What is the purpose of invoicing? Why should you send invoices to your clients? “Invoice” and “invoicing” are two of the most common terms in commerce. Still, not all businesses use invoices. Meanwhile, some individuals that claim to use invoices don’t use them appropriately.

Adequate knowledge of the purpose of invoicing will streamline your transactions and prevent losses. At the most basic level, invoices are composed to request payments from people or businesses who bought goods from you or employed your services.

Yet, the significance of invoicing transcends this purpose. Invoicing can be utilized for bookkeeping purposes, marketing your business, tracking inventory, legal defense, and recording taxes.

We shall talk more about these functions and answer relevant questions in the following sections.

How Can Invoicing Be Used in Bookkeeping and Marketing?

An organized and well-defined invoice can serve as a practical record of your sales and provided services. With a good invoicing tradition, you can easily keep tabs on your business’s financial activities even without receipts and tellers.

Thus, you’ll be able to monitor how much money is entering your business from sales and rendered services and calculate your cash flow and profits accordingly.

This procedure will enable you to know what’s best for your business and avoid losses.

Similarly, invoicing can enable you to market your business and brand effectively by helping you recognize when you have the highest patronage, your most sought-after and least popular goods and services, and other market trends.

From this information, you can adopt marketing strategies and develop plans that will boost your profits and curtail your losses.

Tips: Ultimate Guide to Onboarding U.S. Employees 2025

How Can I Track My Inventory With Invoicing, and How Can I Use Invoices for Legal Defense?

Proper invoicing can help you survey your current, available stock of goods and predict the number of goods you’ll need in the future.

You can achieve this objective by assessing the number of goods you’ve sold and the frequency of your sales through your invoices.

Although you can formulate your manual inventory tracking system based on your invoices, invoicing software, such as ProInvoice, makes the process easier and faster.

Invoices can also provide legal protection for small businesses as they can serve as proof of your dealings with your customers.

They can inform a legal representative of how many goods or services you sold or rendered to a particular customer, the individual and total amounts you charged them, the time the transaction took place, and other related activities and terms.

Additionally, signed invoices can be used as legally binding agreements.

Hence, it’s vital to ensure you avoid making errors in your invoices and try to make them as descriptive and credible as possible.

What’s the Relationship Between Invoicing and Tax Records?

Large businesses often employ detailed sales invoices that comprise the tax information relating to their sales and goods.

Similarly, small businesses can fill in their tax details along with their daily business transactions in their invoices.

This practice provides a form of tax records for your business as your invoices can help to ascertain your annual tax filings, thus preventing foul play.

What’s the Main Purpose of Invoicing, and Who Needs Invoice?

Invoices are primarily created to establish a sales agreement between your business and your customers.

Invoicing enables both small and large businesses to get paid faster as they notify the customers of the amount owed, invoice due date, payment terms and conditions, a methodical list of the goods sold or services rendered, and other information that can facilitate the payment process.

