In the dynamic world of business, the question of whether to ask for an upfront payment before commencing work is one that often plagues both business owners and freelancers alike.

It’s a crucial decision that can have significant financial and operational implications, and the answer isn’t one-size-fits-all.

In this article, we’ll dive deep into the concept of upfront payments, explore the advantages and disadvantages, and provide insights to help small business owners and freelancers make an informed choice.

Understanding Upfront Payment

First and foremost, let’s define what we mean by “upfront payment.” An upfront payment, also known as an initial payment or deposit, is a sum of money that is collected from clients or customers before any actual work begins.

It serves as a financial commitment from the client, demonstrating their seriousness about the project or service.

This payment is typically a percentage of the total cost or a fixed amount agreed upon by both parties.

The Pros of Requesting Upfront Payments

Risk Mitigation: It act as a safety net for both freelancers and business owners. By securing a portion of the payment in advance, you reduce the risk of non-payment or payment delays. This is particularly important for freelancers who rely on a steady income stream.

For instance, a freelance graphic designer, after being burned by non-paying clients in the past, decides to request a 30% upfront payment from a new client. This ensures that they have funds to cover software costs and maintain cash flow during the project.

Commitment from Clients: Requesting an upfront payment isn’t just about finances; it’s also about commitment. Clients who are willing to make an initial payment are more likely to be invested in the project’s success and less likely to back out, changing their minds.

In this instance, a marketing agency, before starting a comprehensive advertising campaign for a client, asks for a 50% upfront payment. The client’s willingness to make the payment demonstrates their commitment to the campaign’s success.

Working Capital: It provides freelancers and business owners with immediate working capital. This capital can be used to cover project-related expenses, invest in business growth, and maintain cash flow, which is essential for operational stability.

For example, a web development agency collects a 50% upfront payment from a client to kickstart a website project. This payment helps cover initial design and development costs.

Industry Norms: In many industries, requesting upfront payments is not just acceptable; it’s expected. Clients and customers may be accustomed to making these payments, making it easier to incorporate into your business model.

The Cons of Requesting Upfront Payments:

Client Trust: Some clients may be hesitant to make upfront payments, especially if they are unfamiliar with your work or your reputation.

Requesting an upfront payment can sometimes be seen as a lack of trust in the client’s ability to pay upon project completion.

A freelance writer trying to secure a new client outside of the well known applications such as fiverr or upwork may face some resistance when requesting an upfront payment because the client is unfamiliar with their work and is concerned about the outcome.

Cash Flow Constraints: It can be a financial burden for some clients, especially if they are small businesses or startups with limited resources.

Insisting on a substantial upfront payment may lead potential clients to seek services elsewhere.

Complex Negotiations: Determining the right percentage for an it can be challenging.

Negotiations with clients may be required to find a suitable balance between securing your work and accommodating the client’s financial situation.

Market Competition: In highly competitive markets, clients might opt for providers who don’t require it. Being flexible in your payment terms can be a competitive advantage.

How Do You Find The Right Balance?

The decision to ask for an upfront payment should not be a one-size-fits-all approach. It requires careful consideration of the specific circumstances and the nature of the work.

Business owners and freelancers must strike a balance between securing their work, demonstrating trust in clients, and accommodating clients’ financial capabilities. This is a key freelancing tip that the top 1% freelancers use in acquiring their clients.

Useful Tips For Finding The Right balance:

Understand Your Client: Get to know your client’s financial position and their past payment history. Tailor your payment request accordingly.

Contracts and Agreements: Clearly outline payment terms in contracts and agreements. This ensures that expectations are transparent and legally binding.

Negotiate: Be open to negotiation. Discuss payment terms with clients and be willing to adapt, especially if the client demonstrates a strong commitment.

Consider Milestone Payments: If requesting a large upfront payment is not feasible, consider breaking the project into milestones and request payments upon reaching these checkpoints.

Build Trust: Invest in building trust and a strong client-provider relationship. As trust grows, clients may be more willing to make upfront payments.

FAQs

Is upfront payment a deposit?

Yes, an it is often referred to as a “deposit.”

In various business contexts, the terms “upfront payment” and “deposit” are used interchangeably to describe an initial payment made by a customer or client before receiving goods or services.

This payment serves as a commitment to secure the product or service and may be a portion of the total cost or a fixed amount agreed upon in advance.

Deposits can serve different purposes, such as reserving a product or service, demonstrating a client’s commitment, or providing the seller with financial security.

For example, in the context of renting an apartment, a security deposit is often required upfront to cover potential damages, while in the context of freelance work, a deposit may be collected to initiate a project and ensure the client’s commitment.

