In South Africa’s dynamic business environment—whether you’re a Cape Town freelancer, Johannesburg startup, or remote solopreneur—getting paid promptly is crucial for cash flow and growth. Let’s explore practical strategies to help you invoice clients effectively and get paid faster, backed by tools like ProInvoice.

1. Invoice Immediately Upon Delivery

Delaying invoices creates unnecessary waiting periods. If you wait two weeks after delivering a service and then issue a “Net 14” invoice, you’re looking at months before getting paid. Prompt invoicing shows you’re professional and organized.

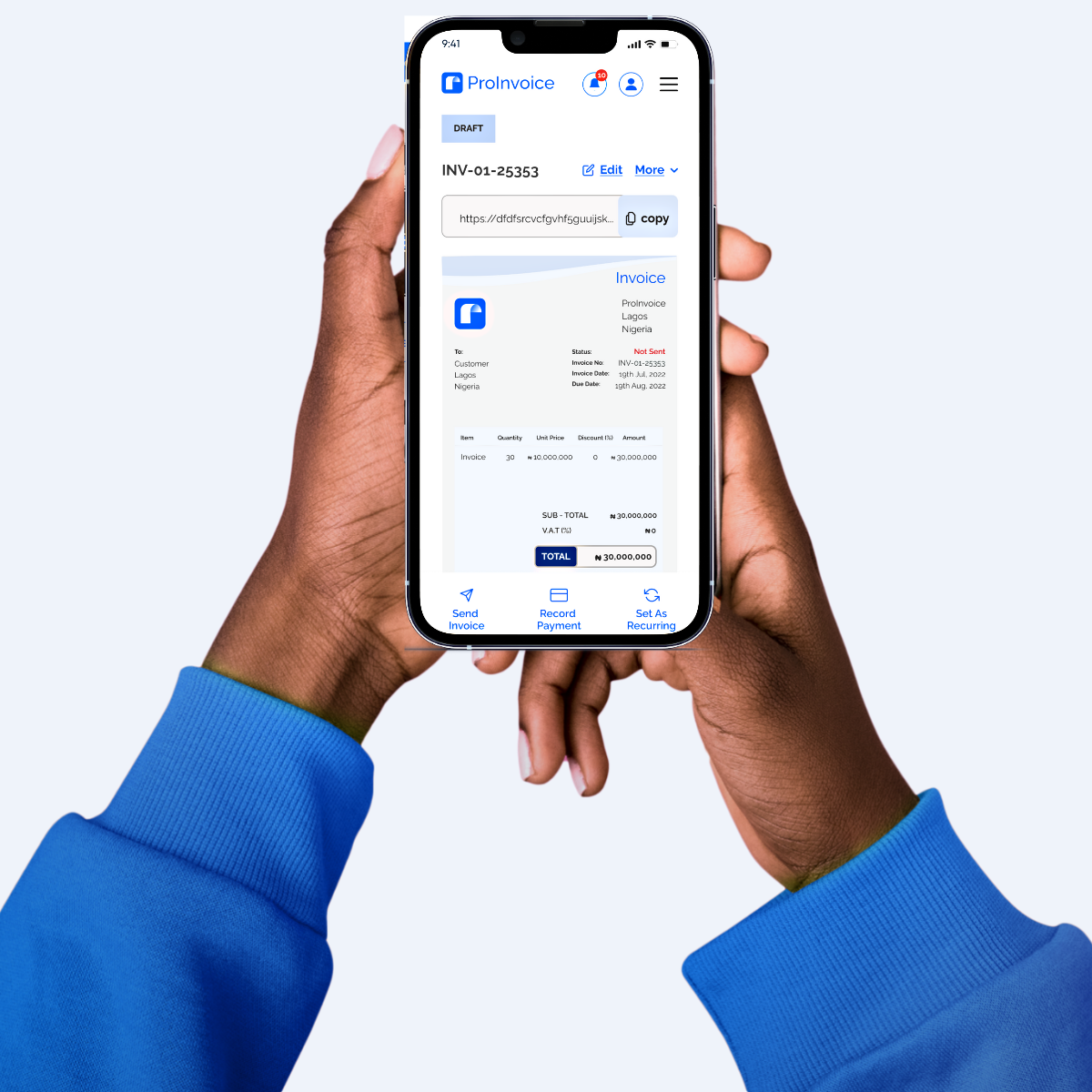

With ProInvoice, you can generate branded invoices in just minutes—right from your phone or laptop—so you can invoice clients as soon as your work is done.

