Are you new to sole proprietorship or freelancing and wondering if you would look desperate if you send an invoice to a company you just started doing business with? You are not the only one who has had to wonder whether they should or not.

Lots of freelancers and sole proprietors have at one time or another found themselves in this situation.

According to studies, the United States tops the list with around 60 million independent contractors, followed by India with over 15 million and millions more from the rest of the world.

As a freelancer or sole proprietor, you most likely operate your company under your own name.

The extra effort of naming their services or even incorporating their sole proprietorship is only taken by a small number of freelancers.

If this applies to you, creating an invoice for the companies you work for will be one of your first obstacles to conquer.

The question, “Can I send an invoice to a firm as an individual?” may arise as a result.

The most time-consuming and unpleasant component of being a freelancer, according to freelancers around the world, is creating invoices and tracking down money.

Moreover, freelancers may encounter legal issues, but only in specific circumstances, such as when the invoice:

- Declares erroneous charges for non-existent services

- Demand for money rather than payment

- More fees than originally discussed

So this makes it evident that the invoice should be accurate/true and have a clear breakdown of the products and services you’ve offered with their rates.

Still, there are several things to consider before invoicing, including a myriad of mistakes to avoid.

So, this article discusses the legalities and best practices for freelance invoices, and if you ever encounter issues with non-payment, you will find that including the right wording on your invoices will make it much easier for you to state your case.

Can an individual send an invoice to a company?- Question Answered

You may send an invoice for any work you perform on a one-on-one basis. It doesn’t matter how much the provided goods or services cost.

The invoice may be sent to more than one person, including a business. When doing financial transactions, anyone, even a private person, may request an invoice from another private person.

No rules for private invoices

Generally speaking, a private individual’s invoice, or one that is not issued in the course of a trade or professional activity, is exempt from rules.

You don’t have to get in touch with the tax authorities in order to issue a private invoice, for instance, as a private individual. Individual invoices from individuals are not subject to the same formal restrictions as those from businesses, so they can be as different as you like.

But, there are things you should take note of before you send an invoice. From a legal standpoint, each invoice represents a payment request, i.e., a claim from the issuer to the recipient.

A private invoice should have certain components to support the provided claim, even though there are no statutory criteria for this in private transportation.

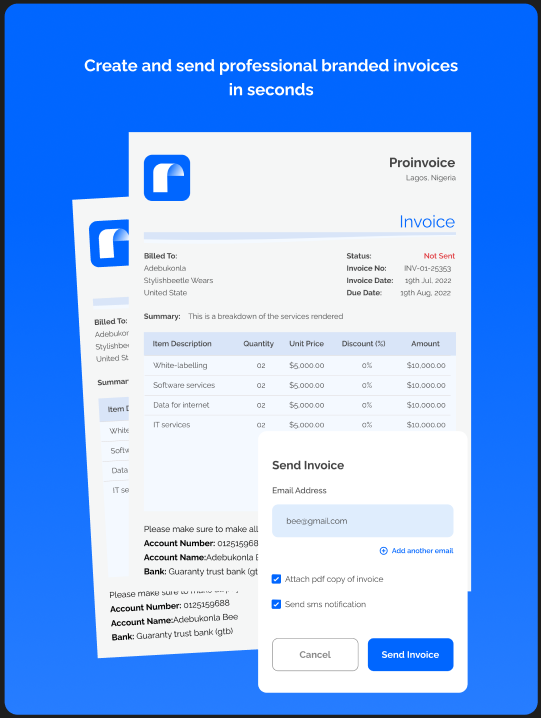

Consequently, the following items ought to be on a private invoice:

- Name and address of the issuer

- Name and address of the recipient

- Location and invoice issue date

- Reason for invoicing: Sale of goods, services rendered, or similar

- Performances (or services) in list form, if applicable, including:

- Time of delivery

- Number, type, unit price, total price (possibly per item)

- Invoice amount, if applicable, as the sum of the individual items

The invoice will be tastefully completed with a greeting and perhaps a thank you note for the receiver.

The invoice should additionally include the issuer’s bank information if payment is not made in full right away in cash (in this case, the received amount can also be recognized directly on the invoice).

In a private invoice, you should always include a payment date, either “immediately,” a deadline (such as “in ten days after receipt of invoice”), or a specific day.

This information is crucial because, according to the law, if the debtor fails to make the required payment by the deadline, they will be in default of payment, violating the terms of the invoice contract, and the invoice issuer may request payment or take other appropriate measures.

In general, if the defaulting debtor is at fault for the late payment, they must also make up the losses.

PLEASE NOTE:

Private legal transactions are not subject to the 14-day right of withdrawal that applies to business contracts.

But, you can kindly remind the recipient to do so with the following remark on a private account:

“This invoice concerns a private transaction, so the 14-day withdrawal period applicable to consumer contracts shall not apply.”

The private invoice may additionally contain information about the legal transaction.

It is important to note any known defects on the private invoice, such as if a secondhand item being sold has one.

“The upper left corner of the phone’s display screen has a few minor scratches, as was previously mentioned.”

What should not be included on a private invoice?

Of course, adding sales tax to a private transaction is superfluous, and it shouldn’t be on the invoice.

Sales tax obligations only apply to businesses, and anyone issuing a private invoice is explicitly not acting in the capacity of a business.

Private sales limitations with invoices

Anybody who sends out private invoices frequently should be mindful of the following:

The tax office can determine that you are engaging in a trade or profession as soon as an economic activity is conducted on a regular basis, in which case you must register as a trader or at the very least as a freelancer with the tax office.

A sale every quarter may be seen by the tax office as “regular” depending on the products being sold.

Private provider and entrepreneur boundaries might be swiftly and frequently accidentally breached.

There are no clear standards on when a sale should be considered private and when it should be considered commercial.

As a private seller, there are only a few characteristics to watch out for. The following factors are regarded as signs of business activity when it comes to the sale of goods:

- The purchase of goods for resale

- Sale of new products or similar items

- Regular sales over a longer period

- Many sales in a short time, such as 30 products every month

- Sales made on behalf of friends or family members

- Possessing a reputable website with advertising

Before the tax office finds out, you should think about registering as a trader if you fit any of these requirements.

After all, you won’t need to register as a business or pay taxes if you occasionally sell items like clothing, televisions, cell phones, jewelry, furniture, and possibly a gaming console online.

The obligations you have as a business dealer, however, are more comprehensive. For instance, you must ensure that private customers have a 14-day right of withdrawal and a warranty in the event that the item is faulty.

Advice:

Use caution if you routinely sell goods on online marketplaces like eBay. The tax authorities may view this kind of sale as routine business.

So, you can be regarded as a sole proprietor with all the corresponding financial and tax duties.

If you acquire something and then sell it for a profit, you can still be responsible for income tax even on private sales.

To find out what the free limits are where you reside, contact the local state authorities.

Furthermore, you are only required to pay taxes on these earnings within the one-year window between the acquisition and sale.

However, if the property is not used privately, the speculative period is longer for privately bought and resold homes.

Complying with International Invoicing Laws

Aside from the aforementioned, it is imperative to learn how to adhere to their legislation if you work as a freelancer for international clients.

For instance, the European Union (EU) demands that invoices comply with the following:

- Itemizing and charging VAT based on the consumer’s country

- Displaying your VAT number

- Types of services offered

Conversely, freelancers located in AU or doing business with residents of AU may have to charge goods and services tax (GST), itemizing all services provided.

Yet, in Canada, GST is only required for certain sales, which fall under tiers of sales minimums.

If all of this seems like too much, then it’s better to refrain from doing business with clients outside of the countries you’re familiar with.