Digital billing systems for SMEs are quickly replacing paper-based invoicing across Kenya and Ghana. While many small and medium-sized businesses still rely on handwritten invoices or spreadsheets, these outdated methods slow payments, increase errors, and limit growth.

Today, SMEs that switch from paper to digital billing gain faster payments, better cash flow visibility, and stronger customer trust. More importantly, modern invoicing tools make the transition simple, affordable, and highly effective.

This guide explains how Kenyan and Ghanaian SMEs can upgrade their billing systems, why digital invoicing matters, and how the right tools make the transition seamless.

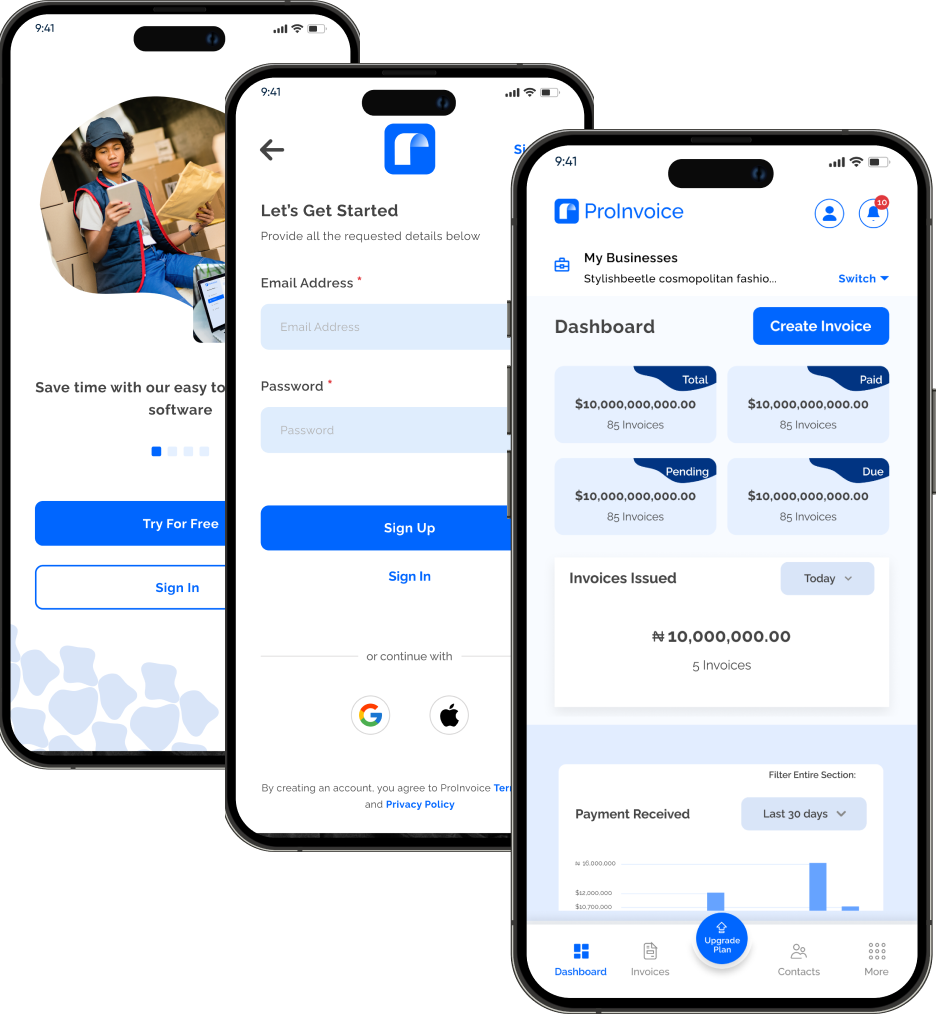

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Why Paper-Based Billing Is Holding SMEs Back

Paper invoicing once served businesses well. However, as markets become more competitive, paper billing creates more problems than solutions.

First, paper invoices delay payments. When invoices are written manually, they take longer to prepare, send, and process. Consequently, payment cycles stretch unnecessarily.

Second, paper billing increases errors. Missing figures, incorrect totals, and illegible handwriting often cause disputes. As a result, clients delay payments while seeking clarification.

Third, paper records are difficult to track. SMEs struggle to know which invoices are paid, unpaid, or overdue. Over time, this lack of visibility damages cash flow.

Because of these challenges, digital billing systems for SMEs are no longer optional—they are essential.

What Digital Billing Systems Mean for SMEs

Digital billing systems replace manual invoicing with automated, cloud-based tools. Instead of writing invoices on paper, businesses create, send, and track invoices online.

With platforms like ProInvoice, SMEs can generate professional invoices in minutes, store records securely, and monitor payments in real time.

