Nigerian businesses often struggle to access traditional loans due to collateral requirements. However, invoice platforms offer an innovative solution that transforms unpaid invoices into immediate cash flow. Furthermore, this financing method allows businesses to leverage their accounts receivable without pledging physical assets as security. Additionally, tools like ProInvoice help businesses maintain professional invoice records that strengthen their financing applications.

What is Invoice Financing?

Invoice financing represents a revolutionary approach to business funding that eliminates traditional collateral requirements. Moreover, this financing method allows businesses to borrow against their outstanding invoices, providing immediate access to cash while waiting for customer payments. Invoice finance, also known as debtor finance or receivables finance, is a financial product that allows you to borrow money — based on what customers owe to your business. This is usually in the form of unpaid invoices (accounts receivable).

Additionally, invoice financing differs significantly from traditional bank loans because it focuses on the creditworthiness of your customers rather than your business’s credit history. Furthermore, the unpaid invoices serve as security for the loan, reducing the lender’s risk without requiring physical collateral from your business.

How Invoice Financing Works

The invoice management process operates through several straightforward steps. Initially, businesses submit their unpaid invoices to financing companies for evaluation. Subsequently, lenders assess the creditworthiness of the customers who owe money on these invoices. Moreover, approved businesses receive advance payments typically ranging from 70% to 90% of their invoice values.

The Bank provides up to 70% of the invoice value to enable our customers meet working capital needs while awaiting payment for goods supplied or services rendered. Furthermore, when customers eventually pay their invoices, the financing company deducts their fees and remits the remaining balance to the business.

Additionally, this arrangement allows businesses to maintain control over their customer relationships while accessing immediate funding. Therefore, companies can continue operating normally while leveraging their unpaid invoices for working capital needs.

Benefits of Invoice Financing

Immediate Cash Flow Improvement

Invoice Flow provides immediate access to cash tied up in unpaid invoices. Moreover, this rapid funding helps businesses address urgent operational needs without waiting for customer payments. Additionally, improved cash flow enables companies to take advantage of growth opportunities and supplier discounts.

Furthermore, businesses can maintain steady operations even when customers delay payments. Therefore, invoice financing serves as a crucial buffer against cash flow disruptions that often threaten business stability.

No Traditional Collateral Required

Unlike conventional loans, proper billings management eliminates the need for physical assets as collateral. Additionally, businesses don’t risk losing property or equipment if they encounter repayment difficulties. Moreover, this arrangement particularly benefits service-based businesses that may lack substantial physical assets.

Furthermore, the invoices themselves serve as security for the financing arrangement. Therefore, businesses can access funding based on their sales performance rather than their asset holdings.

Flexible Funding Solutions

Flexible Business offers remarkable flexibility compared to traditional banking products. Moreover, businesses can access funding as needed rather than receiving large lump sums. Additionally, the financing amount adjusts based on invoice volumes, providing scalable funding solutions.

Furthermore, businesses maintain control over which invoices to finance and when to access funding. Therefore, this flexibility helps companies manage their cash flow more effectively while maintaining operational independence.

Faster Approval Process

Accurate Invoice data typically involves faster approval processes than traditional loans. Moreover, lenders focus primarily on customer creditworthiness rather than extensive business history documentation. Additionally, established businesses with reliable customers can often receive approval within days rather than weeks.

Furthermore, the streamlined evaluation process reduces paperwork and administrative burden. Therefore, businesses can access funding quickly when opportunities arise or emergencies occur.

Types of Invoice Financing

Invoice Factoring

Invoice factoring involves selling unpaid invoices to financing companies at discounted rates. This enables companies to sell any unpaid invoices (accounts receivable) to a third party (a factoring company). Subsequently, the company takes on the responsibility for collecting these payments. Additionally, the company assumes responsibility for collecting payments from customers.

Moreover, this arrangement completely removes the collection burden from businesses while providing immediate cash. Furthermore, factoring companies typically advance 80-90% of invoice values immediately, with the remainder paid after customer payments are received.