2. Use Digital Invoicing for Speed and Reliability

Electronic invoices (e-invoices) are delivered instantly, bypassing mail delays, spam filters, and oversight. This significantly increases the chance of early payment.

ProInvoice supports digital delivery via email and download so your clients receive the invoice immediately—making payments faster and smoother.

3. Set Clear and Reasonable Payment Terms

Define due dates clearly (Net 7, Net 14) and communicate payment terms upfront—preferably before the project starts.

Using ProInvoice, you can preset these terms in your invoice template and adjust them per client—making expectations transparent and consistent.

4. Offer Early-Payment Discounts (Smart Dynamic Pricing)

Incentivize early payment with a built-in discount—like 2% off if paid within 10 days—boosting your cash conversion cycle.

Customize your ProInvoice template to include early-payment incentives, so the discount is clearly visible and professional.

5. Follow-Up on Overdue Invoices Professionally

Clients may simply forget or overlook invoices. Set a schedule to follow up quickly once overdue. Reminding clients early increases payment likelihood.

ProInvoice offers dashboard views of outstanding invoices and sends polite, automated reminders—saving you time and improving your collection rate.

6. Automate Recurring Invoices

For retainer-based or subscription services, use automated recurring invoices. This ensures payment continuity without manual intervention.

ProInvoice makes it easy to automate recurring billing, keeping your cash flow predictable and reducing admin overhead.

7. Personalize Your Invoices to Build Trust

Adding your logo, signature, and a personal greeting helps build rapport and encourages prompt action. Even a “thank you” can increase payment rates by over 40%.

With ProInvoice, every invoice can include your branding and customized notes—enhancing your professionalism and client goodwill.

8. Use One-Click Payment Features

Reduce friction by including payment links or bank details directly in your invoice. The easier it is to pay, the faster you get paid.

ProInvoice supports popular payment methods and ensures the details are embedded clearly, making payments seamless for your clients.

9. Build a Culture of Prompt Payment with Clients

When onboarding new clients, note your payment terms in proposals, contracts, and invoices. Repeat it consistently to normalize early payment behavior.

You can reinforce this message using ProInvoice by ensuring every financial document reflects the same upfront terms.

10. Combine Upfront Fees with Installments for Security

For large projects or new clients, request partial payment upfront to reduce your risk and secure commitment.

ProInvoice lets you easily issue split invoices—one for the deposit, another for completion—keeping your cash flow safe and your client commitments clear.

11. Leverage Automation Over Spreadsheets

Manual tracking in spreadsheets is prone to error and forgotten follow-ups. Automate your invoicing to stay efficient and error-free.

With ProInvoice, all your invoices and reminders are digital, tracked, and organized in one dashboard—freeing you to focus on work, not admin.

12. Use Personalized Follow-Up Tactics

Customize your reminders with a friendly tone—”Hi [Client Name], just a reminder…”—and include invoice info concisely. Small touches go a long way.

ProInvoice enables you to add personal communication within reminders while automating delivery—professionally consistent, yet human.

13. Track Payment Behavior and Adjust Terms

Review how clients respond—some may need shorter terms or more frequent reminders. Adjust these to maintain cash flow and relationships.

ProInvoice analytics help you spot trends—like recurring late payers—and adapt invoicing strategies accordingly.

14. Build Cash Flow Resilience

Late payments disrupt business planning. Encourage a mix of prepaid, early-payment, and recurring terms to keep your cash flow robust and stable.

Implementing these strategies through ProInvoice gives you the administrative power to reduce delays and maintain financial agility.

15. Final Thoughts

Getting paid early isn’t magic—it’s about strategy and consistency. By:

- Invoicing promptly

- Leveraging digital delivery

- Setting clear terms

- Automating reminders

- Personalizing invoices

—you turn good intentions into fast payments. South African businesses gain confidence and cash flow when supported by tools like ProInvoice every step of the way.

Want to take control today? Sign up with ProInvoice for free and invoice smarter starting now.