Getting access to funding is one of the biggest challenges entrepreneurs face in Nigeria. Unlike loans, business grants are non-repayable—meaning you don’t need to return the money or give up equity in your business.

If you’re running a small business, a startup, or even just launching your first idea, this guide will show you exactly how to apply for business grants in Nigeria and stand a better chance at success.

What Are Business Grants?

Grants are financial support from government agencies, NGOs, corporates, and international organizations to help small businesses grow, scale, or recover.

Grants are perfect for:

- Women-owned businesses

- Youth-led startups

- Agri-tech, health, education, and digital businesses

- MSMEs that need working capital or equipment

- Founders looking for funding without collateral

Where to Find Business Grants in Nigeria

Here are some trusted sources of grants:

✅ Tony Elumelu Foundation (TEF)

✅ LSETF (Lagos State Employment Trust Fund)

✅ YouWiN Connect Nigeria

✅ Bank of Industry (BOI) matching grants

✅ African Women Development Fund (AWDF)

✅ Google for Startups, Orange Corners, and other international accelerators

✅ Grant platforms like SME.ng, OpportunityDesk, and YouthOp

💡 Pro Tip: Join WhatsApp or Telegram groups that share real-time grant opportunities.

Step-by-Step: How to Apply for a Business Grant in Nigeria

1. Prepare a Bankable Business Idea

Your idea must be clear, impactful, and feasible. Avoid vague concepts — funders want to see how you will use the grant and how it creates value or jobs.

Ask yourself:

- What problem am I solving?

- Who are my customers?

- How will this grant help me grow?

2. Register Your Business

Most grant programs require your business to be registered with the Corporate Affairs Commission (CAC). It builds credibility and gives you access to official documents like your RC number and Tax ID.

3. Write a Solid Business Plan or Proposal

This is your chance to sell your idea on paper.

Your business plan should include:

- Executive summary

- Problem and solution

- Target market

- Revenue model

- Marketing strategy

- Use of funds

- Financial projections

Need help with writing one? Read our full guide: How to Write a Business Proposal in Nigeria

4. Keep a Record of Your Business Transactions

This is where many small businesses fail — no receipts, no structure, no documentation.

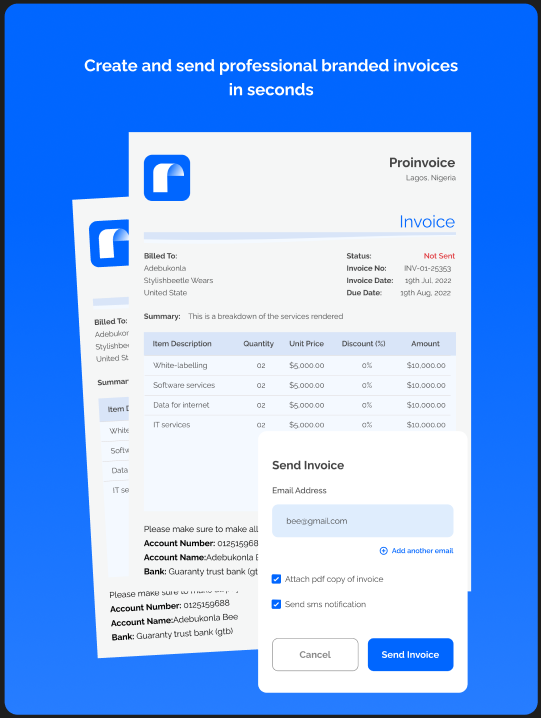

With ProInvoice, you can:

✅ Send FREE professional invoices to clients

✅ Track your income and payments

✅ Show proof of business activity during grant applications

✅ Build a record of customer transactions — even without a registered business account

🎯 This positions you as credible and organized to funders.

👉 Create your FREE ProInvoice account here

5. Tailor Each Application

Don’t copy and paste proposals. Customize each grant application based on the theme, focus area, and eligibility criteria.

Read all instructions carefully and submit before the deadline.

6. Leverage Past Results and Testimonials

If you’ve already made sales, trained people, or launched a pilot, mention it. Evidence of traction makes your application stronger.

📌 Add screenshots, testimonials, links to your website or Instagram page, and records from tools like ProInvoice to show you’ve been active.

7. Practice Your Pitch (If Required)

Many grants now include a pitch stage. Practice summarizing your business in 1-3 minutes, highlighting:

- The problem

- Your unique solution

- Your business model

- The impact you’ve made

- What you need the grant for

Common Mistakes to Avoid

🚫 Applying for every grant — focus on relevant ones

🚫 Submitting late or incomplete documents

🚫 Not showing how the money will be used

🚫 No proof of income, traction, or customer base

🚫 Ignoring the impact or sustainability aspect

Final Thoughts

Grants can be the lifeline your business needs — but you must be intentional. Prepare in advance, organize your records, and tell a compelling story.

And remember: tools like ProInvoice help you stay structured, track revenue, and build credibility — all of which improve your chances.

Ready to Show You’re Grant-Ready?

📊 Send your first invoice today for FREE

📲 Sign up on ProInvoice

Whether you’re applying for a ₦500,000 or ₦5 million grant, structure and proof of traction make all the difference.