Running a business in South Africa involves more than delivering great products or services—it also means managing operations professionally. That starts with issuing the right documentation at the right time. Invoicing is more than a transaction record—it sets the tone for payment, clarity, and compliance. Fortunately, tools like ProInvoice make creating and issuing invoices effortless and professional.

This article explains when you’re required to send an invoice in South Africa, what information must be included, and how ProInvoice can simplify the process and keep your business compliant.

Do You Have to Send an Invoice?

1. When Is It Legally Required?

Yes—under South African tax law, issuing a tax invoice is mandatory in certain situations. Specifically:

- If you’re VAT-registered and the amount of the supply exceeds R50, you must issue a tax invoice within 21 days of the supply.

- If the amount is between R50 and R5 000, an abridged tax invoice is permitted.

- For supplies of R50 or less, a formal invoice isn’t required, but you must still keep proof of the transaction.

This ensures both legal compliance and clarity in your records.

2. What’s Required on a Valid Tax Invoice?

A full tax invoice must include:

- The words “Tax Invoice”, “VAT Invoice”, or “Invoice” clearly displayed

- Supplier’s name, address, and VAT registration number

- Recipient’s name and address (VAT number if they’re a vendor)

- A unique invoice number and issue date

- A clear description of goods/services, quantities, and prices

- A breakdown showing VAT-exclusive price, VAT amount, and the total

For amounts between R50 and R5 000, a simplified (abridged) tax invoice can be used.

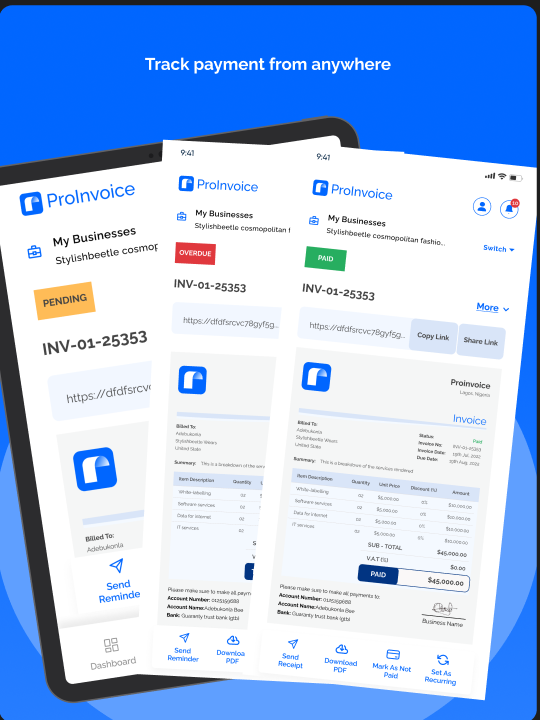

3. What About E-Invoicing?

Electronic invoicing is increasingly popular in South Africa. While not mandatory yet, e-invoices are valid as long as they meet the same requirements as paper invoices. This makes digital solutions like ProInvoice an ideal choice for businesses aiming to modernize and stay ahead.

Why Issuing Invoices Matters

- Legal compliance: Without a proper tax invoice, businesses cannot claim VAT or prove transactions.

- Financial clarity: Invoices provide an audit trail for transactions and help with bookkeeping.

- Professionalism & cash flow: Clear invoices speed up payments and reduce disputes.

How ProInvoice Helps

Creating compliant invoices doesn’t have to be complex. That’s where ProInvoice comes in:

- Easy invoicing: Generate professional tax or abridged invoices in minutes—fully compliant with South African requirements.

- Automated details: Invoice templates include all mandatory fields, ensuring you never miss a detail.

- Time-stamped and ready: Issue invoices instantly, helping you meet the 21-day compliance window.

- Organized records: Store and retrieve your invoices easily—ideal for audits or VAT tracking.

Summary Table

| Invoice Type | When Required | Key Details Required |

|---|---|---|

| Full Tax Invoice | VAT-registered, supply > R50 | All mandatory details with VAT breakdown |

| Abridged Tax Invoice | Supply between R50 and R5 000 | Simplified version; fewer details allowed |

| Receipt/Docket | Supply ≤ R50 | Proof of transaction |

| E-Invoice | Optional (valid if compliant) | Same requirements as a paper invoice |

Final Thoughts

If your business is VAT-registered and your supplies exceed R50, issuing a compliant invoice is not just good practice—it’s legally required. Even for smaller amounts, keeping documentation is essential. Digital tools like ProInvoice make invoicing faster, accurate, and audit-ready.

Ready to simplify your invoicing process, stay compliant, and save time? Sign up now for ProInvoice and take control of your billing today.