ProInvoice’s recurring invoices offer a powerful tool that can help small businesses in streamlining business finances, thereby helping it’s users achieve their business goals by building a professional invoicing process.

In the world of small business finance, maintaining consistency, predictability, and efficient cash flow is essential for success.

In this article, we’ll delve into the world of recurring invoices, exploring their benefits, how to set them up with ProInvoice, and practical tips to ensure they work seamlessly for your business.

Small business owners using the platform are already familiar with the it’s efficiency and effectiveness.

ProInvoice takes the hassle out of invoicing, and recurring invoices are another brilliant feature in its arsenal.

They offer a steady stream of income, reduced administrative headaches, and improved cash flow – something every user can benefit from.

Setting Up Recurring Invoices with ProInvoice

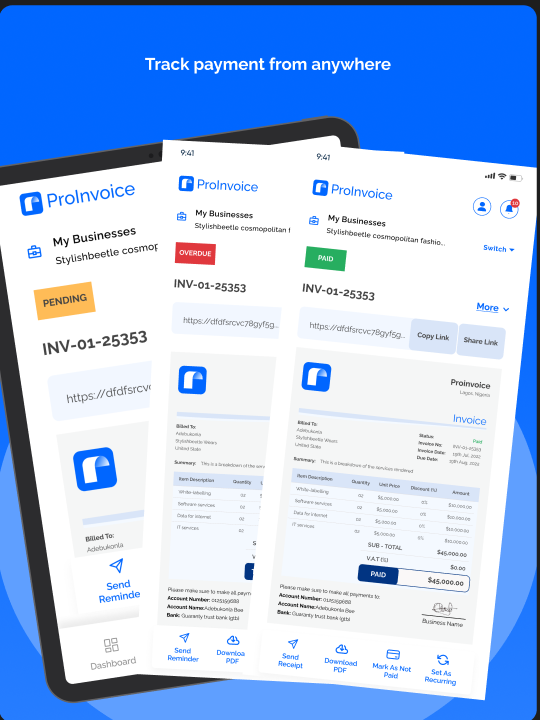

Setting up recurring invoices with ProInvoice is a actually easy. It’s users can access this feature easily within the platform.

You need to provide the necessary details, such as the client’s information, invoice frequency (e.g., monthly or quarterly), and the invoice’s start date. ProInvoice ensures a user-friendly experience.

Remember, clear invoicing terms are essential, and ProInvoice allows you to customize these terms. Your clients should understand what they’re paying for, the payment due date, and any penalties for late payments, and ProInvoice makes it simple to include these details.

The Benefits of ProInvoice’s Recurring Invoices

ProInvoice’s recurring invoices provide small businesses with a host of benefits. They bring consistency, ensuring that your clients using it receive invoices like clockwork, making it easier for them to plan their payments.

This predictability helps stabilize your cash flow, reducing the uncertainty that can be a constant concern for small business owners using the software.

Additionally, ProInvoice’s recurring invoices save you time by automating the invoicing process. With it, you set them up once, and they work their magic, sending invoices at predefined intervals.

This automation not only reduces the risk of human errors but also frees up your time to focus on growing your business.

Key Things To Remember Before You Setup Recurring Invoices For Your Business

1. Effective Communication Through ProInvoice’s Recurring Invoices

Recurring invoices with ProInvoice aren’t just about numbers; they’re also a communication tool.

ProInvoice’s recurring invoices give you an opportunity to convey important information to your clients using the platform.

For example, if you’re adjusting your services or rates, ProInvoice’s recurring invoices can be used to communicate these changes clearly to your clients within the same interface.

2. Regular Review and Adjustments with ProInvoice

While recurring invoices are automated with ProInvoice, they are not set in stone. Users should periodically review them to ensure they remain aligned with your business needs.

If you change your pricing, add new services, or modify your terms, ProInvoice’s recurring invoices should reflect these adjustments.

3. Client Convenience with ProInvoice

Recurring invoices aren’t just beneficial for you; they make life easier for your clients as well, especially when using ProInvoice.

They know when to expect your invoices, which simplifies their bookkeeping and financial planning.

This convenience can enhance your client relationships, and ProInvoice’s user-friendly interface ensures that your clients can easily manage their payments.

ProInvoice’s recurring invoices are not just a financial tool; they’re a strategy for success. They provide financial consistency, reduce administrative burdens, and enhance cash flow.

In conclusion, by using ProInvoice, you can streamline your financial processes and improve client relationships, all within a trusted and user-friendly platform.

Are you a ProInvoice user ready to take your small business finances to the next level? Explore ProInvoice’s recurring invoice feature, discover the benefits it offers, and start implementing it today.

It’s a smart move that can bring financial stability and predictability to your business, all within the familiar and efficient ProInvoice platform.