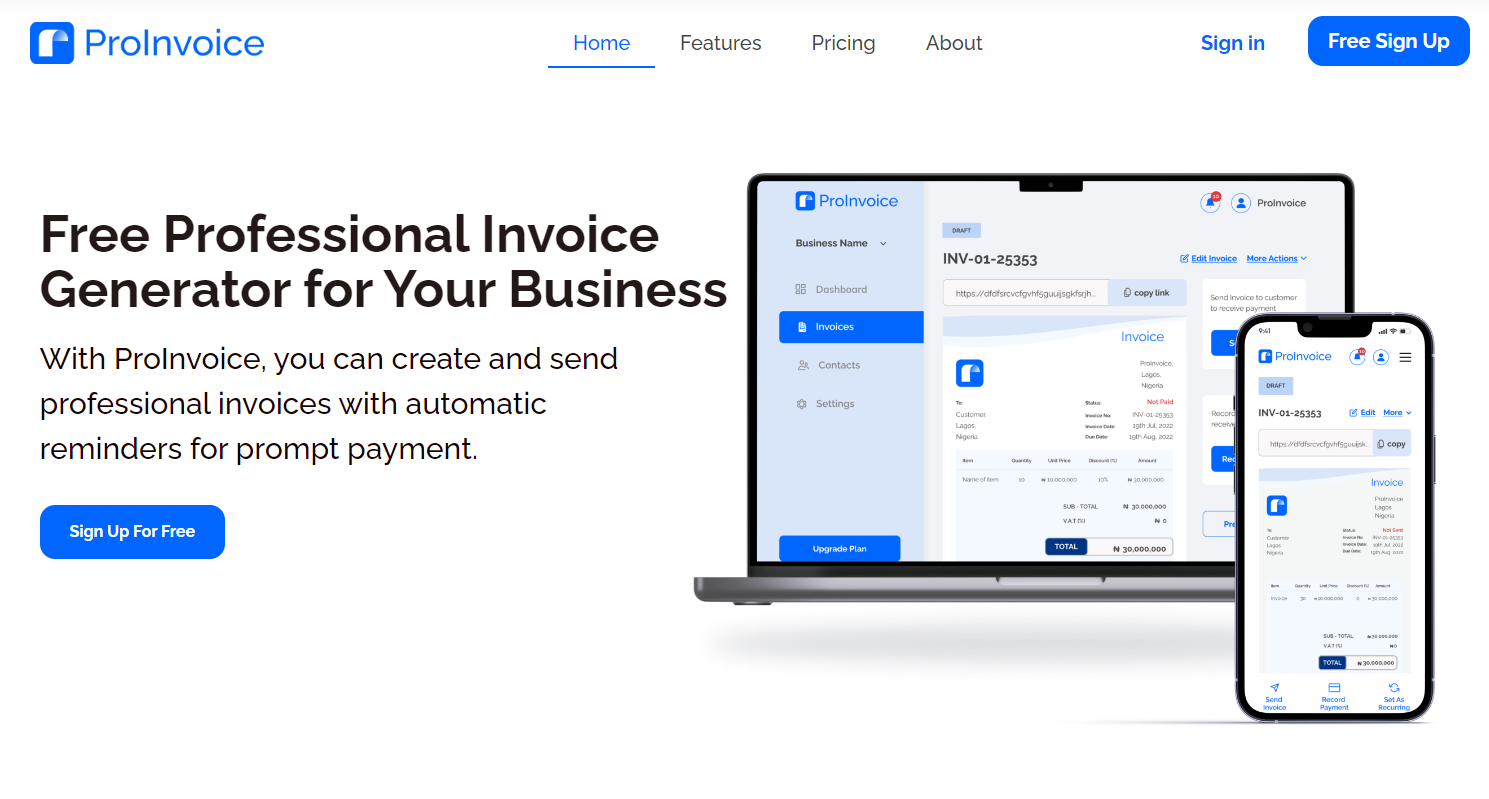

Transform your business operations with the right invoicing solutions that deliver professional results and faster payments. Whether you’re a freelancer, small business owner, or growing enterprise, modern professional invoicing software empowers you to create stunning invoices, automate payments, and maintain healthy cash flow—all from one intuitive platform.

Ready to revolutionize your billing process? Get started with ProInvoice and experience the difference professional invoicing software can make for your business.