Invoice Discounting

Invoice discounting allows businesses to borrow against their invoices while maintaining control over customer collections. Additionally, this arrangement preserves existing customer relationships since businesses continue handling all communications. Moreover, customers remain unaware of the financing arrangement.

Furthermore, invoice discounting typically offers more favorable terms for businesses with strong customer relationships. Therefore, companies can access funding while maintaining their professional reputation and customer trust.

Selective Invoice Financing

Selective invoice financing enables businesses to choose specific invoices for financing rather than financing all outstanding receivables. Additionally, this approach provides maximum flexibility for managing cash flow needs. Moreover, businesses can finance high-value invoices while maintaining smaller receivables internally.

Furthermore, selective financing allows companies to test invoice financing arrangements before committing to comprehensive programs. Therefore, businesses can evaluate the benefits and costs before making larger commitments.

Key Requirements for Invoice Financing

Professional Invoice Documentation

Successful invoice financing applications require professional, detailed invoice documentation. Moreover, invoices must clearly specify payment terms, customer information, and service or product details. Additionally, consistent invoice formatting and numbering systems demonstrate business professionalism.

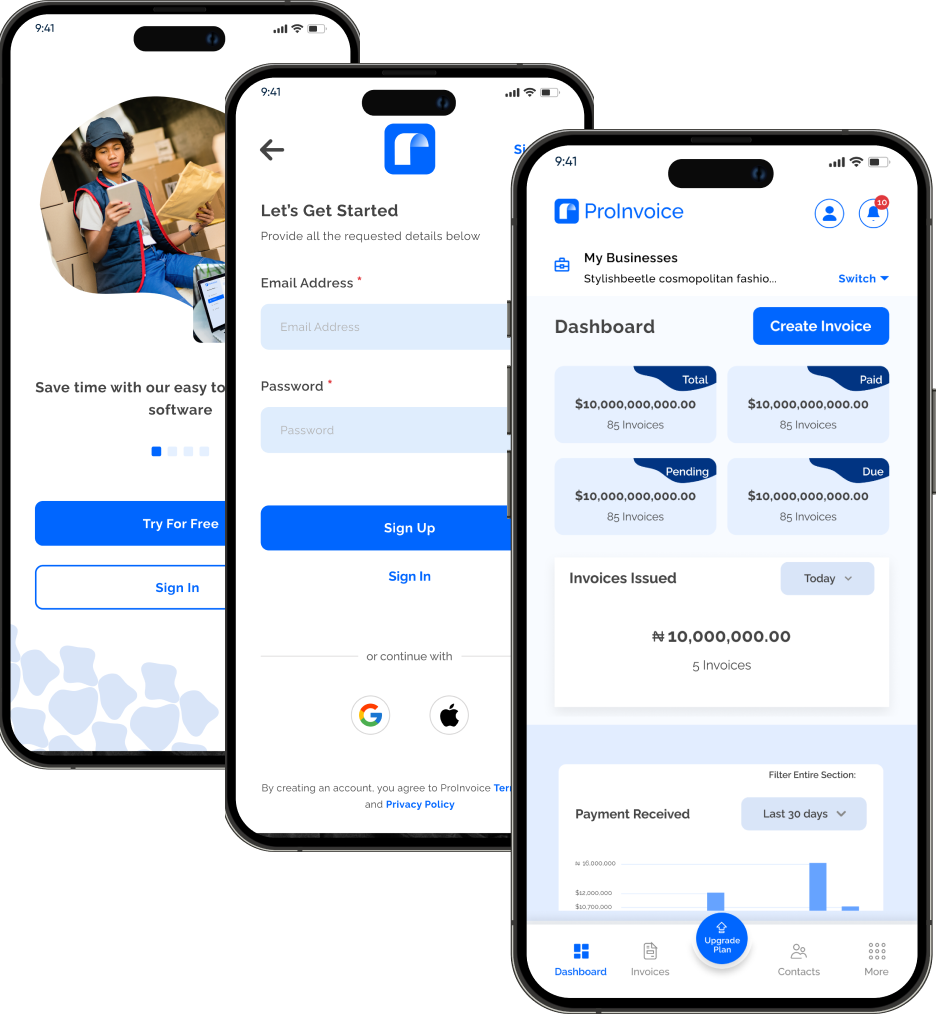

Furthermore, using professional invoicing tools like ProInvoice app helps create standardized, professional invoices that strengthen financing applications. Therefore, businesses should invest in quality invoicing systems to improve their financing prospects.

