Keyphrase: Businesses You Can Start in Nigeria With 500k–6 Million, Free Invoice Online, Online Businesses, snail farming in Nigeria

Nigeria’s entrepreneurial landscape is bursting with opportunities for ambitious individuals ready to transform their capital into thriving enterprises. Whether you’re sitting on ₦500,000 or have access to ₦6 million, the Nigerian market offers diverse pathways to financial success. Furthermore, the key lies in identifying businesses that align with local needs, leverage existing infrastructure, and can scale effectively in our dynamic economy.

Why Start a Business in Nigeria Today?

The beauty of starting a business in Nigeria today is the convergence of traditional market demands with digital innovations. From Lagos to Kano, Port Harcourt to Abuja, consumers are seeking quality products and services, creating multiple entry points for smart investors. Additionally, this comprehensive guide explores seven proven business models that have consistently delivered impressive returns for Nigerian entrepreneurs.

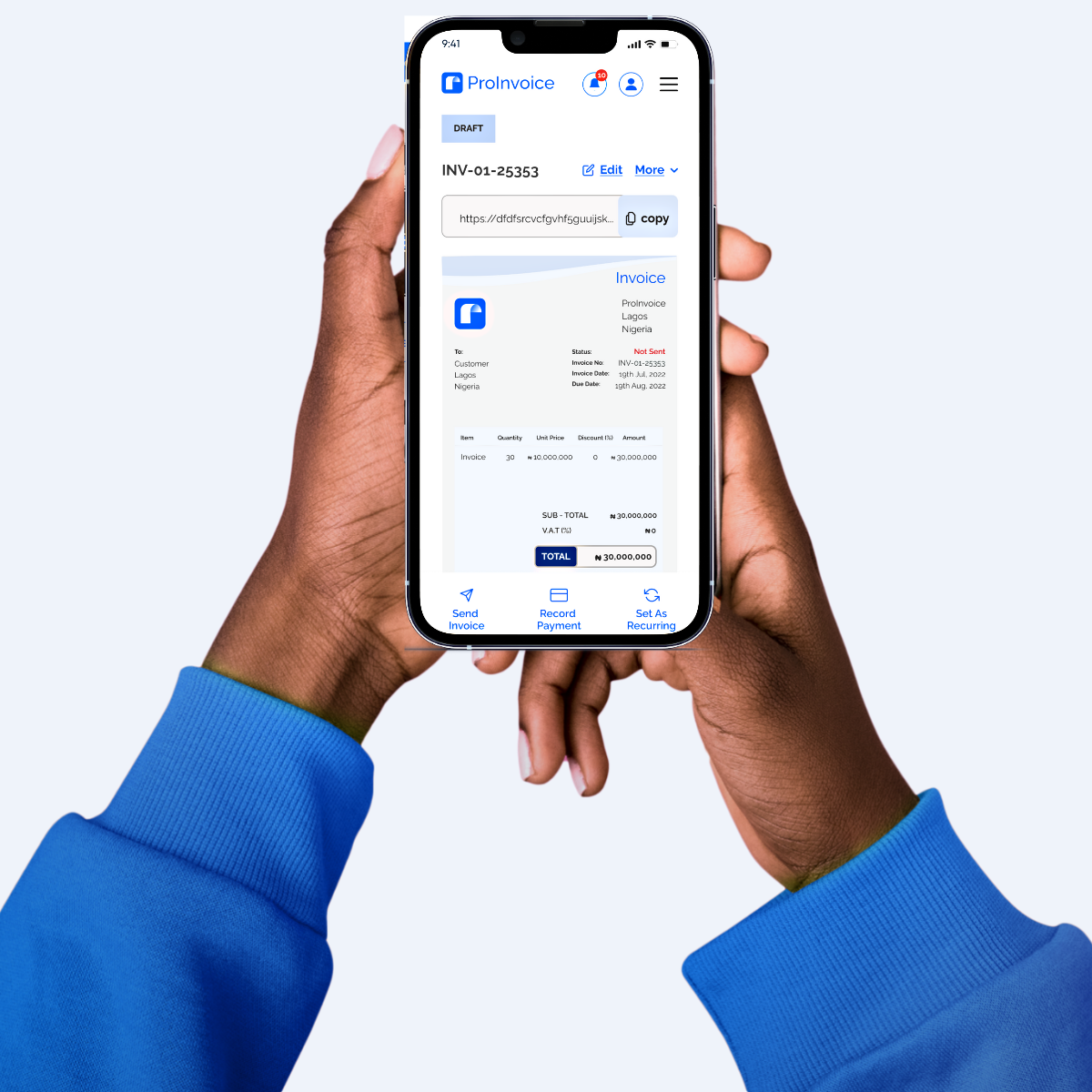

Meanwhile, successful entrepreneurs understand that proper financial management starts from day one. Therefore, sign up for ProInvoice to establish professional invoicing systems that build credibility with your first customers.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

