Best Online Loan Apps in Nigeria: Quick Access to Funds Without Hassle

Best Online Loan Apps in Nigeria: Quick Access to Funds Without Hassle: Financial emergencies don’t wait for payday. Whether you need funds for business expansion, medical bills, or unexpected expenses, online loan apps in Nigeria offer quick solutions without traditional banking hassles. This guide reviews the best online loan apps in Nigeria to help you secure instant […]

A Simple Invoice Example

Introduction Running a service-based business—whether you’re a designer, consultant, digital marketer, writer, event planner, or coach—means you’re constantly delivering value through your skills. But after the service is rendered, one important thing remains: getting paid. To make this easier, a simple invoice example can help you create clear and professional billing documents that ensure timely payment […]

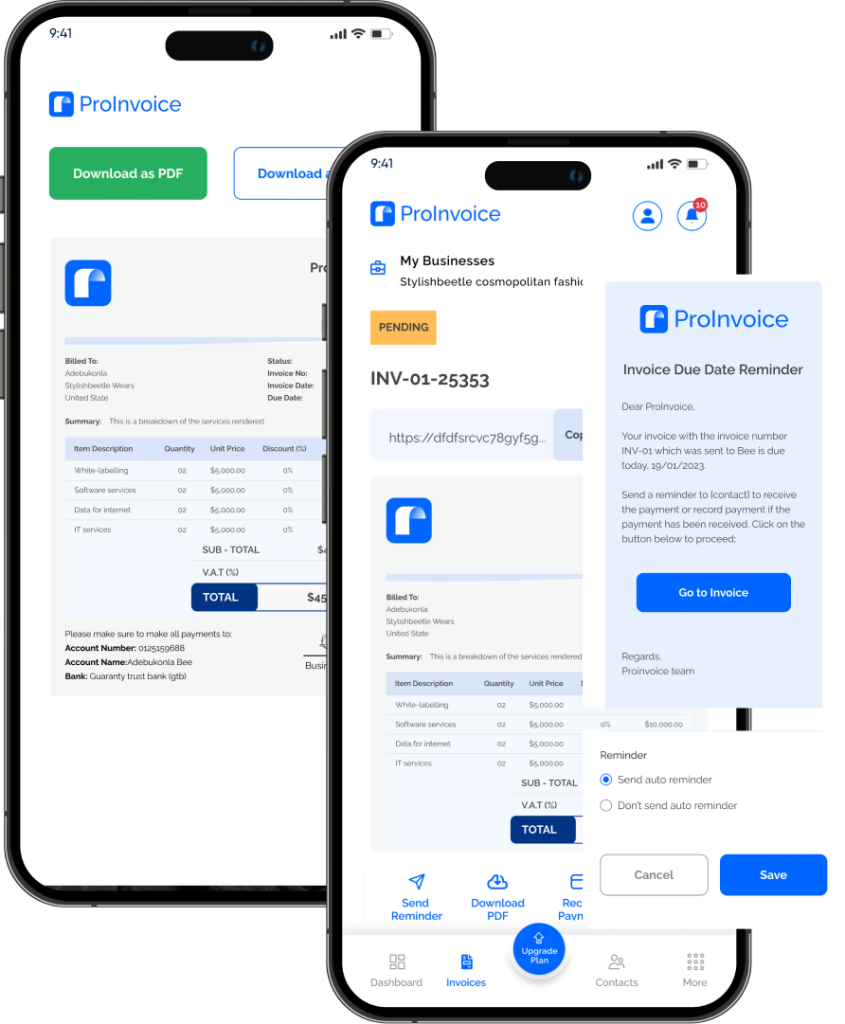

Creating an Invoice for Freelancers: What You Must Include.

