In today’s article, we shall be delving into the definition, uses of Journal entries, and answering the question Where Should an Invoice Be Recorded? You already know how important an invoice is in your business; without an invoice, you won’t receive payment for your goods and services.

Since we agree on this fact, where should you keep record of your invoices? Not recording your invoice is as bad as not having one at all.

After creating your invoice for payments of your products and services, you need to keep an organized record of paid and pending invoices in what is known as a journal entry.

What Is A Journal Entry?

Journal entries are by far one of the most important skills to master. Without proper journal entries, companies financial statements would be inaccurate and could lead to financial disaster.

A journal entry is an official book where you keep record of all transactions in order and with dates.

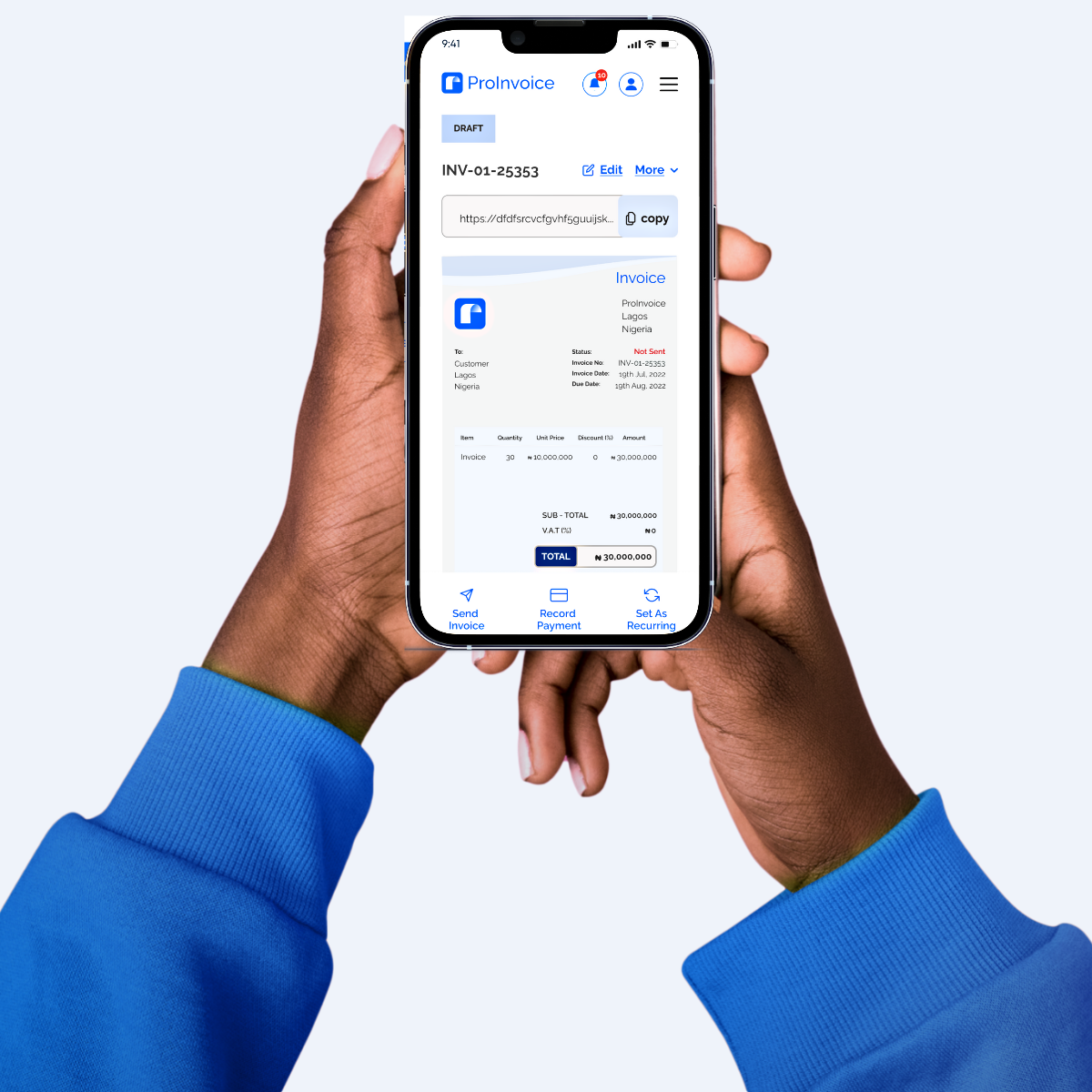

In the past the journal entries were kept in books and papers, nowadays accounting software like Proinvoice makes your records – journal entries, much easier and effective.

