Want to know how to tell the difference between invoicing and accounting? Understanding the differences between these two critical procedures is essential before delving into the world of financial management.

The functions of invoicing and accounting are different in the corporate world.

Accounting includes a wide range of tasks, including documenting and evaluating financial transactions, creating financial statements, and maintaining regulatory compliance.

Invoicing, on the other hand, refers to the process of creating and sending invoices to clients or customers for goods or services provided.

Do you know that luck is not the major determinant of who will or will not become successful as a freelancer or business owner?

Research and findings from experts around the world have made us realize that what differentiates most of them are the seemingly little things they fail to take into consideration.

Some of the things mentioned are automating their processes to make it easier for themselves and their clients or customers and also keeping proper records to ensure a coordinated business through understanding of invoicing and accounting system.

So, as earlier mentioned, accounting refers to the process of keeping accurate and detailed records of all financial transactions of a business enterprise while Invoicing refers to the process involved in requesting payment for products or services and documenting such transactions.

Showing up on time, getting the work done, and delivering when due is important today as business owner and freelancer.

But how effectively are you accounting for this process and making invoicing simplified?

Do you have a thorough understanding of what differentiates accounting from invoicing and also where they overlap?

Differences between invoicing and accounting

Accounting

- Accounting focuses on the overall state of health of your finances as a freelancer or business owner as it takes a deep interest in every aspect of the financial operations of such business enterprise such as income, taxes, expenses, loans, assets, etc.

- It is mainly concerned with you having a detailed and accurate record of how money flows in and out of your freelancing business.

- There are three major types of accounting, which includes: cost accounting, managerial accounting, and financial accounting.

Invoicing

- Invoicing has to do with getting an itemized bill across to an individual you sold products to or rendered some services.

- It usually contains information such as details of the services you rendered, individual prices for each service, total cost, due date, accepted payment methods, overdue fee, etc.

- An invoice also serves as a transaction record for products sold or services rendered.

- Whether as a freelance writer, photographer, or web designer, an invoice helps you keep a permanent record of the work you completed and what you charged for it. And to your clients, serves as a guide to making accurate payments.

- The three known types of invoices include, the proforma invoice, interim invoice, and recurring invoice.

Benefits of invoicing and accounting

Accounting

- Accounting helps you as a freelancer or business owner, whether big or small, in the maintenance of your business records in such an organized way that makes the decision-making process much easier and faster.

- It helps in taxation-related issues by preventing any error that might occur and making it seems as if the business is unlawfully withholding back the amount to be paid to cover taxes.

- It helps you keep a proper valuation of your business enterprise i.e. accounting information helps you measure the financial worth of your business.

- Accounting ledgers can also be submitted as evidence in legal matters involving the business. This means it is legally accepted in any recognized law court as evidence in financial disputes.

Invoicing

- Beyond keeping track of and receiving payment from customers, invoices protect freelancers and business owners in the event of transaction disputes with clients and customers.

- Offering an invoice after issuing the product or service helps your customers pay easily by giving them a thorough breakdown of the services, easing the stress of calculating it themselves.

- When you issue a customer an invoice, it shows your business, big or small is running an efficient process which makes them trust your business more and keep coming back for your services.

- In total, it is a great way of keeping your business organized and keeping your customer happy with a wonderful customer experience.

- It helps you as a freelancer, or business owner keep an eye on all your payments (pending or paid) and gives you insight into your financial standing

Which is more important for small businesses between invoicing and accounting?

We now live in a digital world where everything happens at the speed of time whether in communication, advertising, marketing, negotiation, getting the products to the final consumers, and making payments.

So as a freelancer or a small or big business owner who wants to make profits, keep up with market trends, maintain visibility, and even your spot in the heart of your potential and existing clients or customers, both accounting and invoicing are non-negotiable for your small business.

Together, they will not only help you run a coordinated business, keep track of all your services, track profit and loss, but also ease the stress on the part of your customers and make them happy and keep coming back for more.

Importance of automated invoicing for your business?

Gone are the days business run on autopilot, in which you just make your services available using various online and offline means without adequate structures and strategies in place to keep track of customers interactions with the business, transactions, payments, etc.

In today’s world, such a method would not only fail, but it’s just a matter of time before you lose relevance as a freelancer or a business owner.

