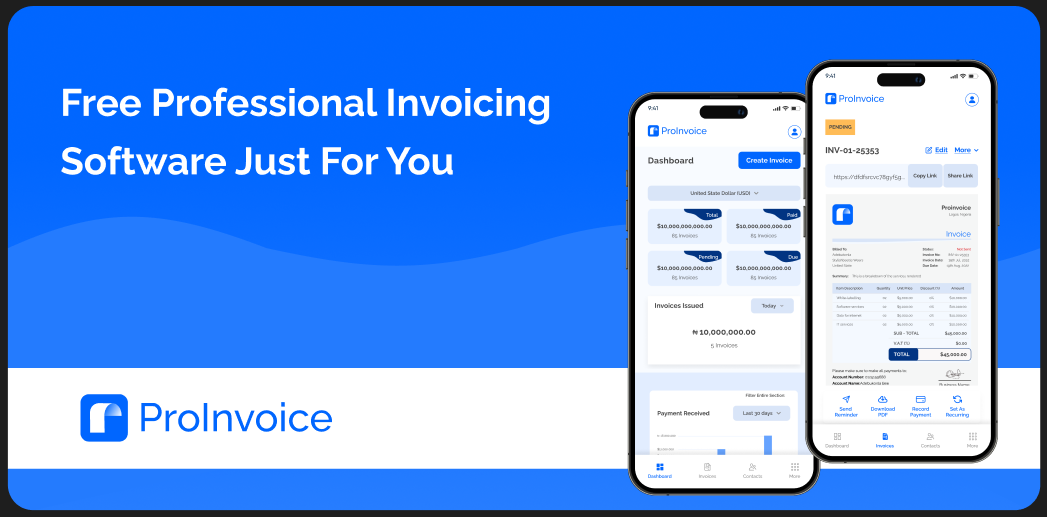

Small and medium-sized enterprises (SMEs) play a vital role in the economies of Kenya and Ghana. However, many of these businesses struggle with invoicing, payment tracking, and financial organization. As competition increases and compliance requirements grow, SMEs need reliable digital tools to stay efficient and professional.

This is exactly why ProInvoice for SMEs has become a preferred invoicing solution for businesses across Kenya and Ghana. By simplifying billing, automating processes, and improving visibility into cash flow, ProInvoice helps SMEs grow faster and operate smarter.

This guide explains in detail why ProInvoice is ideal for SMEs in Kenya and Ghana and how it supports daily business operations, long-term growth, and financial compliance.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

The Invoicing Challenges SMEs Face in Kenya and Ghana

Before choosing the right invoicing tool, it is important to understand the common challenges SMEs face in both countries.

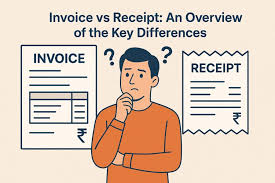

Many businesses still rely on:

- Manual invoicing

- Paper receipts

- Spreadsheets

- Disconnected billing records

As a result, SMEs often experience:

- Late payments

- Invoicing errors

- Poor cash flow visibility

- Lost records

- Difficulty preparing for audits

Fortunately, ProInvoice for SMEs addresses these challenges directly.

What Makes ProInvoice Different for SMEs?

Unlike generic invoicing tools, ProInvoice is built with African SMEs in mind. It focuses on simplicity, speed, and flexibility—features that small businesses truly need.

ProInvoice helps SMEs:

- Create professional invoices quickly

- Track payments in real time

- Maintain accurate records

- Invoice clients on the go

- Present a credible brand image

Professional Invoicing That Builds Trust

First impressions matter. When SMEs send poorly formatted or inconsistent invoices, clients may question their professionalism.

With ProInvoice, SMEs can:

- Create clean, branded invoices

- Maintain consistent invoice formats

- Present clear payment terms

Professional invoices improve credibility and make clients more confident about paying on time.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

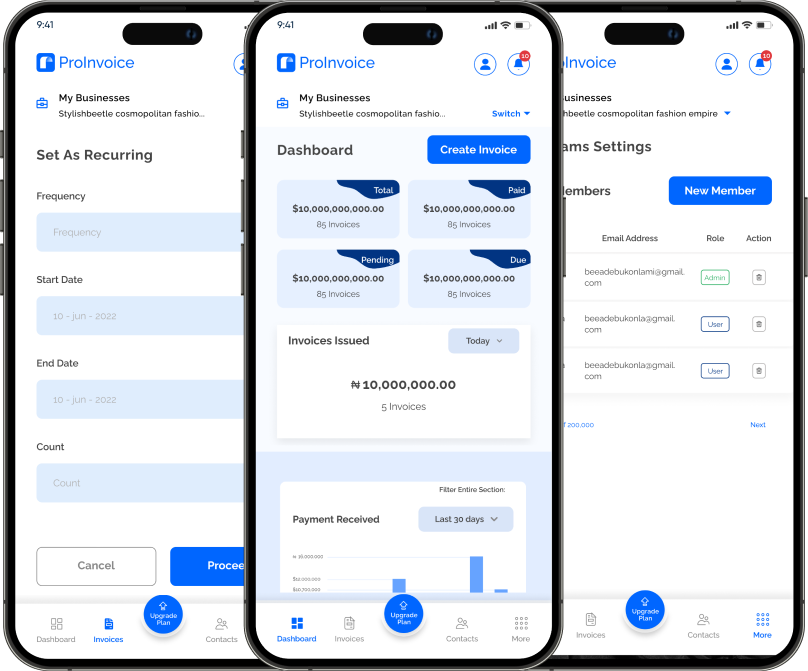

Easy Invoice Creation for Busy Business Owners

Time is valuable for SME owners. ProInvoice simplifies invoice creation by providing ready-to-use tools that reduce manual work.