Why Online Invoicing is Essential for Modern Businesses

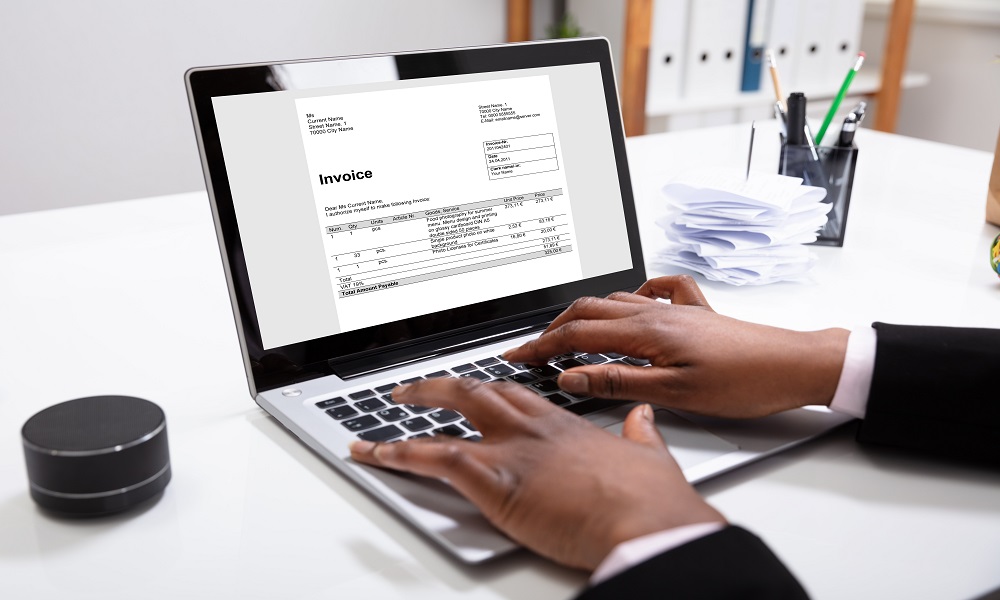

Online invoicing has revolutionized how businesses manage their billing processes. Gone are the days of manual invoice creation and payment tracking. Today’s digital invoicing platforms offer comprehensive solutions that address every aspect of your billing workflow, from initial quote to final payment.

The Power of Digital Invoicing for Every Business Type

Small business invoicing requires flexibility, affordability, and robust features that grow with your company. Meanwhile, freelance invoicing demands simplicity, professional presentation, and reliable payment processing. Modern invoicing platforms serve both needs through scalable, user-friendly interfaces.

Core Features That Define Superior Invoicing Solutions

Professional Invoice Creation & Customization

Transform your billing process with free invoicing templates designed for various industries. Professional invoice generator for services platforms provide:

- Brand Customization: Upload your company logo, apply brand colors, and add personalized messaging

- Industry-Specific Templates: Access pre-designed layouts optimized for consulting, retail, creative services, and more

- Detailed Line Items: Accurately itemize services or products with automated tax calculations

- Multi-Currency Support: Handle international clients with multi-currency invoicing capabilities

Automated Recurring Invoices Software

Streamline subscription billing and retainer management with recurring invoices software that eliminates manual intervention:

- Flexible Scheduling: Set up weekly, monthly, quarterly, or custom billing cycles

- Automatic Generation: Invoices are created and sent automatically based on your schedule

- Client Notifications: Customers receive advance notice of upcoming charges

- Payment Processing: Integrated payment collection for seamless transactions

Smart Payment Automation & Reminders

Accelerate cash flow with automated payment reminders that maintain professional relationships while ensuring timely payments:

- Customizable Reminder Sequences: Create personalized follow-up schedules for different client types

- Multiple Communication Channels: Send reminders via email, SMS, or in-app notifications

- Overdue Management: Escalate collection efforts automatically for past-due accounts

- Payment Link Integration: Include direct payment options in every reminder

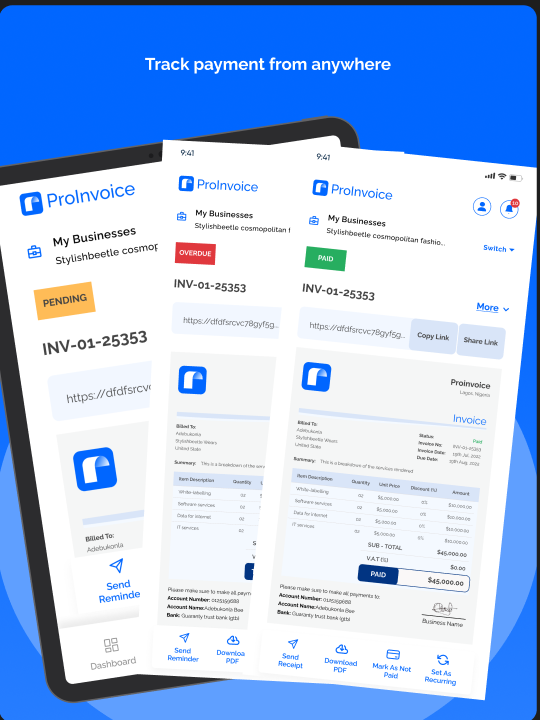

Real-Time Invoice Status Tracking

Gain complete visibility into your receivables with advanced track invoice status functionality:

