Running a business in Kenya or Ghana often means juggling clients, projects, and payments. One of the biggest challenges entrepreneurs face is knowing which invoices have been paid, which are pending, and which are overdue.

If you don’t consistently track invoice status, it’s easy to lose sight of unpaid bills, delay cash flow, or even damage client relationships. That’s why modern businesses are turning to digital tools like ProInvoice — a simple yet powerful invoicing solution that helps you stay in control.

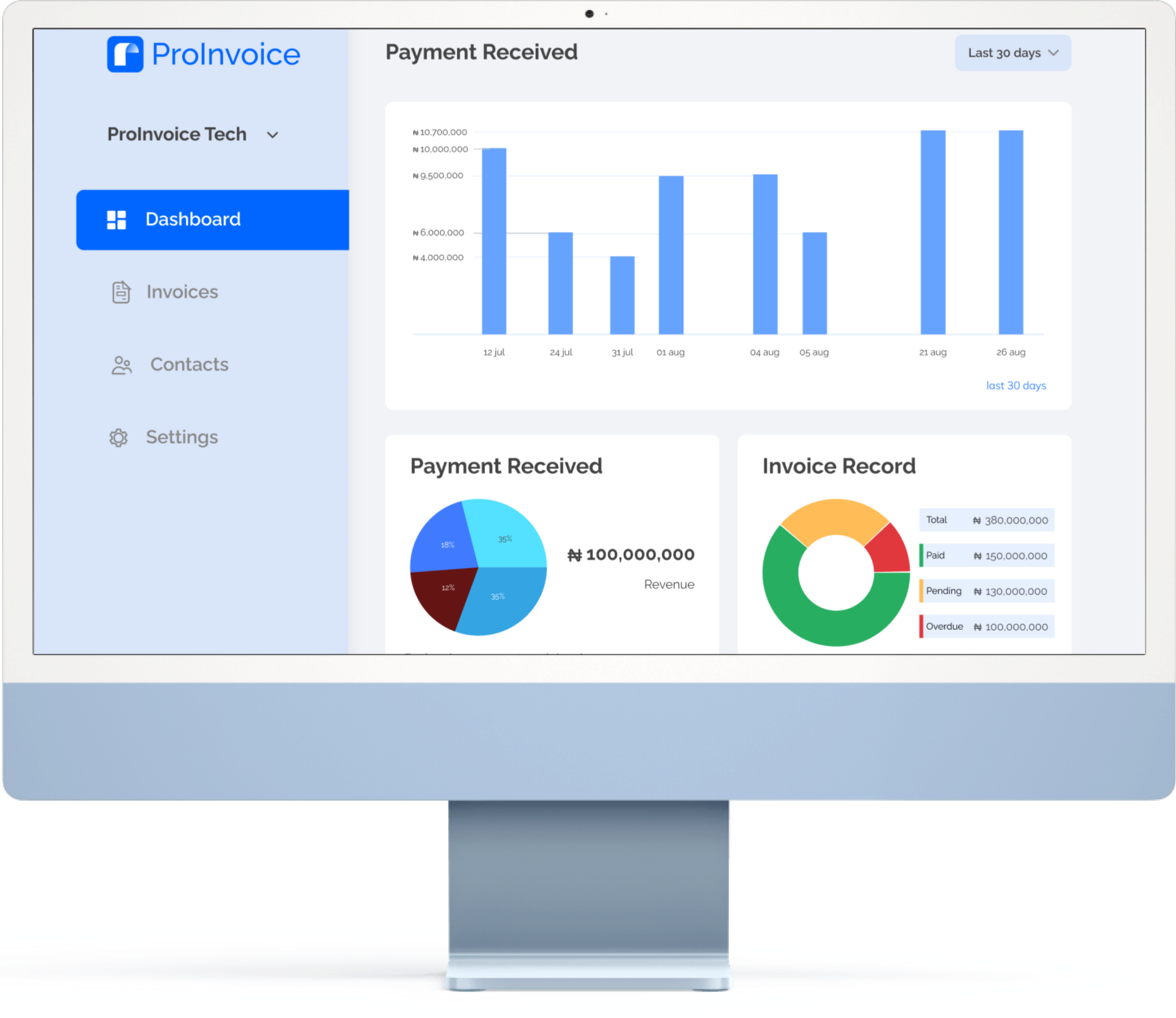

With ProInvoice, you can easily create invoices, send them instantly, and track invoice status in real-time — all from one dashboard.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

What Does It Mean to Track Invoice Status?

To track invoice status means monitoring every invoice from the moment it’s created until it’s paid. This includes keeping tabs on invoices that are:

- Pending: Sent but not yet paid

- Viewed: Opened by the client but awaiting payment

- Paid: Successfully settled

- Overdue: Past the due date without payment

Having this information at your fingertips helps you understand your cash flow, make smarter business decisions, and take timely follow-up actions.

With ProInvoice, tracking your invoice status becomes automated — no more spreadsheets, no more manual updates.

Why Businesses in Kenya and Ghana Need to Track Invoice Status

In markets like Kenya and Ghana, where small and medium-sized enterprises (SMEs) drive much of the economy, cash flow management is crucial. Late payments are common, and without a clear system to track invoice status, businesses can quickly lose track of what’s owed.

Here’s why this feature matters so much:

1. Prevent Cash Flow Disruptions

When you know which invoices are overdue, you can plan for shortfalls, follow up promptly, and keep your finances stable.

2. Maintain Professionalism

Clients appreciate organized businesses. When you use tools like ProInvoice to send clear, timely invoices with proper status tracking, it boosts your credibility.

3. Save Time

Instead of manually checking payment histories, your Invoice Dashboard does all the work — automatically updating each invoice’s progress.

