Understanding the difference between invoice vs receipt is essential for businesses in Kenya and Ghana. Although many business owners use the two terms interchangeably, they serve very different purposes in accounting, payments, and compliance. When used correctly, invoices and receipts help businesses get paid faster, track income accurately, and maintain clean financial records.

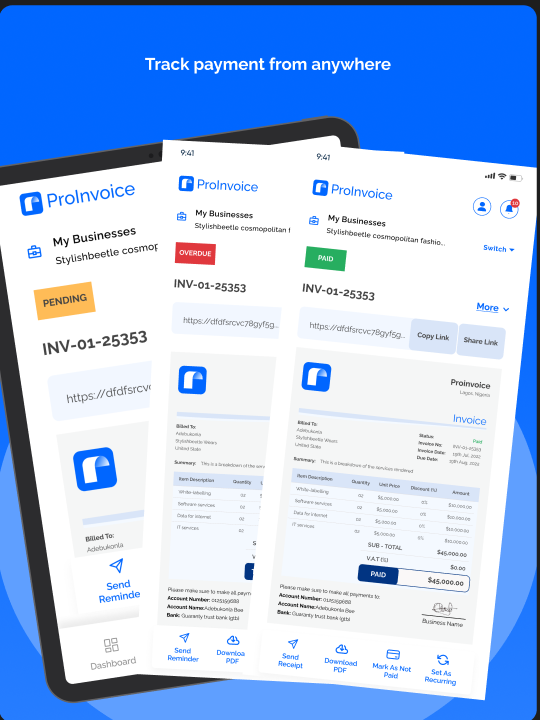

Fortunately, modern invoicing tools like ProInvoice make it easy to create professional invoices, issue receipts automatically, and stay organized without confusion.

In this guide, you’ll learn what invoices and receipts really mean, how they differ, when to use each one, and how businesses in Kenya and Ghana can manage both efficiently.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Why Understanding Invoice vs Receipt Matters

Many small businesses struggle with cash flow, audits, or client disputes simply because documents are misused. In fact, mixing up invoice vs receipt can lead to:

- Payment delays

- Poor record-keeping

- Tax reporting issues

- Client confusion

On the other hand, businesses that clearly understand and apply invoices and receipts correctly operate more professionally and avoid unnecessary problems.

With digital solutions like ProInvoice, these documents are clearly defined, properly generated, and easy to track.

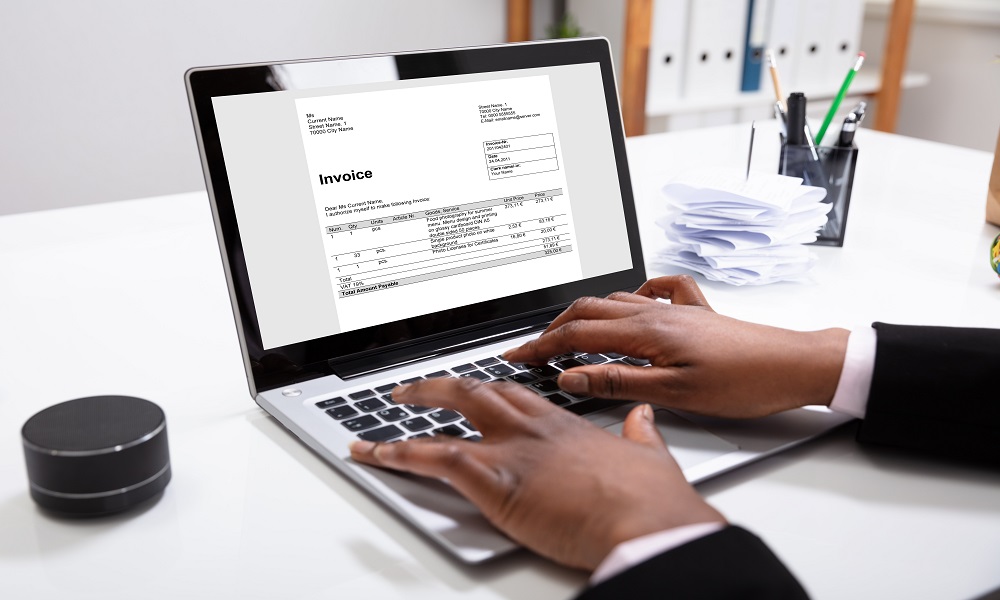

What Is an Invoice?

An invoice is a request for payment. It is sent to a client before payment is made and outlines what the client owes.

Key Details on an Invoice

An invoice typically includes:

- Business name and contact details

- Client information

- Invoice number

- Description of goods or services

- Quantity and price

- Tax (VAT, where applicable)

- Total amount due

- Payment terms and due date

Invoices are legally recognized documents and are essential for professional transactions.