Journal entries are beneficial for recording the financial activity of your business.

Journal entries are either recorded in subsidiary ledgers if you are keeping your books manually or they are recorded directly into the general ledger if you are using an accounting software.

Just an addition, in every journal entry that you record, always make sure that the debts and credits are equal to ensure balancing your account taking.

There are four factors to be considered in recording your invoices :

- Which accounts get affected by the transactions.

- For each account determine if it is increased or decreased

- For each account determine how much it is changed.

- Make sure that the records stay in balance.

There are two accounts mostly considered in invoice recording, they are…

Accounts Payable and Accounts Receivable

A new account payable and a new account receivable are created every time an invoice is sent and/or received.

This is why invoices and payments must be recorded in order to keep an accurate financial statement.

- Accounts Payable: These are the sums you owe to suppliers as payments for the items and services you have received from them.

- Accounts Receivable: This is the money your customers owe you for the goods and services they have received from you. Your invoice should be for this whole account, since account receivable represents future cash flows, they are considered current assets.

How To Record Invoices

Every enterprise has its unique challenges, which makes each one have a different way of doing its journal entries and invoice records.

This means that every company should develop a unique system for keeping track of vendor invoices and payments tailored to its specific demands.

However there are several categories that are common to most fields :

- Accounts payable journal entry: Accounts payable are credited while the asset or cost used to fund the purchase is deducted. If cash is credited then an account payable is debited for the goods and services the company sells.

- Accounts Receivable journal entry: This is the money your customers owe you for the goods and services they have received from you. Your invoice should be for this whole account, since account receivable represents future cash flows, they are considered current assets.

- Logging of small sum money: when the petty cash box needs replenishing, the financial transactions to do so is recorded as a credit to cash accounting. A debit entry is made in the expenditures to be charged to the accounts receivable account in the total amount of money used to replenish the petty cash account.

- Keeping track of payroll: Wages and pay roll tax charges/expenses are debited and the cash account is credited during processing pay roll. Additional credits for deductions must be provided from benefit expenditure accounts if an employee has authorized a deduction from pay or salary for benefits.

These are some of the common entries in the record keeping.

How To Record Payments (Basic Example)

Let’s say a company called ”bags unlimited” sold 100 nylon bags to Company B, and both companies agreed on a certain payment due date.

Bags unlimited sends its invoice and writes the due date as December 15, as agreed by both parties.

It records the transaction as an accounts receivable while company B will record it as an account payable.

Advantages Of A Well-run Journal Entry or Invoice Record System

While every business has its answer to how invoices should recorded, there are many benefits to organizations in automating proper invoice record.

- Optimization of cash flow: Accurate financial records and cash-flow forecasting is made possible by automating the accounts payable and receivable process thereby reducing the need for manual operations and possible errors. Accounts payable benefit from process visibility because they may direct their efforts towards the most critical tasks that affect cash flow.

- Make the most of your experience: Centralizing the inbound invoicing process improves payables posting accuracy. A full audit trail is constructed to double-check the steps and the workers that performed them.

- Better Monitoring system: Increasing adherence to internal controls to avoid fraud and preserve the integrity of financial results is crucial as the globe shifts to electronic invoices in response to new regulations.

- Massive Money-saving Measures: Spending may be reduced in every department, thanks to automation. Self-service portals for suppliers, a decline in duplicate invoices (and duplicate payments), a rise in cash discount advantages (e.g payment terms like early payment discounts and fees for late payments), and the removal of later date penalties owing to late payments are just a few of how businesses may save money with invoice automation.

- Enhancing Quality: Mistakes, delays and excessive expenses can be avoided using an automated process with high quality invoice total data and credit amounts. Instead of having a separate exception procedure, they are handled inside the workflow itself.

In conclusion, these key takeaways show that invoice recording will always be very crucial to business owners, companies and freelancers since it not only helps them get paid but also helps them keep track of other important factors like cash flow.

ProInvoice makes an appealing impression for recording your invoices. Choose ProInvoice to create, share and record your professional invoices.