Creditworthy Customer Base

Lenders primarily evaluate the creditworthiness of customers who owe money on the invoices. Additionally, businesses with established customers who have strong payment histories receive more favorable financing terms. Moreover, government contracts and large corporate customers often qualify for premium financing rates.

Furthermore, diversified customer bases reduce lender risk and improve financing availability. Therefore, businesses should focus on building relationships with creditworthy customers to enhance their financing options.

Established Business Operations

Most operation financing providers require businesses to have established operational histories. Additionally, companies typically need to demonstrate consistent sales patterns and customer relationships. Moreover, businesses should maintain accurate financial records that support their financing applications.

Furthermore, established businesses with proven track records receive better financing terms and higher advance rates. Therefore, maintaining detailed business records and demonstrating stability improves financing prospects.

Clear Payment Terms

Invoices must specify clear payment terms that align with lender requirements. Additionally, payment terms typically range from 30 to 90 days, with shorter terms receiving more favorable rates. Moreover, consistent payment terms across all invoices demonstrate business professionalism.

Furthermore, lenders prefer businesses that enforce their payment terms consistently. Therefore, maintaining disciplined credit management practices improves financing availability and terms.

Steps to Access Invoice Financing

1. Prepare Professional Documentation

Begin by organizing all invoice-related documentation professionally. Moreover, ensure invoices contain complete customer information, detailed service descriptions, and clear payment terms. Additionally, maintain consistent formatting and numbering systems across all invoices.

Furthermore, using professional invoicing software like ProInvoice helps create standardized documentation that meets lender requirements. Therefore, invest in quality invoicing tools to strengthen your financing applications.

2. Research Financing Providers

Identify reputable invoice financing providers that serve Nigerian businesses. Additionally, compare their terms, advance rates, and fees to find the most suitable arrangements. Moreover, consider both traditional banks and specialized financing companies.

Furthermore, evaluate providers based on their industry experience and customer reviews. Therefore, choose established providers with proven track records in invoice financing.

3. Submit Financing Applications

Complete detailed applications that highlight your business strengths and customer quality. Additionally, provide comprehensive invoice documentation and customer payment histories. Moreover, be prepared to answer questions about your business operations and customer relationships.

Furthermore, submit applications to multiple providers to compare terms and increase approval chances. Therefore, maintain organized documentation that can be easily shared with different lenders.

4. Undergo Due Diligence

Cooperate fully with lender due diligence processes that evaluate your business and customers. Additionally, provide additional documentation promptly when requested. Moreover, be transparent about any potential issues or challenges.

Furthermore, use this process to demonstrate your business professionalism and commitment to the financing arrangement. Therefore, maintain open communication with lenders throughout the evaluation process.

5. Negotiate Terms

Review all financing terms carefully before accepting any offers. Additionally, negotiate aspects like advance rates, fees, and payment schedules when possible. Moreover, ensure you understand all costs and obligations associated with the financing arrangement.

Furthermore, consider seeking professional advice when evaluating complex financing terms. Therefore, make informed decisions that align with your business needs and capabilities.

Top Loans Providers for Online Businesses in Nigeria

Traditional Banks

Several Nigerian banks offer invoice financing products for established businesses. Moreover, banks like First Bank provide invoice discounting services with competitive rates. Additionally, bank-based financing often offers lower costs but may have stricter requirements.

Furthermore, established banking relationships can facilitate faster approval processes. Therefore, consider approaching your primary bank first when exploring invoice financing options.

Specialized Financing Companies

Specialized financing companies often provide more flexible terms and faster approval processes. Moreover, these providers focus exclusively on invoice financing and understand business needs better. Additionally, they may serve smaller businesses that banks might decline.

