One of the many reasons why you may be asking the question, ”Can i invoice my own company?” would likely be because you own different legal entities or work under an organization that has different subsidiaries.

So, yes, you can invoice your own company. It is worthy to mention that this occurs frequently with Companies that have subsidiaries.

Corporations will have adjunct businesses that do work for each other for a number of different reasons.

In such a case, one business will bill the other for services rendered. Because our businesses have unique workflows and structures, we may need to invoice ourselves from time to time.

When do I invoice my own Company?

An invoice is usually generated when a business purchases goods or contracts for services from another.

If one of your Company’s contracts works from another business that you also own, you may be wondering if it’s worthwhile to bill yourself.

Entrepreneurs, small business owners, and even larger corporations collaborate with other businesses to get things done and many business professionals own multiple businesses.

You may invoice yourself for service offered if you own or are a partner in more than one Company.

For example, if your construction company contracts work from your electrical company, you’ll need an invoice to document the transaction and track payments.

However, it is strongly advised to consult with an accountant and possibly a business attorney when trying it for the first time.

Invoicing your own business may result in complicated tax situations and make accounting more difficult.

Why would I want to invoice my own Company?

Some of our businesses are usually operated as separate limited companies and, as a result, will have to be invoiced separately.

The first is for promotional purposes. Perhaps you work part-time as a Mechanic and also own a transport company.

To avoid any confusion, you establish you will have to set up a limited company to run the transport company and continue to work as a self-employed mechanic for your original customers.

When the transport company requires the service of a mechanic, you charge it from one business to the next. Alternatively, you could have a company set up by several people to run an advertising agency.

Each shareholder has a specialty, and the company does not have enough money to pay a wage in the beginning.

As a result, they continue to work for themselves while owning stock in the company. As a result, each hour of copy writing, web design, or account management is invoiced separately.

