Access to credit shouldn’t require jumping through endless hoops or putting up valuable assets as security. For Nigerian freelancers, entrepreneurs, and individuals facing urgent financial needs, digital lending platforms have revolutionized how quickly you can secure funds—often within minutes, with no collateral required. Learn about the top 12 websites that give quick loans without collateral in Nigeria.

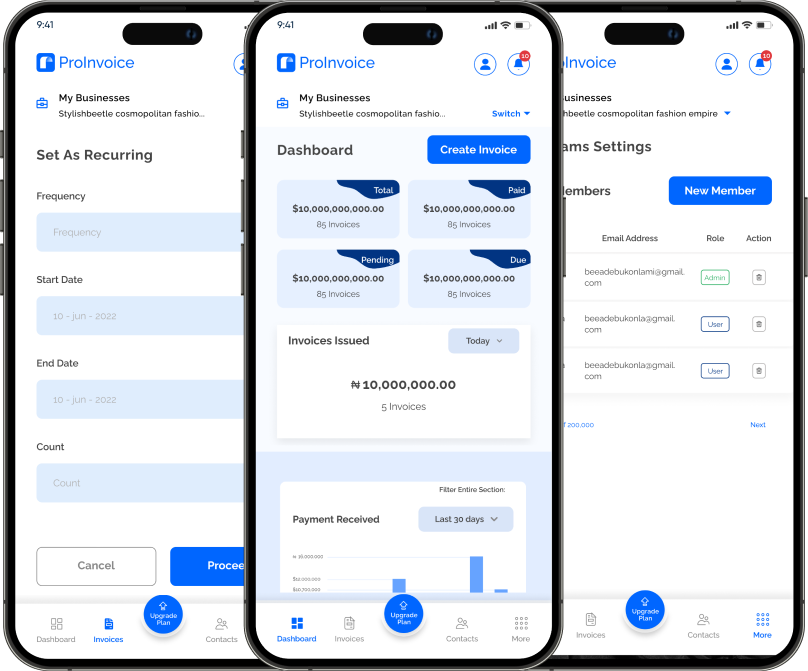

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

This guide explores 12 reliable platforms offering fast, unsecured loans in Nigeria, helping you make informed decisions about your financial options.

Why Choose Collateral-Free Loans?

Traditional bank loans often demand property deeds, vehicle titles, or other valuable assets as security. Digital lending platforms have eliminated this barrier by using alternative credit assessment methods, including transaction history, behavioral data, and machine learning algorithms to evaluate creditworthiness.

Top 12 Platforms for Quick Loans Without Collateral in Nigeria

1. Carbon (formerly Paylater)

As one of Nigeria’s pioneering digital lenders, Carbon has built a reputation for reliability and speed. Their mobile-first approach makes loan applications remarkably straightforward.

What You Get:

- Loan range: ₦1,500 to over ₦1 million

- No collateral or paperwork required

- Disbursement within minutes

- Competitive interest rates based on credit history

- Additional features like bill payments and investments

Best For: Users seeking larger loan amounts with established credit history

2. Branch

Branch stands out for its transparency and user-friendly interface. The platform eliminates hidden fees and provides clear terms upfront.

What You Get:

- Loan amounts up to ₦500,000

- Flexible repayment schedules (9 to 68 weeks)

- No hidden charges

- Credit limit increases over time with good repayment behavior

Best For: First-time borrowers who value transparency

3. FairMoney

FairMoney combines speed with accessibility, offering one of the most intuitive mobile experiences in the Nigerian lending space.

What You Get:

- Loans up to ₦1 million

- Zero collateral requirement

- Competitive interest rates starting from 5% per month

- Quick approval process with instant disbursement

Best For: Users needing mid-to-large loan amounts quickly

4. PalmCredit

Specializing in micro-loans, PalmCredit is ideal for smaller, short-term financial needs with hassle-free applications.

What You Get:

- Loan range: ₦2,000 to ₦100,000

- Instant approval for eligible applicants

- Simple repayment structure

- User-friendly mobile interface

Best For: Emergency micro-financing and first-time digital borrowers

5. Aella Credit

Aella Credit focuses on serving both salaried employees and entrepreneurs, with partnerships across multiple Nigerian employers.