1. E-commerce and Online Retail Business (₦800k – ₦3M)

E-commerce offers unlimited growth potential with Nigeria’s growing internet penetration. Moreover, focusing on high-demand products like fashion, electronics, or beauty items through Instagram, Facebook Marketplace, and e-commerce websites can yield significant returns.

Initial investment covers inventory, website development, and logistics. However, success requires consistent customer service and professional invoicing systems. Consequently, monthly revenues can range from ₦500,000 to ₦5 million within the first year.

Building Customer Trust in E-commerce

Trust becomes crucial in online retail, especially when customers can’t physically inspect products. Therefore, professional invoicing demonstrates reliability and builds confidence. Additionally, ProInvoice’s e-commerce templates help manage order confirmations, payment receipts, and refund documentation seamlessly.

2. Food Processing and Packaging Business (₦600k – ₦2.5M)

Food processing meets Nigeria’s massive demand for processed foods. Specifically, specializing in traditional Nigerian foods with modern packaging – premium palm oil, organic pepper blends, or packaged traditional soups – can be highly profitable.

Startup costs include processing equipment, packaging materials, and NAFDAC approvals. Therefore, managing supplier relationships and customer billing efficiently becomes essential for cash flow. As a result, profit margins can reach 40-60% with strong brand positioning.

Regulatory Compliance and Documentation

Food businesses require extensive documentation for regulatory compliance. Meanwhile, professional invoicing software helps maintain proper records for NAFDAC inspections and tax purposes. Furthermore, automated invoice generation saves time while ensuring accuracy in financial reporting.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

3. Real Estate Investment and Development (₦1M – ₦6M)

Real estate offers reliable wealth-building through Nigeria’s growing population and urbanization. With ₦1-2 million, entrepreneurs can focus on land acquisition in developing areas. Alternatively, for ₦3-6 million, exploring rental properties or small-scale development projects presents excellent opportunities.

Key Success Factors in Real Estate

Success requires thorough location analysis, proper legal documentation, and understanding local market dynamics. Meanwhile, professional invoicing software helps manage rental payments and property expenses efficiently. Typically, real estate delivers 15-25% annual returns plus property value appreciation.

Managing Property Rental Income

Rental income management demands consistent documentation and professional presentation. Therefore, automated rental invoicing ensures timely payments while maintaining landlord-tenant relationships. Additionally, expense tracking features help monitor property maintenance costs and calculate actual returns.

4. Agricultural Business and Agro-Processing (₦500k – ₦4M)

Agriculture offers opportunities from crop production to livestock farming and agro-processing. Notably, focusing on high-value crops like vegetables, fruits, or cash crops can maximize returns. Similarly, poultry farming, fish farming, and livestock rearing also present excellent opportunities.

Investment covers land lease, farming inputs, and equipment. Subsequently, managing supplier relationships and customer payments becomes crucial for operational efficiency. Generally, agricultural businesses can generate 25-50% returns annually.

Seasonal Cash Flow Management

Agricultural businesses face seasonal cash flow challenges that require careful financial planning. Therefore, ProInvoice’s payment tracking helps monitor receivables and plan for seasonal variations. Furthermore, automated reminders ensure timely payments during critical planting and harvesting seasons.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

5. Transportation and Logistics Services (₦800k – ₦5M)

Transportation and logistics offer multiple opportunities from ride-hailing services to cargo transportation and delivery services. Initially, starting with commercial vehicle operations provides a solid foundation for growth. Nevertheless, success depends on efficient route planning, vehicle maintenance, and customer service excellence.