Furthermore, specialized providers often offer innovative financing structures tailored to specific industries. Therefore, explore both traditional and specialized financing options to find optimal solutions.

Digital Financing Platforms

Invoice financing in Nigeria is rapidly growing, offering SMEs and contractors flexible cash flow solutions through digital platforms and tailored products amid tight credit conditions. Additionally, digital platforms streamline application processes and provide faster funding decisions.

Moreover, these platforms often serve smaller businesses and provide more accessible financing options. Furthermore, digital solutions typically offer transparent pricing and simplified application processes.

Managing Invoice Financing Successfully

Maintain Professional Standards

Continue maintaining professional invoicing standards throughout the financing arrangement. Moreover, ensure all invoices meet lender requirements and maintain consistent quality. Additionally, address any customer disputes promptly to protect your financing relationship.

Furthermore, use professional tools like ProInvoice to maintain consistent invoice quality and documentation. Therefore, invest in systems that support long-term financing relationships.

Monitor Customer Payments

Track customer payment patterns carefully to identify potential issues early. Additionally, communicate proactively with customers about payment schedules and any concerns. Moreover, address payment delays promptly to maintain lender confidence.

Furthermore, maintain detailed records of all customer communications and payment activities. Therefore, demonstrate active credit management to strengthen your financing position.

Plan for Growth

Use invoice financing strategically to support business growth rather than just addressing cash flow problems. Additionally, reinvest the improved cash flow into activities that generate additional revenue. Moreover, build stronger customer relationships that enhance your financing prospects.

Furthermore, consider expanding your customer base to improve financing terms and availability. Therefore, use invoice financing as a tool for sustainable business growth.

Common Challenges and Solutions

Customer Payment Delays

Customer payment delays can complicate invoice financing arrangements. However, maintaining strong customer relationships and proactive communication helps minimize these issues. Additionally, offering early payment discounts can encourage faster payments.

Furthermore, diversifying your customer base reduces dependence on any single customer. Therefore, focus on building relationships with multiple reliable customers to strengthen your financing position.

Financing Costs

Invoice financing involves costs that reduce the effective amount received from invoices. Nevertheless, these costs often compare favorably to the opportunity costs of delayed payments. Additionally, improved cash flow can generate returns that exceed financing costs.

Furthermore, shopping among multiple providers helps identify the most competitive terms. Therefore, evaluate the total cost of financing against the benefits of improved cash flow.

Documentation Requirements

Maintaining proper documentation requires ongoing effort and attention to detail. However, investing in professional invoicing systems significantly reduces this burden. Additionally, consistent documentation processes become routine with proper systems in place.

Furthermore, quality documentation supports other business activities beyond financing. Therefore, view professional invoicing as an investment in overall business improvement.

Future of Invoice Financing in Nigeria

The invoice financing sector in Nigeria continues expanding rapidly. Moreover, increasing digitalization and improved payment systems enhance the viability of invoice financing. Additionally, regulatory improvements create more favorable environments for both lenders and borrowers.

Furthermore, integration with digital payment systems and e-invoicing platforms will streamline financing processes. Therefore, businesses should prepare for increasingly sophisticated financing options that leverage technology.

Conclusion

Invoice financing offers Nigerian businesses an excellent opportunity to access funding without traditional collateral requirements. Additionally, this financing method leverages existing business assets – unpaid invoices – to improve cash flow immediately. Moreover, professional invoice management using tools like ProInvoice strengthens financing applications and improves approval prospects.

Furthermore, invoice financing provides flexibility and speed that traditional banking products cannot match. Therefore, businesses should seriously consider invoice financing as part of their funding strategy. Additionally, the growing availability of invoice financing options means more businesses can access this valuable funding source.

Finally, success with invoice financing requires maintaining professional standards, building strong customer relationships, and managing the financing arrangement strategically. Therefore, businesses that approach invoice financing professionally can unlock significant growth opportunities while maintaining financial stability.