Using ProInvoice, businesses can generate invoices instantly, customize them, and send them digitally.

What Is a Receipt?

A receipt is a confirmation of payment. It is issued after payment has been received and proves that a transaction is complete.

Key Details on a Receipt

A receipt usually includes:

- Business name and contact details

- Receipt number

- Date of payment

- Amount paid

- Payment method

- Reference to the original invoice

Receipts protect both the business and the customer by providing proof of payment.

With ProInvoice, receipts can be generated automatically once an invoice is marked as paid.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Invoice vs Receipt: Key Differences Explained

Understanding invoice vs receipt becomes easier when you compare them side by side.

Timing

- Invoice: Sent before payment

- Receipt: Issued after payment

Purpose

- Invoice: Requests payment

- Receipt: Confirms payment

Accounting Role

- Invoice: Accounts receivable

- Receipt: Income record

Legal Importance

- Invoice: Supports payment claims

- Receipt: Supports proof of payment

Both documents are essential, but they serve very different roles.

When Should Businesses Use an Invoice?

Businesses should issue an invoice when:

- Services have been rendered

- Goods have been delivered

- Payment is not immediate

- Working with corporate or repeat clients

In Kenya and Ghana, most professional services rely on invoices to formalize transactions.

Tools like ProInvoice allow businesses to set payment terms, apply VAT, and maintain consistency across all invoices.

When Should Businesses Issue a Receipt?

Receipts should be issued when:

- Full payment has been received

- A client requests proof of payment

- Cash or bank transfers are involved

- Closing a transaction

Receipts are particularly important for record-keeping and audits.

With the ProInvoice mobile app, businesses can issue receipts instantly—even while on the move.

Why Businesses in Kenya and Ghana Must Use Both Correctly

In Kenya and Ghana, proper documentation is critical for:

- Business transparency

- Financial reporting

- Client trust

- Regulatory compliance

Using invoice vs receipt incorrectly can create gaps in records that affect audits or financing opportunities.

Digital invoicing platforms like ProInvoice help businesses manage both documents seamlessly.

VAT and Tax Considerations

VAT regulations in Kenya and Ghana require clear documentation of transactions.

Invoices and VAT

Invoices must:

- Show VAT clearly

- Include registration details

- Break down taxable amounts

Receipts and VAT

Receipts confirm VAT has been paid and support tax filings.

If you need compliant formats quickly, free invoice templates from ProInvoice help ensure accuracy and consistency.

Common Mistakes Businesses Make

Even experienced business owners make errors with invoice vs receipt.

Common Mistakes Include:

- Issuing receipts before payment

- Failing to issue receipts at all

- Missing invoice numbers

- Mixing invoices and receipts in records

Using ProInvoice prevents these mistakes by automating document flow.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

How Digital Invoicing Simplifies Invoice vs Receipt Management

Manual invoicing increases errors and confusion. Digital invoicing, however, creates clarity.

With ProInvoice, businesses can:

- Generate invoices in seconds

- Convert invoices to receipts automatically

- Track payment status in real time

- Store records securely

Additionally, the free invoice generator allows quick invoice creation without setup stress.

Real-Life Example: A Small Business in Ghana

A retail business in Accra struggled with payment disputes because receipts were issued instead of invoices. After switching to ProInvoice:

- Invoices clarified payment expectations

- Receipts confirmed completed payments

- Client trust improved

- Record-keeping became organized

This highlights why understanding invoice vs receipt matters.

Best Practices for Managing Invoices and Receipts

To stay organized:

- Always issue invoices before payment

- Issue receipts immediately after payment

- Use consistent numbering

- Store records digitally

- Automate where possible

The ProInvoice mobile app makes this process seamless for busy entrepreneurs.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!

Invoice vs Receipt for Freelancers and SMEs

Freelancers often skip invoices, especially for small jobs. However, this practice weakens professionalism.

Using ProInvoice helps freelancers:

- Look professional

- Track unpaid invoices

- Issue receipts quickly

- Maintain financial history

Final Thoughts: Invoice vs Receipt Made Simple

Understanding invoice vs receipt is not optional—it’s essential for running a professional business in Kenya and Ghana. Invoices request payment, while receipts confirm payment. Both documents protect your business, support compliance, and build trust with clients.

With ProInvoice, businesses can manage invoices and receipts effortlessly, stay compliant, and focus on growth instead of paperwork.

If you want to simplify invoicing, improve record-keeping, and get paid faster, ProInvoice gives you everything you need—web and mobile.

Click to download the Proinvoice mobile app now to manage your invoices anytime, anywhere with ease!