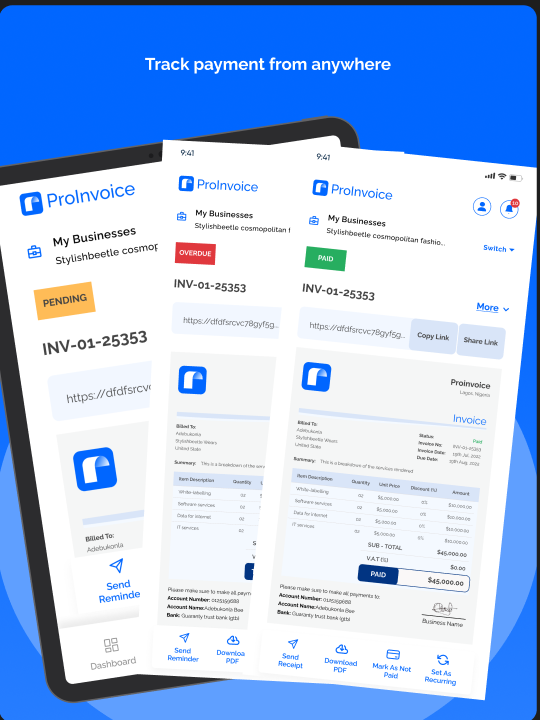

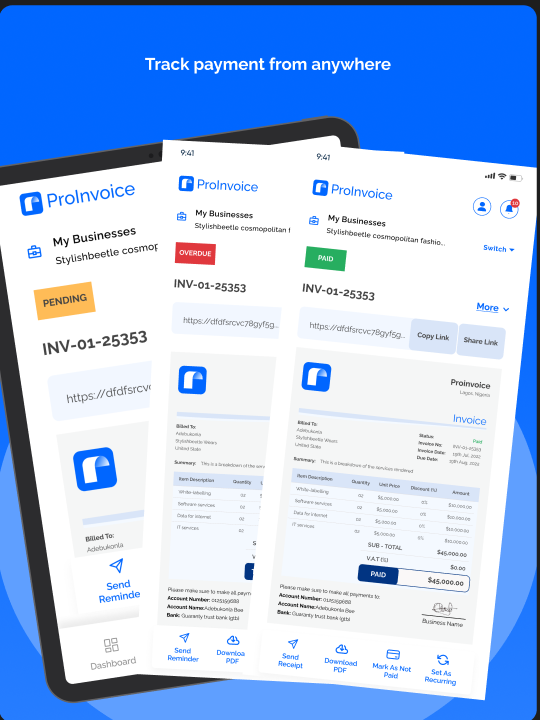

Proinvoice makes invoicing effortless. Use custom templates, automate reminders, set recurring bills, and track everything from one smart dashboard. Get paid faster — with less hassle.

Any business, regardless of its size or type, that needs a prompt, convenient, and effective payment process can benefit from invoicing.

You may be a freelance writer offering writing services to various clients or the owner of a large-scale wholesale business with hundreds of customers.

Nonetheless, invoicing provides a legal agreement between you and your clients/customers for your goods and services and the payment owed.

Businesses wanting to monitor their sales and control their finances can achieve their aim through invoicing. Invoices allow you to track your sales over time and forecast your business accurately.

Furthermore, they can help you evaluate how long your customers/clients take to pay you for your goods or services. This function can enable you to regulate your cash flow.

How Can I Make the Best Use of My Invoices, and What Can I Do With Invoicing Software?

You have to use an invoice appropriately to get paid on time and reap the benefits of invoicing. Below are some excellent invoicing tips that may help you:

- Encourage prompt invoice payments from your customers or clients.

- Ensure your invoice and payment process are convenient for your customers.

- State and specify your payment terms and conditions in writing.

- Request upfront payments if possible or convenient for your clients.

- Use invoicing software as they reduce human errors and are easier to use.

- Try to establish a healthy relationship with your customers or clients.

- Pause projects or hold onto the next batch of goods if the client fails to pay on time.

- Ensure the due date is clearly stated on the invoice and that other details are correct.

With invoicing software, you can select a pre-made invoice template and customize it to your taste and automate your business’s invoicing workflows and payment reminders.

Invoicing software also facilitates effective and secure payments and enhances customer relations. You can also use invoicing software because they:

- Lessen the need for employees in your billing and invoicing department, thus reducing the cost of staff labor.

- Reduce losses and fraud.

- Facilitate timely error resolution.

- Save you the stress and time involved with tracking late payments.

- Guarantee faster payment, leading to improved cash flow.

Final Thoughts

The invention of invoices has made it easier and faster for businesses to request payment from their customers.

It has also helped to reduce fraud, financial errors, late payments, losses, and payment conflicts.

Aside from the primary reason for invoicing, invoices can serve other purposes, such as bookkeeping, business analysis, legal protection, tracking inventory, and tax records.

So, it’s your responsibility to make the best use of your invoices to enhance your business and customer relations.

Are you looking for useful invoicing software for your business or brand? ProInvoice can help you handle all your invoicing needs. Subscribe to ProInvoice today to enjoy the benefits of invoicing!

Proinvoice makes invoicing effortless. Use custom templates, automate reminders, set recurring bills, and track everything from one smart dashboard. Get paid faster — with less hassle.