Introduction As a freelancer, your work may speak for itself—but your payment depends on something else entirely: your invoice. Creating an invoice for freelancers isn’t just about requesting payment; it’s about building trust and showcasing your professionalism. Whether you’re a writer, designer, consultant, or social media manager, your invoice is a financial document that represents your […]

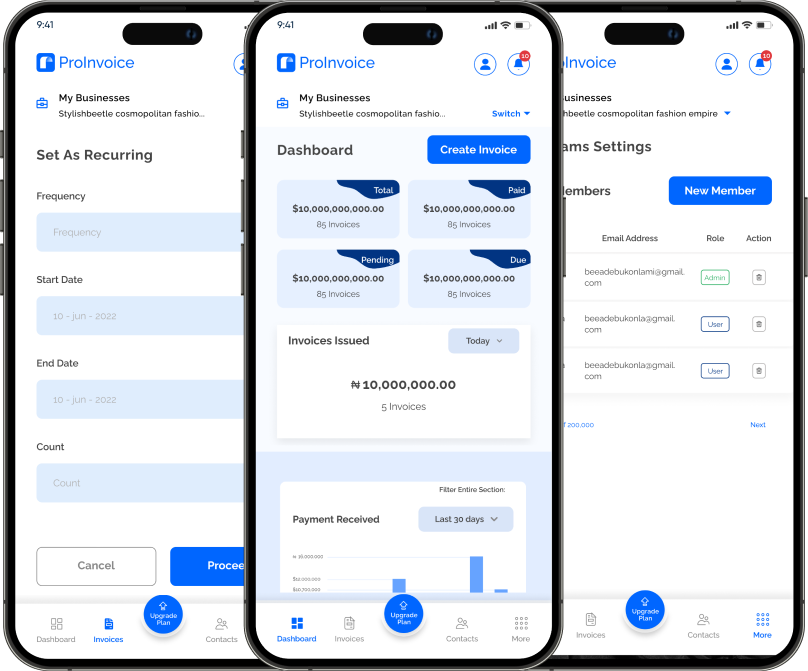

Using an Online Invoice Template vs. Manual Invoicing: Pros and Cons.

When it comes to getting paid, invoicing is non-negotiable. But how you create and send invoices can dramatically affect your time, professionalism, and cash flow. Traditionally, many small businesses and freelancers have relied on manual invoicing—crafting bills from scratch using Word documents, Excel spreadsheets, or even handwritten notes. However, the rise of digital tools like ProInvoice has […]

Businesses You Can Start in Nigeria With 500k–6 Million

Keyphrase: Businesses You Can Start in Nigeria With 500k–6 Million, Free Invoice Online, Online Businesses, snail farming in Nigeria Nigeria’s entrepreneurial landscape is bursting with opportunities for ambitious individuals ready to transform their capital into thriving enterprises. Whether you’re sitting on ₦500,000 or have access to ₦6 million, the Nigerian market offers diverse pathways to […]

The Role of Invoicing in Building Strong Client Relationships and Customer Loyalty

1. Introduction: Why Invoicing Is More Than Just Billing Invoicing is traditionally viewed as a backend process—something that merely facilitates payment for products or services. However, in today’s service-driven economy, invoicing has evolved into a vital communication tool that plays a significant role in client satisfaction, trust, and loyalty. A well-crafted, timely invoice can reinforce […]

