Late payments remain one of the biggest challenges facing small businesses, freelancers, and growing companies. Clear payment terms reduce late payments by removing confusion, setting expectations early, and encouraging faster action from clients. However, many businesses still struggle because their invoices lack clarity, structure, or enforcement.

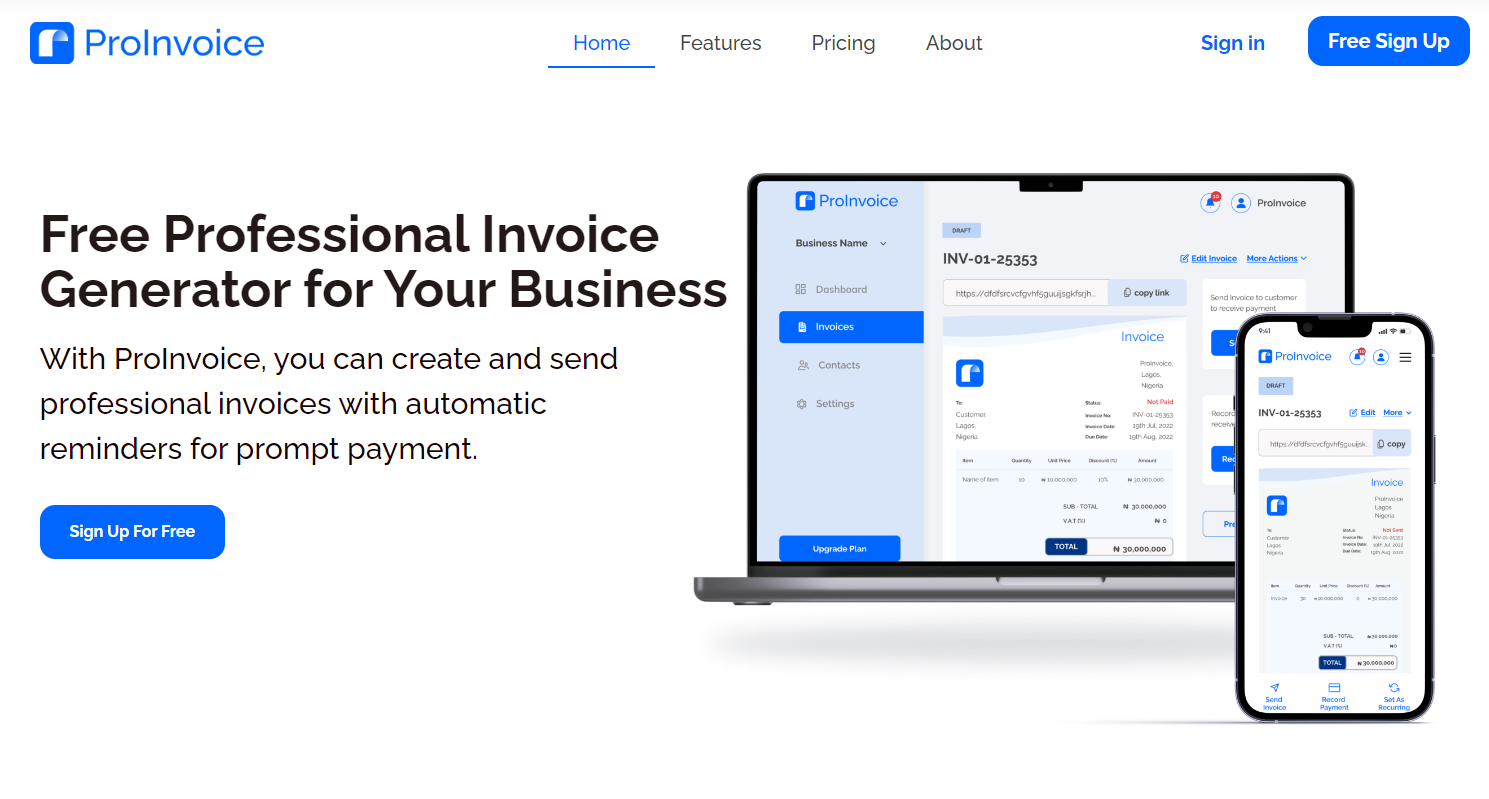

Fortunately, with modern invoicing tools like ProInvoice, businesses can define, communicate, and automate payment terms in a professional and consistent way.

In this guide, you’ll learn how to set clear payment terms that reduce late payments, improve cash flow, and protect your business relationships—without sounding aggressive or unprofessional.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Why Clear Payment Terms Matter More Than Ever

Payment delays rarely happen by accident. Instead, they often result from unclear expectations, missing information, or weak follow-up systems.

When businesses fail to define payment terms clearly:

- Clients don’t know when payment is due

- Disputes arise over timelines or amounts

- Cash flow becomes unpredictable

- Business growth slows down

On the other hand, clear payment terms reduce late payments by creating certainty from the start. More importantly, they show professionalism and build trust with clients.

With invoicing platforms like ProInvoice, payment terms are built directly into every invoice, ensuring consistency across all clients and transactions.

What Are Payment Terms?