The specific purpose and terms of the deposit can vary depending on the industry and the nature of the transaction

Is upfront payment refundable?

Whether an upfront payment is refundable or not depends on the terms and conditions agreed upon between the parties involved, as well as the industry norms and local regulations.

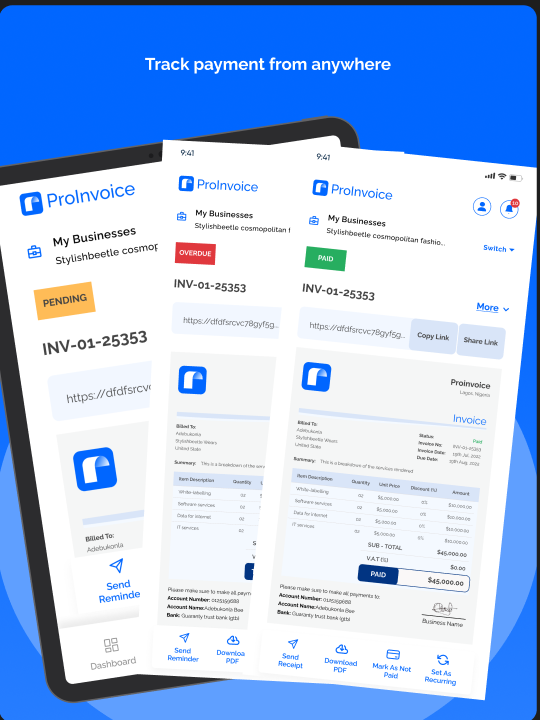

However, before sending an invoice, you and the client would have reached and agreement and the terms can be stated in clear terms in both the signed contract and the invoice for reference purposes.

Here are some common scenarios related to the ”refundability” of upfront payments:

Non-Refundable Upfront Payments

In many cases, upfront payments are non-refundable. This means that once the client or customer has made the payment, they do not have the right to request a refund, even if the product or service is not delivered or if they change their mind.

Non-refundable upfront payments are often used to secure a product or service and ensure the commitment of the client.

Refundable Upfront Payments

In some cases, businesses or service providers may offer refundable upfront payments.

These payments are typically refundable under certain conditions, such as if the product or service cannot be delivered as agreed or if the client cancels within a specified period.

The terms for refundability are usually outlined in the contract or agreement.

Partial Refundability

In some cases, upfront payments may be partially refundable. This means that only a portion of the payment is refundable, while another portion is non-refundable. The specific terms for partial refundability are outlined in the agreement.

For example, a wedding venue might request a partial upfront payment to secure a booking. If the wedding is canceled far in advance, they may refund a portion of the payment but retain a non-refundable portion for reservation costs.

It’s important for both clients and service providers to carefully review the terms and conditions associated with upfront payments before entering into an agreement.

Legal regulations and consumer protection laws may also influence the refundability of upfront payments in certain jurisdictions.

Ultimately, the refundability of an upfront payment is a matter of negotiation and agreement between the parties involved.

What is another word for upfront payment?

There are several alternative terms or phrases that can be used to refer to an upfront payment, depending on the context and the specific nature of the transaction. Some synonyms or alternative expressions for “upfront payment” include:

Advance Payment: This term implies that the payment is made in advance of receiving the goods or services.

Initial Payment: This refers to the first payment made before the work or transaction begins.

Deposit: In many cases, a deposit is an upfront payment made to secure a product or service, such as a rental deposit for an apartment or a security deposit for a rental car.

Down Payment: This is a term commonly used in the context of making an initial payment on a purchase, such as a down payment on a house or a down payment on a vehicle.

Prepayment: Prepayment refers to the act of paying for something before it is due, which is essentially an upfront payment.

Front-End Payment: This term emphasizes that the payment is made at the beginning or “front end” of the transaction.

Commencement Payment: This term indicates that the payment is made at the start or commencement of a project or service.

Retainer: In some professional services, like legal or consulting services, an upfront payment is often referred to as a retainer, which is a fee paid to secure ongoing services.

Advance Fee: This term is commonly used in situations where a fee is charged in advance of a service, such as an advance fee for a credit application.

Initial Installment: This phrase suggests that the payment is the first installment in a series of payments, often used in installment payment plans.

The choice of synonym depends on the specific transaction and industry. Each of these terms can be used to describe an upfront payment made before receiving goods, services, or entering into an agreement.

In conclusion, whether to ask for an upfront payment before starting work is a decision that requires careful consideration and a case-by-case approach.

By understanding the advantages and disadvantages, negotiating with clients, and tailoring your approach to the specific context, you can strike the right balance that ensures your financial security while fostering trust and positive client relationships.

Remember, the key to success is finding the approach that works best for both you and your clients