Additionally, businesses that are transitioning gradually can start with a free invoice generator to experience the benefits without upfront costs.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

Key Benefits of Digital Billing Systems for SMEs

Faster Invoice Creation and Delivery

Digital billing systems dramatically reduce the time required to invoice customers. Instead of spending hours writing or formatting invoices, SMEs can create invoices instantly.

Because invoices are sent digitally, customers receive them immediately. Therefore, payment timelines begin sooner, which directly improves cash flow.

Improved Cash Flow Management

One of the strongest advantages of digital billing systems for SMEs is improved cash flow visibility.

Businesses can instantly see:

- Paid invoices

- Unpaid invoices

- Overdue invoices

- Total outstanding revenue

This clarity allows SMEs in Kenya and Ghana to plan expenses, manage suppliers, and make confident business decisions.

Reduced Errors and Disputes

Manual billing leads to mistakes. Digital billing systems eliminate this risk by automating calculations and reusing accurate templates.

SMEs can also rely on free invoice templates to ensure consistency and professionalism across every invoice.

As errors decrease, disputes reduce. Consequently, payments arrive faster.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

How Digital Billing Systems Improve Professional Image

Professional presentation matters. Clients are more likely to trust businesses that send clean, branded invoices.

Digital billing systems allow SMEs to:

- Add logos

- Maintain consistent formatting

- Include clear payment terms

When businesses use tools like ProInvoice, invoices look polished and credible. As a result, customers take payments more seriously.

Transitioning from Paper to Digital Billing Step by Step

Switching from paper invoicing does not need to be overwhelming. SMEs can transition smoothly by following these steps.

Step 1: Assess Current Billing Processes

Businesses should identify how invoices are currently created, sent, and stored. This helps highlight inefficiencies.

Step 2: Choose a Digital Billing Tool

Select a tool that matches business size and needs. Platforms like ProInvoice are designed specifically for growing businesses.

Step 3: Start with Templates

Using ready-made invoice templates simplifies the transition and reduces errors immediately.

Step 4: Train Staff or Team Members

Digital tools are only effective when everyone understands how to use them. Fortunately, modern invoicing platforms are intuitive.

Why Mobile Billing Is Crucial for Kenyan and Ghanaian SMEs

Many SMEs operate on the move. Business owners meet clients, supervise projects, and deliver services outside the office.

Digital billing systems with mobile access allow invoices to be created immediately after service delivery. With the ProInvoice mobile app, businesses can invoice clients from anywhere.

As a result, invoicing happens faster, and payments follow sooner.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

How Automation Strengthens Billing Efficiency

Automation is one of the biggest advantages of digital billing systems for SMEs.

Automated features include:

- Saved client details

- Reusable invoice templates

- Automatic totals

- Payment reminders

Because reminders are automated, SMEs no longer need to chase payments manually. This saves time and preserves customer relationships.

Supporting Business Growth with Digital Billing Systems

As SMEs grow, billing complexity increases. Managing multiple clients, services, and payment schedules becomes challenging with paper invoices.

Digital billing systems scale effortlessly. Businesses can handle more clients without losing control or accuracy.

Moreover, invoice history stored digitally helps SMEs analyze revenue trends and identify growth opportunities.

Compliance and Record-Keeping Benefits

Accurate records are essential for audits and tax compliance. Digital billing systems automatically store invoices securely.

SMEs can retrieve records instantly when needed, reducing stress during audits or financial reviews.

Businesses in Kenya and Ghana should always align invoicing practices with guidance from:

- Kenya Revenue Authority (KRA)

- Ghana Revenue Authority (GRA)

Digital invoicing supports transparency and accountability.

Cost Efficiency of Digital Billing Systems

Contrary to common belief, digital billing systems are affordable. In fact, they reduce costs over time by:

- Eliminating printing expenses

- Reducing administrative labor

- Preventing revenue leakage

SMEs can even start with free tools before upgrading as they grow.

Why Now Is the Best Time to Go Digital

The business environment is becoming increasingly digital. Clients expect fast communication, clear documentation, and professional service.

SMEs that delay digital transformation risk falling behind competitors who already enjoy faster payments and better cash flow.

Digital billing systems for SMEs are no longer future tools—they are present-day necessities.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Final Thoughts: Upgrading Billing Systems Is a Growth Decision

Moving from paper to digital billing is not just an operational change—it is a strategic decision. SMEs in Kenya and Ghana that adopt digital billing systems improve efficiency, professionalism, and financial stability.

By using tools like ProInvoice, businesses can upgrade their billing processes without complexity or high costs.

Ultimately, digital billing systems empower SMEs to get paid faster, manage finances better, and grow with confidence.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.