Financial Requirements and Returns

Capital requirements include vehicle acquisition, insurance, and registration fees. However, proper financial management determines long-term sustainability and profitability. Therefore, professional invoicing solutions help track trip payments and manage driver settlements efficiently. Transportation businesses can generate ₦200,000 to ₦800,000 monthly per vehicle.

Driver Management and Payment Systems

Managing multiple drivers requires transparent payment systems and clear documentation. Additionally, automated invoice generation helps calculate driver commissions and track vehicle expenses accurately. Furthermore, professional documentation builds trust with corporate clients seeking reliable logistics partners.

6. Technology Services and Digital Solutions (₦700k – ₦3M)

Technology services offer high-growth potential with low physical infrastructure requirements. Particularly, specializing in solutions addressing Nigerian market needs creates sustainable competitive advantages. However, success requires staying current with technology trends and understanding customer needs deeply.

Startup costs include equipment, software licenses, and team building investments. Additionally, client billing management becomes crucial for maintaining cash flow in project-based work. Technology businesses can scale rapidly with profit margins often exceeding 50%.

Client Relationship Management

Technology services depend heavily on client relationships and professional presentation. Therefore, ProInvoice’s customizable templates help maintain professional standards while managing complex project billing. Furthermore, automated payment reminders ensure consistent cash flow for ongoing development projects.

7. Manufacturing and Production Business (₦1M – ₦6M)

Manufacturing presents opportunities as Nigeria seeks to reduce import dependence. Specifically, focusing on products with strong local demand but limited domestic production creates market advantages. Furthermore, success requires understanding production processes, quality control, and market positioning strategies.

Investment covers equipment, raw materials, facility setup, and regulatory compliance costs. Additionally, managing supplier payments and customer billing efficiently impacts working capital significantly. Manufacturing businesses typically generate 20-40% profit margins.

Supply Chain Financial Management

Manufacturing businesses require sophisticated financial management for complex supply chains. Therefore, integrated invoicing systems help track raw material costs, production expenses, and customer payments. Meanwhile, automated calculations ensure accurate pricing and profit margin analysis.

Professional Invoice Management for Nigerian Businesses

Running any successful business requires proper financial documentation and invoicing systems. Whether you’re operating as an artisan, providing professional services, or running a retail operation, professional invoicing builds credibility and ensures financial control.

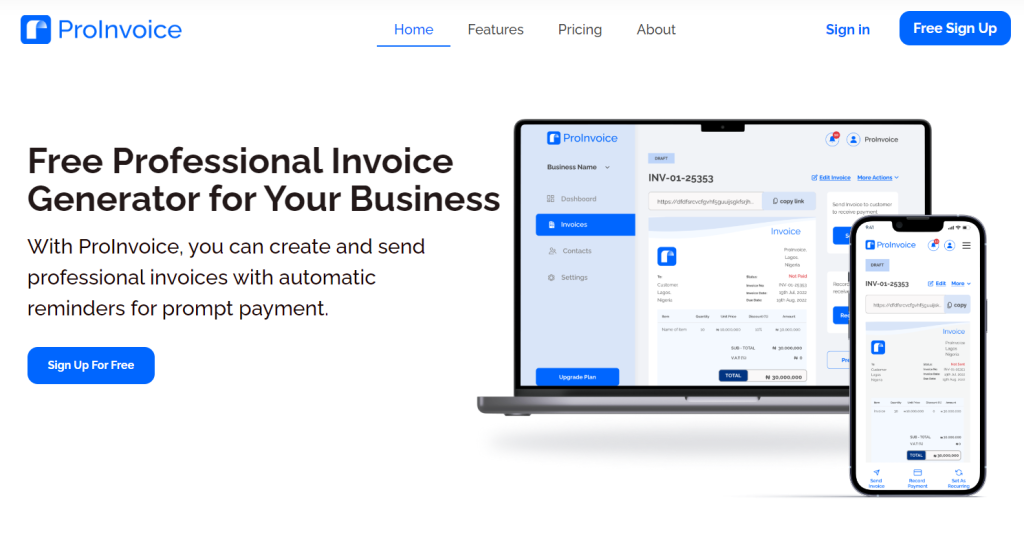

Why Choose ProInvoice?

ProInvoice offers comprehensive invoicing solutions tailored for Nigerian businesses across all categories. With customizable templates, automated calculations, and professional formatting, entrepreneurs can maintain proper financial records while projecting credibility. Furthermore, getting started with ProInvoice takes just minutes and provides immediate access to professional invoicing tools.

