Why SMEs Need Real-Time Financial Data to Grow Faster

Running a small or medium-sized enterprise comes with constant financial decisions—whether it’s managing cash flow, tracking invoices, or planning for growth. Unfortunately, many SMEs still rely on outdated methods like spreadsheets, manual bookkeeping, or delayed reports. This makes it extremely difficult to know your financial position in real time, which can delay decisions, reduce cash flow, and slow growth.

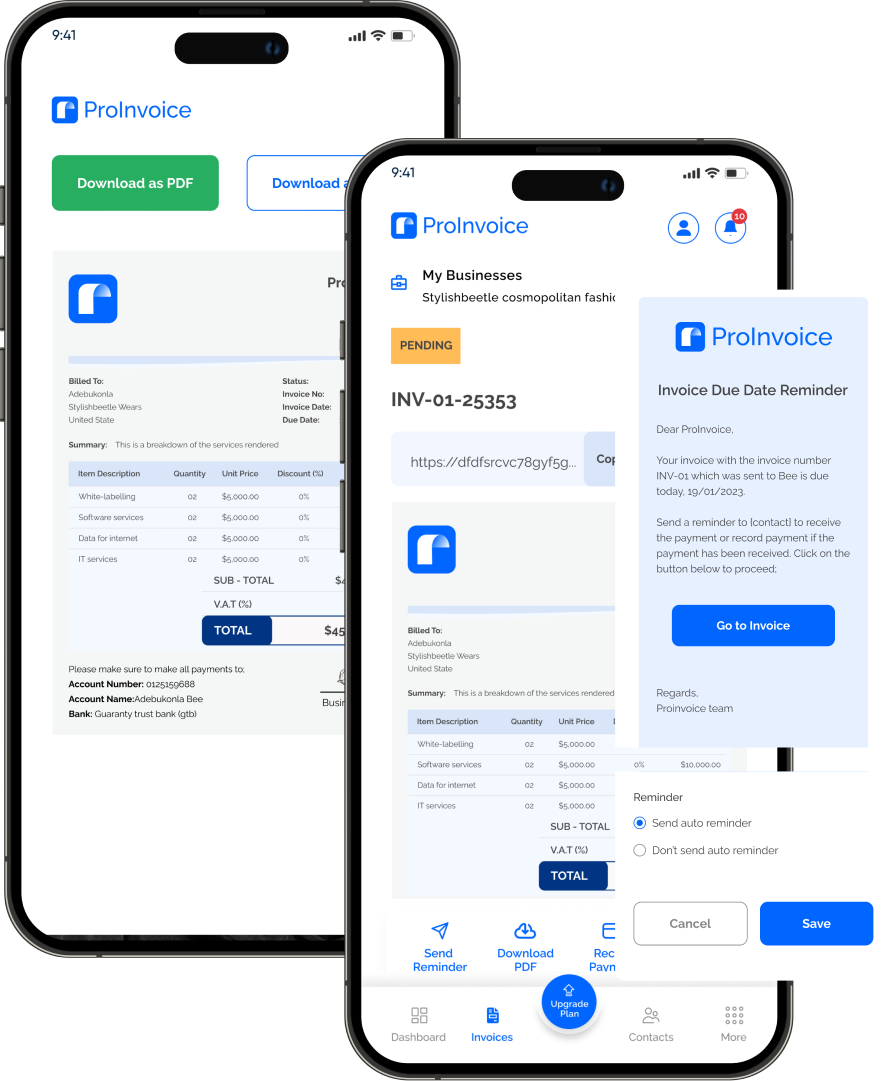

For SMEs in Kenya, Ghana, and Nigeria, having real-time financial data for SMEs is no longer optional. Businesses that access live financial insights make smarter decisions, streamline operations, and maintain professional client relationships. Tools like ProInvoice offer automated solutions for invoicing, real-time payment tracking, and instant reporting—all critical for sustainable growth.

In this article, we’ll explore why real-time financial data is crucial for SMEs, how it impacts operations, and practical ways to implement it using digital tools.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

1. Make Faster, Smarter Decisions

SMEs often face time-sensitive decisions: whether to restock inventory, hire staff, or launch a marketing campaign. Delayed or inaccurate financial information can lead to poor decisions and missed opportunities. With real-time financial data for SMEs, business owners can:

- Evaluate current cash flow instantly

- Track unpaid invoices and client payments

- Adjust budgets on the fly

- Make operational decisions confidently

For example, a retail SME in Accra using ProInvoice can see all outstanding client invoices at a glance, ensuring stock is purchased without overextending funds. Similarly, a digital agency in Lagos can decide on new hires only when it sees current and expected payments in real time.

2. Streamline Cash Flow Management

Cash flow is the lifeblood of every SME. Many businesses struggle simply because they lack visibility into their actual funds. Real-time financial data enables SMEs to:

- Monitor outstanding invoices immediately

- Forecast cash availability accurately

- Identify slow-paying clients early

- Allocate resources efficiently

Automated tools like the ProInvoice free invoice generator allow SMEs to send invoices promptly, track payments in real time, and maintain a consistent cash flow. For example, a Ghanaian SME offering consultancy services can instantly know which clients have paid and which invoices are overdue, allowing proactive follow-ups.