How to create an invoice for your Company: step-by-step

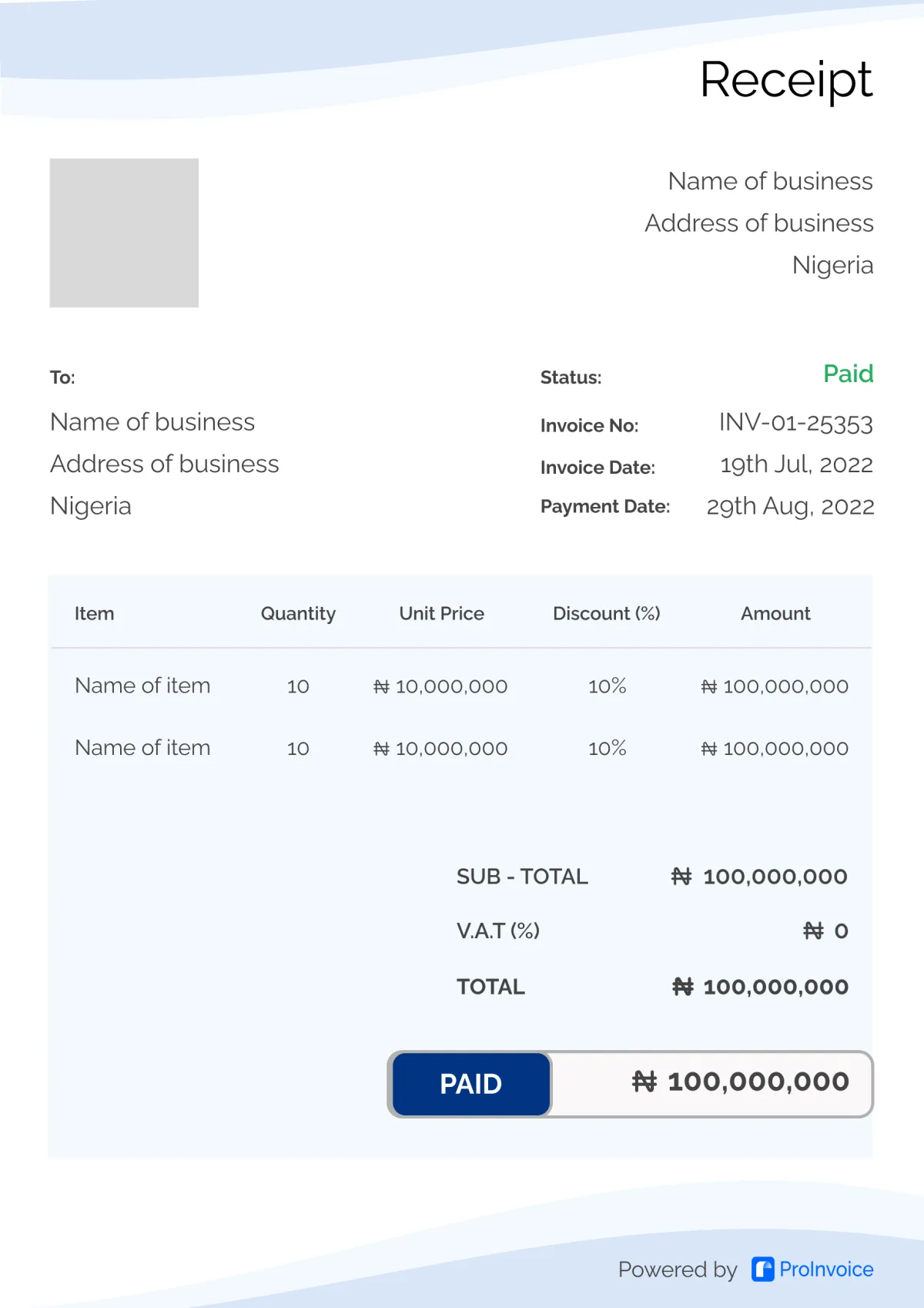

- Ensure your invoice looks professional. The first step is to put your invoice together.

- Clearly mark your invoice.

- Add your company name and information.

- Write a description of the goods or services for which you are charging.

- Include the dates.

- Sum up the money owed.

- Indicate payment terms.

Ensure your invoice looks professional:

Having a professional-looking invoice is essential for leaving a positive impression on your clients and showcasing your company’s credibility.

It helps build trust and increases the likelihood of timely payments.

To create a professional invoice, use a clean and consistent layout with your company’s logo, branding colors, and relevant contact information.

Organize the details logically, making it easy for clients to understand the charges.

Clearly mark your invoice:

The clarity of an invoice is vital to avoid confusion and disputes. Clearly label the document as an “Invoice” at the top, so it’s unmistakable.

Use bold and legible fonts for headings and important information. Properly segment sections such as “Bill To,” “Description,” “Date,” “Total Amount,” and “Payment Terms.”

This organization makes it easier for both you and your client to navigate the document.

Add your company name and information:

Include your company’s full legal name, address, phone number, and email address at the top of the invoice.

This information establishes your identity as a business entity and makes it simple for clients to reach out for any queries or clarifications.

It also prevents potential misunderstandings if the client deals with multiple vendors.

Write a description of the goods or services for which you are charging:

Clearly outline the goods or services you provided to the client. This includes itemizing each product or service along with its corresponding cost.

Providing a detailed description helps clients understand what they are being billed for and eliminates any ambiguity.

If applicable, use specific codes or reference numbers for better organization.

Include the dates:

Dates are crucial in an invoice to indicate when the goods or services were delivered or the project was completed.

Mention the date of issue on the top of the invoice. Additionally, include the dates for each item or service provided, indicating when they were delivered or completed.

This information helps both parties keep track of the timeline and enables accurate record-keeping.

Sum up the money owed:

Clearly state the total amount owed by the client. Sum up all the costs of goods and services provided, including any taxes or applicable discounts.

This total amount is what the client should remit for payment.

Using bold formatting for the total amount can draw attention to this critical piece of information.

Indicate payment terms:

Payment terms specify when and how the client should make the payment.

This may include the due date, accepted payment methods (e.g., credit card, bank transfer, etc.), and any late payment penalties or early payment discounts.

Providing clear payment terms helps manage expectations and ensures a smooth payment process.