Invoicing for freelancers is like fish to water. As a freelancer, invoicing is an essential aspect of your business.

Not only does it ensure that you get paid for your hard work, but it also helps you keep track of your earnings and maintain a professional image.

However, creating and sending invoices can be time-consuming and challenging, especially if you’re new to freelancing.

That’s why we’ve put together the ultimate guide to invoicing for freelancers.

In this comprehensive guide, we’ll cover everything you need to know about invoicing, from creating invoices to following up on late payments.

With this guide, you can streamline your invoicing process and focus on doing what you do best – providing top-notch freelance services to your clients.

Invoicing for freelancers – Steps to follow

1. Choose the Right Invoicing Software

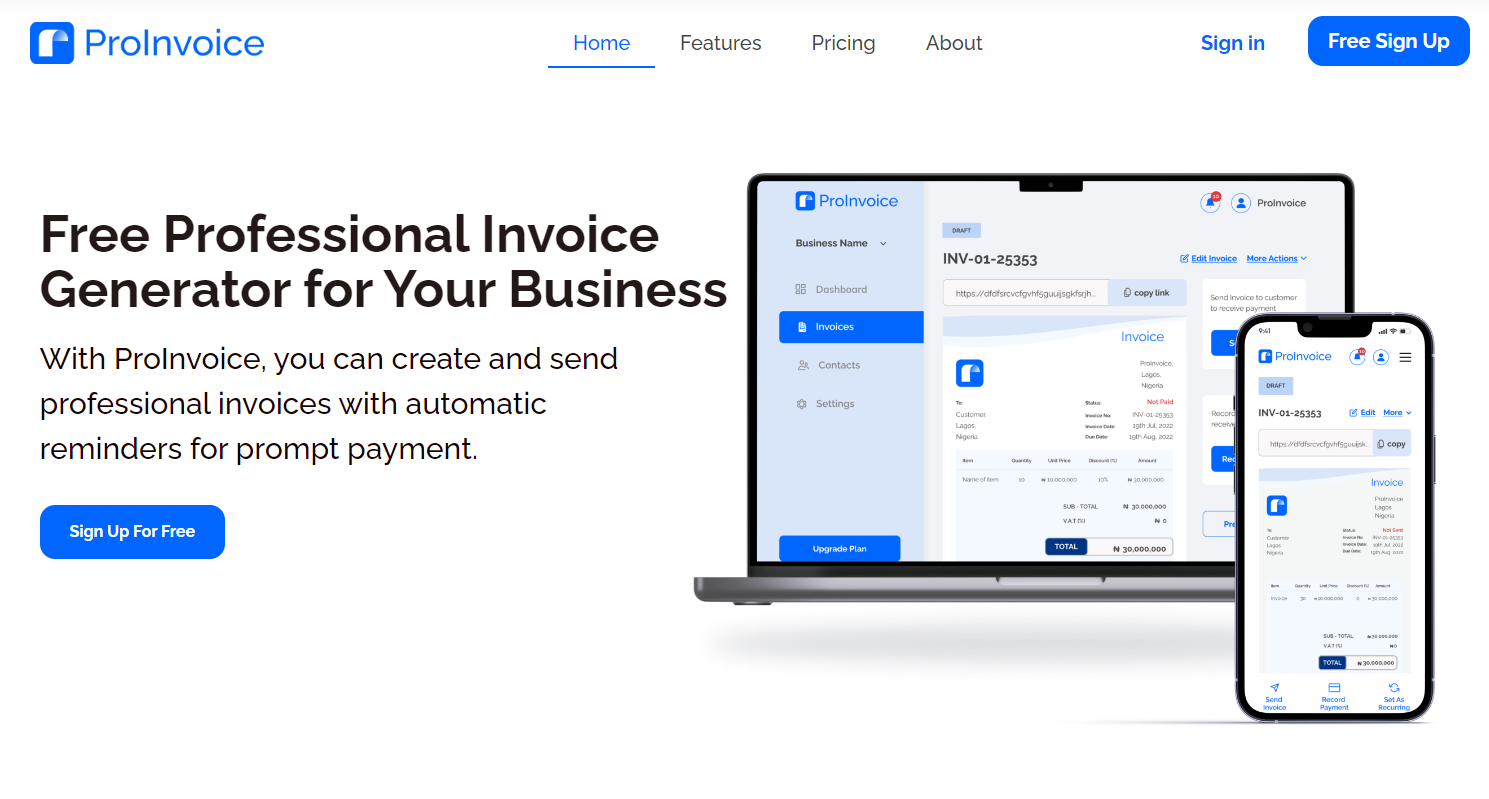

One of the first steps to take to make invoicing an easy task for you is to select an invoicing software. An invoicing software is an app that helps you create invoices seamlessly.