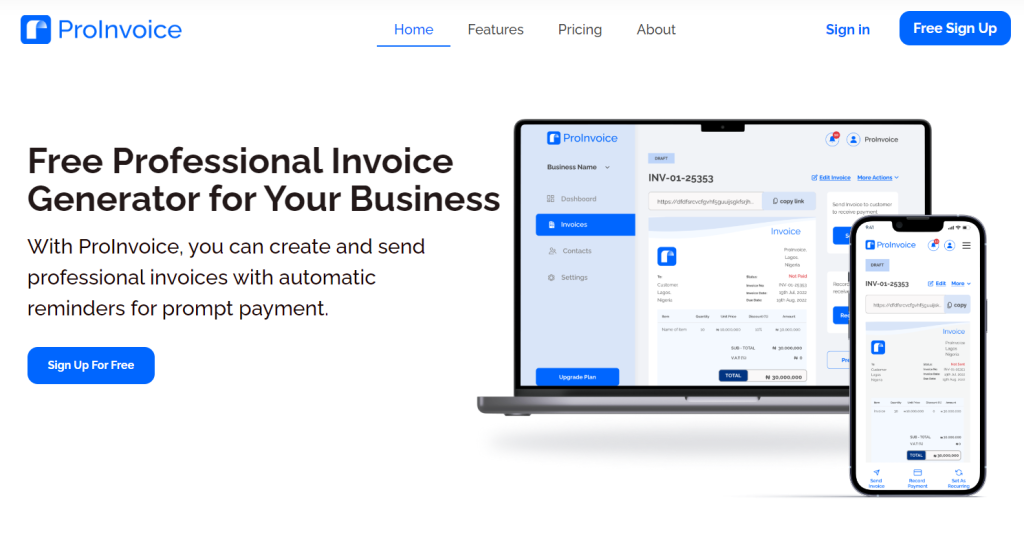

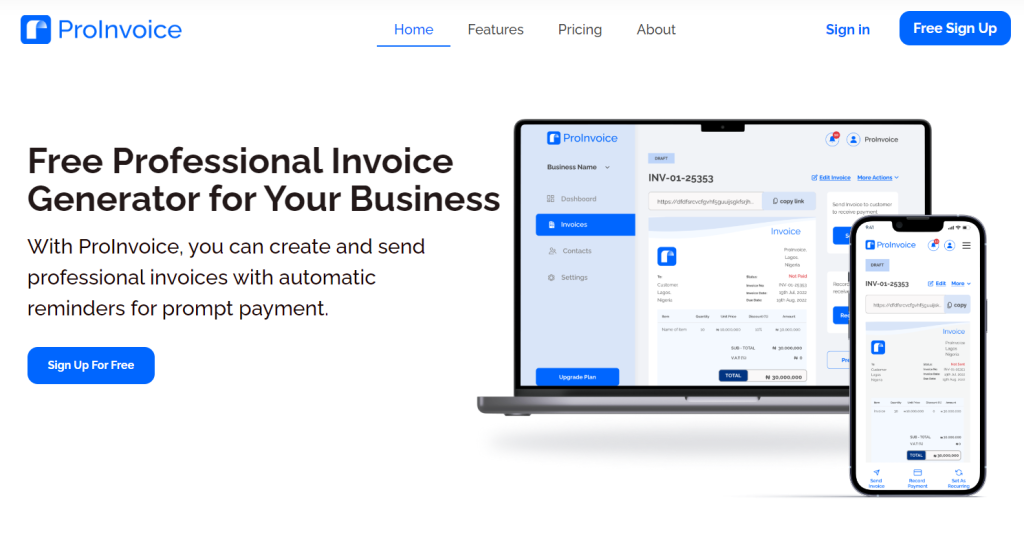

Free Invoicing Software That Works for You.

Introduction 1. Discover the Power of Free Invoicing Software for Your Business Running a business requires efficiency, accuracy, and most importantly, tools that help you get paid faster. This is where free invoicing software becomes essential. Whether you are a freelancer, startup, or small business owner, having the right invoicing tool can streamline your workflow […]

Professional Invoice Template Free Download for Seamless Billing.

In today’s fast-paced business world, creating and managing invoices manually can be both time-consuming and error-prone. That is why small businesses, freelancers, and professionals are turning to ProInvoice, the trusted online solution for hassle-free invoicing. With ProInvoice’s invoice template free download, you get professionally designed invoice formats that simplify billing and help you look more credible in front […]

Discover the Best Free Online Invoice App for Businesses.

In today’s digital age, businesses need smart solutions to stay efficient and competitive. Whether you run a freelance gig, a startup, or a growing small business, managing invoices is keyto smooth operations. A reliable free online invoice app not only saves time but also ensures that your billing is accurate and professional. That is where ProInvoice comes in. With its […]

Create Invoices Effortlessly with Invoice Template from ProInvoice.

Every freelancer, small business owner, and entrepreneur knows how important it is to send invoices that are not just professional but also quick to create. With the right tools, like a free invoice template, you can save time, impress clients, and track your finances more efficiently. ProInvoice provides an intuitive and powerful platform that lets you generate […]