If you looking to learn how to generate a professional looking invoices as a freelancer, entrepreneur or Small business owner, this article is for you.

According to a report by Brodmin, by 2027, the online invoicing market will hit and surpass $24.7 billion. An understandable and accurate invoice helps to sustain business processes for a business owner and aids easy and fast payment for the receiver.

It reflects brand equity and professionalism, which allows business owners to retain more clients.

Contrarily, incorrect invoices often confuse customers, reduce their desire to do business transactions with you, and result in payment interruptions, ultimately hurting your revenue flow.

It’s critical to know how invoices function. Manual invoice creation is becoming a thing of the past.

Honestly, manual processes are becoming a thing of the past because of the increasing technological innovations.

However, regarding e-invoicing, there is an easy way to generate professional looking invoices.

So, without further ado, this article will discuss ways to generate an invoice, why you should consider going digital with invoicing, and best practices for timely payments.

Guide to creating professional looking invoices

To generate an invoice flawlessly, follow the steps below:

Step 1 – Enter organization details

As the first step, begin by inputting the information below at the top of your invoice page:

- Your organization’s name, contact details, and address

- Your customer’s company name and address

- Name, contact details, and your client’s verified email address

In addition, include your company’s logo at the top of your invoice and change the fonts and colors to your brand’s pattern. That will go a long way to making your invoice look more exquisite, which would assist in making client engagement efficient.

Step 2 – Tag your invoice and include the dates

Your customer is interacting with others, not just with you alone. By clearly labeling your invoice with “invoice” above the page, you can avoid getting it misplaced or skipped in your client’s inbox.

Don’t forget to include an exclusive billing number. That aids in organizing and identifying your invoices, which could be useful if you frequently charge a customer for similar products.

Although using a number label (beginning with #0001 and gradually working chronologically) is the simplest, using an alphanumeric code also works well.

It’s crucial to maintain your labeling system consistently.

After that, the next thing to do is to enter the invoice’s payment deadline and date.

The invoice date will remind the receiver when the job was finished or when items were delivered, whereas the payment deadline date is self-explanatory.

If your company uses those terms, this date also marks the beginning of any net-30 payment conditions.

Step 3 – Give a detailed summary of the products and services

In this part, you’ll outline everything your customer is paying for. Without this list, a receiver uncertain about the bill description might refuse to cover the invoice with no further explanation, which can cause a delayed payment.

For every line item, your invoice needs to include the information below:

- The given service or item

- The amount of time spent on the items delivered

- Hourly amount or item-specific cost (if applicable)

There is more clarity regarding the project’s scope and charges thanks to the line item’s succinct descriptions.

For instance, a marketing firm might decide to divide its monthly commission cost into terms like “10 Instagram video captions” and “Instagram ad management for February 2022.”

Step 4 – Calculate the costs and the overall amount due

Include fees separately in line items in your invoice if you intend to include fees, sale taxes, service fees, or discounts.

List the final figure near the foot of your invoice after adding the fees and subtotal. Use bold fonts or enlarge the font size to make the total amount easy to find since you want it to be clearly displayed.

Step 5 – Include footnotes, instructions, and payment conditions

Include instructions on how your client should pay the bill and any consequences attached to late payments.

This section will serve as a gentle reminder that both of you have already reached an agreement on the payment conditions.

You can include a special message for the receiver here as well. Thanking your clients for their patronage is crucial because they are the backbone of your brand.

You might also want to add more information here, like:

- Money-back guarantees or warranty

- Policies for exchanges and returns

- Details about your referral initiative

- Future updates on sales or promotions

Step 6 – Review the information twice before sending

Invoice errors can cause payment delays and give you a poor professional look.

Therefore, please spend some time making sure the information is accurate before sending them.

Review the file as the client would. That will assist you in identifying formatting errors.

Why Use a Digital Software to create professional looking invoices?

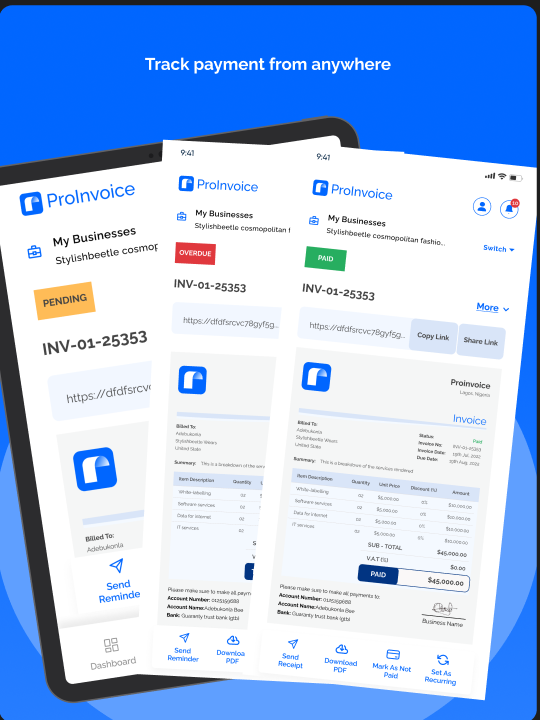

Online invoicing software can significantly lessen the risk of human mistakes while assisting you in producing professional looking invoices from virtually anywhere.

Also, it only takes some steps to submit invoices online and seconds to get payments instantly with effective online invoicing software.

It makes it much easier for your company to join the global market because it allows your customers to choose their preferred language and currency.

Online invoicing software generally has many benefits, from guaranteeing accurate invoices to promoting good brand support.

Top Digital Invoicing Practices for Timely Payments

Want to make timely invoice payments? Consider these:

i. Invoice as fast as you can

To save time, some business owners produce and distribute invoices only at the end of each month or once a week; however, if your business runs out of money between these invoice batches, that could seriously affect your cash flow.

Additionally, suppose an excessive amount of time elapses between when you fulfill your contract’s requirements and when you invoice.

In that case, your customer may have forgotten entirely about the terms of your agreement. Sending invoices before the contract/business transaction elapses will help you prevent this.

That guarantees that you receive payment as quickly as possible.

ii. Offer a range of payment options

Giving clients a choice of payment options increases their flexibility, establishes you as a simple business, and speeds up the payment process.

Businesses have typically used bank transfers or paper checks to pay bills. Companies now offer various payment methods, including PayPal, Stripe, credit cards, Payoneer, and Apple Pay.

Although you might have to pay a small amount in processing fees, the quick money delivery and immediate feedback these methods provide might be worth the extra cost.

iii. Leverage free invoice generators and templates

ProInvoice uses a simple template-based method. All you should do is enter the necessary data, and the software will populate a pre-made template you can download.

It also reduces errors when, for example, calculating fees and totals thereby helping to make professional looking invoices.

Regardless of your technique, ensure you send your invoice in a PDF format to prevent tampering with the data.

On the other hand, ProInvoice has a more flexible approach to that. They have an email option. You can send your invoice via email regardless of the file type.

In addition, ensure you keep a copy of your invoice in case of possible tax audits and invoice reconciliation.

Make and Receive Payment Faster with ProInvoice

ProInvoice is a user-friendly digital platform developed in Nigeria to streamline the requirements for invoicing, including sending highly professional looking invoices, estimates, templates, and quotes.

Would you love to learn more about our services? Feel free to contact us at help@proinvoice.co. We are eager to hear from you.