What You Get:

- Loans from ₦1,500 to ₦1 million

- Rapid disbursement (often same-day)

- Completely paperless process

- Salary advance options for partnered employees

Best For: Employed individuals and small business owners

6. QuickCheck

Leveraging advanced machine learning, QuickCheck offers personalized loan offers based on sophisticated credit analysis.

What You Get:

- Instant loan decisions powered by AI

- Minimal application requirements

- Customized loan amounts based on individual profiles

- Growing credit limits with consistent repayment

Best For: Tech-savvy users comfortable with AI-driven assessments

7. Renmoney

For those needing substantial amounts, Renmoney offers some of the highest loan limits in the Nigerian digital lending market.

What You Get:

- Loan amounts up to ₦6 million

- No security required

- Flexible repayment terms (up to 24 months)

- Online and offline application options

Best For: Business owners needing significant capital injection

8. Okash (OPay Loans)

Integrated within the OPay ecosystem, Okash provides seamless access to micro-loans for OPay users.

What You Get:

- Loan range: ₦3,000 to ₦500,000

- Variable tenures from 91 to 365 days

- Instant disbursement to OPay wallet

- Integration with OPay’s broader financial services

Best For: Existing OPay users seeking convenient access

9. KiaKia

Operating as a peer-to-peer lending platform, KiaKia connects borrowers with individual and institutional lenders.

What You Get:

- AI-powered credit assessment

- Personalized loan offers based on credit profile

- Competitive rates through marketplace competition

- Fast response times

Best For: Users with strong credit history seeking competitive rates

10. SokoLoan

SokoLoan focuses on accessibility, providing micro-loans with minimal barriers to entry.

What You Get:

- Small loan amounts with rapid processing

- Straightforward mobile application

- Flexible repayment terms

- Progressive credit limit increases

Best For: Quick access to small amounts for urgent needs

11. Lidya

Specifically designed for businesses, Lidya understands the unique challenges facing Nigerian SMEs and entrepreneurs.

What You Get:

- Business-focused loan products

- Streamlined online application

- No collateral or complex paperwork

- Working capital solutions tailored to business cycles

Best For: Small business owners and entrepreneurs seeking business capital

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

12. Specta by Sterling Bank

Backed by Sterling Bank’s infrastructure, Specta offers the security of traditional banking with digital convenience.

What You Get:

- Loans up to ₦5 million

- Zero collateral requirement

- Quick digital application and approval

- Bank-backed reliability and security

Best For: Users seeking higher loan amounts with institutional backing

Smart Borrowing: Essential Tips

Before applying for any loan, consider these important factors:

Assess Your Need: Borrow only what you genuinely need and can comfortably repay. Emergency expenses differ from business capital requirements.

Compare Interest Rates: Rates vary significantly across platforms. A few percentage points can mean substantial differences over your repayment period.

Understand Repayment Terms: Check whether the platform offers flexibility in repayment schedules and what penalties apply for late payments.

Read the Fine Print: Look for hidden charges, processing fees, or insurance requirements that might increase your total cost.

Build Your Credit Profile: Start with smaller loans and maintain excellent repayment records to access larger amounts at better rates over time.

Have a Repayment Plan: Before borrowing, clearly outline how you’ll repay the loan. Missed payments damage your credit score and limit future access.

Managing Your Business Finances

While quick loans can solve immediate cash flow challenges, maintaining organized financial records is equally crucial for long-term success. Professional invoicing, payment tracking, and cash flow management help you stay on top of your finances and reduce the need for emergency borrowing.

Tools like ProInvoice can help freelancers and small businesses create professional invoices, track payments, and maintain clear financial documentation—essential elements for both daily operations and future credit applications.

Final Thoughts

Nigeria’s digital lending landscape has democratized access to credit, making it possible for millions to secure funds without traditional collateral. Whether you’re facing an emergency, need business capital, or want to bridge a temporary cash gap, these platforms offer viable solutions.

Remember that responsible borrowing starts with understanding your needs, comparing options carefully, and having a solid repayment plan. Used wisely, these platforms can be powerful tools for financial flexibility and growth.

Ready to take control of your business finances? Consider implementing proper invoicing and financial tracking systems to complement your funding strategy and build a stronger financial foundation.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.