3. Reduce Errors and Financial Risks

Manual bookkeeping often results in errors: duplicate invoices, miscalculated totals, or missed entries. These mistakes distort reports, impact decision-making, and can damage client trust. Real-time financial systems reduce these risks by:

- Automating calculations for taxes, totals, and discounts

- Sending invoices automatically to clients

- Updating payment records instantly

- Generating accurate financial reports

With the ProInvoice mobile app, SME owners can manage invoices and track payments from anywhere. Even while traveling or attending meetings, they maintain accurate records and avoid costly financial errors.

4. Enhance Client Relationships

Professionalism and transparency improve client relationships. With real-time financial data, SMEs can:

- Track payment histories accurately

- Send timely reminders for overdue invoices

- Avoid double billing

- Communicate clearly and promptly

Using ProInvoice free invoice templates, businesses can send polished invoices with clear terms, itemized costs, and due dates. Clients in Kenya or Nigeria appreciate the professionalism, often paying faster and maintaining long-term partnerships.

5. Boost Operational Efficiency

Manual financial processes consume time and resources. Real-time insights streamline operations, allowing SMEs to:

- Automate recurring invoices

- Track payments automatically

- Generate instant reports

- Identify and correct billing errors quickly

This efficiency enables business owners to focus on growth-driven activities such as marketing, product development, or customer engagement. For example, a logistics SME in Lagos can automate weekly billing, freeing staff to focus on delivery operations and client satisfaction.

6. Accurate Forecasting and Budgeting

Access to live financial data improves forecasting and budgeting. SMEs can analyze trends in:

- Revenue streams

- Seasonal fluctuations

- Customer payment behaviors

- Monthly and annual expenses

Armed with these insights, businesses can plan investments, prepare for slow periods, and allocate resources effectively. Tools like ProInvoice generate instant reports, giving SMEs a clear financial picture to make informed strategic decisions.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

7. Maintain Compliance and Reporting Accuracy

Compliance is crucial for SMEs operating in regulated markets. Real-time financial tracking helps businesses:

- Capture all transactions as they occur

- Calculate VAT or tax liabilities accurately

- Generate reports suitable for regulatory filings

- Reduce manual record-keeping errors

Using ProInvoice, SMEs in Nigeria, Ghana, and Kenya can maintain clean financial records automatically, simplifying tax reporting and ensuring peace of mind during audits.

8. Gain a Competitive Edge

Businesses that respond quickly to market changes and customer demands have an advantage. Real-time data enables SMEs to:

- Adjust pricing or promotions dynamically

- Follow up on overdue invoices immediately

- Identify profitable clients or products

- Make strategic decisions faster than competitors

By leveraging ProInvoice dashboards, SMEs gain full visibility into revenue, outstanding invoices, and client behavior, giving them the insights to act faster and smarter.

9. Steps to Implement Real-Time Financial Tracking

Here’s a practical roadmap for SMEs:

Step 1: Choose a Reliable Digital Invoicing Tool

Platforms like ProInvoice integrate invoicing, real-time payment tracking, and reporting for multiple clients.

Step 2: Use Professional Invoice Templates

The ProInvoice free invoice templates save time, maintain branding consistency, and ensure invoices are clear and professional.

Step 3: Automate Invoice Generation

With the ProInvoice free invoice generator, SMEs can create accurate invoices in minutes, reducing human errors and speeding up billing cycles.

Step 4: Send Timely Payment Reminders

Automated reminders through ProInvoice ensure clients are notified about upcoming or overdue payments, improving cash flow without manual effort.

Step 5: Monitor Financial Dashboards Daily

With the ProInvoice mobile app, business owners can check payment statuses, pending invoices, and overall financial health from anywhere, keeping data live and actionable.

10. Real-World Examples in Africa

- A marketing SME in Accra used ProInvoice to automate monthly invoices. Within six months, cash flow improved by 40% as clients paid on time.

- A logistics business in Nairobi tracked all payments in real time via ProInvoice, preventing stock shortages and ensuring smooth operations.

- A Nigerian consultancy firm implemented ProInvoice templates for all clients, standardizing branding and reducing invoice disputes.

These examples show how real-time financial data for SMEs directly supports growth, efficiency, and client trust.

11. FAQs About Real-Time Financial Data for SMEs

Q1: Can small SMEs afford digital invoicing tools?

Yes. Platforms like ProInvoice offer free and affordable plans suitable for small businesses in Kenya, Ghana, and Nigeria.

Q2: Is it difficult to transition from spreadsheets to real-time systems?

No. Tools like ProInvoice are designed for easy adoption. Templates and generators make setup quick.

Q3: Will automation reduce my personal touch with clients?

Not at all. Real-time invoicing improves professionalism and allows SMEs to focus on personalized communication rather than chasing payments manually.

Q4: Can I manage multiple clients simultaneously?

Yes. With ProInvoice mobile app, you can track multiple client invoices, payments, and reminders in one place.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Conclusion

Real-time financial data for SMEs is essential for growth, cash flow management, operational efficiency, and client trust. Businesses relying on manual processes risk errors, late payments, and missed opportunities.

By leveraging ProInvoice, along with its free invoice generator, free templates, and mobile app, SMEs in Kenya, Ghana, and Nigeria gain instant visibility, streamlined operations, and confidence to scale sustainably.