Using ProInvoice, businesses can:

- Generate invoices in minutes

- Reuse client details automatically

- Avoid repetitive data entry

Additionally, SMEs can access free invoice templates that make invoicing faster and more accurate.

Faster Payments Through Clear Billing

Delayed payments hurt small businesses the most. ProInvoice for SMEs helps reduce payment delays by ensuring invoices are clear, timely, and easy to understand.

With ProInvoice, businesses can:

- Clearly display payment terms

- Send invoices immediately after service delivery

- Track overdue invoices easily

As a result, SMEs experience improved cash flow and fewer follow-ups.

Real-Time Payment Tracking

One of the biggest advantages of ProInvoice is real-time payment visibility.

Instead of guessing who has paid and who hasn’t, SMEs can:

- See invoice statuses instantly

- Identify unpaid invoices

- Monitor payment trends

This level of clarity allows business owners to make better financial decisions.

Mobile Invoicing for Flexible Businesses

Many SMEs in Kenya and Ghana operate outside traditional offices. Field teams, freelancers, and service providers need invoicing tools that move with them.

The ProInvoice mobile app allows SMEs to:

- Create invoices from anywhere

- Send invoices instantly

- Track payments on the go

This flexibility is especially valuable for businesses that operate remotely or across multiple locations.

Simplified Record-Keeping for Compliance

As tax regulations evolve, proper documentation is becoming increasingly important. Digital record-keeping ensures SMEs stay prepared.

ProInvoice stores:

- Invoice histories

- Client records

- Payment data securely

These records make audits, tax filings, and financial reviews much easier.

Better Cash Flow Management

Cash flow is the lifeblood of SMEs. ProInvoice for SMEs helps business owners understand and manage their cash flow more effectively.

Using ProInvoice, SMEs can:

- Track incoming payments

- Identify revenue gaps

- Plan expenses better

Improved cash flow visibility supports stability and growth.

Ideal for Growing SMEs

As businesses grow, manual systems quickly become inefficient. ProInvoice scales easily with SMEs as they expand.

Whether a business:

- Adds new clients

- Expands services

- Hires more staff

ProInvoice adapts without adding complexity.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Supports Freelancers and Small Teams

Not all SMEs are large organizations. Many are freelancers or small teams managing multiple clients.

ProInvoice supports:

- Multiple clients

- Multiple invoices

- Repeat billing

This makes it ideal for consultants, creatives, and service providers in Kenya and Ghana.

Reduces Administrative Work

Manual billing consumes time and energy. ProInvoice automates many repetitive tasks.

Automation helps SMEs:

- Reduce paperwork

- Minimize errors

- Focus on core business activities

Less admin work means more time for growth.

Free Tools to Get Started Easily

Many SMEs hesitate to adopt digital tools due to cost concerns. ProInvoice removes this barrier by offering free options.

Businesses can start with the free invoice generator and upgrade as needed.

This makes digital invoicing accessible to businesses of all sizes.

Improves Client Relationships

Clear, timely invoicing improves communication with clients.

ProInvoice helps SMEs:

- Avoid billing disputes

- Maintain transparency

- Build long-term client trust

Strong relationships lead to repeat business and referrals.

Secure and Reliable Data Storage

Data security matters. ProInvoice stores billing information securely, reducing the risk of data loss.

Cloud-based storage ensures:

- Access anytime

- Safe backups

- Protection from physical damage

This reliability gives SMEs peace of mind.

Easy Adoption with Minimal Training

ProInvoice is designed for ease of use. Even business owners with limited technical skills can start quickly.

Its intuitive interface ensures:

- Quick onboarding

- Minimal training

- Smooth daily use

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Why SMEs in Kenya and Ghana Choose ProInvoice

SMEs choose ProInvoice because it:

- Solves real invoicing problems

- Fits local business needs

- Supports growth

- Improves professionalism

It is not just an invoicing tool—it is a business support system.

Final Thoughts

In today’s competitive environment, SMEs must work smarter to survive and grow. Choosing the right invoicing solution makes a significant difference.

ProInvoice for SMEs provides Kenyan and Ghanaian businesses with the tools they need to invoice professionally, manage cash flow efficiently, and maintain financial transparency.

By adopting ProInvoice, SMEs can reduce stress, improve operations, and focus on what truly matters—growing their business.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!