As a business owner, making money and customer retention should be your priorities. To do this, you need to provide your customers with a smooth, user-friendly payment process while giving them a sense of confidence that their details will stay secure.

You also want to know you’re going to receive payments quickly and efficiently.

Online payment involves everything that allows individuals and businesses to initiate and receive payments online.

Online payment methods allow users to make online purchases and send or transfer funds from one account to another using the internet.

These payment methods provide small businesses with a more efficient, secure, and convenient way of making transactions than traditional payment methods like cash or checks.

As a small business owner, managing transactions can be an overwhelming and tedious task.

But what if I say there are ways to automate your payments, reduce expenses, and increase customer satisfaction simultaneously?

The answer is to adopt online payment methods for your business.

In this blog post, we explore how you can enhance your small business by adopting online payments and how it can benefit both you, your business, and your customers!

Understanding online payment methods

Globally, online or electronic payments are a booming industry, having attracted more investment than any other financial services sector and delivered the highest returns and growth in the sector over the past decade.

Although Africa has seen a more rapid increase in digital payment adoption over the past few years,. This increase can be attributed to several factors, such as the increasing number of mobile phone users on the continent and the rise of e-commerce.

Several different digital payment systems are currently being used in Africa, including debit cards, digital wallets, mobile money, and online banking.

Here are some means of accepting online payments for small businesses.

Payment service providers

A payment service provider (PSP) is a company that enables businesses to accept and process payments from their customers. These companies act as intermediaries between your business and your customers, helping you facilitate secure and efficient online payment transactions.

Mobile payments

Mobile payments are digital platforms that allow consumers to use their mobile devices, such as smartphones or smartwatches, to purchase goods and services. Instead of using physical cash or credit cards,

Mobile payments use digital wallets and payment apps to complete monetary transactions.

Invoicing and billing

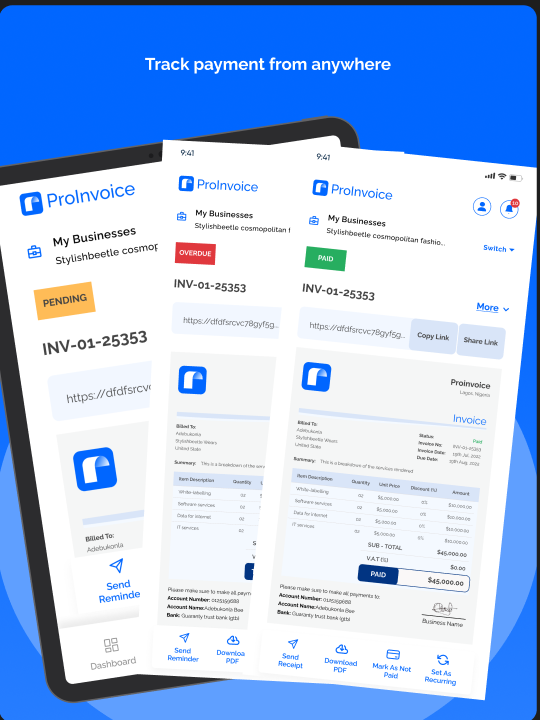

When receiving online payments, invoicing and billing are must-haves for any business that wants to successfully keep track of its finances.

From the customer’s point of view, this facilitates timely and accurate processing and provides transparent information about the items purchased, cost, and payment expectations.

Collecting payments is simplified thanks to popular invoicing systems such as Proinvoice, which offers integration with various payment providers.

Popular online payment methods for Small business

Online payment methods are ways to make payments electronically via the Internet. These payment methods allow people to pay for goods or services they purchase online without the need for physical cash or checks. Some of the most popular online payment methods that you can choose from as a small business owner include:

1. Credit and Debit Cards

Credit and debit cards are the most common online payment forms. Almost all online retailers accept credit card payments, and many also accept debit card payments.

2. eWallets or Digital Wallets

eWallets are digital wallets that allow you to store your credit or debit card information securely. PayPal, Google Pay, and Apple Pay are some of the most popular e-wallets.

3. Bank Transfers

Online bank transfers enable people to send money electronically from their bank account to a merchant’s account.

4. Mobile Payments

Mobile payments allow people to make payments using their smartphones.

Benefits of adopting Online payment as a business

1. Increased Sales and Revenue

Online payment methods enable businesses to reach a broader audience, including customers beyond their local vicinity.

Aside from the fact that online payment is available 24/7, this means that businesses can accept payment at any time, even outside regular business hours, leading to increased sales revenue.

2. Create Convenience for Customers

Online payments provide a convenient, easy, and user-friendly way for customers to make purchases without the need for physical cash or checks. You can also offer multiple payment options, including credit and debit cards and digital wallets, thereby reducing friction in the purchasing process and making it more appealing to customers.

3. Cost Savings and Efficiency

Automating payment processes can reduce the time and resources spent on manual administrative tasks associated with traditional payment methods.

4. More Secure than the physical payment method

Most reputable online payment platforms employ advanced encryption and security precautions and methods that ensure a secure environment for online financial transactions.

5. Better Record-Keeping:

With online payment methods, businesses can generate digital records that are easier to track and manage. This can simplify accounting and financial management for your businesses.

6. Building Trust: and Credibility

Adopting an online payment method can enhance your business’s credibility and professionalism in the eyes of customers.

Most customers feel more relaxed when they know your business has an online payment system, as it helps to build trust in your business, encouraging repeat business and positive reviews.

Rounding Up on accepting online payment as a small business

Small businesses have a range of online payment methods that allow their customers to pay their invoices conveniently online.

One way small businesses in Nigeria have been accepting payment for their invoices is by adopting Proinvoice for their general invoicing activities.

Over 22,000 businesses use Proinvoice to create and send invoices to their customers, while also using the platform to accept payment for every invoice sent.

One major benefit of adopting Proinvoice is that you can send automatic payment reminders for ‘every sent invoice, meaning you won’t miss out on any invoice or payment.

You can get started for free on Proinvoice