There are a lot of these tools, one of which is ProInvoice. When choosing the invoicing software there are things you need to look out for such as the cost of subscription, features of the software, the usability, etc.

Choosing the wrong invoicing software can only make your invoicing task just as difficult as manual invoicing.

One advantage of choosing an invoicing software include being able to minimize the time of invoicing.

Manually invoicing is time-consuming, which can lead to fatigue and lack of productivity sometimes. Another advantage is that you get to avoid human error, while invoicing.

The right software will have features that help terminate or reduce errors while invoicing.

2. Make Sure to Add the Necessary Details

When invoicing, you want to make sure that you do not leave any stone unturned. This means that you must fill in all the necessary details that need to be in the invoice.

Such as the total amount of money you are to be paid, the task which you have done for them, the name of the client, the date of completing the tasks, etc.

This way when the client to who you’re sending the invoice to receives it, there is no surprise on the path of the client.

Filling in the necessary details helps you to avoid confusion and communicate better with your client.

Another important thing to include in your invoice is a logo. If you do not own a logo for your business, it is best to create one.

This way, whenever a client receives an invoice from you, it is easy to recognize that it is from you with your logo.

A logo is a sign of showing that your business is legit and professional. This can earn you the respect and trust of a client.

3. Send Invoices Immediately and Often

As a freelancer, it is best to send out invoices when you’re done with a particular task. Do not delay so that you do not forget or the client does not forget about your payment.

You can schedule the invoice to send out at a time you think you will be done with the task at hand.

Scheduling the time an invoice will go out is an advantage of using the right invoicing software.

Besides waiting till you’re done with a task, you can send an invoice even before you are done with a task, this is just a way of avoiding late payment.

You can also send the invoices to clients as often as possible to make the clients pay up quickly. Not every client will pay up as soon as you complete a task for them.

So it is necessary to send follow-up invoices to ensure your clients don’t forget. Invoicing software has a setting that allows it to send out continuous invoices to clients automatically.

4. Have Multiple Payment Methods

Having more than one payment method is very important for you as a freelancer.

There are various reasons why multiple payment methods are very important, some of which are below:

Convenience for your Clients:

You want to ensure that your clients find it easy when they are to send you their payment.

You want to avoid frustrating them when they want to send you payment and then the payment platform you are using at the time is not responding.

This can cause a delay in your payment. This means it not only causes convenience for your clients but also for you as a freelancer.

A sign of Professionality:

Having more than one payment platform shows that you are professional in your work and ready for any form of disappointment that may happen at any time in any of the platforms.

This brings a sense of trust to your business and the customer will have confidence in giving you more tasks to do for them.

Brings new customers:

To show that your company is in vogue, it is good to have more than one payment platform.

This can attract customers to you simply because you accept a payment method that others did not. This increases your customer scale over time.

5. Have a Payment Policy that you Follow

Lastly, as a freelancer, besides building your network of customers, one thing that matters to you is your payment.

Having a payment policy is very important and letting your customers know this policy before they even start a business with you is very important.

Having a payment policy will help you avoid late payments because the customer already knows that there will be consequences if they fail to make payments on time.

Conclusion

Once again, invoicing for freelancers can be a big problem because of all the work it takes in creating it.

However, with the right invoicing software such as ProInvoice, you are sure that creating invoices for clients is a thing of pleasure.

Watch this Video to see how to create an invoice using ProInvoice Invoicing Software

As a freelancer, you must keep in mind that if you must track your finances, you should have an invoicing account with our software.

Be sure that you can receive money in different currencies also. Once you follow the steps above, in no time, you will start receiving your payments on time and show levels of professionalism in your career.