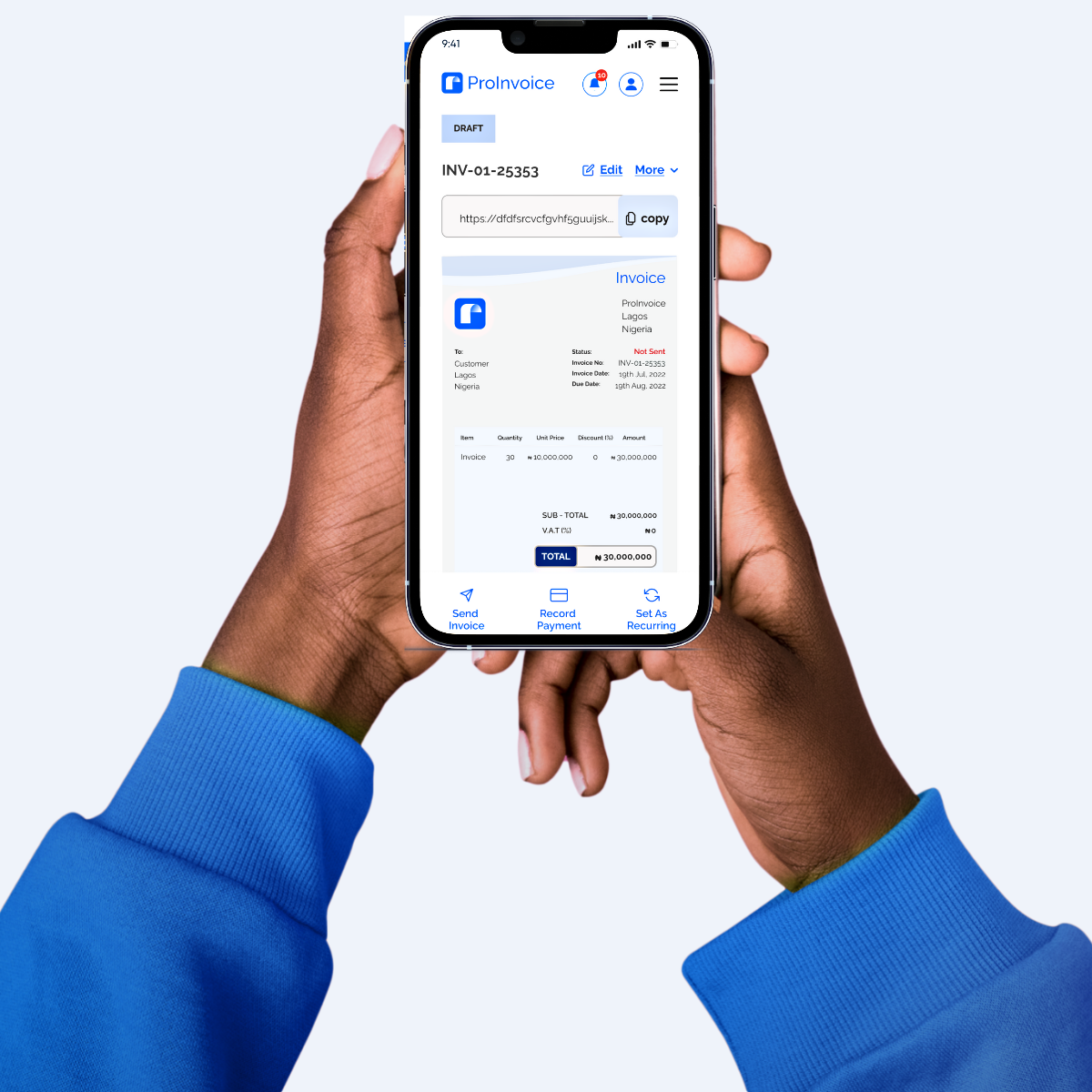

However, automating your invoicing efforts using ProInvoice, one of the best automating and easy-to-use invoicing software out there that’s not just about the looks but with tested and trusted features that make it easy to manage your finance, will not only save you time but also help you invoice your customers or clients more effectively.

Start automating your invoicing efforts today using invoicing tools like ProInvoice software, ProInvoice Invoice generator, and ProInvoice Invoicing templates, so that you can focus on other aspects of your business, ease your customers of payment stress and keep them smiling and happy.

Conclusion

Only with proper invoicing and accounting can you adequately position yourself and accelerate your growth as a freelancer or business owner.

How can you effectively do this except by automating your processes using the services of experts, tested and trusted by other successful businesses out there?

Therefore, start that journey today with ProInvoice, the right answer for your freelancing business.