Payment terms are the conditions that explain how, when, and under what rules a client must pay an invoice. They usually include:

- Payment due date

- Accepted payment methods

- Late payment penalties (if any)

- Discounts for early payment

- Consequences of non-payment

When written clearly, payment terms eliminate guesswork and reduce excuses for delayed payments.

Common Reasons Clients Pay Late

Before setting better payment terms, it’s important to understand why late payments happen in the first place.

1. Vague or Missing Due Dates

Invoices that say “pay soon” or “due upon receipt” often confuse clients. Without a specific date, payment becomes optional in their minds.

2. Inconsistent Terms

When one invoice says Net 7 and another says Net 30, clients may delay payment intentionally.

3. Poor Invoice Structure

Invoices that lack clarity, totals, or tax breakdowns slow down approval processes.

4. No Reminders

Even responsible clients forget. Without reminders, invoices get buried.

5. Manual Invoicing Errors

Mistakes in amounts, dates, or client details lead to disputes and delays.

Thankfully, tools like ProInvoice solve these issues by standardizing invoices and automating follow-ups.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

How Clear Payment Terms Reduce Late Payments

Let’s explore how properly defined payment terms directly improve payment speed.

1. They Set Expectations From Day One

When payment terms are stated upfront—before work begins—clients understand their obligations.

2. They Reduce Disputes

Clear terms leave little room for interpretation, reducing back-and-forth conversations.

3. They Improve Client Accountability

Clients are more likely to pay on time when consequences are clearly stated.

4. They Support Automation

Digital invoicing tools can trigger reminders based on payment terms automatically.

This is exactly why businesses using ProInvoice experience faster payments and fewer disputes.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Essential Payment Terms Every Invoice Should Include

1. Clear Due Date

Always include an exact date, such as:

“Payment due by March 15, 2026.”

Avoid vague phrases like “due immediately.”

Using ProInvoice, due dates are automatically calculated and displayed clearly on every invoice.

2. Accepted Payment Methods

List all payment options you accept. This reduces delays caused by uncertainty.

Digital invoicing platforms like ProInvoice make it easier for clients to understand how to pay without follow-up questions.

3. Late Payment Penalties

While penalties shouldn’t feel threatening, they must be clear. For example:

“A 2% late fee applies after 7 days past the due date.”

Clearly stated penalties encourage timely payments and show seriousness.

4. Early Payment Incentives

On the positive side, offering discounts can motivate faster payment.

Example: “2% discount if paid within 7 days.”

5. Currency and Tax Clarity

Always specify currency and tax details. Confusion here can delay internal approvals on the client’s side.

If you need compliant formats quickly, free invoice templates from ProInvoice help standardize this instantly.

Best Payment Terms for Small Businesses

Choosing the right terms depends on your industry, cash flow needs, and client type.

Common Options Include:

- Net 7 – Best for freelancers and service providers

- Net 14 – Balanced and client-friendly

- Net 30 – Common for larger corporate clients

- Due on receipt – Suitable for short-term or one-off jobs

With ProInvoice, you can set default payment terms once and reuse them across all invoices.

How to Communicate Payment Terms Clearly

1. Include Them in Contracts

Payment terms should appear in contracts, proposals, and invoices—not just at the end.

2. Repeat Them on Every Invoice

Consistency builds habit. Every invoice should reinforce the same terms.

3. Use Simple Language

Avoid legal jargon. Clear language reduces misunderstandings.

Automating Payment Terms With Invoicing Software

Manual invoicing increases errors and weakens enforcement. Automation, however, changes everything.

Using ProInvoice, businesses can:

- Set default payment terms

- Auto-calculate due dates

- Send scheduled reminders

- Track invoice status in real time

As a result, clear payment terms reduce late payments even further when combined with automation.

How Payment Reminders Reinforce Payment Terms

Even the best payment terms fail without follow-up.

Automated reminders:

- Reduce awkward conversations

- Keep invoices top of mind

- Improve on-time payment rates

With the ProInvoice mobile app, you can send reminders on the go and track responses instantly.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Using Professional Invoice Design to Support Payment Terms

Clients take professionally designed invoices more seriously. Clean layouts, branding, and structured sections reinforce authority.

If you need instant designs, try the free invoice generator from ProInvoice to create professional invoices in minutes.

Real-World Example: How Clear Terms Improved Cash Flow

A small consulting firm struggled with late payments averaging 45 days. After switching to ProInvoice and standardizing payment terms to Net 14 with automated reminders:

- Late payments dropped by 60%

- Cash flow stabilized

- Client disputes decreased significantly

This proves that clear payment terms reduce late payments when combined with the right tools.

Mistakes to Avoid When Setting Payment Terms

- Using inconsistent terms across invoices

- Hiding terms in fine print

- Failing to follow up

- Allowing exceptions too often

Instead, use a structured system like ProInvoice to maintain consistency.

Final Thoughts: Make Payment Terms Work for You

Late payments don’t have to be part of running a business. With the right structure, communication, and automation, clear payment terms reduce late payments significantly.

By using tools like ProInvoice, businesses gain control over invoicing, improve professionalism, and get paid on time—without chasing clients endlessly.

If you’re ready to simplify invoicing, generate professional documents, and enforce payment terms with ease, start using ProInvoice today.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!