Key Features for Nigerian Entrepreneurs

Modern businesses need invoicing solutions that understand local requirements and business practices. Therefore, ProInvoice includes naira currency formatting, local tax calculations, and Nigerian business address formats. Additionally, cloud-based access ensures entrepreneurs can manage invoicing from anywhere with internet connectivity.

Frequently Asked Questions About Invoicing for Nigerian Businesses

Q: What is an invoice and why do I need one for my business?

A: An invoice is a formal document requesting payment for goods or services provided. It’s essential for tracking income, managing cash flow, and maintaining professional credibility with customers. Furthermore, professional invoicing software automates this process while ensuring consistency and accuracy.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.

Q: What should be included in a professional invoice?

A: A professional invoice should include your business details, customer information, invoice number, date, itemized services/products, amounts, payment terms, and total due. Additionally, modern invoicing platforms handle these requirements automatically.

Q: How often should I send invoices to my customers?

A: Send invoices immediately after delivering goods or services, or according to agreed payment terms. For ongoing services, monthly invoicing is standard practice. Meanwhile, automated invoicing systems can schedule recurring invoices for regular customers.

Q: Can I create invoices for free?

A: Yes, you can use ProInvoice’s free invoice generator to create professional invoices without any cost. However, premium features offer additional functionality for growing businesses.

Q: What’s the difference between an invoice and a receipt?

A: An invoice requests payment for goods/services before or at the time of delivery, while a receipt confirms payment has been received. Therefore, both documents serve different purposes in the sales process.

Q: How long should I keep invoice records?

A: Keep invoice records for at least 6 years for tax purposes and business documentation requirements in Nigeria. Furthermore, digital invoicing platforms automatically store and backup all records securely.

Q: Can I customize my invoice template?

A: Yes, ProInvoice offers customizable templates that allow you to add your logo, brand colors, and specific business information. Additionally, professional branding helps build customer trust and recognition.

Q: What payment terms should I include on my invoices?

A: Common payment terms include “Net 30” (payment due within 30 days), “Due on Receipt,” or “Net 15” depending on your business type and customer agreements. However, clear payment terms reduce disputes and improve cash flow.

Q: How do I handle overdue invoices?

A: Send polite payment reminders, offer payment plans if needed, and maintain professional communication. Professional invoicing software can help automate reminder schedules. Therefore, ProInvoice’s automated reminders help maintain customer relationships while ensuring timely payments.

Q: Is electronic invoicing legally valid in Nigeria?

A: Yes, electronic invoices are legally valid in Nigeria as long as they contain all required information and maintain proper records for tax purposes. Furthermore, digital invoicing offers better security and backup compared to paper systems.

Your Path to Entrepreneurial Success

Nigeria’s business environment offers unprecedented opportunities for entrepreneurs willing to commit capital and effort toward building sustainable enterprises. The seven business categories outlined here represent proven paths to financial success, each with unique advantages and growth potential.

Essential Success Factors

Success in any of these ventures requires thorough market research, proper planning, adequate capitalization, and persistent execution. Consider your personal interests, skills, and available resources when choosing your entrepreneurial path. Remember that business success often comes from identifying specific market needs and delivering superior solutions consistently.

Additionally, financial management systems should be established from the beginning to ensure proper cash flow monitoring. Therefore, professional invoicing tools help entrepreneurs maintain financial control while focusing on business growth.

Current Market Opportunities

The current economic environment, despite its challenges, creates numerous opportunities for innovative entrepreneurs. Government policies supporting local businesses, growing consumer sophistication, and technological advancement combine to create a favorable landscape for new ventures.

Whether you choose e-commerce, agriculture, real estate, or any other sector, focus on building systems that can scale effectively. Meanwhile, maintaining high service standards and continuously adapting to market changes ensures long-term sustainability. Your entrepreneurial journey starts with taking the first step – choose your path and begin building the business that will transform your financial future.

Getting Started with Professional Tools

Ready to start your business journey? Ensure professional financial management from day one with ProInvoice – Nigeria’s leading invoicing solution for entrepreneurs and businesses of all sizes. Create your first professional invoice today and establish credibility with your customers from the start.

Stay organized as you grow. Use ProInvoice to manage billing and client relationships with ease.