Sales Tax and Invoicing Requirements in US States: What You Need to Know and Other Useful Tips

Understanding sales tax and invoicing requirements in US states is crucial for any business selling goods or services in America. The US sales tax system is complex, with different rules and rates in every state, county, and city. This makes invoicing a bit tricky but knowing the rules can help you avoid fines and ensure smooth business operations.

In this post, we’ll explore the basics of sales tax in the US, how it varies by state, and what you need to include on your invoices to stay compliant.

What Is Sales Tax and Why Does It Matter in US States?

Sales tax is a consumption tax imposed by state and local governments on sales transactions. Each US state has its own rules about which products and services are taxable, the tax rates, and how the tax should be collected and reported.

For more detailed state-by-state sales tax info, check out the official Sales Tax Handbook.

If you’re not collecting sales tax correctly, you risk audits and penalties — so understanding these requirements is vital for US businesses.

Also Read: How to get loans without collateral in Nigeria

How Sales Tax Rates Vary Across US States

Each US state sets its own sales tax rate. On top of that, local cities and counties may add their own sales taxes, making the total tax rate vary even within a single state.

For example:

- California: State rate is 7.25%, but combined rates in cities like Los Angeles can be over 10%.

- Texas: State rate is 6.25%, with local add-ons up to 2%.

- Oregon: No state sales tax.

You can view detailed rates and rules on TaxJar’s US Sales Tax Map.

Nexus: When Must You Collect Sales Tax in US States?

“Nexus” means a connection to a state that requires you to collect sales tax. This could be physical presence (offices, employees), or economic nexus (sales thresholds).

For detailed nexus laws by state, the Avalara Nexus Guide is an excellent resource.

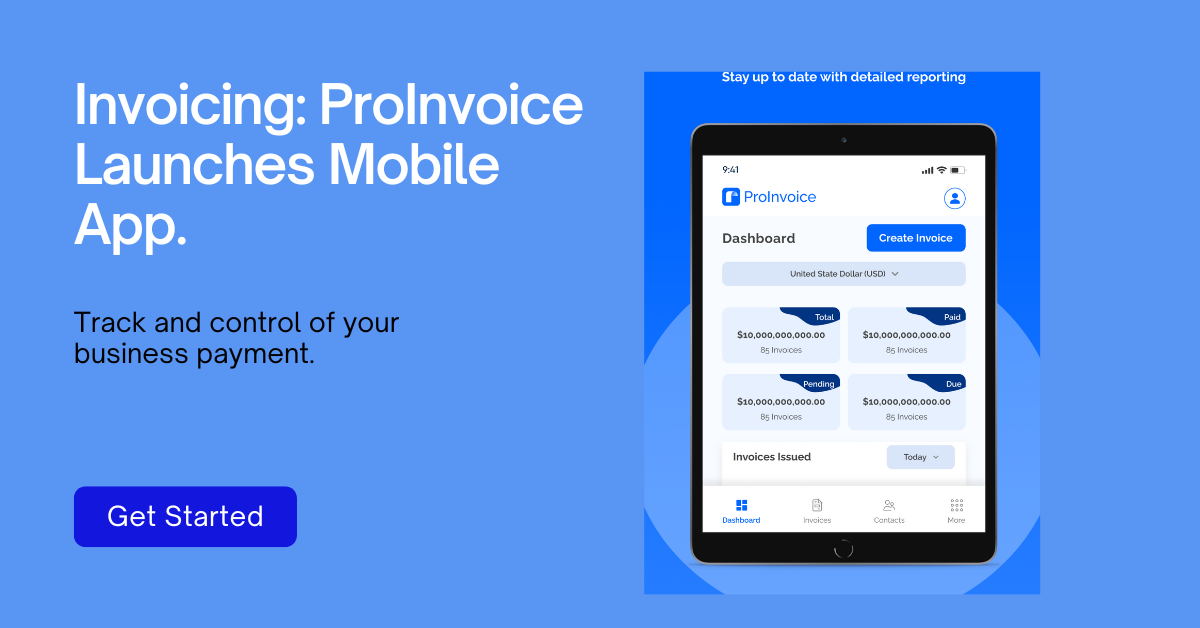

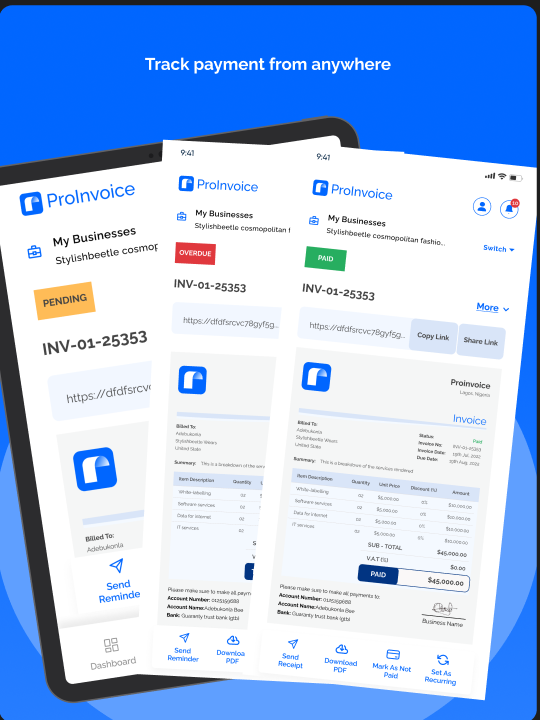

Manage your invoices on the go with the ProInvoice mobile app — invoicing made easy, anytime, anywhere.

What to Include on Your Invoice for US States

Invoices in the US must comply with sales tax laws. Here’s what your invoice should include:

- Seller and buyer information

- Unique invoice number and date

- Description of goods or services

- Itemized sales tax amount by state/local tax

- Total amount due

For more detailed invoicing guidelines, you can visit the IRS Guide to Invoicing.

How Invoicing Software Can Simplify Compliance in US States

Using invoicing software with built-in sales tax automation helps apply the right tax rate based on customer location and state laws. It saves time, reduces errors, and ensures invoices meet legal requirements.

If you’re interested, check out our invoicing software page to see how we handle US state tax rules.

Conclusion

Understanding sales tax and invoicing requirements in US states can be challenging due to varying rules. Knowing your nexus, correctly calculating tax, and creating compliant invoices will protect your business and improve customer trust.

For more tips on US invoicing and tax compliance, explore our blog section or contact us directly.