4. Reduce Errors

Automated status updates minimize the risk of forgetting who’s paid and who hasn’t, ensuring your books are always accurate.

How to Track Invoice Status Effectively

Monitoring invoices doesn’t need to be complicated. Here’s how to simplify it using smart invoicing practices and tools like ProInvoice:

1. Use a Centralized Dashboard

A single view where all invoices are listed by status — paid, unpaid, pending, or overdue — gives you full control. The ProInvoice dashboard updates automatically so you always know your current financial position.

2. Automate Invoice Tracking

With automation, you don’t have to manually check every invoice. ProInvoice automatically marks invoices as “sent,” “viewed,” or “paid,” and reminds clients when payments are due.

3. Enable Real-Time Notifications

Get instant alerts whenever a client views or pays an invoice. This real-time insight helps you make quicker follow-up decisions.

4. Customize Payment Terms

Set clear due dates, payment methods, and reminders within each invoice. ProInvoice lets you include terms like “Net 7” or “Net 30” to ensure both you and your client are aligned.

5. Review Monthly Reports

At the end of every month, review your invoicing reports. See which clients pay on time and which ones need reminders. These insights help you manage client relationships better.

Benefits of Tracking Invoice Status with ProInvoice

1. Instant Payment Visibility

With ProInvoice, every invoice you send updates automatically. You’ll know immediately whether a client has opened it, viewed it, or paid it — no need for guesswork.

2. Organized Records

All invoices, payment histories, and client details are neatly stored in your ProInvoice account. You can search, filter, and export them anytime.

3. Time Efficiency

Automation means you no longer have to manually check or remind clients. ProInvoice handles these tasks while you focus on running your business.

4. Mobile Access

Using the ProInvoice mobile app, you can track invoice status wherever you are — whether you’re traveling between client meetings in Nairobi or managing projects in Accra.

5. Improved Cash Flow Forecasting

With real-time tracking, you can predict when funds will come in and plan expenses accordingly. That’s the power of visibility.

Why ProInvoice Is Ideal for Businesses in Kenya and Ghana

1. Localized for African Businesses

ProInvoice is designed with African entrepreneurs in mind. It supports local currencies — Kenyan Shillings (KES) and Ghanaian Cedis (GHS) — and allows flexible payment terms that suit your business needs.

2. Seamless Mobile Experience

The ProInvoice mobile app ensures you can send invoices, check payment status, and monitor your cash flow directly from your phone. Perfect for on-the-go professionals.

3. Professional Branding

Every invoice you send through ProInvoice reflects your business professionalism. You can easily add your logo, address, and brand colors — leaving a positive impression on clients.

4. Secure and Reliable

Your data is safely stored in the cloud, meaning you can access your invoices and track payment history anytime, even if you switch devices.

Common Challenges Businesses Face Without Invoice Tracking

If you’re still relying on manual methods or scattered records, you might recognize these problems:

- Missed Payments: Without reminders, some invoices simply get forgotten.

- Poor Cash Flow: You can’t plan spending without knowing what’s due.

- Client Confusion: Without clear records, clients might dispute payments.

- Time Wastage: Chasing payments manually takes valuable time.

Using ProInvoice helps you overcome all of these — through automation, reminders, and accurate tracking.

ProInvoice Features That Help You Track Invoice Status

ProInvoice offers several smart features that make invoice tracking easy:

| Feature | Benefit |

|---|---|

| Invoice Status Indicators | See at a glance which invoices are Paid, Pending, or Overdue. |

| Automatic Reminders | Let the system remind clients about due payments. |

| Payment Notifications | Get alerts when an invoice is opened or paid. |

| Client Dashboard | See all client activity, including payment behavior. |

| Reports and Analytics | Visualize income trends, overdue invoices, and more. |

These features work together to help Kenyan and Ghanaian entrepreneurs track invoice status seamlessly.

How to Use ProInvoice to Track Invoice Status

Here’s how simple it is to get started:

- Sign up on ProInvoice — registration is quick and free.

- Create your first invoice — add your client’s name, payment terms, and amount.

- Send the invoice via email directly from the platform.

- Track invoice status — see when it’s viewed, due, or paid.

- Use your dashboard to monitor all transactions in real-time.

- Download the mobile app to manage invoices from anywhere in Kenya or Ghana.

In just a few minutes, you’ll have a professional invoicing system running that saves time and improves financial control.

Best Practices for Tracking Invoices

Even with automation, consistency is key. Here are some best practices for small business owners:

- Send invoices immediately after completing work or delivering goods.

- Set payment reminders at 3-day and 7-day intervals before due dates.

- Categorize clients by reliability to know who needs closer follow-up.

- Reconcile payments weekly to ensure your dashboard reflects reality.

- Review reports monthly to identify trends and improve performance.

ProInvoice automates most of these, but developing a consistent review habit ensures nothing slips through the cracks.

The Future of Invoice Tracking in Africa

The future of finance management across Africa is automation. As digital adoption rises in Kenya and Ghana, more businesses are shifting from manual systems to tools like ProInvoice.

These tools not only help you track invoice status but also provide insights that drive growth — such as client reliability, income projections, and payment behavior patterns.

Businesses that embrace automation will enjoy smoother operations, faster payments, and stronger client trust.

Conclusion: Stay in Control with ProInvoice

Knowing your numbers is key to success — and being able to track invoice status gives you that control.

With ProInvoice, you’ll always know who owes what, when payments are due, and how your business is performing — all from a single dashboard.

Whether you’re a freelancer in Nairobi, a consultant in Kumasi, or an SME in Accra, ProInvoice helps you track payments efficiently, get paid faster, and manage your finances with confidence.

Start today — sign up for free and experience how ProInvoice makes invoice tracking effortless and professional.