- Live Dashboard: Monitor all invoices from a centralized command center

- Status Updates: Track when invoices are sent, viewed, and paid in real-time

- Client Activity: See which clients consistently pay on time versus those requiring follow-up

- Performance Analytics: Identify trends in payment behavior and optimize your billing strategy

Comprehensive Expense Management Software Integration

Modern invoicing platforms often include built-in expense management software features that create a complete financial ecosystem:

Unified Financial Overview

- Expense Tracking: Categorize and monitor business expenses alongside invoice income

- Receipt Management: Capture and store expense receipts digitally

- Tax Preparation: Generate comprehensive reports for accounting and tax purposes

- Profit Analysis: Calculate true profitability by tracking both income and expenses

Advanced Reporting & Analytics

- Cash Flow Forecasting: Predict future financial position based on pending invoices and recurring expenses

- Client Profitability: Analyze which clients generate the highest margins

- Payment Trends: Identify seasonal patterns and optimize billing schedules accordingly

Choosing the Right Invoicing Solutions for Your Business

For Freelancers and Solo Professionals

Freelance invoicing platforms should prioritize:

- Simple, intuitive interface requiring minimal setup

- Professional templates that enhance your brand image

- Integrated time tracking for accurate service billing

- Mobile accessibility for on-the-go invoice management

For Small and Growing Businesses

Small business invoicing systems need:

- Team collaboration features with role-based access

- Advanced reporting for financial planning and analysis

- Integration capabilities with existing accounting software

- Scalable pricing that grows with your business

Ready to scale your business billing? ProInvoice offers enterprise-grade features at small business prices, with plans that adapt as your company grows.

For Service-Based Companies

An effective invoice generator for services must include:

- Project-based billing capabilities

- Time and expense tracking integration

- Milestone and progress billing options

- Client portal access for transparency

Implementation Best Practices for Maximum ROI

Getting Started with Digital Invoicing

- Audit Current Processes: Identify pain points in your existing billing workflow

- Choose Appropriate Templates: Select free invoicing templates that align with your industry

- Set Up Automation: Configure recurring invoices software for regular clients

- Train Your Team: Ensure all stakeholders understand the new system capabilities

Optimizing Payment Collection

- Enable Multiple Payment Methods: Credit cards, bank transfers, and digital wallets

- Set Clear Payment Terms: Specify due dates, late fees, and acceptable payment methods

- Implement Automated Reminders: Use automated payment reminders to maintain cash flow

- Offer Early Payment Incentives: Encourage faster payments with discounts or perks

The Future of Professional Invoicing Software

As businesses continue to digitize their operations, professional invoicing software evolves to meet changing needs:

- AI-Powered Insights: Predictive analytics for cash flow management

- Enhanced Security: Advanced encryption and compliance features

- Mobile-First Design: Optimized experiences for smartphone and tablet users

- Integration Ecosystem: Seamless connections with CRM, accounting, and project management tools

Key Takeaways for Choosing Invoicing Solutions

When evaluating online invoicing platforms, prioritize solutions that offer:

✓ Comprehensive Feature Set: From basic invoice creation to advanced expense management software ✓ Scalability: Platforms that grow with your business needs ✓ Integration Capabilities: Seamless connection with your existing business tools ✓ Reliable Support: Access to help when you need it most ✓ Competitive Pricing: Value that justifies the investment

Transform your billing process today with professional invoicing solutions designed to streamline operations, improve cash flow, and enhance client relationships. The right platform doesn’t just handle invoicing—it becomes a strategic asset for business growth and financial success.

Want to see these features in action? Explore ProInvoice’s comprehensive platform and discover how professional invoicing software can transform your business operations. Start your free trial today and join thousands of businesses already streamlining their billing processes.

Frequently Asked Questions About Modern Invoicing Solutions

Q: How does professional invoicing software improve cash flow? A: Professional invoicing software accelerates payments through automated reminders, integrated payment processing, and real-time status tracking. These features typically reduce payment cycles by 30-50%.

Q: Can small businesses benefit from advanced invoicing solutions? A: Absolutely. Small business invoicing platforms are specifically designed to provide enterprise-level features at affordable prices, helping smaller companies compete professionally while maintaining cost efficiency.

Q: What’s the difference between free and paid invoicing templates? A: While free invoicing templates offer basic customization, paid solutions provide advanced branding options, industry-specific designs, and ongoing template updates to maintain a professional appearance.

Q: How does multi-currency invoicing work for international clients? A: Multi-currency invoicing automatically converts amounts based on current exchange rates, allows clients to pay in their preferred currency, and provides clear financial reporting in your base currency.

Q: Is recurring invoices software suitable for all business types? A: Recurring invoices software works best for businesses with subscription models, retainer clients, or regular service agreements. It’s particularly valuable for consultants, SaaS companies, and service providers with ongoing client relationships.