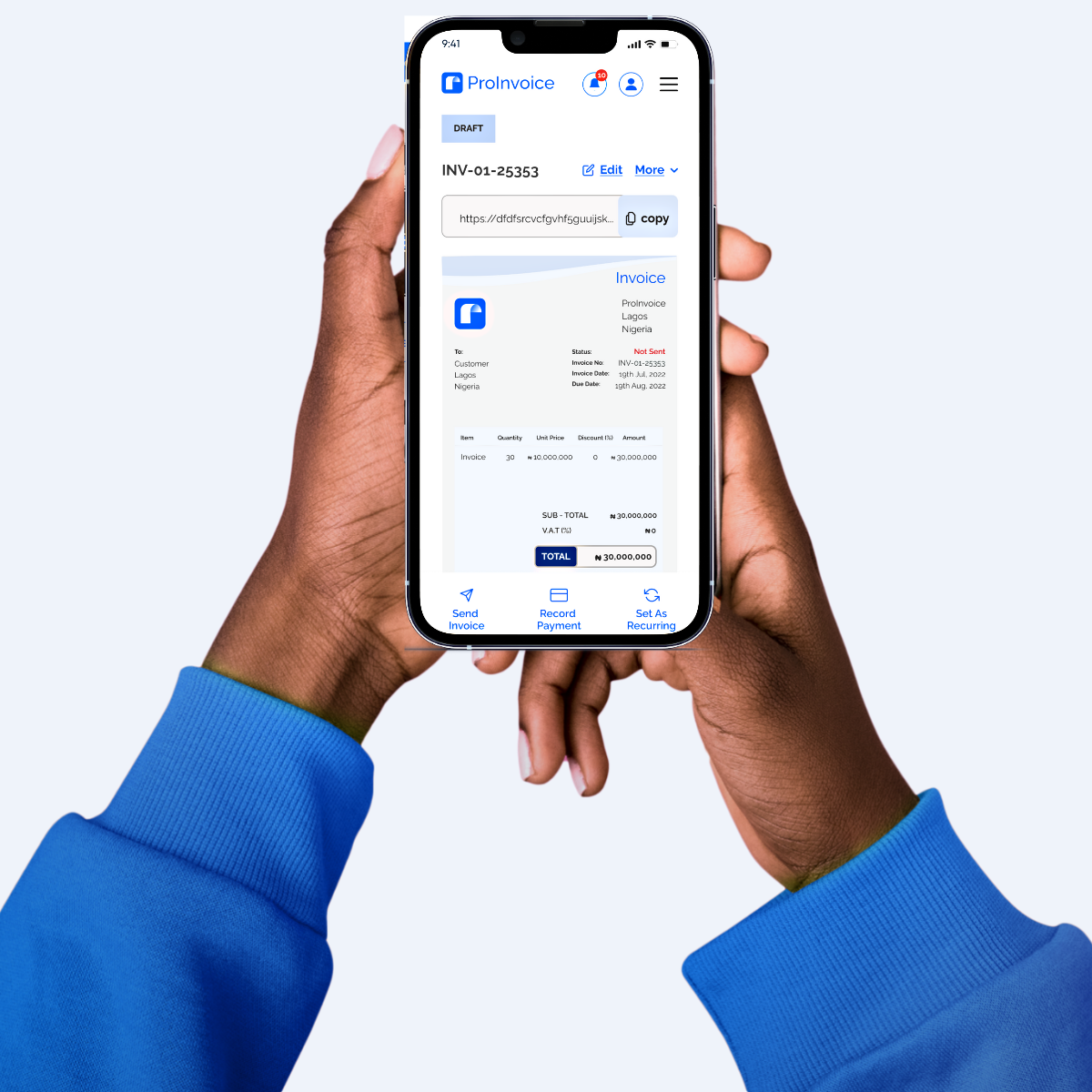

A sample invoice should represent your company, including your logo and other pertinent company details.

It should contain the precise information required to identify the transaction and make it possible for both parties to comprehend the conditions of the sale.

The following information should be included in a sample invoice;

- The name and address of the business person and end-user

- A unique invoice number

- Invoice date

- A description of the goods or services provided

- The quantity and price of the goods or services provided

- The total amount

- Discounts if any

- Applicable taxes

- Payment terms and due date.

Including all of this information ensures that the invoice is clear and concise and reduces the chance of confusion or disagreement.

The invoice should also be simple to read and understand so the client can figure out what must be paid and how to do so.

The easier clients can obtain the information they need, the cleaner the invoice seems.

What are some benefits of using a sample invoice for your small business?

As a small business owner, your role is more than providing oversight and responding to clients.

You wear several hats, and the payroll manager is probably one of them, which is where invoices come in. There are several benefits of using a sample invoice for your business, and some of them include:

- Professional appearance: Using a well-designed sample invoice, you can give your clients the impression that you are an organized business concern. This can improve your company’s standing and raise the possibility of repeat business.

- Saving time: You can save time and effort using a sample invoice rather than starting from scratch. You may rapidly create an invoice using a pre-existing template and change the details to suit your needs.

- Consistency: By using a sample invoice, you can keep the details on your invoices consistent. Errors can be avoided, and the possibility of client conflicts is decreased.

- Compliance: Using a sample invoice, you can ensure that your invoices contain all the details required by law or industry standards.

A sample invoice may be valuable for any business wanting to improve professionalism, streamline the billing process, and keep correct financial records.

What are the types of sample invoices we have?

Depending on the nature of the transaction, businesses may use several different sorts of sample invoices. The following are a few of the most typical styles of sample invoices:

1. Proforma Invoice

A proforma invoice is an estimated invoice the seller sends to the buyer before providing any goods or services.

It includes information on the expected price, the deadline for delivery, and other specifics regarding the products or services that need to be provided.

The buyer approves the proforma invoice and instructs the supplier to begin completing their portion of the deliverables.

The things that will be sold, their amount and price, the delivery date, and the shipping address are some fields listed in a proforma invoice.

It is often used for international transactions and provides the buyer with an estimate of the cost of the goods or services.

2. Standard/Regular Invoice

When we hear the word “invoice,” we typically picture this. In order to receive payment for a good or service, a standard invoice is issued to the customer.

The invoice serves as a formal transaction record once payment has been received.

It features sections for the seller’s information, the buyer’s address, the delivery date, the terms of payment, the goods prices, and the overall cost.

It also has sections the buyer can utilize to make payments, like bank information and payment links.

3. Commercial Invoice

A commercial invoice is used for international transactions and contains extra details like the sale terms and the items’ country of origin.

- Debit Memo: A debit memo is sent to clients to make changes to previous invoices and increase the total amount due by the client to the business.

It is comparable to a sales invoice, but the only distinction is that a sales invoice is sent following the sale of a good or service.

In contrast, a debit memo is provided following the adjustment of invoice totals for goods or services already sold.

Credit Memo: A credit memo is used when the seller owes the buyer money, unlike typical business transactions when the buyer pays the seller, this credit note is a letter the seller sends to the customer acknowledging the debt and granting the customer a line of credit.

The purchaser may later purchase from the same seller using the provided credits. Credit notes are usually issued when;

- The buyer wants to return a product.

- The buyer wants to cancel an

- The buyer needs to be compensated for an invoicing

- The buyer is not satisfied with a product or service.

- The seller wants to offer a discount to the buyer on their next purchase.

In conclusion, a sample invoice is a vital record utilized for tax and record-keeping purposes and serves as proof of a transaction.

Including all pertinent information when preparing a sample invoice is crucial to ensure clarity and prevent misunderstanding.